Seyedmajid Masharian / Perfil

forex trader

em

home

Seyedmajid Masharian

Credit Suisse FX Technical Strategy Research notes that NZD/USD recent rally is likely due for a short-term correction against the strong resistance of the core bull trend at the .7376/.7404 area.

If a cap is found into this area, CS expects the pair to form a small top below .7253 to target .7198 initially, then the measured objective from the top and 38.2% retracement of the recent rally at .7160/45.

"We would expect the latter to try and hold at first. Removal of .7145 can see a deeper fall to test the 55- and 200-day averages at .7100/.7096, and potentially lower to the 50% retracement at .7082, where we see a firmer floor," CS adds.

https://www.efxnews.com/story/36532/nzdusd-rally-may-come-end-levels-targets-credit-suisse

If a cap is found into this area, CS expects the pair to form a small top below .7253 to target .7198 initially, then the measured objective from the top and 38.2% retracement of the recent rally at .7160/45.

"We would expect the latter to try and hold at first. Removal of .7145 can see a deeper fall to test the 55- and 200-day averages at .7100/.7096, and potentially lower to the 50% retracement at .7082, where we see a firmer floor," CS adds.

https://www.efxnews.com/story/36532/nzdusd-rally-may-come-end-levels-targets-credit-suisse

Seyedmajid Masharian

Footprints of the Big Boys

Brandon Wendell

Instructor, CMT

When we are trying to learn a new skill, we usually try to copy the actions of someone who is already successful in that field. When it comes to making money in the markets, we can easily see that the institutional traders are the big winners on a consistent basis. Online Trading Academy teaches their students how to identify where those institutional traders make their money and how to follow them for their own trading success.

One of the things that we will look for is the area where institutions have pushed prices higher or lower with high velocity due to a large order. When placing these orders, these institutions know that they may not get all of their orders filled at once. They are looking to receive an average price in a zone that is acceptable for their goals with that investment. This is known as working the order.

Imagine that I am working an order for several hundred thousand shares for a mutual fund. They decided they wanted to invest in XYZ stock due to its potential to rise on their good management, good product, past track record, new products, etc. I identify that a good price for this stock is in the $40 to $41 range. I will start to place orders when price gets into that range.

There is a problem though. I cannot place the order for the entire amount all at once. If I were to show that much demand in the market, most astute traders would jump in front of me and buy knowing I will support price with my demand. This would drive prices higher and prevent me from getting my stock in the desired price range. So I have to be smart and buy in pieces with smaller orders that seem innocuous.

What happens if the price zone I selected happens to be a great buying price? This would mean that I am buying in an area where there is a lack of sellers since prices dropped so fast that they either dumped their supply or they are holding on, hoping that prices will return to lessen their losses.

When I step in with my demand, I find a lack of supply to fill my buy orders. This is going to cause me to have to raise my bid for shares quickly and dramatically so that I can get those shares. This is going to cause a large green candle at an area where I was trying to buy. As a retail trader, this is a signal of a demand zone for me.

Going back to the institutional trader, they were unlikely to fill all of their orders to buy shares when prices moved up as quickly as they did. So there are still latent (unfilled) orders sitting in the demand zone they created. Since they likely programmed a computer to do the buying for them in that zone, there is no emotion involved. The computer will not chase price or become impatient. The computer waits for prices to return to the demand (specified entry) zone to buy again.

This is where traders should pounce. Once the institutions have shown their hand on the charts by forming the origin of the demand zone, we have an opportunity to buy in the same zone as prices return to it. We can see from past behavior that the supply is lacking in the zone and someone is supporting the price. Those latent orders are likely to cause another bounce in price that we can benefit from.

Trading is simply a game of identifying the order placement locations of the institutional traders.

http://www.tradingacademy.com/lessons/article/footprints-big-boys/

Brandon Wendell

Instructor, CMT

When we are trying to learn a new skill, we usually try to copy the actions of someone who is already successful in that field. When it comes to making money in the markets, we can easily see that the institutional traders are the big winners on a consistent basis. Online Trading Academy teaches their students how to identify where those institutional traders make their money and how to follow them for their own trading success.

