Gary Comey / Perfil

- Informações

|

10+ anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

3

sinais

|

787

assinantes

|

http://www.blackwavetrader.com Sou corretor registrado desde 2000, quando comecei a trabalhar na Fexco Stockbroking, que comprou a Goodbody, uma das maiores corretoras da Irlanda. Sou membro do Institute of Bankers na Irlanda. Sou registrado na Sociedade de Analistas Técnicos do Reino Unido e trabalho na indústria há algum tempo, inclusive no IG Group e na Fidelity.

Amigos

1807

Pedidos

Enviados

Gary Comey

Far from withdrawing I will be adding another $10K to my balance in the medium risk account over the weekend. As we are at 100% cash it cannot affect open positions. My goal is to compound as I said this time last year. Running my total balance of all accounts and making an assumption of 5% per month (based on historical data, no more deposits or withdrawals) that puts me at $1m AUM in 28 months. Hmm! They say if you want to make God laugh tell him your plans but on the other hand we must decide what our destination is in order to aim towards it and arrive at it. Erm anyway the high risk account is at 2.63% so far this month and not quite halfway through December and north of 65% for 2020 so far. Have a good weekend.

Mostrar todos os comentários (6)

Gary Comey

2020.12.14

Tariqtanoli. Minimum investment $20K. Still interested tell me your email address.

Simon Leiper

2020.12.28

Gary, Im interested in the MAM account. I didnt want to post my email address here publicly so I sent you a follow request on Linkedin. Merry christmas and HNY from Dubai....

ChrisGoh

2021.02.01

hi Gary, just sent you friend request so as to get detail for signing up MAM account. I asked IC Markets partner support and they are not helpful at all. simply ask me to google for it :(

Gary Comey

We've gone from LEVEL 5 lockdown to LEVEL 3 in Ireland which means I can go out and about and see the world outside of my 5km. That is what I'll be doing later and the reason for the early Friday update. November went well and the high risk account knocked out the third greater than 8% month of 2020. I only wish it had happened in the first three months of the year and was allowed compound for the rest of 2020. Still it's fairly good to get it at any point of any year and I suppose it's most definitely a head start on 2021. Performance fees are taken but we've paid back some of that already with the 1% return this week. I wanted to get back to cash for 24 hours to allow for Santa Claus etc but am now back selling into this overbought H1,H4,D1,W1,MN EURUSD. Our grid begins at 1.2157. The buck is beaten up across the board and way off the 14 period M.A, irrespective of the reason nothing goes on forever. Also selling NZDJPY for the same reason. I'll keep going into December and try to squeeze the last out of this incredible year. Have a good weekend.

[Excluído]

2020.12.12

[Excluído]

