Manh Viet Tien Vu / Vendedor

Produtos publicados

Signal: Live Bob Volman Final Price: The price increases based on the number of licenses sold. The starting price for this EA was $185. Available copies: 10 Suitable for prop firm trading. ️ WARNING: DON’T BUY any of my products unless you fully understand the trading concepts and principles explained on the product page and in my website. You won’t be able to make money like I do. Trading is highly risky — it's essentially a bet on an uncertain future, backed by an edge. Past perform

Signal: Live AI Quant Price: The price increases based on the number of licenses sold. The starting price for this EA was $1089. Available copies: 10 Suitable for prop firm trading ️ WARNING: DON’T BUY any of my products unless you fully understand the trading concepts and principles explained on the product page and in my website. You won’t be able to make money like I do. Trading is highly risky — it's essentially a bet on an uncertain future, backed by an edge. Past performance is n

Signal: Live Turtle System Price: The price increases based on the number of licenses sold. The starting price for this EA was $189. Available copies: 10 Suitable for prop firm trading ️ WARNING: DON’T BUY any of my products unless you fully understand the trading concepts and principles explained on the product page and in my website. You won’t be able to make money like I do. Trading is highly risky — it's essentially a bet on an uncertain future, backed by an edge. Past performance

Signal: Live Range Sniper Price: The price increases based on the number of licenses sold. The starting price for this EA was $899. Available copies: 10 Suitable for prop firm trading ️ WARNING: DON’T BUY any of my products unless you fully understand the trading concepts and principles explained on the product page and in my website. You won’t be able to make money like I do. Trading is highly risky — it's essentially a bet on an uncertain future, backed by an edge. Past performanc

Signal: Live Sonic R Price: The price increases based on the number of licenses sold. The starting price for this EA was $189. Available copies: 10 Suitable for prop firm trading ️ WARNING: DON’T BUY any of my products unless you fully understand the trading concepts and principles explained on the product page and in my website. You won’t be able to make money like I do. Trading is highly risky — it's essentially a bet on an uncertain future, backed by an edge. Past performance is no

Signal: Live MeanAI Price: The price increases based on the number of licenses sold. The starting price for this EA was $199. Available copies: 10 ️ WARNING: DON’T BUY any of my products unless you fully understand the trading concepts and principles explained on the product page and in my website. You won’t be able to make money like I do. Trading is highly risky — it's essentially a bet on an uncertain future, backed by an edge. Past performance is no guarantee of future results. Thi

Signal: Live Price Action Quant

Price: The price increases based on the number of licenses sold. The starting price for this EA was $184. Available copies: 10 Suitable for prop firm trading ️ WARNING: DON’T BUY any of my products unless you fully understand the trading concepts and principles explained on the product page and in my website. You won’t be able to make money like I do. Trading is highly risky — it's essentially a bet on an uncertain future, backed by an edge. Past pe

This is an easy-to-use trade copier with full functionality that I am using to copy my trades across multiple accounts. I use it to trade hundreds of accounts simultaneously. It can copy trades based on different magic numbers or comments from a master account. It also features time-based copying, automatic closure of trades at the end of the day or week. Additionally, it can manage prop firms according to profit targets or maximum daily loss limits Add it to the main account in master mode, and

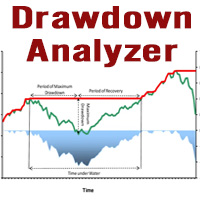

This tool is specifically designed to calculate drawdowns in a trading or investment account, expressed as a percentage, by using user-input balance figures. In essence, it allows users to track how much their account dips from a peak balance to a subsequent low point, a metric that is instrumental in understanding risk exposure. By supporting the option to choose a specific timeframe, it empowers traders and investors to pinpoint the start date of their measurement, ensuring that the data refle

FREE

This is an easy-to-use trade copier with full functionality that I am using to copy my trades across multiple accounts. I use it to trade hundreds of accounts simultaneously. It can copy trades based on different magic numbers or comments from a master account. It also features time-based copying, automatic closure of trades at the end of the day or week. Additionally, it can manage prop firms according to profit targets or maximum daily loss limits Add it to the main account in master mode, and

This is an EA designed to support manual trading. It can accurately calculate risk, automatically enter trades, set stop loss, and perform trailing stop loss using buttons on the chart. There are many features for risk calculation, setting stop loss, and trailing stop loss to suit various trading styles. It can also automatically manage prop firms by closing trades when reaching the target profit level or maximum daily loss. Additionally, it can perform manual backtesting using the strategy test

FREE

This is a tool that helps you calculate potential slippage you may encounter in real trading. This is quite important to understand how slippage can affect your strategy. It helps you gain a better understanding of your trading system and compare slippage levels among different brokers. Simply add it to the chart of the symbol you wish to estimate slippage for.

FREE

This is a versatile tool designed to help traders analyze their trading performance on a MT5 account. It provides a detailed of profit, allowing users to review their overall account performance or filter trades based on specific criteria. With this tool, traders can: Check total profit across all trades. Filter by a single Magic Number or multiple Magic Numbers (enter directly, separated by ",") Analyze individual symbols or a custom set of symbols to evaluate different market instruments (

FREE

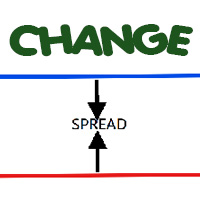

Most current tick data does not accurately reflect the actual spread levels. To achieve more precise backtest results, we need to adjust it to a higher value to account for slippage that may occur when Expert Advisors (EAs) execute orders in real trading.

This tool is used to change the Spread value in custom symbols created from tick data for backtesting purposes. Simply select the desired Spread value and wait for the tool to adjust it accordingly.

FREE

This tool helps you calculate the ratio of slippage and current spread compared to the average price movement over the timeframe of a specific symbol. It can indicate whether you should trade on that timeframe or not. If the ratio is too high, it will be very challenging to make a profit. Typically, this ratio should be less than 15%.. Simply add it to the chart of the timeframe for the symbol you wish to estimate.

FREE

Sinais publicados

- Crescimento

- 52%

- Assinantes

- 0

- Semanas

- 52

- Negociações

- 2771

- Vitória

- 50%

- Fator de lucro

- 1.22

- Max Rebaixamento

- 13%

- Crescimento

- 16%

- Assinantes

- 0

- Semanas

- 4

- Negociações

- 186

- Vitória

- 45%

- Fator de lucro

- 1.13

- Max Rebaixamento

- 29%

- Crescimento

- 23%

- Assinantes

- 0

- Semanas

- 22

- Negociações

- 247

- Vitória

- 37%

- Fator de lucro

- 1.46

- Max Rebaixamento

- 10%

- Crescimento

- 0%

- Assinantes

- 0

- Semanas

- 16

- Negociações

- 186

- Vitória

- 68%

- Fator de lucro

- 1.04

- Max Rebaixamento

- 20%

- Crescimento

- -10%

- Assinantes

- 0

- Semanas

- 16

- Negociações

- 85

- Vitória

- 23%

- Fator de lucro

- 0.61

- Max Rebaixamento

- 10%

11. Copy MAINBOT

- Crescimento

- -100%

- Assinantes

- 0

- Semanas

- 118

- Negociações

- 17812

- Vitória

- 42%

- Fator de lucro

- 1.06

- Max Rebaixamento

- 100%

- Crescimento

- 18%

- Assinantes

- 0

- Semanas

- 42

- Negociações

- 820

- Vitória

- 38%

- Fator de lucro

- 1.13

- Max Rebaixamento

- 21%

- Crescimento

- 9%

- Assinantes

- 0

- Semanas

- 33

- Negociações

- 265

- Vitória

- 50%

- Fator de lucro

- 1.24

- Max Rebaixamento

- 5%

- Crescimento

- 7%

- Assinantes

- 0

- Semanas

- 25

- Negociações

- 1721

- Vitória

- 38%

- Fator de lucro

- 1.19

- Max Rebaixamento

- 7%

- Crescimento

- -5%

- Assinantes

- 0

- Semanas

- 16

- Negociações

- 77

- Vitória

- 23%

- Fator de lucro

- 0.71

- Max Rebaixamento

- 5%

10. MAIN BOT

- Crescimento

- -100%

- Assinantes

- 0

- Semanas

- 104

- Negociações

- 34672

- Vitória

- 43%

- Fator de lucro

- 1.16

- Max Rebaixamento

- 100%