One of the things that we will look for is the area where institutions have pushed prices higher or lower with high velocity due to a large order. When placing these orders, these institutions know that they may not get all of their orders filled at once. They are looking to receive an average price in a zone that is acceptable for their goals with that investment. This is known as working the order.

Imagine that I am working an order for several hundred thousand shares for a mutual fund. They decided they wanted to invest in XYZ stock due to its potential to rise on their good management, good product, past track record, new products, etc. I identify that a good price for this stock is in the $40 to $41 range. I will start to place orders when price gets into that range.

There is a problem though. I cannot place the order for the entire amount all at once. If I were to show that much demand in the market, most astute traders would jump in front of me and buy knowing I will support price with my demand. This would drive prices higher and prevent me from getting my stock in the desired price range. So I have to be smart and buy in pieces with smaller orders that seem innocuous.

What happens if the price zone I selected happens to be a great buying price? This would mean that I am buying in an area where there is a lack of sellers since prices dropped so fast that they either dumped their supply or they are holding on, hoping that prices will return to lessen their losses.

When I step in with my demand, I find a lack of supply to fill my buy orders. This is going to cause me to have to raise my bid for shares quickly and dramatically so that I can get those shares. This is going to cause a large green candle at an area where I was trying to buy. As a retail trader, this is a signal of a demand zone for me.

Going back to the institutional trader, they were unlikely to fill all of their orders to buy shares when prices moved up as quickly as they did. So there are still latent (unfilled) orders sitting in the demand zone they created. Since they likely programmed a computer to do the buying for them in that zone, there is no emotion involved. The computer will not chase price or become impatient. The computer waits for prices to return to the demand (specified entry) zone to buy again.

This is where traders should pounce. Once the institutions have shown their hand on the charts by forming the origin of the demand zone, we have an opportunity to buy in the same zone as prices return to it. We can see from past behavior that the supply is lacking in the zone and someone is supporting the price. Those latent orders are likely to cause another bounce in price that we can benefit from.

Trading is simply a game of identifying the order placement locations of the institutional traders.