Gary Comey

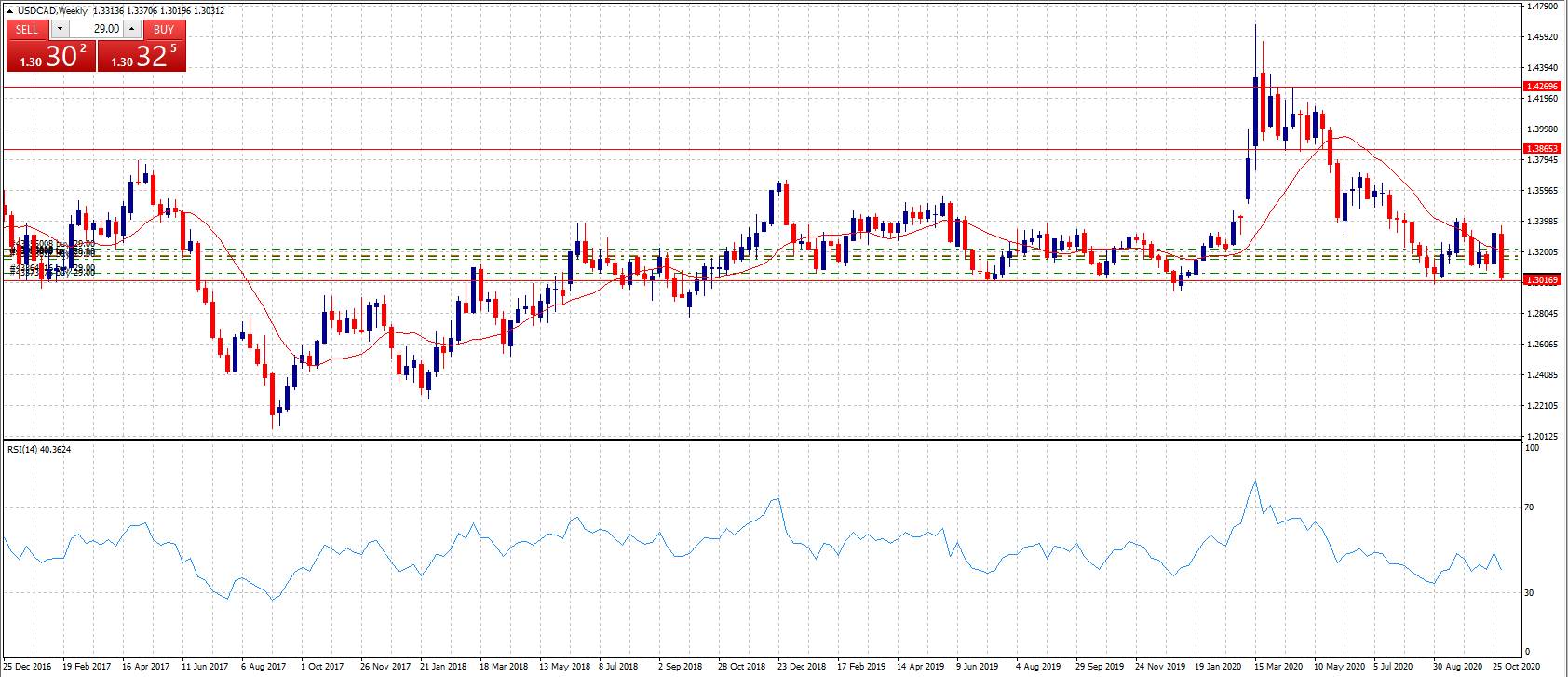

Pretty good week considering it was punctuated with the Thanksgiving holiday and the lower participation that usually brings. Closer now to an 8% month for the high risk account and good performance for all accounts. We cruise towards month end more quietly now and fingers crossed back to cash soon. USDCAD continues to thread medium term support circa 1.30 and AUDNZD having put in a daily hammer formation early in the week has been lacklustre since perhaps giving us a second bite of the cherry 🍒.

Gary Comey

An okay week and shaping up to be an okay month circa 6% or more. GBPNZD is a big mover and that can unnerve people when it goes the other way but we pretty much got entries pretty correct. Nobody ever can time it perfectly. We finish the week at a slower pace long AUDNZD and CHFJPY. Notably the Alpine managed account exceeded $3m and the Pacific managed account passed $1m AUM for the first time in the month of November. No doubt that statement will spark large scale withdrawals 🙂 Add in the low risk California managed account and all in that's $4.3m Assets Under Management. What I am trying to say is THANKS. This year won't be the home run that other years have had in terms of performance but in what you might agree was a tricky and unpredictable year and towards the end of it's fifth year of continuous yearly growth, Blackwave Alpine will now easily surpass 60% growth or roughly ten times the growth of the S&P500 this year....so far. Have a good weekend.

Logan-FX2020

2020.11.27

Hi Gary Comey. Everyone is very grateful to you. I really thank you so much. I subscribed your signal side signalstar. It's amazing. You are doing a job that blesses many people. thank you

Gary Comey

2020.11.27

Shgustavo, California is low risk. 0.01 lots per $3000. You say you want to “copy exactly” but you are taking more risk than me in that account.

waelmeta1988

2020.12.03

hi Gary comey..i will subscribe soon california with 3000$..but i will have the same volume of you ( volume=0.13)..how i can do this..any idea plz and thnx king

Gary Comey

So back to cash for the weekend. USDCAD worked out okay and I got circa 100 pips from GBPNZD in the early hours before the London session began at 8am. On my radar for next week are EURCHF, almost overbought and given the valuations of the stock market etc. Probably GBPNZD again which is almost oversold and threading rising multi-year support going back to 2016. I'll keep an open mind as always and see what events transpire to give us panic, pestilence, disease, anxiety and doom as I do in any other given week. Have a good weekend.

Julien Bernard Claude Boiteau

2020.11.15

Yeay ! I love your trading Style Gary, mine is pretty similar to yours

Gary Comey

We're off the mark for November and looking at the accounts from managed clients point of view the performance fees for October are already paid for. What's left going into the weekend is only one pair namely USDCAD, and just five positions into it spread over nearly 200 pips. From the graph it appears that the 1.30 handle has at various times since 2017 been resistance and then multi-year support so I am trading that fact. Also RSI is close to oversold so I am also trading that fact. Finally the election aftermath is turning out to be volatile so I am trading that fact too. I can not tell you if the buck will rally in response to a resolution to the Presidential election but I can tell you that a volatile market is good for a grid strategy. So we pick our battles and manage our position size. It's not much more complicated than that.

Gary Comey

2020.11.07

First goal is to open an account at IC Markets as you appear to be in the U.S so that’s complicated. Only Blackwave Pacific and Blackwave California are still open. Minimum balance is $20K. https://www.icmarkets.com/?camp=4352

Lucas Marques Mendonca

2020.11.09

Hi, Gary. I want to subscribe, I just don't understand yet, what is the minimum deposit? Is 4k dollars possible?

Gary Comey

2020.11.09

$4K is fine for any of the three strategies. Check the strategy description for specifics.

Gary Comey

So far a quiet end to the week. Next week will be interesting needless to say with the U.S election and a likely RBA rate cut both on Tuesday November 3rd. If the winds are blowing in our favour we will get back to cash and if not then AUDNZD is likely to be the only position we have. No USD trade will be opened until at least Tuesday/Wednesday. I think the markets are relaxed enough about a Biden win and we all know what we'll get if the incumbent president wins....more of the same so either way that seems to be taken account of. The issue arises if we get a close run thing and it ends up in the Supreme Court as it did with Bush vs Gore after the Florida debacle back in 2000 or begins to test the now fairly outdated parts of the U.S Constitution. I was in New York in 2000 and the New York Times called it for Gore and then had to do a reprint. I'm old enough to recall "hanging chads, and pregnant chads" but perhaps that's gibberish to some of you. Gore won the popular vote but lost the election. The point here is that I think we are in a good position going in and I have no desire to jeopordise it.

JakkalsVanDieJSE

2020.10.30

Thanks for the update Gary! :-) Looking forward to next week, I think it will be a big one!

Gary Comey

I said a few weeks ago "it's useful to be flat or at least have very few positions going into a weekend where the President of the United States apparently has Covid-19 a few weeks out from the election." Now that The Donald is cured we still have the election next weekend and I am comfortable that we are ticking over making money but not creating a large basket of trades going into next weekend. It will be my focus to keep it that way and try to find the balance between making money and taking on too much. The equity markets and the Dollar itself seems comfortable with the opinion polls and I'd almost say they don't care who wins, but there's always the unplanned, unknown unknowns, the once in a hundred years kind of thing.....again.

Gary Comey

Not a lot out there that’s too compelling as of tonight. Given the latest BREXIT deadline not to mention the impending U.S election I’d rather not find myself 10 positions deep into a currency when I didn’t love the idea in the first place. We never have to wait too long for a move that’s interesting so it’s no big deal.

Gary Comey

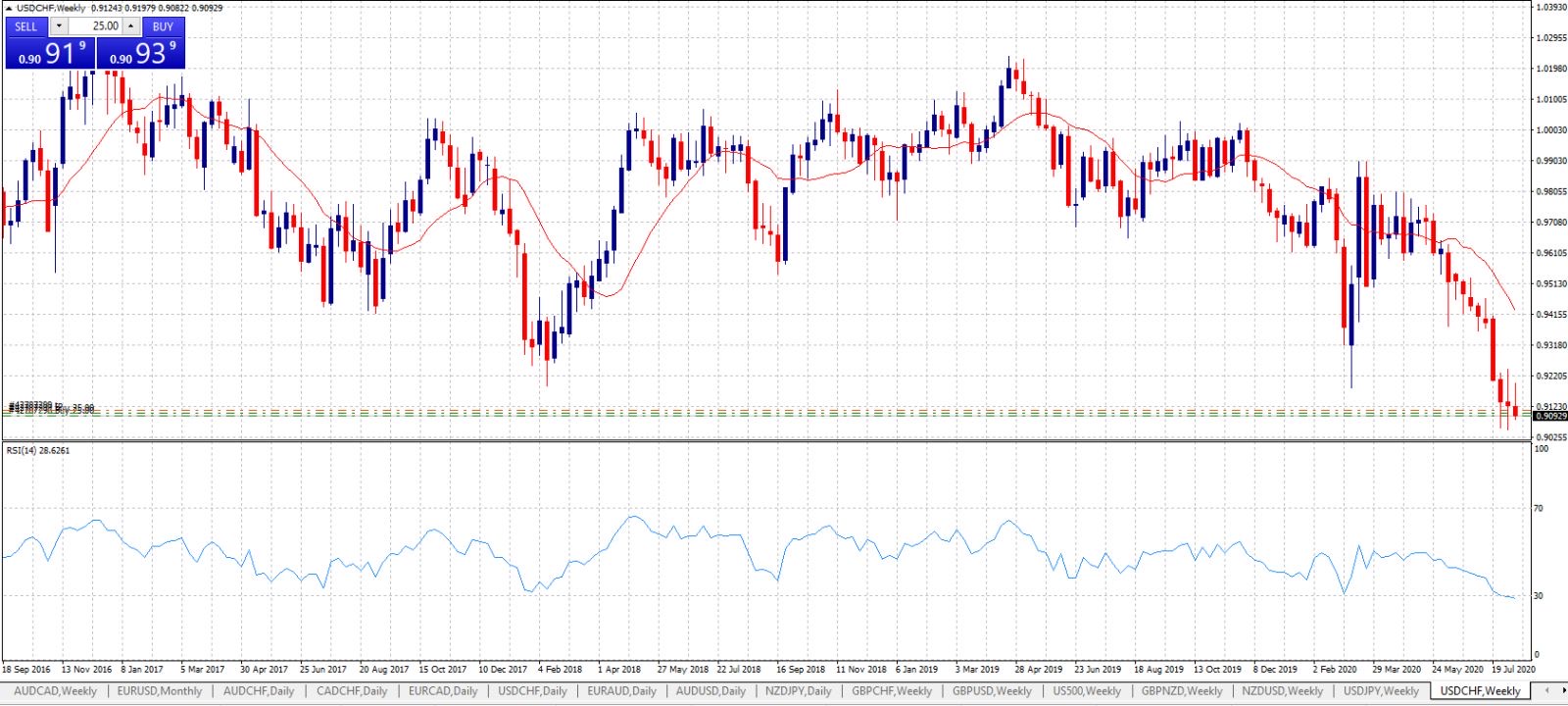

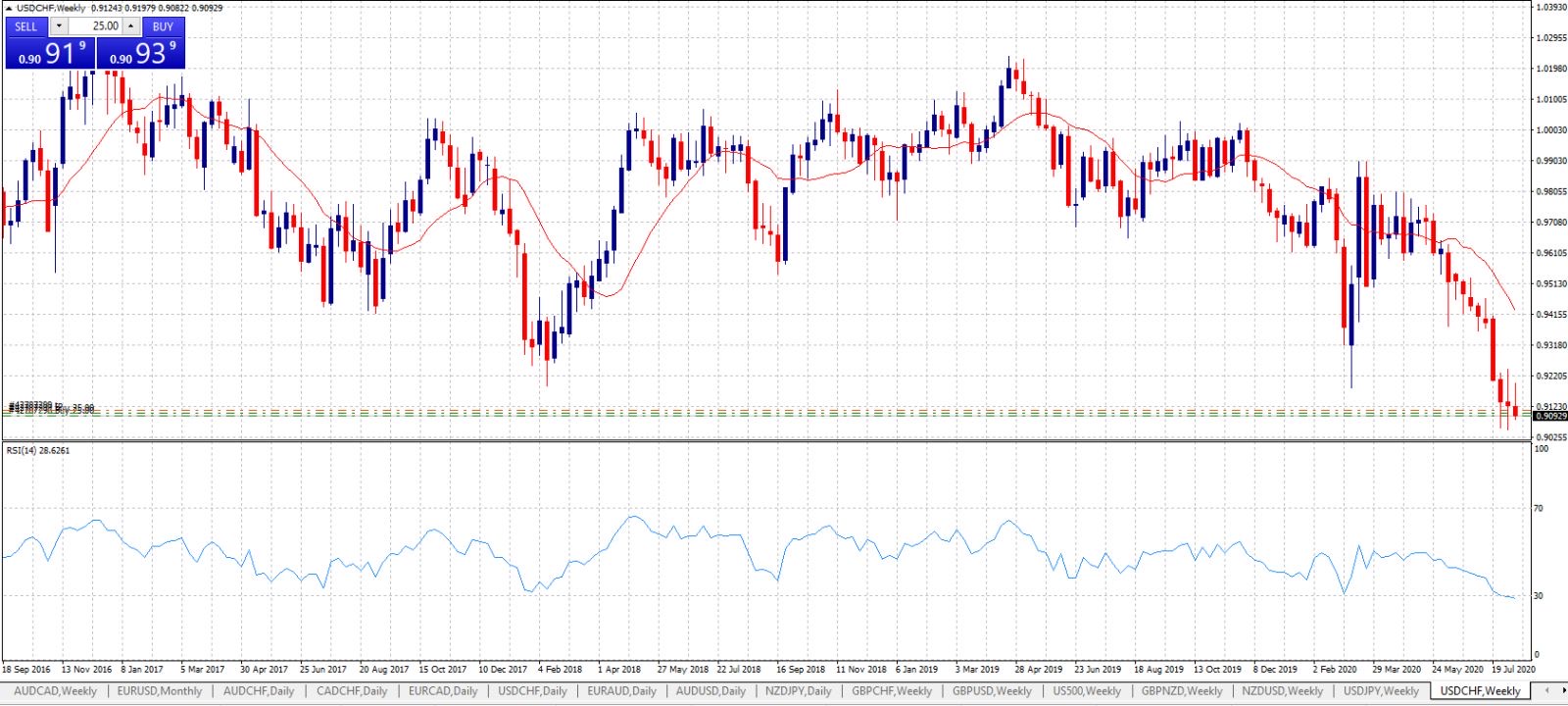

Taking advantage of a fairly week dollar and unusually I've ended the week trading two US Dollar related pairs. It's not a breach of the strategy but I try not to do it as an informal rule. After a significant decline USDCHF attempted a rally off weekly technically oversold levels three weeks ago that has almost been taken completely back this week and I think represents an opportunity. As I mentioned earlier in the week there's a slight carry trade with USDCHF so we may as well have the broker pay us rather than the other way around. There's also multi-year support in the 0.90's going back to 2015. USDCAD is close to multi-year support too in the 1.30's going back to circa 2018. That is not to say multi-year support cannot be breached but to do so EURUSD will likely have to make a run at 1.25 being the February 2018 swing lower high and not just run at it but run at it in a straight line that does not let us out of our trades. Right now the DD is 2.5% in the high risk account (so lower in all the others) and I feel it is an acceptable risk given the relatively few positions we have.

KilleX

2020.10.16

Hi Gary, I am considering to user your signal subscription services. I would like to get in touch with you since I am new to copy trading. Where can I reach you (send message button is disabled)? I would like to discuss what initial deposit to use and what leverage should I use.

Gary Comey

There may be an opportunity with USDCAD later in the day but looking around I am not seeing anything that fits my typical set-up amongst major and minor forex pairs. It's been a decent enough beginning to the month which only started yesterday and indeed September recorded an 8.61% growth in the Alpine managed account. The bad news is that performance fees are due but between today and yesterday they are sort of paid for in advance. Lets see what NFP's gives us but it's useful to be flat or at least have very few positions going into a weekend where the President of the United States apparently has Covid-19 a few weeks out from the election. I guess when he beats it he can look like a strong man vs "old man Biden". :-) Have a good weekend.

Gary Comey

The predominant theme this week as with all weeks is risk trends. Equity markets are 10% off their highs and while officially that is correction territory the S&P500 has been having a bit of difficulty with following through much lower up to now. If I'd stayed with GBPNZD we'd have made a good deal more by now but I am actually happy to leave some for the next guy. That market moves quickly as I am sure you recall from last month and we had two nice goes at it, took our money and left the table. We finish off the week selling into a relatively strong Yen (at least as measured on daily timeframes by RSI) which is of course risk correlated with the S&P500. Good week and good month to date and relatively painless too which is not always the case. End of month is next Wednesday and according to myfxbook the Alpine Managed account is up over 8% for the month so trying to tick over without getting into any hot water by month end.

Imtiaz73

2020.09.30

Hi Gary,

Imtiaz here from Melbourne. i want to subscribe and copy your signal through mql5 on my mt4 live platform. money is sitting in my account but fail to activate. i am trying from last 2 weeks but unsuccessful . i watched the video how to activate but some how link is not working. plz help me.

Kind Regards

my email imtiazkiwi@hotmail.com

Imtiaz here from Melbourne. i want to subscribe and copy your signal through mql5 on my mt4 live platform. money is sitting in my account but fail to activate. i am trying from last 2 weeks but unsuccessful . i watched the video how to activate but some how link is not working. plz help me.

Kind Regards

my email imtiazkiwi@hotmail.com

Gary Comey

2020.10.01

Imtiaz I’m afraid I’m the trader, I’m not mql5 so I don’t know what you are doing wrong. I’ve never copied anyone on mql5. Perhaps someone in the forum can help.

Gary Comey

Reasonably good week. Shame I didn't close the GBPNZD yesterday but I was hoping for a move above 1.9320. We got close but it was not to be. That said the cash is higher again and at 2.5-3% in the HIGH RISK account the DD is well in control. Sterling is obviously weaker after the BOE said it was looking into the possibility of negative rates. Make no mistake ongoing talks with Brussels will override the central bank any day of the week so any positive news re: BREXIT negotiations will help this beaten down currency. Trading GBPNZD this time I have spaced the trades further apart than the last time as a safety measure even as it trades back at the multi-year rising line of support

sabot3116

2020.09.18

Hi Gary. Really love your weekly updates and your honesty. Yea, the GBPNZD trade was very unlucky. Taking two trades 1 and 5 minutes after the BOE rate decision and statement, and trying to catch a falling knife (market dropped 100 pips in one 15 minute candle...) was quite a gamble. Probably shouldn't have taken a trade this close to a major news event. Also should have been happy we made it back to break-even, let alone get into profit before markets went south again. But should have, would have, could have doesn't help anyone, and hindsight is always 20/20. If the past shows us anything it is that your cool head will eventually prevail and I'm certain we will make it out of this position. Other than those trades it has been a pretty good month. Keep up the good work! And let's hope for some positive brexit news next week. Have a nice weekend!

Gary Comey

Moving towards the beginning of Q3. In this is final quarter we have the high stakes poker game that is BREXIT plus a U.S Presidential election. This will provide plenty of volatility so the goal is to not get stuck with 12 positions in a big moving pair all within 200 pips and praying for a reversal. That is not speculating but rather gambling. We don't do that. However that said if we want to make money we must play the game. So we are predictably long the Pound which is weakening as the rhetoric heats up and it moves away from the Moving Average. No doubt the U.K Prime minister and various cabinet members plus a few heads from the E.U will be quoted in the Sunday papers so if I must add another position I'll wait until Monday's price action to see how it trades the weekend news. Our USDCAD basket is at about breakeven or better and looking healthy enough.

Gary Comey

Not a bad 36 hours. Managed clients virtually got all of the performance fee for the last few months back in that period. There's a lots of indecision regarding the Dollar and EURUSD having technically broken it's down trend and acelerated higher, has moved off overbought conditions. I've used my usual contrarian strategy with these big moves off the moving average to make money using USDCHF, USDCAD and GBPUSD (Cable). All the talk a few days ago was for a convincing break of 1.20. Who knows maybe it will happen, maybe it won't, that possibility is sort of binary I guess. Either way there's a plan. Everything I touched was almost instantly profitable this week. There is an element of luck there just as there was an element of bad luck in the previous few months with DD's. The trick is to expect the DD and plan for getting out of jail. When you don't go to jail it's a bonus. Your talking to the guy who did the Escape From Alcatraz Triathlon in SF a few years ago.

Gary Comey

Decent enough week and month though the month is not quite over. Given recent months I’m also defining “decent” as low DD or as I said last week “staying close to shore”

Gary Comey

Just noticed on myfxbook that the cumulative profit in the Alpine Managed account has crossed $3m. On a cumulative basis people have withdrawn more money than they deposited but the balance is still $2.6m. Pretty cool though it's not like we have not taken risks to get it. Trading is risky. Anyway back to cash having made money again likely for the 30th consecutive month (the month ain't over yet). I'm trying to stay close to shore (so to speak) and not get too deep into a drawdown for a little while. Trading has a recency bias, in other words when markets are going down we expect them to continue, when they are going up we expect them to continue. When I have a string of drawdowns or a string of straight winners we expect it to continue. It never does. Enjoy the weekend

Joshua Barnard

2020.08.26

Hi Gary, I am signed up to your Pacific signal. I am not sure you are the person to ask this, but here goes. My account is not calculating the position size correctly, on 5k account and the ratio compared to your lot size, my account opens 0.01 lot when it should be +/- 0.03... Any idea? I know its not a signal question, but if you can help I would appreciate it. Thanks

sabot3116

2020.08.26

Hi dottybee. If you use MT4 make sure that in the Options -> Signals tab the "Use no more than" is at the maximum of 95% if you want to use full equity for the signal.

Gary Comey

Slowing getting back into positions and long the buck vs the Swiss Franc. As you can see from the charts weekly oversold position there's quite an amount of upside with the 14 period M.A above 0.94. The only thing that concerns me about this position is that we are short the Swiss Franc with the S&P 500 so relatively high. IF it falls the Franc would in theory strengthen though I think so would the dollar. Experience says the market will return to the M.A from deeply oversold conditions. IF anyone is still looking at GBPNZD you'll see that even more patience would have been even more profitable. Have a good weekend.

Gary Comey

I'm probably behind where I thought I'd be by July this year but I am taking two comforts. 1. It's been a kind of a Black Swan year and if you had been invested in the S&P500 you'd be flat to slightly down in spite of the massive and well intentioned central bank and government lead program which is destroying the value of paper money by printing countless trillions more of it. Dollars will soon be as plentyfull as baked beans so hopefully they are able to hold their value better than baked beans do. 2. I'm confident that my strategy will make me money and get me to where I want to be in life whether the market goes up or down and that's a hell of skill to have. I can use it to turn paper money into real assets and hopefully have a business I can pass on. I know this because I used to have no skills and just bought stocks and prayed for good non-farm payroll numbers. I know for a fact that despite all the congrats for which I am grateful, some of you looked into the abyss at some point in the last seven months. You held your nerve and that's a hell of a thing too. THANK YOU. To use an Irish term, "fair balls to ya". Trading is risky but more so the market can at any moment pin you to your belief in your strategy which is why I have no interest in any other strategy, I just need to be good at this and specialise in this strategy so that when I'm grabbed by the balls I hold my nerve because believe me plenty of amateurs lose thieir nerve and abandon countless millions at the table upon the first sign of trouble. People with no confidence or likely no deep understanding of their strategy, some with no strategy at all..... except pray for good non-farm payrolls etc. Anyway we are flat and back to cash. Take a few days to consider how you felt over the last few months, there's HIGH, MEDIUM and LOW risk versions of this strategy or if you withdraw money then obviously that money is safe from the volatile forex market. If something compelling happens I could be trading by this day next week but lets say there's no danger of it until next Thursday 13th.

James Wilko

2020.08.10

Hi Gary, I am pretty new to signal trading and have been looking at your signals as a good place to start based on them appearing to be proven over a good amount of time. Am I correct in saying that the California is the lower risk signal and perhaps a good starting point for me? cheers.

Gary Comey

7.22% for Pacific is actually the best month this year.

Oh ye of little faith. Back to cash in the copy trading accounts. I’m going to let the proper managed accounts run a little longer. Good week! Thanks for sticking with me guys. 💪

The $20K earned today goes towards the €170K price tag for the second Blackwave apartment in Albufeira, Portugal 🇵🇹

I’ll be withdrawing $102,000 for this apartment from Blackwave Pacific on Monday leaving $200,000 with position sizes adjusted accordingly of course.

Oh ye of little faith. Back to cash in the copy trading accounts. I’m going to let the proper managed accounts run a little longer. Good week! Thanks for sticking with me guys. 💪

The $20K earned today goes towards the €170K price tag for the second Blackwave apartment in Albufeira, Portugal 🇵🇹

I’ll be withdrawing $102,000 for this apartment from Blackwave Pacific on Monday leaving $200,000 with position sizes adjusted accordingly of course.

Gary Comey

2020.08.04

Actually they want the money sooner for the apartment so a second 100K withdrawal. Leaves $100K and I’ll build back up from there.

: