LiteFinance / Perfil

Desde ano 2005, a corretora ECN online LiteFinance (ex. LiteForex) oferece aos clientes uma oportunidade de acessar à liquidez profundíssima nos mercados cambiais e de valores mobiliários. Para operar através de LiteFinance (ex. LiteForex), são disponíveis todos os principais pares de moedas e cotações cruzadas, petróleo, metais nobres, índices bolsistas, ações das companhias e maior conjunto de pares de criptomoedas entre as corretoras.

Amigos

381

Pedidos

Enviados

LiteFinance

Forex in June: the impossible is possible

The growth of global risk appetite, which looked incredible in April and unnatural in May, can continue in June

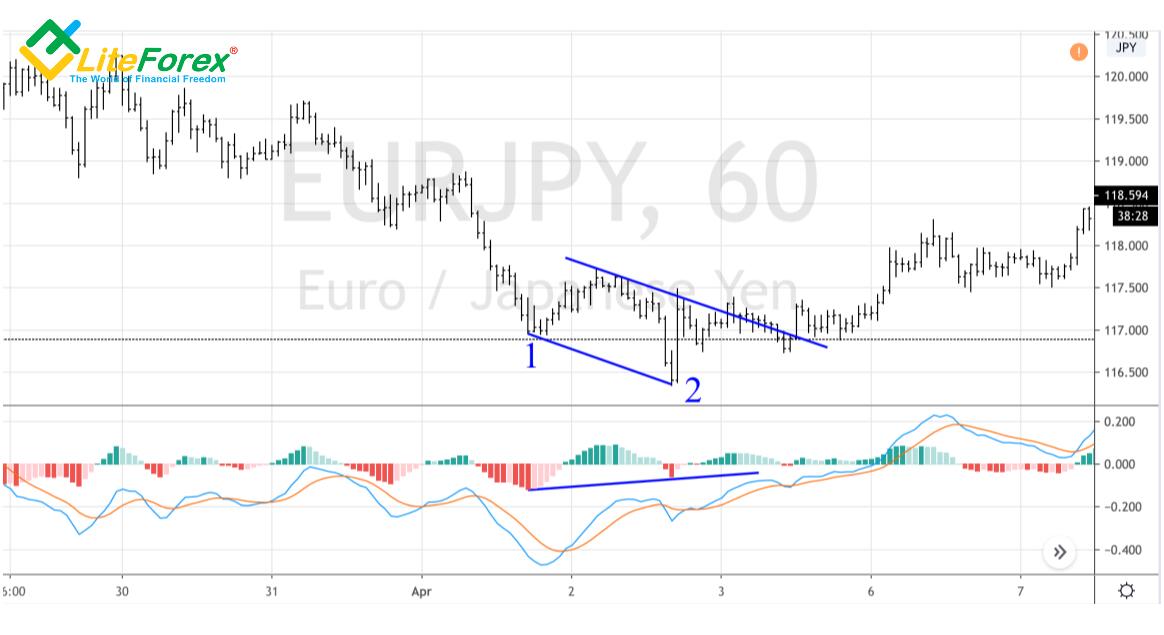

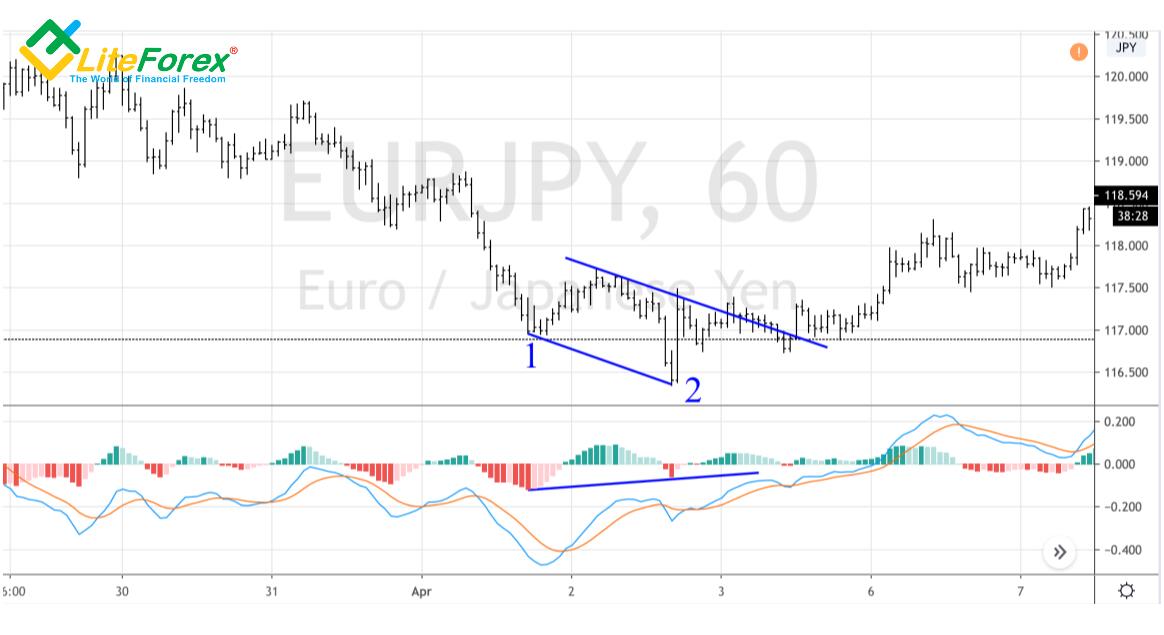

In Forex, like in a casino, the most important is to stop at the right time. Based on the statistical analysis with fundamental components, I recommended exiting the EUR/USD and GBP/USD shorts at the end of May. Just these two operations could have increased the deposit by 6%. Alas, but the strong euro rally at the end of May has a little spoiled the whole situation. The shorts on the EUR/USD and EUR/JPY yielded losses of about 3.3%, and shorts on the GBP/USD and GBP/CHF resulted in a loss of about 3.9%. Greed may lead to losses. However, I have many times stressed that seasonal regularities should be used in addition to the fundamental and technical analysis.

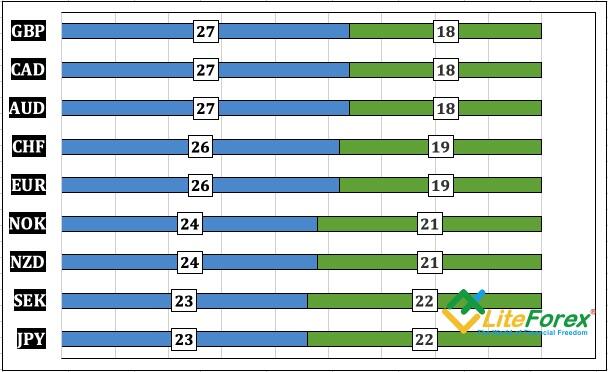

June is a good time for commodity currencies. Since 1975, the AUD and CAD strengthened versus the US dollar in 27 cases against 18. The NZD performed a little worse, however, it also rose against the greenback. The idea to buy the AUD/USD and sell the USD/CAD is not new, I have recently written about this based on the lockdown stringency.

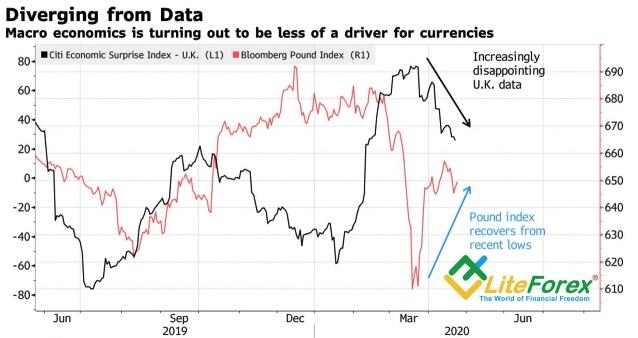

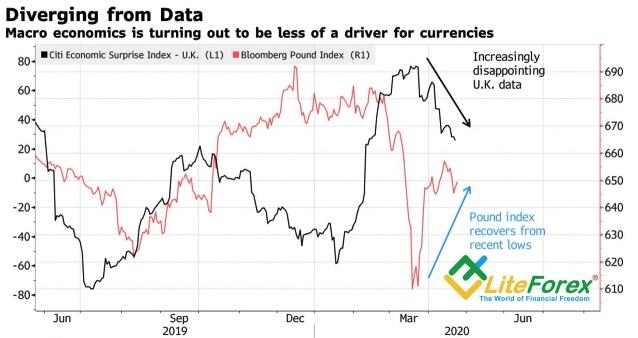

The pound is usually weak in May amid the dividend payments to foreigners, which has been again proven in May. However, history proves that the situation radically changes in June. The sterling, as a rule, is among the best-performing currencies in June. The GBP median performance is behind only the AUD and the NZD. The median value was lower due to the GBP/USD sale-offs in 1975 (-6.1%), 1981 (-6.8%), 1988 (-7.9%), and 2016 (-8.4%). In the latter case, the sales resulted from the referendum on the UK membership in the EU, whose fallout is still present. For example, Boris Johnson should participate in the EU summit in June. If the UK Prime Minister makes a step towards the agreement with Brussels or extends the Brexit deadline, this will be a positive factor for the pound.

I should note that the greenback was usually rather weak in June, which under the current conditions means the S&P 500 rally should continue. According to James Bullard, the president Federal Reserve Bank of St. Louis, if the US GDP features the worst drop in the second quarter, it should feature the best performance in the third quarter. There is still some hope for the V-shaped recovery of the US economy. Besides, the growth of the US stocks, usually followed by an increase in the global risk appetite, is a good reason to use the excellent trading conditions offered by LiteForex and buy income-earning assets. However, do remember the rule that, in Forex, like in a casino, the most important is to stop on time. Even in the best times, the AUD and the CAD rose by just 1.55% and 1.12%.

Supported by the unity and generosity of the EU, the euro is rising. However, taking into account the seasonal strength of the Swiss franc, I would hedge the EUR/USD longs by the EUR/CHF shorts, betting on the high volatility of the world’s major currencies, which suggest moderate targets.

Periods of rise and fall

The growth of global risk appetite, which looked incredible in April and unnatural in May, can continue in June

In Forex, like in a casino, the most important is to stop at the right time. Based on the statistical analysis with fundamental components, I recommended exiting the EUR/USD and GBP/USD shorts at the end of May. Just these two operations could have increased the deposit by 6%. Alas, but the strong euro rally at the end of May has a little spoiled the whole situation. The shorts on the EUR/USD and EUR/JPY yielded losses of about 3.3%, and shorts on the GBP/USD and GBP/CHF resulted in a loss of about 3.9%. Greed may lead to losses. However, I have many times stressed that seasonal regularities should be used in addition to the fundamental and technical analysis.

June is a good time for commodity currencies. Since 1975, the AUD and CAD strengthened versus the US dollar in 27 cases against 18. The NZD performed a little worse, however, it also rose against the greenback. The idea to buy the AUD/USD and sell the USD/CAD is not new, I have recently written about this based on the lockdown stringency.

The pound is usually weak in May amid the dividend payments to foreigners, which has been again proven in May. However, history proves that the situation radically changes in June. The sterling, as a rule, is among the best-performing currencies in June. The GBP median performance is behind only the AUD and the NZD. The median value was lower due to the GBP/USD sale-offs in 1975 (-6.1%), 1981 (-6.8%), 1988 (-7.9%), and 2016 (-8.4%). In the latter case, the sales resulted from the referendum on the UK membership in the EU, whose fallout is still present. For example, Boris Johnson should participate in the EU summit in June. If the UK Prime Minister makes a step towards the agreement with Brussels or extends the Brexit deadline, this will be a positive factor for the pound.

I should note that the greenback was usually rather weak in June, which under the current conditions means the S&P 500 rally should continue. According to James Bullard, the president Federal Reserve Bank of St. Louis, if the US GDP features the worst drop in the second quarter, it should feature the best performance in the third quarter. There is still some hope for the V-shaped recovery of the US economy. Besides, the growth of the US stocks, usually followed by an increase in the global risk appetite, is a good reason to use the excellent trading conditions offered by LiteForex and buy income-earning assets. However, do remember the rule that, in Forex, like in a casino, the most important is to stop on time. Even in the best times, the AUD and the CAD rose by just 1.55% and 1.12%.

Supported by the unity and generosity of the EU, the euro is rising. However, taking into account the seasonal strength of the Swiss franc, I would hedge the EUR/USD longs by the EUR/CHF shorts, betting on the high volatility of the world’s major currencies, which suggest moderate targets.

Periods of rise and fall

LiteFinance

Gold market

Gold market: peculiarities of pricing and structure

When trading commodities, it’s important to be aware of their demand&supply’s structure and dynamics. A typical example is oil, which is recovering lost positions by leaps and bounds amid expectations of growing demand and surplus reduction, as main global economies have started to reopen. Unlike Brent and WTI, gold is less sensitive to the physical asset market’s state. However, it can punish any time a trader who ignores fundamental analysis.

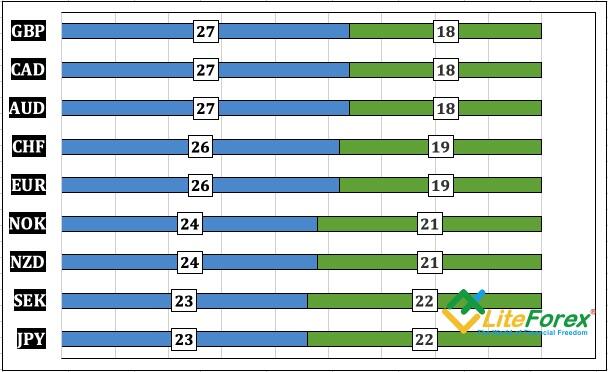

Jewellery production and investment prevail in the gold global demand structure. In 2019, they accounted for 48.5% and 29.2% of demand, respectively. Central banks’ share in gold purchases was 14.8% while industrial use accounted for 7.5% of gold consumption. The latter indicator is important. The thing is it is much higher for silver. The shutdown of industrial enterprises led therefore to a faster slump of XAG/USD if compared with XAU/USD. As a result, the gold-silver ratio soared to historical peaks. Against the backdrop of the recovering global economy, the ratio may be expected to drop. It means, we’d better bet on silver’s faster growth against gold.

The relative share of investment in the structure of the gold global demand grew up to 49.8% while the share of jewellery production dropped to 30.1%. Consumption of gold reduced almost in all sectors, except for ETFs and coins, as compared with October-December and January-March 2019.

A change in a demand structure is an important pricing factor. When it happens, we may say a current trend is stable. The shift from jewellery to investment is a clear sign of bulls’ market dominance. Jewellery is too expensive and its consumption is falling. On the contrary, the faster ETFs’ reserves grow, the higher their quotes are and the bigger their buying army is. They sometimes say, gold flows from east to west in an uptrend. True, in 2019 the relative share of China and India in the jewellery’s gold consumption structure was 67%, while the main ETFs are located in the USA, including the biggest fund SPDR Gold Shares, and Europe.

The main producers of gold are China (404.1 t), Australia (314.9 t), Russia (297.3 t), USA (221.7 t) and other countries. Supply’s influence on the price is limited. The year 2013 is a bright example. Many said then XAU/USD quotes couldn’t drop below $1,300-1,350 per ounce as it was gold producing companies’ break-even. They said production would be cut to provoke a deficit and a price growth. But in fact, existing hedging technologies allowed companies to fix the price and continue producing the same volumes of gold. So, gold fell even below the expected levels and buyers were punished for their extreme self-confidence.

At the same time, supply shouldn’t be fully ignored. In 2020, investors felt a critical shortage of the physical asset when trading forwards amidst the pandemic and shutdowns. As a result, gold premiums grew in the USA and Europe and XAU/USD quotes rose as well.

So, investment demand is an important factor in gold pricing. Its volume is mostly affected by central banks’ monetary policies. Massive monetary expansion contributes to weakening major currencies, dropping bond yield and raising XAU/USD quotes.

Dynamics of global demand for gold

Gold market: peculiarities of pricing and structure

When trading commodities, it’s important to be aware of their demand&supply’s structure and dynamics. A typical example is oil, which is recovering lost positions by leaps and bounds amid expectations of growing demand and surplus reduction, as main global economies have started to reopen. Unlike Brent and WTI, gold is less sensitive to the physical asset market’s state. However, it can punish any time a trader who ignores fundamental analysis.

Jewellery production and investment prevail in the gold global demand structure. In 2019, they accounted for 48.5% and 29.2% of demand, respectively. Central banks’ share in gold purchases was 14.8% while industrial use accounted for 7.5% of gold consumption. The latter indicator is important. The thing is it is much higher for silver. The shutdown of industrial enterprises led therefore to a faster slump of XAG/USD if compared with XAU/USD. As a result, the gold-silver ratio soared to historical peaks. Against the backdrop of the recovering global economy, the ratio may be expected to drop. It means, we’d better bet on silver’s faster growth against gold.

The relative share of investment in the structure of the gold global demand grew up to 49.8% while the share of jewellery production dropped to 30.1%. Consumption of gold reduced almost in all sectors, except for ETFs and coins, as compared with October-December and January-March 2019.

A change in a demand structure is an important pricing factor. When it happens, we may say a current trend is stable. The shift from jewellery to investment is a clear sign of bulls’ market dominance. Jewellery is too expensive and its consumption is falling. On the contrary, the faster ETFs’ reserves grow, the higher their quotes are and the bigger their buying army is. They sometimes say, gold flows from east to west in an uptrend. True, in 2019 the relative share of China and India in the jewellery’s gold consumption structure was 67%, while the main ETFs are located in the USA, including the biggest fund SPDR Gold Shares, and Europe.

The main producers of gold are China (404.1 t), Australia (314.9 t), Russia (297.3 t), USA (221.7 t) and other countries. Supply’s influence on the price is limited. The year 2013 is a bright example. Many said then XAU/USD quotes couldn’t drop below $1,300-1,350 per ounce as it was gold producing companies’ break-even. They said production would be cut to provoke a deficit and a price growth. But in fact, existing hedging technologies allowed companies to fix the price and continue producing the same volumes of gold. So, gold fell even below the expected levels and buyers were punished for their extreme self-confidence.

At the same time, supply shouldn’t be fully ignored. In 2020, investors felt a critical shortage of the physical asset when trading forwards amidst the pandemic and shutdowns. As a result, gold premiums grew in the USA and Europe and XAU/USD quotes rose as well.

So, investment demand is an important factor in gold pricing. Its volume is mostly affected by central banks’ monetary policies. Massive monetary expansion contributes to weakening major currencies, dropping bond yield and raising XAU/USD quotes.

Dynamics of global demand for gold

LiteFinance

All roads lead the euro to Rome

EUR/USD will rally up if the EU adopts the offer made by Emmanuel Macron and Angela Merkel

The ECB is willing to save Italy, but will the EU agree? According to the Bank of France Governor Francois Villeroy de Galhau, using the capital key, when the QE size is associated with the size of the economy, is not necessary for the emergency program. Germany, whose GDP should drop by 6.5% in 2020, is likely to receive the most benefits, while Italy’s, Spain’s and Greece’s GDPs will lose more than 9%. The European central bank is willing to not only boost the QE volume but also break its own rules, which is a positive factor for the euro. However, little depends on Frankfurt, the key decisions will be taken in Brussels.

The EUR/USD rise to 1.1 amid the news about the French-German plan for a €500-billion recovery fund is natural. European governments support unity. However, not all member-states support this idea. Austria, Sweden, Denmark, and the Netherlands stated their opposition to grants, calling for a loans-based approach instead. Only 32% of the investors polled by ExanteData believe that the EU will fully accept the proposal of Paris and Berlin. 38.2% of respondents suggest that the plan should be corrected. This is a bear factor for the euro, allowing selling the EUR/USD on the rise.

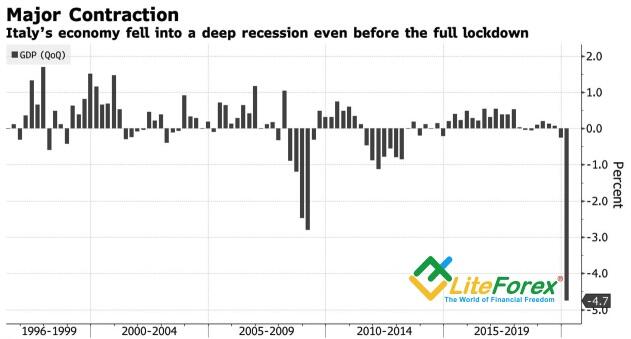

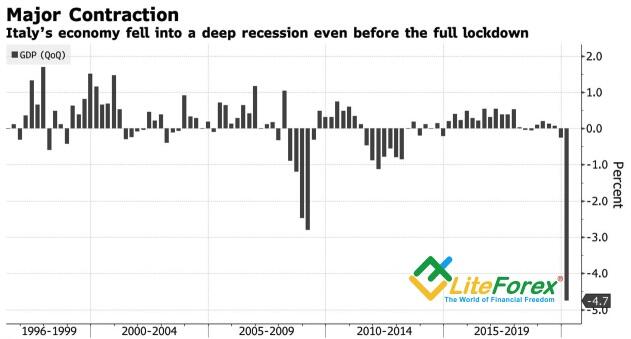

The major problem is in Italy, whose economy stopped expanding after the introduction of the single European currency, and the US stocks started to outperform the euro-area peers.

Unless Rome receives enough support, it makes no sense to be an EU member. The risks of the euro-area breakup will press the EUR/USD down. However, the French-German plan could still be adopted at the EU summit, which will allow the euro to rise.

In the meanwhile, the euro-dollar trend mostly depends on the US stock indexes, as investors are weighing which is a more important factor, the reopening of the global economies or the escalation of the US-China trade war. According to the Netherlands Bureau of Economic Policy, international trade in March contracted by 1.4 M-o-M and 4.3 Y-o-Y, which is the worst drop since 2009. This is a negative factor for the export-led euro-area economy. However, the indicator should rebound in the May-June period, also because of the active fulfillment of China’s obligations to the US.

US-China trade relations seem to have aggravated. However, Donald Trump wants to be re-elected as the US President, so he needs to put pressure on China. Besides, the escalation of the situation forces China to stimulate its economy to increase the purchases of US goods. Since the pandemic started, PBoC has injected about 5.9 trillion yuan ($ 827.6 billion) in the economy, and it is willing to continue in the same way. This suggests a V-shaped rebound of China’s economy, which in the medium term will support the EUR/USD, currently stuck in the trading range of 1.077-1.099.

Dynamics of international trade

EUR/USD will rally up if the EU adopts the offer made by Emmanuel Macron and Angela Merkel

The ECB is willing to save Italy, but will the EU agree? According to the Bank of France Governor Francois Villeroy de Galhau, using the capital key, when the QE size is associated with the size of the economy, is not necessary for the emergency program. Germany, whose GDP should drop by 6.5% in 2020, is likely to receive the most benefits, while Italy’s, Spain’s and Greece’s GDPs will lose more than 9%. The European central bank is willing to not only boost the QE volume but also break its own rules, which is a positive factor for the euro. However, little depends on Frankfurt, the key decisions will be taken in Brussels.

The EUR/USD rise to 1.1 amid the news about the French-German plan for a €500-billion recovery fund is natural. European governments support unity. However, not all member-states support this idea. Austria, Sweden, Denmark, and the Netherlands stated their opposition to grants, calling for a loans-based approach instead. Only 32% of the investors polled by ExanteData believe that the EU will fully accept the proposal of Paris and Berlin. 38.2% of respondents suggest that the plan should be corrected. This is a bear factor for the euro, allowing selling the EUR/USD on the rise.

The major problem is in Italy, whose economy stopped expanding after the introduction of the single European currency, and the US stocks started to outperform the euro-area peers.

Unless Rome receives enough support, it makes no sense to be an EU member. The risks of the euro-area breakup will press the EUR/USD down. However, the French-German plan could still be adopted at the EU summit, which will allow the euro to rise.

In the meanwhile, the euro-dollar trend mostly depends on the US stock indexes, as investors are weighing which is a more important factor, the reopening of the global economies or the escalation of the US-China trade war. According to the Netherlands Bureau of Economic Policy, international trade in March contracted by 1.4 M-o-M and 4.3 Y-o-Y, which is the worst drop since 2009. This is a negative factor for the export-led euro-area economy. However, the indicator should rebound in the May-June period, also because of the active fulfillment of China’s obligations to the US.

US-China trade relations seem to have aggravated. However, Donald Trump wants to be re-elected as the US President, so he needs to put pressure on China. Besides, the escalation of the situation forces China to stimulate its economy to increase the purchases of US goods. Since the pandemic started, PBoC has injected about 5.9 trillion yuan ($ 827.6 billion) in the economy, and it is willing to continue in the same way. This suggests a V-shaped rebound of China’s economy, which in the medium term will support the EUR/USD, currently stuck in the trading range of 1.077-1.099.

Dynamics of international trade

LiteFinance

Dollar creates obstacles

EUR/USD bulls are going ahead, but there are no gains without losses

The risk of the euro-area breakup was reduced as Germany and France offered a €500-billion European recovery fund to support the EU countries worst affected by the pandemic. This news encouraged EUR/USD. At the same time, the dispute between Democrats and Republicans in the USA about the terms and size of the fiscal stimulus may support ….the US dollar. The greenback and the euro react to the growing uncertainty in different ways. The dollar has benefits as a safe-haven asset. In this respect, different approaches of the Fed and the US administration to the US GDP recovery have set the EUR/USD buyers back.

Speaking before the US Senate Banking Committee, the Treasury Secretary Steven Mnuchin and the Federal Reserve Chair Jerome Powell offered contrasting views of the US economic prospects. According to Steven Mnuchin, the third quarter could be quite good, and the GDP can well follow a V-shaped rebound. Jerome Powell, by contrast, says the fear of the coronavirus will set the economic growth back. It will take a long time until the US GDP completely rebounds. The same opinion, by the way, is shared by the Congressional Budget Office, which expects the US GDP in the fourth quarter of 2020 will be 5.6% lower than a year ago.

Different views of the Treasury and the Fed are not a new driver. The US central bank has many times emphasized the necessity of an additional fiscal stimulus. Democrats are willing to provide a total package of $3 trillion. However, Donald Trump is yet rejecting this bill. The US President says that extra money given to the unemployed will discourage them from the search for new jobs, which will hold the US GDP recovery back. The US stock market is not confident in additional support, which strengthens the US dollar.

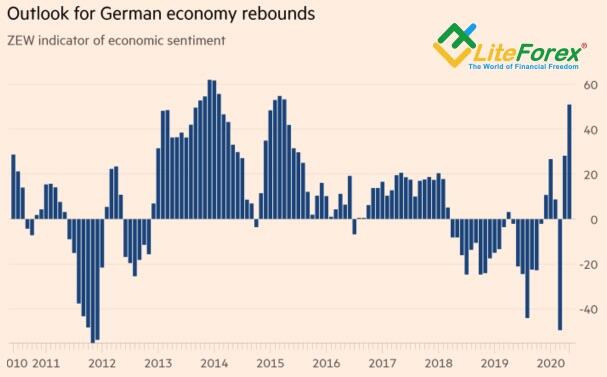

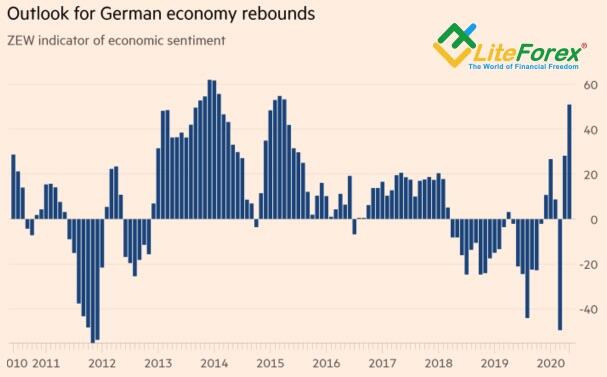

The uncertainty of the S&P 500 is likely to be the major factor weighing on the EUR/USD. The euro is stabilizing due to the offer by Angela Merkel and Emmanuel Macron, the growth of the German indicator of economic sentiment to its 5-year high, the ECB willingness to support the euro-area economy, and the lower risks of the US-China trade war escalation. As a result, the spread between the euro put and call premiums has narrowed to the minimum value since March 17, and the euro-dollar three-month risk reversals have entered the positive area.

According to the U.S. Department of Agriculture, in the 10 weeks ended May 7, gross sales of U.S. corn and pork to China were up by eight times, cotton exports were three times higher than they were in the same period in 2017 before the trade war started, soybeans exports increased by about 30%. China has significantly stepped up purchases of U.S. agriculture products to avert the trade war escalation. This is a positive factor for the export-led euro-area economy, and so, for the euro. The EUR/USD bulls are willing to continue the rally up to 1.1055-1.107. However, the euro has many problems, which are likely to create obstacles for the buyers.

Dynamic of German’s economic sentiment

EUR/USD bulls are going ahead, but there are no gains without losses

The risk of the euro-area breakup was reduced as Germany and France offered a €500-billion European recovery fund to support the EU countries worst affected by the pandemic. This news encouraged EUR/USD. At the same time, the dispute between Democrats and Republicans in the USA about the terms and size of the fiscal stimulus may support ….the US dollar. The greenback and the euro react to the growing uncertainty in different ways. The dollar has benefits as a safe-haven asset. In this respect, different approaches of the Fed and the US administration to the US GDP recovery have set the EUR/USD buyers back.

Speaking before the US Senate Banking Committee, the Treasury Secretary Steven Mnuchin and the Federal Reserve Chair Jerome Powell offered contrasting views of the US economic prospects. According to Steven Mnuchin, the third quarter could be quite good, and the GDP can well follow a V-shaped rebound. Jerome Powell, by contrast, says the fear of the coronavirus will set the economic growth back. It will take a long time until the US GDP completely rebounds. The same opinion, by the way, is shared by the Congressional Budget Office, which expects the US GDP in the fourth quarter of 2020 will be 5.6% lower than a year ago.

Different views of the Treasury and the Fed are not a new driver. The US central bank has many times emphasized the necessity of an additional fiscal stimulus. Democrats are willing to provide a total package of $3 trillion. However, Donald Trump is yet rejecting this bill. The US President says that extra money given to the unemployed will discourage them from the search for new jobs, which will hold the US GDP recovery back. The US stock market is not confident in additional support, which strengthens the US dollar.

The uncertainty of the S&P 500 is likely to be the major factor weighing on the EUR/USD. The euro is stabilizing due to the offer by Angela Merkel and Emmanuel Macron, the growth of the German indicator of economic sentiment to its 5-year high, the ECB willingness to support the euro-area economy, and the lower risks of the US-China trade war escalation. As a result, the spread between the euro put and call premiums has narrowed to the minimum value since March 17, and the euro-dollar three-month risk reversals have entered the positive area.

According to the U.S. Department of Agriculture, in the 10 weeks ended May 7, gross sales of U.S. corn and pork to China were up by eight times, cotton exports were three times higher than they were in the same period in 2017 before the trade war started, soybeans exports increased by about 30%. China has significantly stepped up purchases of U.S. agriculture products to avert the trade war escalation. This is a positive factor for the export-led euro-area economy, and so, for the euro. The EUR/USD bulls are willing to continue the rally up to 1.1055-1.107. However, the euro has many problems, which are likely to create obstacles for the buyers.

Dynamic of German’s economic sentiment

LiteFinance

Aussie is going to be the winner

AUD/USD could break through the two-month highs

After it became clear that China would be the first to win the struggle with the coronavirus, the Australian dollar has become my favorite. The idea to buy the Aussie seemed strange amid the first recession in Australia since the 1990s, the AUD/USD drop to the lowest low since 2002, and the QE launched by the RBA. However, as early as in late March, I saw that, if the global recession had resulted from the pandemic, one should bet on the currencies of the countries that should be the first to manage the pandemic. My basic strategy has been buying the AUD from the zone of $0.59-$0.62 with the targets at $0.675 and $0.69, it perfectly worked out due to the excellent LiteForex trading conditions.

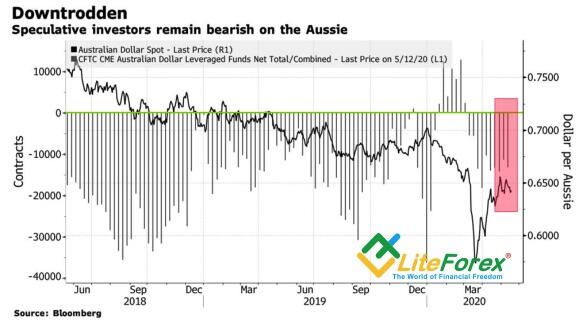

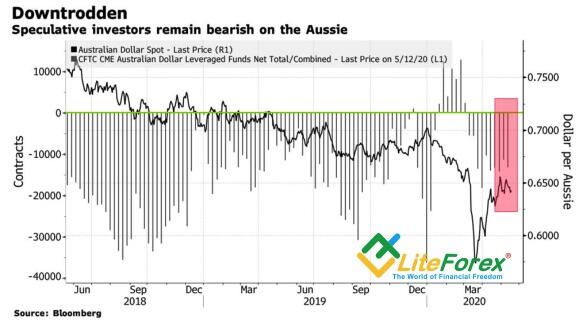

The AUD/USD has been up by 19% from the March lows, and the Australian dollar is now seen as an example to follow by the currencies of the countries hit by COVID-19. Due to China and the growth in commodity prices, Australia’s GDP could recover quicker than the U.S. and euro-area GDPs, which is an important reason to buy the Aussie versus the greenback and the euro. Remember, Jerome Powell says that the US economy will hardly recover until 2021; the ECB says the euro-area GDP will reach the pre-crisis levels only in 2022. Against such a background, it is natural that the speculators, who used to be bearish on the Australian dollar, are now exiting shorts.

Canberra has done a lot to help Australia’s economy recover. The $AU130-billion fiscal stimulus, taking into account the GDP pace, looks one of the most aggressive among the G10 countries. Besides, the RBA, unlike the Fed, didn’t have to boost the balance sheet. Following the Bank of Japan, Australia’s central bank adopted the yield curve control policy, setting the target for the yield on 3-year Australia government bonds at 0.25%, which has proven its effectiveness. The volume of bond purchases is contracting, the market has stabilized, and they may not need to expand the monetary stimulus.

Yes, bears could point to the drop in Australia’s employment by 594,300 in April and the RBA gloomy forecasts that suggest the GDP be down by 10% in the first quarter and by 6% in the entire year 2020, however, all countries are suffering from a downturn now. I would be surprised if any country reported positive statistics.

However, not everything is that bright. China supports the AUD/USD rally, but it can also send the Aussie it down. A typical example is the suspension of the Australian pork imports and the start of an anti-dumping barley import audit by China, which could increase import tariffs to 80%, as China’s retaliation to Australia for its support of the USA in the investigation of the laboratory origins of COVID-19. This idea hasn’t been further developed, so, I expect and improvement in the China-Australia trade relations. Unless there is a new round of trade wars, we can continue to buy the AUD/USD with the targets at 0.675 and 0.69.

AUD speculative positions

AUD/USD could break through the two-month highs

After it became clear that China would be the first to win the struggle with the coronavirus, the Australian dollar has become my favorite. The idea to buy the Aussie seemed strange amid the first recession in Australia since the 1990s, the AUD/USD drop to the lowest low since 2002, and the QE launched by the RBA. However, as early as in late March, I saw that, if the global recession had resulted from the pandemic, one should bet on the currencies of the countries that should be the first to manage the pandemic. My basic strategy has been buying the AUD from the zone of $0.59-$0.62 with the targets at $0.675 and $0.69, it perfectly worked out due to the excellent LiteForex trading conditions.

The AUD/USD has been up by 19% from the March lows, and the Australian dollar is now seen as an example to follow by the currencies of the countries hit by COVID-19. Due to China and the growth in commodity prices, Australia’s GDP could recover quicker than the U.S. and euro-area GDPs, which is an important reason to buy the Aussie versus the greenback and the euro. Remember, Jerome Powell says that the US economy will hardly recover until 2021; the ECB says the euro-area GDP will reach the pre-crisis levels only in 2022. Against such a background, it is natural that the speculators, who used to be bearish on the Australian dollar, are now exiting shorts.

Canberra has done a lot to help Australia’s economy recover. The $AU130-billion fiscal stimulus, taking into account the GDP pace, looks one of the most aggressive among the G10 countries. Besides, the RBA, unlike the Fed, didn’t have to boost the balance sheet. Following the Bank of Japan, Australia’s central bank adopted the yield curve control policy, setting the target for the yield on 3-year Australia government bonds at 0.25%, which has proven its effectiveness. The volume of bond purchases is contracting, the market has stabilized, and they may not need to expand the monetary stimulus.

Yes, bears could point to the drop in Australia’s employment by 594,300 in April and the RBA gloomy forecasts that suggest the GDP be down by 10% in the first quarter and by 6% in the entire year 2020, however, all countries are suffering from a downturn now. I would be surprised if any country reported positive statistics.

However, not everything is that bright. China supports the AUD/USD rally, but it can also send the Aussie it down. A typical example is the suspension of the Australian pork imports and the start of an anti-dumping barley import audit by China, which could increase import tariffs to 80%, as China’s retaliation to Australia for its support of the USA in the investigation of the laboratory origins of COVID-19. This idea hasn’t been further developed, so, I expect and improvement in the China-Australia trade relations. Unless there is a new round of trade wars, we can continue to buy the AUD/USD with the targets at 0.675 and 0.69.

AUD speculative positions

LiteFinance

Dollar changed the shoes

The White House changed its attitude to the U.S. currency

You could do anything to win the presidential elections! You could also abruptly reverse your own point of view. For most of his presidential term, Donald Trump was a fan of a weak dollar. In May, however, he supports the position of the former U.S. administrations that the strong currency is necessary. And the current US President has his reasons. Amid the huge fiscal stimulus, the focus is switched from foreign trade and competitiveness to the sources of managing the growing budget deficit. Besides, the strong greenback currently seems to be an advantage, as the strong currency indicates the US strong economy.

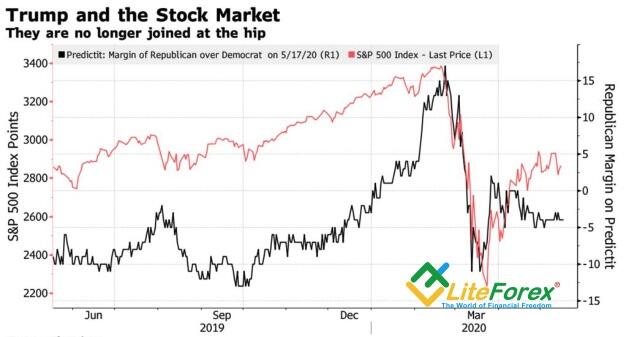

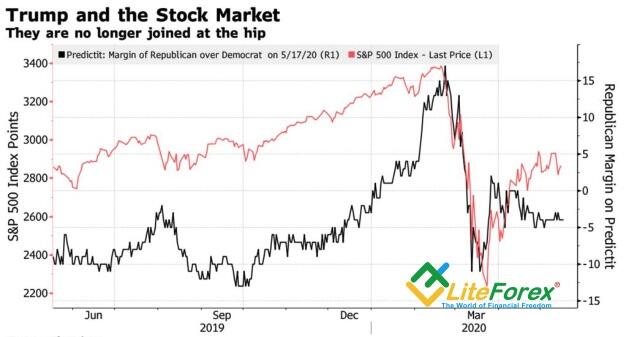

Donald Trump needs to find the subtle balance line between the US stock indexes and the US dollar, which are moving in opposite directions as investors are very responsive to the risk. Trump always saw the S&P 500 be an indicator of his success as the President. Also, the US stock market crash in March substantially lowered Trump’s chance to win the upcoming presidential election.

Therefore, it is not surprising that the worst drop in the US industrial production (-11.2%) and retail sales (-16.4%) since the government began tracking in 1911 and 1992 respectively, is presented as a bottom of indicators’ fall. They say it can’t be worse than in April. Yes, retail sales account for about 42% of the US consumer spending or 70% of the GDP, and the indicator’s drop by 23% over two months has subtracted, according to the ING, more than 6 basis points from the nominal gross domestic product. But the worst is already over, isn’t it?

One should understand Jerome Powell’s words that it doesn’t make sense to bet against the US economy, and the Fed hasn’t yet run out of the monetary tools. According to the FOMC president, the current recession is not that deep as the Great Depression, though the pre-crisis conditions will hardly be restored until 2021. Such a tone of the Fed’s president and the interpretation of the US domestic data support the S&P 500.

The major growth driver for the US dollar is the talks about the escalation of the US-China trade war. I must admit that the White House successfully fuels the conflict that seemed to be easing. Another portion of the gas in the fire of the trade dispute was poured by the tougher licensing requirements for the companies working with Huawei.

The euro, on the contrary, has many problems pressing it down. After the report on Germany’s GDP for the first quarter, the split among the euro-area members continues growing.

Germany’s GDP is better than that of most European states, also because Germany introduced the measure limiting the economic activity later (on March 23) than other European countries, and the production sector was hit by the crisis less than the services and tourism sectors. Under the current conditions, the EUR/USD pair is more likely to break through the bottom of the trading range 1.077-1.09 than the top.

Dynamics of the S&P 500 and the popularity of Democrats and Republicans

The White House changed its attitude to the U.S. currency

You could do anything to win the presidential elections! You could also abruptly reverse your own point of view. For most of his presidential term, Donald Trump was a fan of a weak dollar. In May, however, he supports the position of the former U.S. administrations that the strong currency is necessary. And the current US President has his reasons. Amid the huge fiscal stimulus, the focus is switched from foreign trade and competitiveness to the sources of managing the growing budget deficit. Besides, the strong greenback currently seems to be an advantage, as the strong currency indicates the US strong economy.

Donald Trump needs to find the subtle balance line between the US stock indexes and the US dollar, which are moving in opposite directions as investors are very responsive to the risk. Trump always saw the S&P 500 be an indicator of his success as the President. Also, the US stock market crash in March substantially lowered Trump’s chance to win the upcoming presidential election.

Therefore, it is not surprising that the worst drop in the US industrial production (-11.2%) and retail sales (-16.4%) since the government began tracking in 1911 and 1992 respectively, is presented as a bottom of indicators’ fall. They say it can’t be worse than in April. Yes, retail sales account for about 42% of the US consumer spending or 70% of the GDP, and the indicator’s drop by 23% over two months has subtracted, according to the ING, more than 6 basis points from the nominal gross domestic product. But the worst is already over, isn’t it?

One should understand Jerome Powell’s words that it doesn’t make sense to bet against the US economy, and the Fed hasn’t yet run out of the monetary tools. According to the FOMC president, the current recession is not that deep as the Great Depression, though the pre-crisis conditions will hardly be restored until 2021. Such a tone of the Fed’s president and the interpretation of the US domestic data support the S&P 500.

The major growth driver for the US dollar is the talks about the escalation of the US-China trade war. I must admit that the White House successfully fuels the conflict that seemed to be easing. Another portion of the gas in the fire of the trade dispute was poured by the tougher licensing requirements for the companies working with Huawei.

The euro, on the contrary, has many problems pressing it down. After the report on Germany’s GDP for the first quarter, the split among the euro-area members continues growing.

Germany’s GDP is better than that of most European states, also because Germany introduced the measure limiting the economic activity later (on March 23) than other European countries, and the production sector was hit by the crisis less than the services and tourism sectors. Under the current conditions, the EUR/USD pair is more likely to break through the bottom of the trading range 1.077-1.09 than the top.

Dynamics of the S&P 500 and the popularity of Democrats and Republicans

LiteFinance

Trade war: to be or not to be?

Donald Trump provokes China but China is different now

When I look at some people there’s only one thing I can think about: how do I get an arms licence? A renewal of the US-China trade war is the last thing the global economy needs now when the pandemic is here. Still, Trump won’t calm down and continues blowing the whistle on Beijing. One day he threatens to introduce import taxes in reaction to the alleged origin of coronavirus from a laboratory and failure to fulfil the obligations to buy American products. Another day, he forbids the US largest federal pension fund to invest in Chinese shares. Another say, he speaks aloud of a total breakup with China, which will allow the States to save $500 billion. Can’t Trump just put his mask on and keep his mouth shut?

China understands the benefits of being the first country that has made coronavirus kneel down. It’s not the same country it was at the beginning of 2020. China has made everyone understand no one can twist it around their little finger. Otherwise they will be given the finger. And if the Americans want to tell the Chinese to go to hell, they will have to see them off until the final destination. Beijing swaps diplomacy for threats more and more often. It stops buying Australian pork in response to Canberra’s intention to start a global investigation into the origins of coronavirus; it blows up rumours of the US plot against China; it encourages the states that are loyal to China.

Beijing has started to think again it can outrun the West like it did after the crisis of 2007-2009 when the growth of Chinese GDP helped global economy to recover.

As for Trump, Beijing’s chosen the same tactics as Fed chair Jerome Powell did. It pays no attention to US president's angry talks. All know that ignoring is the oldest method of emotional violence. These 2 countries’ relationship looks more and more often like a family idyll when a husband pretends to be the head of family and makes orders while a wife agrees with him and still does things her way.

Trump’s talks of a total breakup with China look like a man’s desire to divorce:

- Why did you divorce?

- My wife and I didn’t have any common interests except 9 children...

The US-China relations are too tight to be easily broken up. It’s almost impossible to remove Chinese businesses from supply chains which involve the USA. Globalisation rules the world. The US stock indexes’ rally says there won’t be any trade wars. How does S&P 500 know everything? People’s wisdom...Still, people aren’t always wise. Sometimes they aren’t sober.

Donald Trump provokes China but China is different now

When I look at some people there’s only one thing I can think about: how do I get an arms licence? A renewal of the US-China trade war is the last thing the global economy needs now when the pandemic is here. Still, Trump won’t calm down and continues blowing the whistle on Beijing. One day he threatens to introduce import taxes in reaction to the alleged origin of coronavirus from a laboratory and failure to fulfil the obligations to buy American products. Another day, he forbids the US largest federal pension fund to invest in Chinese shares. Another say, he speaks aloud of a total breakup with China, which will allow the States to save $500 billion. Can’t Trump just put his mask on and keep his mouth shut?

China understands the benefits of being the first country that has made coronavirus kneel down. It’s not the same country it was at the beginning of 2020. China has made everyone understand no one can twist it around their little finger. Otherwise they will be given the finger. And if the Americans want to tell the Chinese to go to hell, they will have to see them off until the final destination. Beijing swaps diplomacy for threats more and more often. It stops buying Australian pork in response to Canberra’s intention to start a global investigation into the origins of coronavirus; it blows up rumours of the US plot against China; it encourages the states that are loyal to China.

Beijing has started to think again it can outrun the West like it did after the crisis of 2007-2009 when the growth of Chinese GDP helped global economy to recover.

As for Trump, Beijing’s chosen the same tactics as Fed chair Jerome Powell did. It pays no attention to US president's angry talks. All know that ignoring is the oldest method of emotional violence. These 2 countries’ relationship looks more and more often like a family idyll when a husband pretends to be the head of family and makes orders while a wife agrees with him and still does things her way.

Trump’s talks of a total breakup with China look like a man’s desire to divorce:

- Why did you divorce?

- My wife and I didn’t have any common interests except 9 children...

The US-China relations are too tight to be easily broken up. It’s almost impossible to remove Chinese businesses from supply chains which involve the USA. Globalisation rules the world. The US stock indexes’ rally says there won’t be any trade wars. How does S&P 500 know everything? People’s wisdom...Still, people aren’t always wise. Sometimes they aren’t sober.

LiteFinance

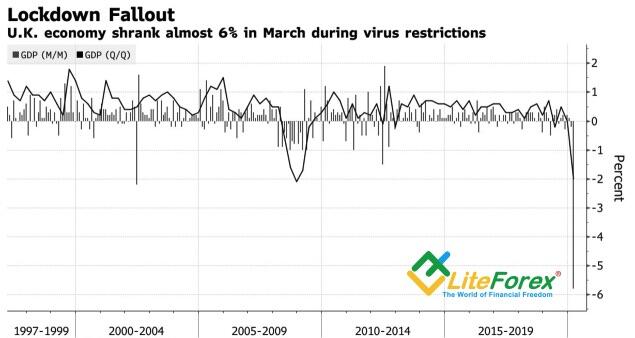

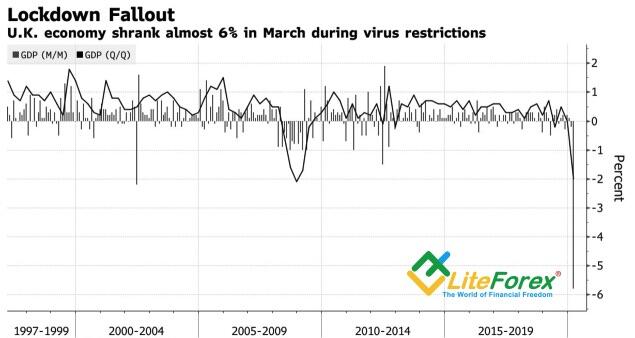

Pound was hit by a train

The medicine may be more dangerous than the illness. This is not the only problem of the GBP/USD

While the US continues boosting its fiscal stimulus, the UK weighs the risks that the medicine could do more harm than the illness. The UK took second place in the number of deaths from coronavirus. Therefore, the Treasury extended the UK scheme to pay wages of workers on leave because of coronavirus will be extended to late October. According to MUFG, this scheme already costs £49 billion, and its extension will increase the spending by another £30 billion. Taking into account the entire financial stimulus package, the budget deficit, according to the UK government, will increase from £55 billion to £337 billion. At best. At worst, it will be as much as £516 billion. The UK will need to raise taxes, which suggests the GDP recovery will be L-shaped. And this is not the only problem of the pound.

In the first quarter, the UK economy contracted by 5.8%, in the second quarter, according to the BoE forecast, it will drop by another 25%, which will be the worst drop over the past 300 years. The British Retail Consortium reported a 19.1% drop Y-o-Y in total sales in April. This is the biggest fall since it began its monthly index in 1995. According to Financial Times source familiar with the issue, Boris Johnson’s government (likely, under Donald Trump’s pressure) is going to lower tariffs on the imports of the US farm products, which will widen the UK’s current account deficit.

The problems of foreign trade, growth of the UK public debt, UK weak economy discourage the foreign investors from buying the UK securities, which increases the differential in the premiums for put and call options on the sterling to 220 basis points (the average value in 2020 is 150 basis points). This sets the GBP/USD bulls back.

In addition to the problems of the economy, the political environment in the UK is also unfavorable amid the Brexit issues, which haven’t yet been settled. So, the pound’s drop looks natural. Until recently, the sterling was supported by the US stocks, however, the little chance of the V-shaped economic recovery in the USA resulted in the S&P 500 sell-offs, drawing investors’ focus back to the UK domestic problems.

Even the GBP/USD surge after the BoE meeting in May hasn’t increased the number of pound’s buyers. It was more like a” dead cat bounce”, a popular Forex pattern when bulls, being too weak, try to break the downtrend but fail. Yes, only two MPC members out of nine voted for the extension of the UK’s QE by £100 billion, however, Andrew Bailey and Ben Broadbent suggested that the BoE could implement additional easing measures.

Therefore, it will always catch up with you in the end, as the proverb says. In early May, the sterling looked too strong, which allowed the traders, who followed the recommendations to sell the GBP/USD from the levels of 1.235 and 1.229, to make profits. You can join successful Forex traders and boost up your deposit by going short on the pound using the LiteForex convenient services.

Dynamics of the UK GDP

The medicine may be more dangerous than the illness. This is not the only problem of the GBP/USD

While the US continues boosting its fiscal stimulus, the UK weighs the risks that the medicine could do more harm than the illness. The UK took second place in the number of deaths from coronavirus. Therefore, the Treasury extended the UK scheme to pay wages of workers on leave because of coronavirus will be extended to late October. According to MUFG, this scheme already costs £49 billion, and its extension will increase the spending by another £30 billion. Taking into account the entire financial stimulus package, the budget deficit, according to the UK government, will increase from £55 billion to £337 billion. At best. At worst, it will be as much as £516 billion. The UK will need to raise taxes, which suggests the GDP recovery will be L-shaped. And this is not the only problem of the pound.

In the first quarter, the UK economy contracted by 5.8%, in the second quarter, according to the BoE forecast, it will drop by another 25%, which will be the worst drop over the past 300 years. The British Retail Consortium reported a 19.1% drop Y-o-Y in total sales in April. This is the biggest fall since it began its monthly index in 1995. According to Financial Times source familiar with the issue, Boris Johnson’s government (likely, under Donald Trump’s pressure) is going to lower tariffs on the imports of the US farm products, which will widen the UK’s current account deficit.

The problems of foreign trade, growth of the UK public debt, UK weak economy discourage the foreign investors from buying the UK securities, which increases the differential in the premiums for put and call options on the sterling to 220 basis points (the average value in 2020 is 150 basis points). This sets the GBP/USD bulls back.

In addition to the problems of the economy, the political environment in the UK is also unfavorable amid the Brexit issues, which haven’t yet been settled. So, the pound’s drop looks natural. Until recently, the sterling was supported by the US stocks, however, the little chance of the V-shaped economic recovery in the USA resulted in the S&P 500 sell-offs, drawing investors’ focus back to the UK domestic problems.

Even the GBP/USD surge after the BoE meeting in May hasn’t increased the number of pound’s buyers. It was more like a” dead cat bounce”, a popular Forex pattern when bulls, being too weak, try to break the downtrend but fail. Yes, only two MPC members out of nine voted for the extension of the UK’s QE by £100 billion, however, Andrew Bailey and Ben Broadbent suggested that the BoE could implement additional easing measures.

Therefore, it will always catch up with you in the end, as the proverb says. In early May, the sterling looked too strong, which allowed the traders, who followed the recommendations to sell the GBP/USD from the levels of 1.235 and 1.229, to make profits. You can join successful Forex traders and boost up your deposit by going short on the pound using the LiteForex convenient services.

Dynamics of the UK GDP

LiteFinance

Dollar demands a gift

The Fed’s rate cut below zero could be a real gift for the US economy

Everything has a price to pay. If the Fed claims there are necessary extra tax deductions to decrease the unemployment rate from its potential peak at 20% to 9%-10%, then it could give a gift to the US economy and lower the federal funds rate below zero. President Donald Trump said the US economy deserves such a gift, and the market is more responsive to his comments than to the announcement of the FOMC officials about the harm of negative interest rates.

The cure can really be more harmful than the illness. If the federal funds rate drops below zero, not only investors and banks will suffer, but the entire huge industry of the US money market funds. Nonetheless, not everybody shares this opinion. For example, JP Morgan citing the ECB’s experience believes that a moderate cut of the interest rates into the negative area will yield more positive than harm. The positive resulted from the easing of the financial conditions and lower fragmentation risks in Europe outweighs the negative from the drop in the interbank market activity.

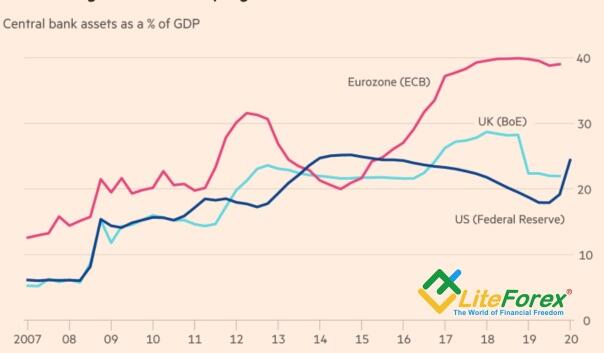

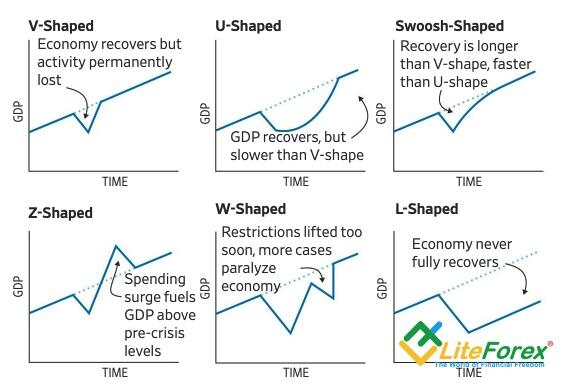

Besides, the U.S. has to fund the costs of the huge volume of Treasuries issuance. The U.S. budget deficit soared to a record of $1.935 trillion in the 12 months through April, and the Treasury is planning to issue $3 trillion in Treasuries in the second quarter and $4.5 trillion in 2019/2020 fiscal year. If buyers pay those debts, it will be a real gift for the U.S. economy. Also, the U.S. dollar will go weaker, as it should be pressed down over the long-term prospect by both the huge debt and the excessively boosted the Fed’s balance sheet.

If Congress is willing to meet the Fed’s claims on the expansion of the fiscal stimulus (House Democrats prepared the plan on an additional $3-trillion aid package), will the central bank be so amendable in response? The strangest thing, to my mind, is Donald Trump’s behavior in this situation. Earlier, he spared no money to draw the US GDP to 3%, without thinking about the consequences, but now he says the states, which do not manage their budgets effectively, should not receive the federal assistance, he also holds back the negotiations. Could it result from the fact that the bill was proposed by the Democrats, not the Republicans?

After all, the talks about potential Fed’s negative interest rates have not been enough to send the US dollar down. The EUR/USD bears have quickly gained back control after Trump ordered the main federal government pension fund, managing about $600 billion, not to invest in the Chinese stocks, based on national security concerns. The US-China trade war hasn’t yet ended, which, together with the concerns about the second wave of the pandemic, weighs on the S&P 500. The crash of the US stock market on May 12 sent the euro down. If the euro goes below the zone of $1.084-1.0845, bulls will have serious problems.

Dynamics of central banks’ balance sheets

The Fed’s rate cut below zero could be a real gift for the US economy

Everything has a price to pay. If the Fed claims there are necessary extra tax deductions to decrease the unemployment rate from its potential peak at 20% to 9%-10%, then it could give a gift to the US economy and lower the federal funds rate below zero. President Donald Trump said the US economy deserves such a gift, and the market is more responsive to his comments than to the announcement of the FOMC officials about the harm of negative interest rates.

The cure can really be more harmful than the illness. If the federal funds rate drops below zero, not only investors and banks will suffer, but the entire huge industry of the US money market funds. Nonetheless, not everybody shares this opinion. For example, JP Morgan citing the ECB’s experience believes that a moderate cut of the interest rates into the negative area will yield more positive than harm. The positive resulted from the easing of the financial conditions and lower fragmentation risks in Europe outweighs the negative from the drop in the interbank market activity.

Besides, the U.S. has to fund the costs of the huge volume of Treasuries issuance. The U.S. budget deficit soared to a record of $1.935 trillion in the 12 months through April, and the Treasury is planning to issue $3 trillion in Treasuries in the second quarter and $4.5 trillion in 2019/2020 fiscal year. If buyers pay those debts, it will be a real gift for the U.S. economy. Also, the U.S. dollar will go weaker, as it should be pressed down over the long-term prospect by both the huge debt and the excessively boosted the Fed’s balance sheet.

If Congress is willing to meet the Fed’s claims on the expansion of the fiscal stimulus (House Democrats prepared the plan on an additional $3-trillion aid package), will the central bank be so amendable in response? The strangest thing, to my mind, is Donald Trump’s behavior in this situation. Earlier, he spared no money to draw the US GDP to 3%, without thinking about the consequences, but now he says the states, which do not manage their budgets effectively, should not receive the federal assistance, he also holds back the negotiations. Could it result from the fact that the bill was proposed by the Democrats, not the Republicans?

After all, the talks about potential Fed’s negative interest rates have not been enough to send the US dollar down. The EUR/USD bears have quickly gained back control after Trump ordered the main federal government pension fund, managing about $600 billion, not to invest in the Chinese stocks, based on national security concerns. The US-China trade war hasn’t yet ended, which, together with the concerns about the second wave of the pandemic, weighs on the S&P 500. The crash of the US stock market on May 12 sent the euro down. If the euro goes below the zone of $1.084-1.0845, bulls will have serious problems.

Dynamics of central banks’ balance sheets

LiteFinance

Euro is dangerously close to the line

Geopolitics and growing risks of a constitutional crisis weigh on the EUR/USD

If the greenback is strengthening amid the rally of the US stock indexes, how deep could the EUR/USD drop if the S&P 500 trend turns down? The buyers of stocks are not discouraged by the bad news from Germany about s surge in the new cases of coronavirus as the economy was partially reopened, growing pessimism about the recovery of the US GDP, or by a potential escalation of the US-China trade war. Besides, the euro is pressed down by the turmoil in the EU judicial system that might result in a constitutional crisis.

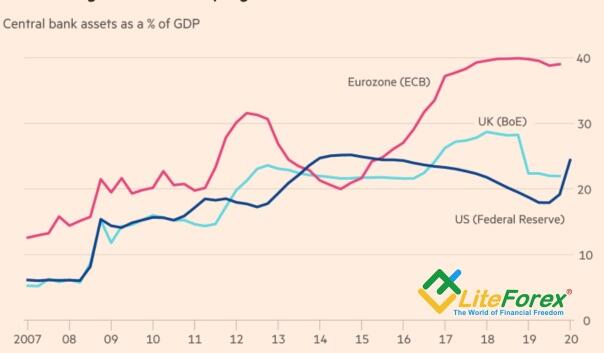

The major growth driver for the S&P 500 is the unwillingness of investors to go against the Fed that is actively stimulating the US economy. They hope that corporate profits will be 13% up in the first quarter of 2021. Besides, analysts suggest a chance that the US stock indexes could rise to all-time highs (JP Morgan, for example, says it will occur in the first half of 2021). Investors are bullish on the sector leaders that, unlike other companies’ stocks, are growing steadily. In fact, the US economic rebound to the pre-crisis pace may be U-, W-, Z- or L-shaped. Investors more often support the idea that the US GDP won’t quickly rebound. It could take months or even years.

One of the drivers of the US stocks sell-off and the growth of the demand for safe-havens, including the US dollar, can be the escalation of the US-China trade war. Washington and Beijing seem to have agreed on the fulfilling obligations under the trade deal signed in January, and China is starting to increase purchases of US soy and pork, reducing Brazilian and Australian imports of these products, but there are distressing talks among investors. Allegedly, China has ended with diplomacy and is switching to the policy of bullying. In response to the charges of the alleged laboratory origin of COVID-19, the Chinese officials point to the elderly coronavirus patients abandoned in France's nursing homes. Also, China’s media spread conspiracy theories suggesting that the USA created the virus to destroy China. China also threatens to block the imports of Australia’s goods as Canberra is going to investigate the virus origins; it also encourages Wellington and Prague for public praise by donating masks and equipment.

Beijing behaves as it did after the 2007-2009 crisis when China was going to outperform the U.S. and Europe. Donald Trump doesn’t like it. He says he is going to halt the further talks with China and should revise the provisions of the phase-one trade deal signed in January.

In addition to the potential sell-offs in the stock market and geopolitical issues, there are disputes between the EU members. Therefore, the EUR/USD is getting more likely to drop below the important support at 1.077-1.0775. After a tough response of the European Court to the German constitutional court, the European Commission could open a legal case against Germany over the violating EU legislation. The situation is alarming. Will the euro stay on the edge of the abyss?

Shapes of the GDP recovery

Geopolitics and growing risks of a constitutional crisis weigh on the EUR/USD

If the greenback is strengthening amid the rally of the US stock indexes, how deep could the EUR/USD drop if the S&P 500 trend turns down? The buyers of stocks are not discouraged by the bad news from Germany about s surge in the new cases of coronavirus as the economy was partially reopened, growing pessimism about the recovery of the US GDP, or by a potential escalation of the US-China trade war. Besides, the euro is pressed down by the turmoil in the EU judicial system that might result in a constitutional crisis.

The major growth driver for the S&P 500 is the unwillingness of investors to go against the Fed that is actively stimulating the US economy. They hope that corporate profits will be 13% up in the first quarter of 2021. Besides, analysts suggest a chance that the US stock indexes could rise to all-time highs (JP Morgan, for example, says it will occur in the first half of 2021). Investors are bullish on the sector leaders that, unlike other companies’ stocks, are growing steadily. In fact, the US economic rebound to the pre-crisis pace may be U-, W-, Z- or L-shaped. Investors more often support the idea that the US GDP won’t quickly rebound. It could take months or even years.

One of the drivers of the US stocks sell-off and the growth of the demand for safe-havens, including the US dollar, can be the escalation of the US-China trade war. Washington and Beijing seem to have agreed on the fulfilling obligations under the trade deal signed in January, and China is starting to increase purchases of US soy and pork, reducing Brazilian and Australian imports of these products, but there are distressing talks among investors. Allegedly, China has ended with diplomacy and is switching to the policy of bullying. In response to the charges of the alleged laboratory origin of COVID-19, the Chinese officials point to the elderly coronavirus patients abandoned in France's nursing homes. Also, China’s media spread conspiracy theories suggesting that the USA created the virus to destroy China. China also threatens to block the imports of Australia’s goods as Canberra is going to investigate the virus origins; it also encourages Wellington and Prague for public praise by donating masks and equipment.

Beijing behaves as it did after the 2007-2009 crisis when China was going to outperform the U.S. and Europe. Donald Trump doesn’t like it. He says he is going to halt the further talks with China and should revise the provisions of the phase-one trade deal signed in January.

In addition to the potential sell-offs in the stock market and geopolitical issues, there are disputes between the EU members. Therefore, the EUR/USD is getting more likely to drop below the important support at 1.077-1.0775. After a tough response of the European Court to the German constitutional court, the European Commission could open a legal case against Germany over the violating EU legislation. The situation is alarming. Will the euro stay on the edge of the abyss?

Shapes of the GDP recovery

LiteFinance

Will the euro make a fortune at the expense of others?

EUR/USD is above 1.08 being supported by the US stocks

The EUR/USD response to the US jobs report represents the market sentiment. The U.S. stock market rally despite the US horrible domestic data weighs on the US dollar. However, as soon as the euro-area problem becomes acute, the EUR/USD is sliding down. The US unemployment rate rose to 14.7% and employment fell by 20.5 million in April. However, the S&P 500 bull trend didn’t break. The forecasts of the Wall Street Journal suggested a weaker report (16.1% and the loss of 22 million jobs). Many analysts believe that April is the worst month based on the loss of jobs amid the pandemic, and, if the worst time is over, it makes sense to buy the US stocks now.

The US stock market rally supported the growth of most G10 currencies versus the US dollar, but the euro has quickly weakened amid the euro-area problems. A split among the euro-area countries that has started after the governments failed to agree on the corona bonds and increased after the ruling of the German constitutional court is a strong point of the Euroskeptics, which increases the risk of the euro-area breakup. Italy is not like Greece or other small countries within the EU that used to cause trouble in the Eurozone earlier.

The size of the euro-area fiscal and monetary stimulus is much less than that in the USA, which suggests the European GDP will be recovering slower than the US economy, so the EUR/USD uptrend will hardly continue. Yes, the EU finance ministers manage to agree on emergency support of 2% of GDP for each stressed country in the week ended May 10. ESM will provide loans at a negative rate, which, taking into account the fees charged, will be about 0.1%. This means that Italy and the euro area, in general, received the support of about €36 billion and €240 billion, which is far less than the US fiscal stimulus of $3 trillion that could be boosted in late May or early June. The negotiations between the White House and Congress are going on, but the US Treasury Secretary Steven Mnuchin says the states that poorly managed the budgets before the pandemic should not be rescued by the federal government.

Remarkably, the derivatives market doesn’t suggest the EUR/USD will break through the low at 1.063 hit in March. Options traders see that the euro is supported by the US stocks and the factors of the dollar weakness in the long-term prospect, including the excessive growth of the Fed’s balance sheet and the increase in the US budget deficit.

In the meanwhile, the European court has retaliated to the German judges that declared its decision on the legacy of the ECB QE is invalid. The EU court noted that its task is to ensure that the EU legislation is properly applied in all the 27 countries within the currency bloc. It alone has the jurisdiction to determine the legacy of acts taken by the EU institutions. On the one hand, this gave the ECB freedom to act, on the other hand, it encourages the Euroskeptics. The EUR/USD bulls are not strong but they still believe the S&P 500 should allow them to hold the pair above 1.08.

Volumes of option contracts

EUR/USD is above 1.08 being supported by the US stocks

The EUR/USD response to the US jobs report represents the market sentiment. The U.S. stock market rally despite the US horrible domestic data weighs on the US dollar. However, as soon as the euro-area problem becomes acute, the EUR/USD is sliding down. The US unemployment rate rose to 14.7% and employment fell by 20.5 million in April. However, the S&P 500 bull trend didn’t break. The forecasts of the Wall Street Journal suggested a weaker report (16.1% and the loss of 22 million jobs). Many analysts believe that April is the worst month based on the loss of jobs amid the pandemic, and, if the worst time is over, it makes sense to buy the US stocks now.

The US stock market rally supported the growth of most G10 currencies versus the US dollar, but the euro has quickly weakened amid the euro-area problems. A split among the euro-area countries that has started after the governments failed to agree on the corona bonds and increased after the ruling of the German constitutional court is a strong point of the Euroskeptics, which increases the risk of the euro-area breakup. Italy is not like Greece or other small countries within the EU that used to cause trouble in the Eurozone earlier.

The size of the euro-area fiscal and monetary stimulus is much less than that in the USA, which suggests the European GDP will be recovering slower than the US economy, so the EUR/USD uptrend will hardly continue. Yes, the EU finance ministers manage to agree on emergency support of 2% of GDP for each stressed country in the week ended May 10. ESM will provide loans at a negative rate, which, taking into account the fees charged, will be about 0.1%. This means that Italy and the euro area, in general, received the support of about €36 billion and €240 billion, which is far less than the US fiscal stimulus of $3 trillion that could be boosted in late May or early June. The negotiations between the White House and Congress are going on, but the US Treasury Secretary Steven Mnuchin says the states that poorly managed the budgets before the pandemic should not be rescued by the federal government.

Remarkably, the derivatives market doesn’t suggest the EUR/USD will break through the low at 1.063 hit in March. Options traders see that the euro is supported by the US stocks and the factors of the dollar weakness in the long-term prospect, including the excessive growth of the Fed’s balance sheet and the increase in the US budget deficit.

In the meanwhile, the European court has retaliated to the German judges that declared its decision on the legacy of the ECB QE is invalid. The EU court noted that its task is to ensure that the EU legislation is properly applied in all the 27 countries within the currency bloc. It alone has the jurisdiction to determine the legacy of acts taken by the EU institutions. On the one hand, this gave the ECB freedom to act, on the other hand, it encourages the Euroskeptics. The EUR/USD bulls are not strong but they still believe the S&P 500 should allow them to hold the pair above 1.08.

Volumes of option contracts

LiteFinance

ECB: who let the judges out?

German Constitutional court’s verdict on QE program looks strange

After Donald Trump afforded to criticize the Fed and speculate about the pros and cons of a weak and a strong dollar, many dream of following his example. Germany’s Supreme Court made another attempt to hog the blanket: it demanded that ECB should justify the appropriateness of its €2.7 trillion QE program launched in 2015. If the ECB fails to do that, the Bundesbank will no longer participate in it. Following Trump, Karlsruhe’s lawyers might have understood life is a dog sled: the landscape is always the same unless you’re the leader.

Dance like no one’s watching, sing like no one’s listening and express your opinion as if you’ve been asked to. The verdict of Germany’s Constitutional Court shocked both ECB investors and plaintiffs themselves. The latter didn’t really believe in the success of their affair after the ECB said the QE program was legitimate. But German judges not only played a dirty trick on the ECB, but also opposed EU principles and norms by overruling the decision of the European Court.

the Executive Board isn’t planning to reply. First, it would undermine the ECB’s independence: they would have to justify every step they make in future if a regional court asked them to. Second, everything has been explained on the ECB’s site already. And can’t they really understand that QE is meant for fighting with the pandemic?

- I can’t be that dumb.

- You underestimate yourself.

According to Christine Lagarde, the current terms are exceptional and they allow the ECB to go beyond the scope of usual instruments. The ECB is an independent establishment accountable to the European Parliament. It will go on doing what it has to do based on its own mandate. The Frenchwoman made the judges in Karlsruhe understand the ECB wasn’t going to react.

Germany’s High Court did recognize that QE wasn’t a direct government financing program. That weakened the euro, but didn’t allow it to collapse. It would have been strange if German judges had spoken of a union between monetary and fiscal policies while the ECB was doing all the dirty work and the German Ministry of Finance was being cheapskate. Money doesn’t disappear into thin air. It just changes its owner.

Anyway, the German verdict stirred up financial markets, as Donald Trump’s verbal interventions did in 2017-2020. The ECB has three months for explaining why its QE program has more benefits than shortcomings. There are so many people eager for ruling. But few are those who strive for work. The Executive Board will keep silent, the European Court is bewildered and the euro got hit in the jaw. How will we work that shit out, dear Europeans? Perhaps, like Donald Trump who declared the USA was about to create a vaccine against Democrats’ electoral victory?

German Constitutional court’s verdict on QE program looks strange

After Donald Trump afforded to criticize the Fed and speculate about the pros and cons of a weak and a strong dollar, many dream of following his example. Germany’s Supreme Court made another attempt to hog the blanket: it demanded that ECB should justify the appropriateness of its €2.7 trillion QE program launched in 2015. If the ECB fails to do that, the Bundesbank will no longer participate in it. Following Trump, Karlsruhe’s lawyers might have understood life is a dog sled: the landscape is always the same unless you’re the leader.

Dance like no one’s watching, sing like no one’s listening and express your opinion as if you’ve been asked to. The verdict of Germany’s Constitutional Court shocked both ECB investors and plaintiffs themselves. The latter didn’t really believe in the success of their affair after the ECB said the QE program was legitimate. But German judges not only played a dirty trick on the ECB, but also opposed EU principles and norms by overruling the decision of the European Court.

the Executive Board isn’t planning to reply. First, it would undermine the ECB’s independence: they would have to justify every step they make in future if a regional court asked them to. Second, everything has been explained on the ECB’s site already. And can’t they really understand that QE is meant for fighting with the pandemic?

- I can’t be that dumb.

- You underestimate yourself.

According to Christine Lagarde, the current terms are exceptional and they allow the ECB to go beyond the scope of usual instruments. The ECB is an independent establishment accountable to the European Parliament. It will go on doing what it has to do based on its own mandate. The Frenchwoman made the judges in Karlsruhe understand the ECB wasn’t going to react.

Germany’s High Court did recognize that QE wasn’t a direct government financing program. That weakened the euro, but didn’t allow it to collapse. It would have been strange if German judges had spoken of a union between monetary and fiscal policies while the ECB was doing all the dirty work and the German Ministry of Finance was being cheapskate. Money doesn’t disappear into thin air. It just changes its owner.

Anyway, the German verdict stirred up financial markets, as Donald Trump’s verbal interventions did in 2017-2020. The ECB has three months for explaining why its QE program has more benefits than shortcomings. There are so many people eager for ruling. But few are those who strive for work. The Executive Board will keep silent, the European Court is bewildered and the euro got hit in the jaw. How will we work that shit out, dear Europeans? Perhaps, like Donald Trump who declared the USA was about to create a vaccine against Democrats’ electoral victory?

LiteFinance

Euro feels dirty

ECB is doing its best to save the euro-area economy, but Germany creates obstacles

How fast the Forex situation is changing! Just a week ago, the balance of power in the EUR/USD was clear. After the drop in the safe-haven demand amid the gradual reopening of the economies and the recovery of the global GDP, the euro should have started rising versus the US dollar. The dollar would be pressed down by the over-expanded Fed’s balance sheet and the U.S. increasing public debt. However, after there was announced the ruling of Germany’s constitutional court and geopolitical risks increased, everything has turned upside down.

BofA Merill Lynch sees the EUR/USD at 1.02 in late 2020 amid weak global economic outlook and limited power of the ECB in managing the monetary stimulus. Société Générale notes that the dispute between the two European supreme courts during the pandemic results in the market uncertainty, which is a rather negative factor. Citi warns about higher risks of the euro-area breakup, coming from not the peripheral countries but the nucleus, as the ECB may ignore the ruling of the Constitutional court, challenging Germany’s government.

According to the Financial Times source familiar with the inside information, the Governing council won’t directly respond to the German court. One of the ECB council members said that it would justify the QE in five minutes, but the ECB didn’t have to do it. It looks as if the ECB should report to any court at the first request when it decides to hike the rates, for example. Another official said that the German government and parliament should be the defendants, and the Governing Council would continue doing everything necessary.

The decision of the German court looks ridiculous. What could justify bond purchases better than the assistance to the countries suffered from the pandemic? The ECB might blur the line between the monetary and the fiscal policies, but this is because the euro-area governments, first of all, Germany, wouldn’t spend money. The ECB is doing a hard job and is criticized at the same time.

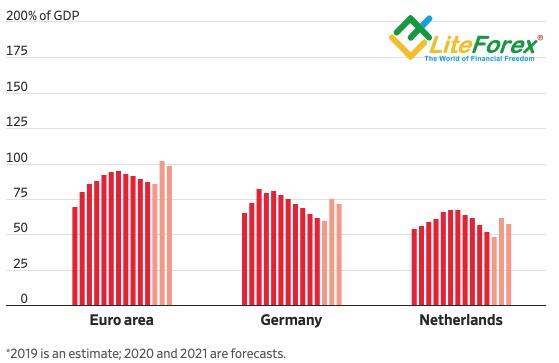

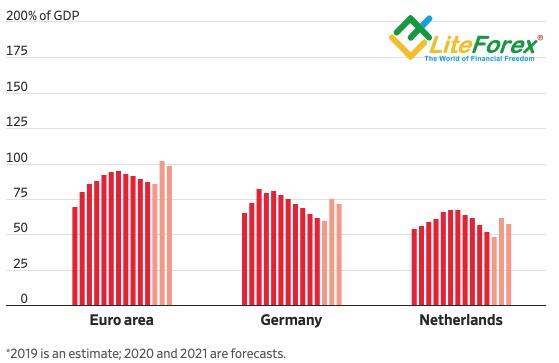

The currency bloc may break up, and the situation is worsened by the EC forecasts. The European Commission says the euro-area GDP will contract by 7.7% in 2020, it should recover by just 6.3% in 2021. Italy’s public debt will increase from 135% to 159% of GDP, Greece’s debt will exceed 200% of GDP. However, German and the Netherlands will perform quite well.

The EUR/USD is also pressed down by Donald Trump. The U.S. President gave Beijing two weeks to make sure whether China would meet its commitments to increase U.S. goods purchases by $200 billion over two years, including $77 billion in 2020. Taking into account the problems of the Chinese economy amid the pandemic, and a decline in the imports from the U.S. in the January-March period, the U.S. could well impose new tariffs soon. The pair’s drop below the support at 1.077-1.0775 could become critical.

Dynamics of public debts of GDP

ECB is doing its best to save the euro-area economy, but Germany creates obstacles

How fast the Forex situation is changing! Just a week ago, the balance of power in the EUR/USD was clear. After the drop in the safe-haven demand amid the gradual reopening of the economies and the recovery of the global GDP, the euro should have started rising versus the US dollar. The dollar would be pressed down by the over-expanded Fed’s balance sheet and the U.S. increasing public debt. However, after there was announced the ruling of Germany’s constitutional court and geopolitical risks increased, everything has turned upside down.

BofA Merill Lynch sees the EUR/USD at 1.02 in late 2020 amid weak global economic outlook and limited power of the ECB in managing the monetary stimulus. Société Générale notes that the dispute between the two European supreme courts during the pandemic results in the market uncertainty, which is a rather negative factor. Citi warns about higher risks of the euro-area breakup, coming from not the peripheral countries but the nucleus, as the ECB may ignore the ruling of the Constitutional court, challenging Germany’s government.

According to the Financial Times source familiar with the inside information, the Governing council won’t directly respond to the German court. One of the ECB council members said that it would justify the QE in five minutes, but the ECB didn’t have to do it. It looks as if the ECB should report to any court at the first request when it decides to hike the rates, for example. Another official said that the German government and parliament should be the defendants, and the Governing Council would continue doing everything necessary.

The decision of the German court looks ridiculous. What could justify bond purchases better than the assistance to the countries suffered from the pandemic? The ECB might blur the line between the monetary and the fiscal policies, but this is because the euro-area governments, first of all, Germany, wouldn’t spend money. The ECB is doing a hard job and is criticized at the same time.

The currency bloc may break up, and the situation is worsened by the EC forecasts. The European Commission says the euro-area GDP will contract by 7.7% in 2020, it should recover by just 6.3% in 2021. Italy’s public debt will increase from 135% to 159% of GDP, Greece’s debt will exceed 200% of GDP. However, German and the Netherlands will perform quite well.