http://www.tradingacademy.com/lessons/article/footprints-big-boys/

Seyedmajid Masharian

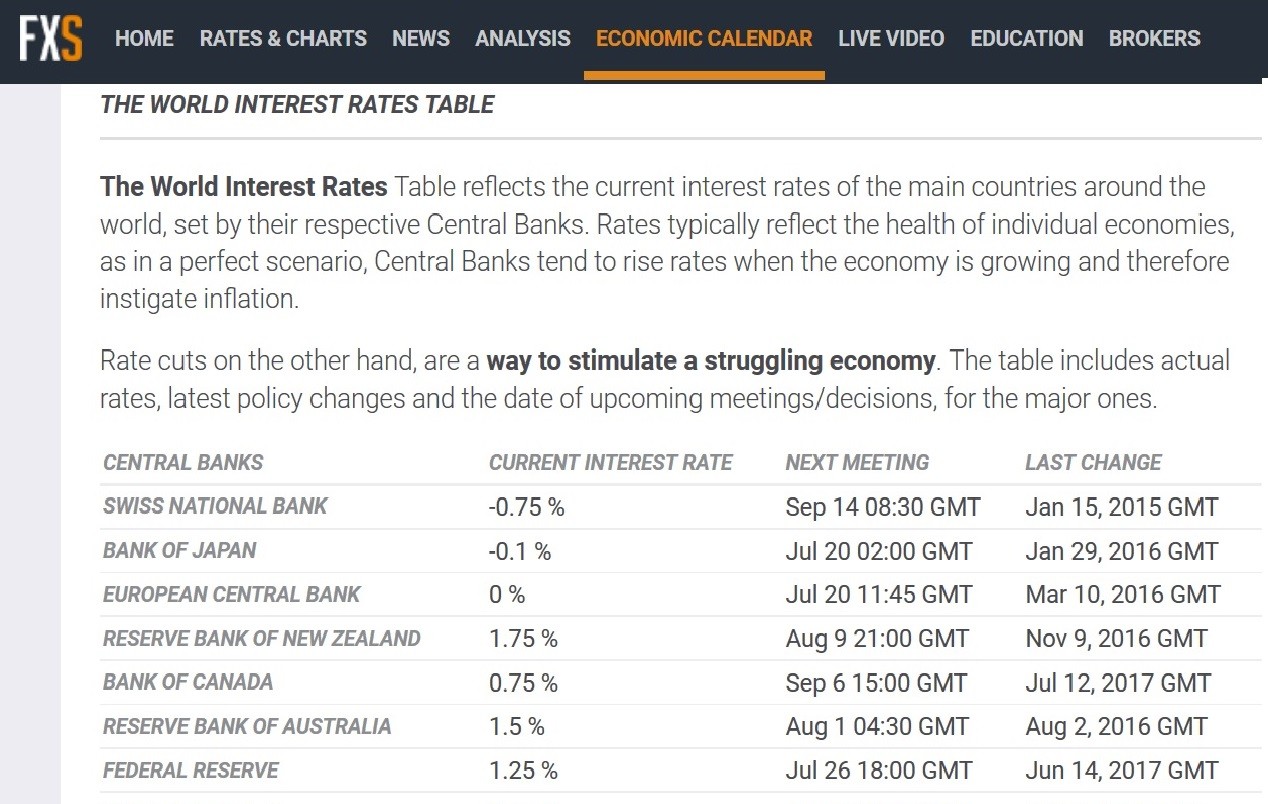

DID YOU KNOW YOU SHOULD FOLLOW MAJOR CENTRAL BANKS POLICIES AND THEIR MAIN MONETARY GOAL AT CURRENT TIME TO MAKE CONSISTENT MONEY IN FOREX?

TO KNOW MORE GO HERE:

https://www.jarrattdavis.com/

TO KNOW MORE GO HERE:

https://www.jarrattdavis.com/

Seyedmajid Masharian

Barclays Capital Research expects an additional BoC hike in Q1 2018 to undo the past “insurance cuts”, but acknowledging that the probability that the BoC moves earlier (in Q4 17) has increased given its upbeat assessment.

On the CAD front, Barclays sees limited downside risk to USD/CAD and continues to expect CAD weakness over the coming months as a subdued inflationary outlook does not imply a more aggressive rate hiking cycle relative to current market pricing.

In line with this view, Barclays is looking for USD/CAD to recover toward 1.33 by year-end and remains long USD/CAD through a 3m 1x2 call spread structure.

Source: Barclays Research

https://www.efxnews.com/story/36528/usdcad-limited-downside-risk-where-target-barclays

On the CAD front, Barclays sees limited downside risk to USD/CAD and continues to expect CAD weakness over the coming months as a subdued inflationary outlook does not imply a more aggressive rate hiking cycle relative to current market pricing.

In line with this view, Barclays is looking for USD/CAD to recover toward 1.33 by year-end and remains long USD/CAD through a 3m 1x2 call spread structure.

Source: Barclays Research

https://www.efxnews.com/story/36528/usdcad-limited-downside-risk-where-target-barclays

Seyedmajid Masharian

HOW MANY GOOD SIGNAL SERVICES AND PAMM ACCOUNTS WITH EXCELLENT RESULTS HAVE YOU SEEN SINCE YOUR

TRADING START JOURNEY ?

HOW MANY OF THEM ARE STILL EXIST?

99% OF THEM CAME AND AFTER A SHORT TIME GONE EVEN WITH THOUSANDS PERCENT OF PROFITS...

DO YOU THINK WHY?

I MYSELF HAVE SEEN SOME ACCOUNTS WITH 2 MILLION PERCENT PROFIT AND IT IS NOW GONE FOR A LONG TIME...

YES BECAUSE THEY DID NOT ADHERE TO CONSERVATIVE MONEY MANAGEMENT RULES...

BELIEVE ME DEAR BROTHERS AND SISTERS I HAVE 8 YEARS EXPERIENCE IN THIS MARKET...

CONSERVATIVE MONEY MANAGEMENT IS THE ONLY THING THAT CAN HELP YOU STAY IN THE MARKET AND ADD TO YOUR PROFITS IN THE LONG TIME.

TRADING START JOURNEY ?

HOW MANY OF THEM ARE STILL EXIST?

99% OF THEM CAME AND AFTER A SHORT TIME GONE EVEN WITH THOUSANDS PERCENT OF PROFITS...

DO YOU THINK WHY?

I MYSELF HAVE SEEN SOME ACCOUNTS WITH 2 MILLION PERCENT PROFIT AND IT IS NOW GONE FOR A LONG TIME...

YES BECAUSE THEY DID NOT ADHERE TO CONSERVATIVE MONEY MANAGEMENT RULES...

BELIEVE ME DEAR BROTHERS AND SISTERS I HAVE 8 YEARS EXPERIENCE IN THIS MARKET...

CONSERVATIVE MONEY MANAGEMENT IS THE ONLY THING THAT CAN HELP YOU STAY IN THE MARKET AND ADD TO YOUR PROFITS IN THE LONG TIME.

Seyedmajid Masharian

THE ONLY THINGS THAT CAN HELP YOU IN REPEATABLE WORST AND UNCERTAIN MARKET CONDITIONS LIKE MARKET INDECISION ARE:

1.CONSERVATIVE MONEY MANAGEMENT

2.BE DISCIPLINED

3.PATIENCE

1.CONSERVATIVE MONEY MANAGEMENT

2.BE DISCIPLINED

3.PATIENCE

Seyedmajid Masharian

Citi: Trading with the bank!

Changes compared to the previous publication:

GBPUSD . A limit order was executed on July 11: sale from 1.2912, target 1.2550, stop 1.3075

Comment: The technical picture indicates the possibility of forming a peak, the balance of short- and medium-term risks is shifted in favor of the depreciation of the pound

Currently opened positions:

EURGBP June 16th purchase from 0.8775, target 0.9100, stop 0.8675. Current result: +47 pips

GBPUSD 13 июля short from 1.2912, target 1.2550, stop loss 1.3075. Current Result : -10 pips

https://www.facebook.com/FX-Trading-Leading-Banks-Trade-Recomendations-1154779751270892/?hc_ref=ARQn3la2WQqDoS9Wv21S8PyXg7EDb0sP2gXwyVzpAxPjhCsU8995im0JI1p8O-TNSKc

Changes compared to the previous publication:

GBPUSD . A limit order was executed on July 11: sale from 1.2912, target 1.2550, stop 1.3075

Comment: The technical picture indicates the possibility of forming a peak, the balance of short- and medium-term risks is shifted in favor of the depreciation of the pound

Currently opened positions:

EURGBP June 16th purchase from 0.8775, target 0.9100, stop 0.8675. Current result: +47 pips

GBPUSD 13 июля short from 1.2912, target 1.2550, stop loss 1.3075. Current Result : -10 pips

https://www.facebook.com/FX-Trading-Leading-Banks-Trade-Recomendations-1154779751270892/?hc_ref=ARQn3la2WQqDoS9Wv21S8PyXg7EDb0sP2gXwyVzpAxPjhCsU8995im0JI1p8O-TNSKc

Seyedmajid Masharian

Credit Suisse: Trading with the Bank

Changes compared to the previous publication:

USDCAD . Limid buy order from 1.2750, target 1.3500, stop 1.2460. The order was executed

Comment: The optimism about the Canadian currency has been lagging lately, but now that the rate has already been raised several timesover over the 18 months, in order to develop the trend, reinforcement is needed in the form of fresh pleasant surprises from economic statistics. Credit Suisse believes that the nature of the data in the near future could disappoint the bulls and cool the hopes for tightening the policy of the Bank of Canada.

Currently opened positions:

USDCAD July, 12 purchase from 1.2750, target 1.3500, stop 1.2460. current result -49 pips

EURGBP 21st of June purchase from 0.8785, target 0.9025, stop loss 0.8710. current result +72 pips

NZDUSD June 20th purchase from 0.7240, target 0.7480, stop 0.7165. current result +21 pips

https://www.facebook.com/FX-Trading-Leading-Banks-Trade-Recomendations-1154779751270892/?hc_ref=ARQn3la2WQqDoS9Wv21S8PyXg7EDb0sP2gXwyVzpAxPjhCsU8995im0JI1p8O-TNSKc&fref=nf

Changes compared to the previous publication:

USDCAD . Limid buy order from 1.2750, target 1.3500, stop 1.2460. The order was executed

Comment: The optimism about the Canadian currency has been lagging lately, but now that the rate has already been raised several timesover over the 18 months, in order to develop the trend, reinforcement is needed in the form of fresh pleasant surprises from economic statistics. Credit Suisse believes that the nature of the data in the near future could disappoint the bulls and cool the hopes for tightening the policy of the Bank of Canada.

Currently opened positions:

USDCAD July, 12 purchase from 1.2750, target 1.3500, stop 1.2460. current result -49 pips

EURGBP 21st of June purchase from 0.8785, target 0.9025, stop loss 0.8710. current result +72 pips

NZDUSD June 20th purchase from 0.7240, target 0.7480, stop 0.7165. current result +21 pips

https://www.facebook.com/FX-Trading-Leading-Banks-Trade-Recomendations-1154779751270892/?hc_ref=ARQn3la2WQqDoS9Wv21S8PyXg7EDb0sP2gXwyVzpAxPjhCsU8995im0JI1p8O-TNSKc&fref=nf

Seyedmajid Masharian

TD Bank: recommendations on currency trading!

Changes compared to the previous publication:

NZDJPY . A short position is opened from 82.980, target is 78.500, stop is 85.200. Current Result: +3 pips

Comment: Markets tend to believe that the Reserve Bank of New Zealand will follow the path of the Bank of Canada and a number of other central banks, fueling hopes for tightening policy, but TD Bank believes that the last statement of the RBNZ did not contain any hints on changing its position, and before the expiration of its current mandate there is no need to wait for it.

Changes compared to the previous publication:

NZDJPY . A short position is opened from 82.980, target is 78.500, stop is 85.200. Current Result: +3 pips

Comment: Markets tend to believe that the Reserve Bank of New Zealand will follow the path of the Bank of Canada and a number of other central banks, fueling hopes for tightening policy, but TD Bank believes that the last statement of the RBNZ did not contain any hints on changing its position, and before the expiration of its current mandate there is no need to wait for it.

Seyedmajid Masharian

Barclays Trade Of The Week: Buy USD/CAD

Currency investors should consider buying USD/CAD this week via options, advises Barclays Capital Research in its weekly FX pick.

"In line with our view that the BoC will signal a cautious hike path, we recommend positioning long USDCAD via a 1x2 call spread," Barclays advises.

" Weak inflation, low wage growth and the risk of triggering a plunge in the housing market, provide the BOC with plenty of rationale to proceed carefully, in our view. A dovish tone or signal that the bank does not intend to engage in a full hike path could see USDCAD rally.

In addition, the USDCAD relative strength index (RSI), currently around 30, indicates that the pair is oversold and momentum to the downside looks stretched," Barclays says as a rationale behind this call.

https://www.efxnews.com/story/36491/barclays-trade-week-buy-usdcad

Currency investors should consider buying USD/CAD this week via options, advises Barclays Capital Research in its weekly FX pick.

"In line with our view that the BoC will signal a cautious hike path, we recommend positioning long USDCAD via a 1x2 call spread," Barclays advises.

" Weak inflation, low wage growth and the risk of triggering a plunge in the housing market, provide the BOC with plenty of rationale to proceed carefully, in our view. A dovish tone or signal that the bank does not intend to engage in a full hike path could see USDCAD rally.

In addition, the USDCAD relative strength index (RSI), currently around 30, indicates that the pair is oversold and momentum to the downside looks stretched," Barclays says as a rationale behind this call.

https://www.efxnews.com/story/36491/barclays-trade-week-buy-usdcad

Seyedmajid Masharian

Feel Like Giving Up Trading? Here’s How to Fix That…

The idea for today’s lesson came to me from a member who emailed me recently asking for help with his trading. He had become so frustrated with his trading that he was ready to throw in the towel and give up on trading completely.

This members story is very real, but I have changed the name to keep his identity private. You will probably identify with much of this story if you’ve been struggling or have become frustrated with your trading recently.

Here’s the plan of action I gave to this member, to help him re-ignite his passion for trading and start improving his results…

http://www.learntotradethemarket.com/forex-articles/are-you-ready-to-give-up-on-trading-heres-how-to-fix-that

The idea for today’s lesson came to me from a member who emailed me recently asking for help with his trading. He had become so frustrated with his trading that he was ready to throw in the towel and give up on trading completely.

This members story is very real, but I have changed the name to keep his identity private. You will probably identify with much of this story if you’ve been struggling or have become frustrated with your trading recently.

Here’s the plan of action I gave to this member, to help him re-ignite his passion for trading and start improving his results…

http://www.learntotradethemarket.com/forex-articles/are-you-ready-to-give-up-on-trading-heres-how-to-fix-that

Seyedmajid Masharian

Why do so many Traders Lose Money?

Q. Why do so many traders fail in this business?

Share

A: It is a fact that most traders lose money with foreign exchange trading being the biggest culprit followed by futures, options, contracts for difference/spread betting and trading shares on margin.

I feel that there are many reasons why people fail in this business and, as in most walks of life, there is no 'one fits all' answer and because of this certain people may fail for one single reason or perhaps, more commonly, a combination of reasons which statistically combined leads to the increase in the probabilities of 'risk of ruin'. Generally these reasons might be -:

http://www.financial-spread-betting.com/Trading-failures.html

Q. Why do so many traders fail in this business?

Share

A: It is a fact that most traders lose money with foreign exchange trading being the biggest culprit followed by futures, options, contracts for difference/spread betting and trading shares on margin.

I feel that there are many reasons why people fail in this business and, as in most walks of life, there is no 'one fits all' answer and because of this certain people may fail for one single reason or perhaps, more commonly, a combination of reasons which statistically combined leads to the increase in the probabilities of 'risk of ruin'. Generally these reasons might be -:

http://www.financial-spread-betting.com/Trading-failures.html

Seyedmajid Masharian

WOULD YOU LIKE TO TRADE WITH BIG INVESTMENT BANKS IN FX MARKET?

IS THIS A %100 WINING SAFE STRATEGY ?

EUR/USD: Bullish But Mind ECB Reaction On A Move 'Well Beyond' 1.15 - Credit Suisse

Credit Suisse FX Strategy Research has been generally bullish on the EUR since March.

CS maintains this EUR bullish view on the ground that the better-than-expected growth and political outcomes combined with its "under-owned" structural position should give the EUR room to rally further.

However, CS suspects that inflationary forces are still not strong enough to tolerate sustained EUR/USD rally well beyond 1.15 without prompting central bank reaction.

CS targets EUR/USD at 1.15 in Q3.

Source: Credit Suisse Global Fixed Income Research

https://www.efxnews.com/story/36472/eurusd-bullish-mind-ecb-reaction-move-well-beyond-115-credit-suisse

IS THIS A %100 WINING SAFE STRATEGY ?

EUR/USD: Bullish But Mind ECB Reaction On A Move 'Well Beyond' 1.15 - Credit Suisse

Credit Suisse FX Strategy Research has been generally bullish on the EUR since March.

CS maintains this EUR bullish view on the ground that the better-than-expected growth and political outcomes combined with its "under-owned" structural position should give the EUR room to rally further.

However, CS suspects that inflationary forces are still not strong enough to tolerate sustained EUR/USD rally well beyond 1.15 without prompting central bank reaction.

CS targets EUR/USD at 1.15 in Q3.

Source: Credit Suisse Global Fixed Income Research

https://www.efxnews.com/story/36472/eurusd-bullish-mind-ecb-reaction-move-well-beyond-115-credit-suisse

Seyedmajid Masharian

Citi Research notes that since 2011, Citi US economic surprise index rebounded around the middle of every year, showing worse than expected US economic data may be reduced gradually in the 2H.

" In 2011-2016, since US economic performance of the first two quarters was dragged down by extreme bad weather, economic forecasts became pessimistic. However, as the bad weather passed, better than expected data increased and the US economic surprise index rebounded in the 2H," Citi adds.

On the back of that seasonal factor, Citi sees the the USD consolidating some of its recent losses in the near-term.

https://www.efxnews.com/story/36405/usd-consolidate-n-term-us-data-seasonal-factor-citi

" In 2011-2016, since US economic performance of the first two quarters was dragged down by extreme bad weather, economic forecasts became pessimistic. However, as the bad weather passed, better than expected data increased and the US economic surprise index rebounded in the 2H," Citi adds.

On the back of that seasonal factor, Citi sees the the USD consolidating some of its recent losses in the near-term.

https://www.efxnews.com/story/36405/usd-consolidate-n-term-us-data-seasonal-factor-citi

Seyedmajid Masharian

A piece from UBS for the weekend, from their most recent Global Macro Strategy

In (very) brief and focusing on the EUR

Central banks are tightening amid falling rates of inflation and declining oil prices

In the short term, this is triggering a mini dollar rally

The new macro cycle suggests investors fade short-lived cycles and use them to position for long-term trends ... investors need to identify pockets of "long-term" value

Building our UBS FX Value frameworks ... based on the analysis of G10 current account dynamics

http://www.forexlive.com/

In (very) brief and focusing on the EUR

Central banks are tightening amid falling rates of inflation and declining oil prices

In the short term, this is triggering a mini dollar rally

The new macro cycle suggests investors fade short-lived cycles and use them to position for long-term trends ... investors need to identify pockets of "long-term" value

Building our UBS FX Value frameworks ... based on the analysis of G10 current account dynamics

http://www.forexlive.com/

Seyedmajid Masharian

CitiFX Technical Strategy Research notes that USD/JPY posted a bullish outside week last week indicating higher levels ahead.

"The setup forming looks to be a double bottom which has previously given signs of a decent rally – in both early 2012 and again last year.

The key level to watch is 114.37. A weekly close above there would confirm the setup and indicate a rally to almost 120," Citi adds.

USD/JPY is trading circa 111.25 as of writing.

https://www.efxnews.com/story/36370/usdjpy-attempting-double-bottom-weekly-charts-levels-targets-citi

"The setup forming looks to be a double bottom which has previously given signs of a decent rally – in both early 2012 and again last year.

The key level to watch is 114.37. A weekly close above there would confirm the setup and indicate a rally to almost 120," Citi adds.

USD/JPY is trading circa 111.25 as of writing.

https://www.efxnews.com/story/36370/usdjpy-attempting-double-bottom-weekly-charts-levels-targets-citi

Seyedmajid Masharian

Forex traders plotted strategy in secret chats

Traders of major banks fined $4.3 billion Wednesday for attempted manipulation of foreign exchange markets used electronic chat rooms to plot their moves.

https://www.usatoday.com/story/money/business/2014/11/12/banks-forex-chat-room-excerpts/18901819/

Traders of major banks fined $4.3 billion Wednesday for attempted manipulation of foreign exchange markets used electronic chat rooms to plot their moves.

https://www.usatoday.com/story/money/business/2014/11/12/banks-forex-chat-room-excerpts/18901819/

: