Francis Dogbe / Perfil

- Informações

|

9+ anos

experiência

|

2

produtos

|

36

versão demo

|

|

1

trabalhos

|

0

sinais

|

0

assinantes

|

Amigos

1783

Pedidos

Enviados

Francis Dogbe

EURUSD is playing stubborn..... it has been selling for the a month now. why? Is the EU getting weak :(

What ever reason it is, i still profit out of it.... :-)

What ever reason it is, i still profit out of it.... :-)

Rinor Memeti

2014.07.31

Eu is getting week. Many companys like bayer made less Profit because of strong euro. Now The euro should fall because a strong euro is bad for economy.

Francis Dogbe

Anyone counter trading EURUSD, ..? well i guess you are facing some serious DD by now. :( "Let the trend be your friend' ;-)

I HAVE LEARNT MY LESSON

I HAVE LEARNT MY LESSON

Francis Dogbe

I am getting fed up with one member in the community who keeps on sharing anything anybody post on his wall. The fellow also post really clumsy and pointless market outlook in the forum session. .... Whoever you are you know yourself please stop it. Its irritating.

:(

:(

Mostrar todos os comentários (10)

Trevor Schuil

2014.07.29

I am of the same opinion. It would be nice to have some relevant stuff on my wall

Francis Dogbe

2014.07.29

Hey Tamer it not you. Your post are interesting. But that guy is just making me crazy

Mirko Sedda

2014.07.29

i was referring to you Tamer :D but with a smile, i mean, i prefer to keep here friends who share forex stuff here, and serial spammer on facebook but i have nothing against you of course ahahahah

Francis Dogbe

Compartilhe seu Frank Breinling artigo

How To Choose A Forex Third Party Signal Provider

With the growing popularity and easy access to the foreign exchange (ForEx) market, more and more people are drawn to it as their financial vehicle of choice. Along with this popularity come all

Francis Dogbe

I am going crazy with indicators...they suck. i give up. :(

Price action here i come

Price action here i come

dan sun

2014.07.21

you dont need loads of indicators, just get 1 for trend direction, and 1 for momentum , that should do. At least for proper entry.

Stuart Browne

2014.07.22

I totally agree that lagging indicators suck (which is 99% of indicators!) and naked price action and good old S/R are far superior. But have you tried using indicators that don't lag and are based on price action? For instance Pivots and currency strength?

Francis Dogbe

produto partilhado pelo vendedor Rasoul Mojtahedzadeh

Awesome.. Best for Rookies

Identifying the trend of the market is an essential task of traders. Trendometer implements an advanced algorithm to visualize the trend of the market. The major focus of this indicator is to evaluate the market in the lower time frames (i.e., M1, M5 and M15) for the scalping purposes. If you are a scalper looking for a reliable indicator to improve your trade quality, Trendometer is for you. The indicator runs on a separate window showing a histogram of red and green bars. A two consecutive

Francis Dogbe

Qiang Zhang

2014.07.13

The creation of human beings never stopped, and then in their ruin everything.

Francis Dogbe

Well here you have it... surprises upon surprises. I said it once and i will say it again NEVER bet on this world cup. anything can happen. See what German Machine did to Samba Boys. Very sad... better luck next time Brazil :(

Francis Dogbe

Market Forecast - Week Beginning 7th July 2014

Emini S&P has not had a single losing month this year & only 1 losing week in the last 12. Thursday we beat 1970/71 to hit our next

target of 1974/75 which held for a couple of hours, before we headed for the next target of 1979/80 & topped less than a point below. If prices continue higher today look for 1983/84 then 1988. You can only wonder if the huge psychological resistance at 2000 will then hold us back.

GBPUSD retested the highs at 1.7175 as predicted on Friday & topped almost exactly here at 1.7170. Outlook remains positive despite the overbought conditions. On a break higher today we look for 1.7195/00 then 1.7225.

Gold topped out last week at 1333, exactly as predicted. The bounce on Friday was to be used to enter fresh shorts with resistance at 1325/26 but prices topped just below at 1323. Outlook remains negative & we could resume the longer term bear trend this week.

EURUSD was unable to beat 1.3700 as forecast last week & headed lower breaking the 2 week recovery to resume the 2 month bear trend. A break below 1.3580 today keeps the market under pressure for 1.3571 then 1.3550.

WTI Crude continued lower last week & exactly as predicted headed for support at 103.60/50 for a buying opportunity. We forecast a good chance of a low for the day & prices bottomed almost exactly here at 103.67/64 at the end of last week. This should hold the downside again today but as stated on Friday, longs need stops below 103.10.

Brent Crude continued lower to good trend line support at 110.70 & short term Fibonacci support at 110.40/35. We forecast a good chance of a bounce from here & exactly as expected prices bottomed within this range at 110.53/51 last week. However bulls need a quick recovery above 110.75 today.

Natural Gas severely oversold as we test important support in the 4340/30 area. We did see a low for the week here last week exactly as predicted. We now expect a recovery to take prices back up to 4390 & perhaps as far as resistance at 4415.

Gasoil testing support at 898/896 & bottomed here so far, exactly as forecast. A good chance of a recovery now to target 905 & possibly as far as 909.

Dax all time highs at 10038/49 of course are crucial today. We are only overbought in the short term so a break higher cannot be ruled out & could target 10084/89.

Failure to break higher however does leave a potential negative triple top pattern. It's only a small pattern but in theory this does have very negative implications for this week at least. Some short term profit taking rather than a significant sell off is expected & should offer better buying opportunities.

FTSE managed to hit our target of 6825 & topped almost exactly here at 6829. Short term we are overbought but we cannot rule out further gains to 6835/40.

AUDUSD hit good support at 9324/20 to bottom almost exactly here at 9327 last week. We wrote: ''This is the best chance of a low for the day but longs need stops below 9300.'' This forecast worked perfectly as the pair recovered to 9363. Again today the 9327/20 is important support & could hold the downside.

Emini S&P has not had a single losing month this year & only 1 losing week in the last 12. Thursday we beat 1970/71 to hit our next

target of 1974/75 which held for a couple of hours, before we headed for the next target of 1979/80 & topped less than a point below. If prices continue higher today look for 1983/84 then 1988. You can only wonder if the huge psychological resistance at 2000 will then hold us back.

GBPUSD retested the highs at 1.7175 as predicted on Friday & topped almost exactly here at 1.7170. Outlook remains positive despite the overbought conditions. On a break higher today we look for 1.7195/00 then 1.7225.

Gold topped out last week at 1333, exactly as predicted. The bounce on Friday was to be used to enter fresh shorts with resistance at 1325/26 but prices topped just below at 1323. Outlook remains negative & we could resume the longer term bear trend this week.

EURUSD was unable to beat 1.3700 as forecast last week & headed lower breaking the 2 week recovery to resume the 2 month bear trend. A break below 1.3580 today keeps the market under pressure for 1.3571 then 1.3550.

WTI Crude continued lower last week & exactly as predicted headed for support at 103.60/50 for a buying opportunity. We forecast a good chance of a low for the day & prices bottomed almost exactly here at 103.67/64 at the end of last week. This should hold the downside again today but as stated on Friday, longs need stops below 103.10.

Brent Crude continued lower to good trend line support at 110.70 & short term Fibonacci support at 110.40/35. We forecast a good chance of a bounce from here & exactly as expected prices bottomed within this range at 110.53/51 last week. However bulls need a quick recovery above 110.75 today.

Natural Gas severely oversold as we test important support in the 4340/30 area. We did see a low for the week here last week exactly as predicted. We now expect a recovery to take prices back up to 4390 & perhaps as far as resistance at 4415.

Gasoil testing support at 898/896 & bottomed here so far, exactly as forecast. A good chance of a recovery now to target 905 & possibly as far as 909.

Dax all time highs at 10038/49 of course are crucial today. We are only overbought in the short term so a break higher cannot be ruled out & could target 10084/89.

Failure to break higher however does leave a potential negative triple top pattern. It's only a small pattern but in theory this does have very negative implications for this week at least. Some short term profit taking rather than a significant sell off is expected & should offer better buying opportunities.

FTSE managed to hit our target of 6825 & topped almost exactly here at 6829. Short term we are overbought but we cannot rule out further gains to 6835/40.

AUDUSD hit good support at 9324/20 to bottom almost exactly here at 9327 last week. We wrote: ''This is the best chance of a low for the day but longs need stops below 9300.'' This forecast worked perfectly as the pair recovered to 9363. Again today the 9327/20 is important support & could hold the downside.

Francis Dogbe

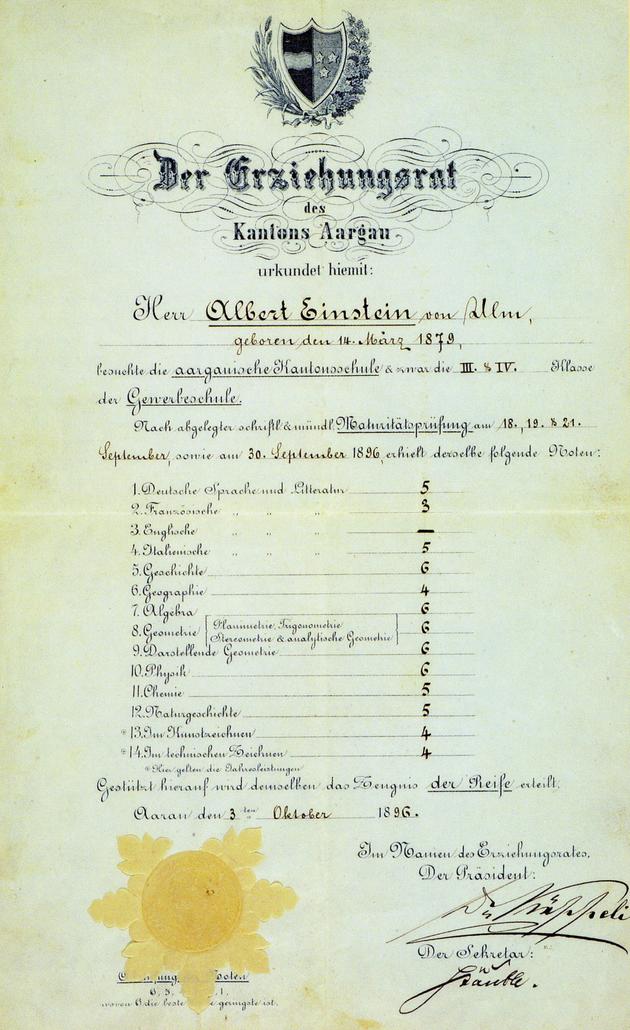

Frank Breinling

2014.07.06

Bestmark is History (Geschichte) with 6 (Best)

In Switzerland they have 6 for "A" (american standard) or "very good" (german standard)

In Switzerland they have 6 for "A" (american standard) or "very good" (german standard)

Francis Dogbe

“When you are not pursuing your goal, you are literally committing spiritual suicide.” – Les Brown

Francis Dogbe

Think Outside the Box

You are driving down the road in your car on a wild, stormy night, when you pass a bus stop and you see three people waiting for the bus:

1. An old lady who looks as if she is about to die.

2. An old friend who once saved your life.

3. The perfect partner you have been dreaming about.

Which one would you choose to offer a ride to, knowing that there could only be one passenger in your car? Think, before you continue reading.

This is a moral/ethical dilemma that was once actually used as part of a job application. You could pick up the old lady, because she is going to die, and thus you should save her first. Or you could take the old friend because he once saved your life, and this would be the perfect chance to pay him back. However, you may never be able to find your perfect mate again.

The candidate who was hired (out of 200 applicants) had no trouble coming up with his answer. She simply answered: "I would give the car keys to my old friend and let him take the lady to the hospital. I would stay behind and wait for the bus with the partner of my dreams."

Sometimes, we gain more if we are able to give up our stubborn thought limitations. Never forget to "Think Outside of the Box."

However, the correct answer is to run the old lady over and put her out of her misery, have sex with the perfect partner against the bus stop, then drive off with the old friend for some beers.

God, I just love happy endings.

You are driving down the road in your car on a wild, stormy night, when you pass a bus stop and you see three people waiting for the bus:

1. An old lady who looks as if she is about to die.

2. An old friend who once saved your life.

3. The perfect partner you have been dreaming about.

Which one would you choose to offer a ride to, knowing that there could only be one passenger in your car? Think, before you continue reading.

This is a moral/ethical dilemma that was once actually used as part of a job application. You could pick up the old lady, because she is going to die, and thus you should save her first. Or you could take the old friend because he once saved your life, and this would be the perfect chance to pay him back. However, you may never be able to find your perfect mate again.

The candidate who was hired (out of 200 applicants) had no trouble coming up with his answer. She simply answered: "I would give the car keys to my old friend and let him take the lady to the hospital. I would stay behind and wait for the bus with the partner of my dreams."

Sometimes, we gain more if we are able to give up our stubborn thought limitations. Never forget to "Think Outside of the Box."

However, the correct answer is to run the old lady over and put her out of her misery, have sex with the perfect partner against the bus stop, then drive off with the old friend for some beers.

God, I just love happy endings.

Francis Dogbe

This is time to use "BlueBall Trading Systems" for maximum profit. :)

Daniel Stein

2014.07.03

The AUDUSD is fighting with it's SR Levels but the NZDUSD offers a great chance for a lot of pips.

: