Aleksey Ivanov / Perfil

- Informações

|

7+ anos

experiência

|

32

produtos

|

143

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

👑 Físico teórico, programador, comerciante com 15 anos de experiência.

--------------------------------------------------------------------------------------

💰 Produtos apresentados:

1) 🏆 Indicadores com ótima filtragem de ruídos de mercado (para escolha de pontos de abertura e fechamento de posições).

2) 🏆 Indicadores estatísticos (para determinar a tendência global).

3) 🏆 Indicadores de pesquisa de mercado (para esclarecer a microestrutura de preços, construir canais, identificar diferenças entre reversões e retrações de tendências).

--------------------------------------------------------------------------------------

☛ Mais informações no blog https://www.mql5.com/en/blogs/post/741637

--------------------------------------------------------------------------------------

💰 Produtos apresentados:

1) 🏆 Indicadores com ótima filtragem de ruídos de mercado (para escolha de pontos de abertura e fechamento de posições).

2) 🏆 Indicadores estatísticos (para determinar a tendência global).

3) 🏆 Indicadores de pesquisa de mercado (para esclarecer a microestrutura de preços, construir canais, identificar diferenças entre reversões e retrações de tendências).

--------------------------------------------------------------------------------------

☛ Mais informações no blog https://www.mql5.com/en/blogs/post/741637

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Alligator Analysis FREE https://www.mql5.com/en/market/product/35227

The “Alligator Analysis” (AA) indicator allows you to build various (by averaging types and by scales) “Alligators” and their combinations, i.e. allows you to analyze the state of the market based on the correlation of this state with a whole range of different "Alligators". The classic "Alligator" by Bill Williams is based on moving averages and Fibonacci numbers, which makes it one of the best indicators now. The classic "Alligator" is based on Fibonacci numbers and is a combination of three smoothed moving averages (SМMA) with periods 5, 8 and 13, which are part of the Fibonacci sequence. In this case, the moving averages are shifted forwards by 3, 5, and 8 bars, respectively, which are numbers from the same sequence (preceding the corresponding period values).

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The indicator AA uses 6 types of averaging, where the classical averaging SMA, EMA, SMMA, LMA are supplemented by averaging the moving average by the median and averaging weighted by volume.

Line shifts can be removed. The colors of the AA indicator lines are set according to the type of color spectrum: from violet for a small smoothing period to red - for the largest period.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Alligator Analysis FREE https://www.mql5.com/en/market/product/35227

The “Alligator Analysis” (AA) indicator allows you to build various (by averaging types and by scales) “Alligators” and their combinations, i.e. allows you to analyze the state of the market based on the correlation of this state with a whole range of different "Alligators". The classic "Alligator" by Bill Williams is based on moving averages and Fibonacci numbers, which makes it one of the best indicators now. The classic "Alligator" is based on Fibonacci numbers and is a combination of three smoothed moving averages (SМMA) with periods 5, 8 and 13, which are part of the Fibonacci sequence. In this case, the moving averages are shifted forwards by 3, 5, and 8 bars, respectively, which are numbers from the same sequence (preceding the corresponding period values).

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The indicator AA uses 6 types of averaging, where the classical averaging SMA, EMA, SMMA, LMA are supplemented by averaging the moving average by the median and averaging weighted by volume.

Line shifts can be removed. The colors of the AA indicator lines are set according to the type of color spectrum: from violet for a small smoothing period to red - for the largest period.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

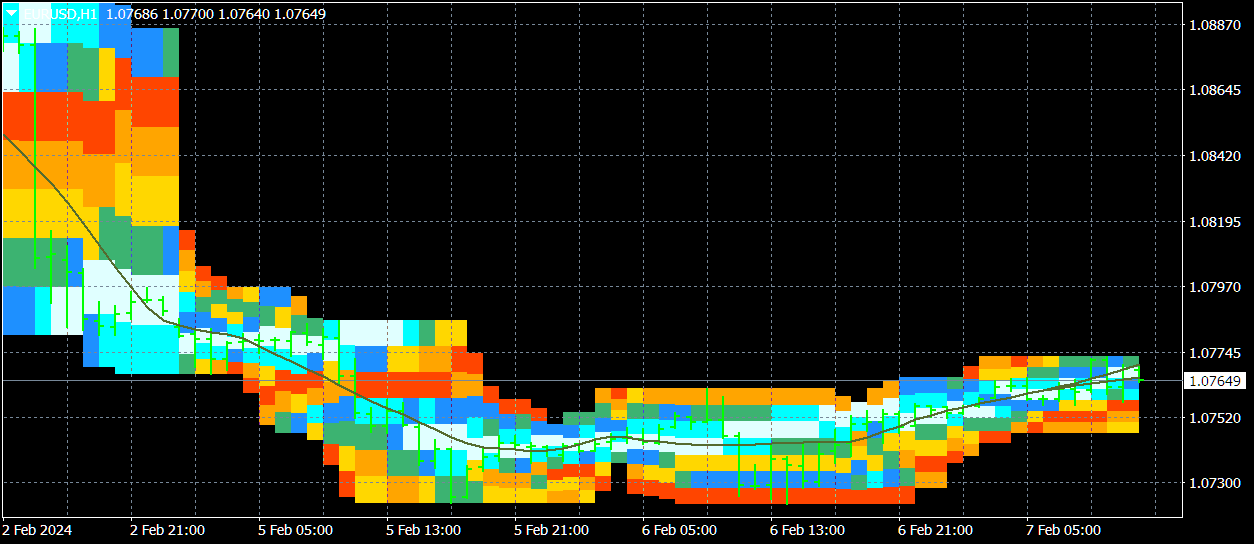

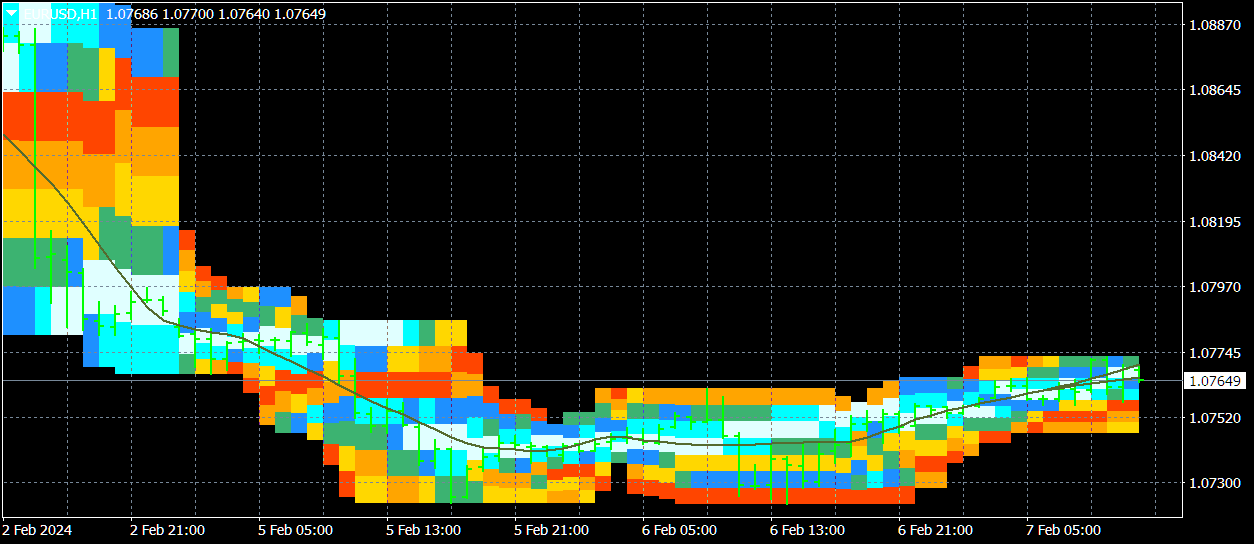

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Estimation moving average without lag https://www.mql5.com/en/market/product/36945

A simple moving average (SMA) with an averaging period (2n + 1) of bars is always obtained lagging by n bars. If SMA or other types of moving averages are the basis for making trading decisions, then their strong delay does not allow to open positions in time and close positions, which leads to losses.

The Estimation moving average without lag indicator calculates an estimate of a non-lagging moving average and displays the corresponding confidence interval.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Estimation moving average without lag https://www.mql5.com/en/market/product/36945

A simple moving average (SMA) with an averaging period (2n + 1) of bars is always obtained lagging by n bars. If SMA or other types of moving averages are the basis for making trading decisions, then their strong delay does not allow to open positions in time and close positions, which leads to losses.

The Estimation moving average without lag indicator calculates an estimate of a non-lagging moving average and displays the corresponding confidence interval.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Iterative Moving Average https://www.mql5.com/en/market/product/31714

Iterative Moving Average – IMA. IMA is obtained by correcting the usual MA. The correction consists in addition to MA averaged difference between the time series (X) and its MA, i.e. IMA(X)=MA(X) + MA (Х-MA(X)). Correction is done in several iterations (and, exactly, 2 iterations in this indicator) and with a change in the averaging period.

As a result, the time-series points begin to cluster around (on all sides) of the getting IMA and with a smaller delay than around the usual MA. Therefore, IMA is a more effective tool for manual and automatic trading than all types of conventional MA (SMA, EMA, SSMA, LMA).

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Iterative Moving Average https://www.mql5.com/en/market/product/31714

Iterative Moving Average – IMA. IMA is obtained by correcting the usual MA. The correction consists in addition to MA averaged difference between the time series (X) and its MA, i.e. IMA(X)=MA(X) + MA (Х-MA(X)). Correction is done in several iterations (and, exactly, 2 iterations in this indicator) and with a change in the averaging period.

As a result, the time-series points begin to cluster around (on all sides) of the getting IMA and with a smaller delay than around the usual MA. Therefore, IMA is a more effective tool for manual and automatic trading than all types of conventional MA (SMA, EMA, SSMA, LMA).

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Signal Bands https://www.mql5.com/en/market/product/29171

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

✔️The indicator has all types of alerts.

✔️The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Signal Bands https://www.mql5.com/en/market/product/29171

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

✔️The indicator has all types of alerts.

✔️The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Robust filter https://www.mql5.com/en/market/product/52668

The Robust filter indicator is based on the robust filtering algorithm developed by the author using the multi-period averaged moving median.

The indicator calculates and shows:

✔️1. The direction of the trend;

✔️2. Entry and exit points of positions;

✔️3. StopLoss lines calculated from current price probability distributions and selected probability of closing an order by StopLoss before the trend reversal;

✔️4. Lot sizes based on the accepted risk level, deposit size and StopLoss position.

============================================================

✔️The indicator has all kinds of alerts.

✔️The indicator does not redraw.

✔️The indicator can be used both for trading scalper strategies and for long-term trading strategies.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Robust filter https://www.mql5.com/en/market/product/52668

The Robust filter indicator is based on the robust filtering algorithm developed by the author using the multi-period averaged moving median.

The indicator calculates and shows:

✔️1. The direction of the trend;

✔️2. Entry and exit points of positions;

✔️3. StopLoss lines calculated from current price probability distributions and selected probability of closing an order by StopLoss before the trend reversal;

✔️4. Lot sizes based on the accepted risk level, deposit size and StopLoss position.

============================================================

✔️The indicator has all kinds of alerts.

✔️The indicator does not redraw.

✔️The indicator can be used both for trading scalper strategies and for long-term trading strategies.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Probabilities distribution of price https://www.mql5.com/en/market/product/27070

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

✔️ It has built-in management

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Probabilities distribution of price https://www.mql5.com/en/market/product/27070

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

✔️ It has built-in management

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

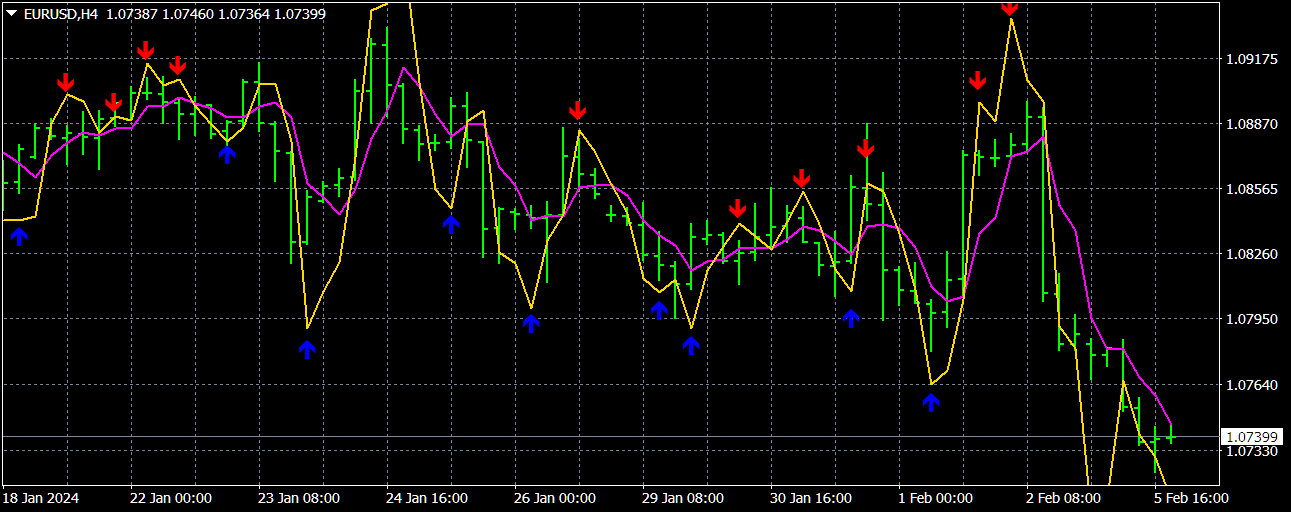

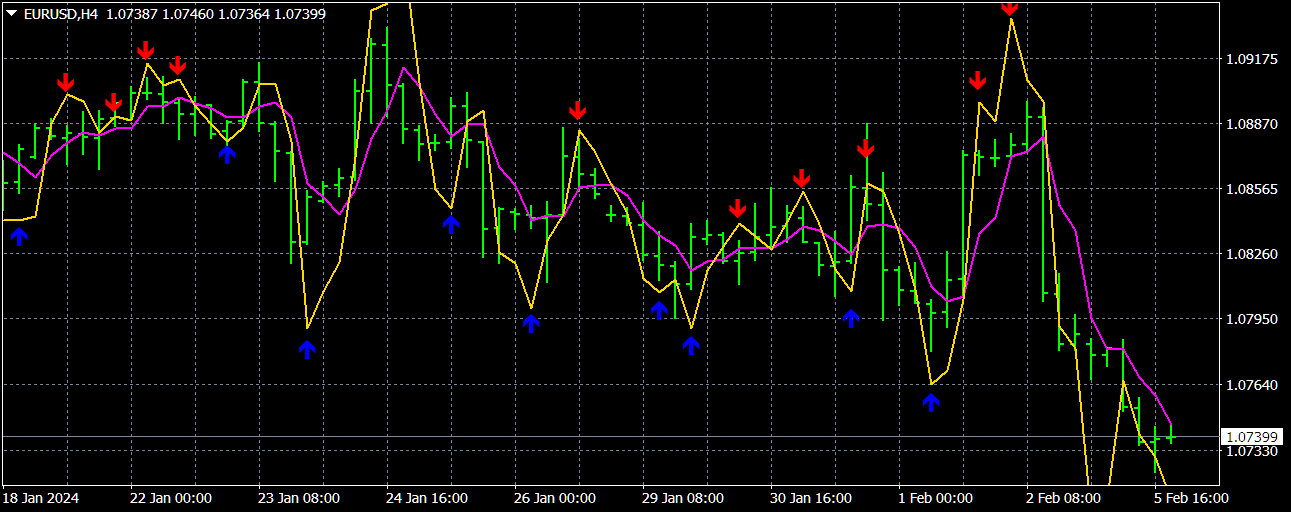

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Prof MACD (MT5) https://www.mql5.com/en/market/product/65276

✔️ One of my most profitable indicators with optimal filtering.

✔️The algorithms of this indicator are unique and developed by their author

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Prof MACD (MT5) https://www.mql5.com/en/market/product/65276

✔️ One of my most profitable indicators with optimal filtering.

✔️The algorithms of this indicator are unique and developed by their author

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Asummetry https://www.mql5.com/en/market/product/40005

The Asummetry indicator allows you to predict the beginning of a change in the direction of trends, long before their visual appearance on the price chart.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Asummetry https://www.mql5.com/en/market/product/40005

The Asummetry indicator allows you to predict the beginning of a change in the direction of trends, long before their visual appearance on the price chart.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Strong Trend Flat Signal https://www.mql5.com/en/market/product/37203

The Strong Trend Flat Signal indicator is the intersection of two, developed by the author, non-lagging moving averages with averaging periods 21 and 63.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Strong Trend Flat Signal https://www.mql5.com/en/market/product/37203

The Strong Trend Flat Signal indicator is the intersection of two, developed by the author, non-lagging moving averages with averaging periods 21 and 63.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Friends! What we see on the price charts as a trend is often not a trend, but arises as a result of the imposition of a large number of unidirectional price jumps, i.e. is a purely random occurrence. Such pseudo-trends especially often occur on small timeframes, where the level of noise is very high against the background of a weak regular price movement. And you can win on such random false trends only by chance. Therefore, following such false trends, as a rule, leads to losses. My indicators were designed to filter out such noise, which is not an easy task. For more information about this phenomenon and how to identify it, see the blog «True and illusory currency market trends” https://www.mql5.com/en/blogs/post/740838

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Probability distribution PRO https://www.mql5.com/en/market/product/41174

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Probability distribution PRO https://www.mql5.com/en/market/product/41174

Indicator is used for:

1. defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2. defining the channel change moment.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Signal Envelopes https://www.mql5.com/en/market/product/46593

The Signal Envelopes indicator uses the robust filtering method based on: (1) the moving median Buff0 = < Median> = (Max {x} + Min {x}) / 2 and (2) the averaging algorithm developed by the author Buff1 = <( ) ^ (- 3)> * ( ) ^ 4 based on the moving median. The Signal Envelopes indicator allows you to most accurately and with the minimum possible delay set the beginning of a new trend. The Signal Envelopes indicator can be used both for trading according to scalper strategies, and when using long-term trading strategies.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Signal Envelopes https://www.mql5.com/en/market/product/46593

The Signal Envelopes indicator uses the robust filtering method based on: (1) the moving median Buff0 = < Median> = (Max {x} + Min {x}) / 2 and (2) the averaging algorithm developed by the author Buff1 = <( ) ^ (- 3)> * ( ) ^ 4 based on the moving median. The Signal Envelopes indicator allows you to most accurately and with the minimum possible delay set the beginning of a new trend. The Signal Envelopes indicator can be used both for trading according to scalper strategies, and when using long-term trading strategies.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Signal Channel https://www.mql5.com/en/market/product/50988

The Signal Channel indicator uses a robust filtering method based on two moving medians applicable to the High and Low prices, i.e. the lines and , where <..> is the sign of linear averaging, which are shifted by certain values in an uptrend and by opposite values in a downtrend, which allows you to get a narrow channel, approximately outlining each bar. Sharp kinks of the lines of such a channel allow the most accurate and minimal possible delay to establish the beginning of a new trend movement. The possible change in the direction of the trend is also indicated by sharp narrowing of the channel lines, which, in fact, is expressed by the fall in volatility. The indicator also has an additional filtering function, upon activation of which the signal is identified only after a decrease in volatility, which makes the indicator more reliable. In addition to the main channel, inside which the most probable price fluctuations occur, an auxiliary channel is built (in dashed lines), beyond the borders of which the price does not go anymore, which serves to set stoplosses on it.

✔️ The Signal Channel indicator can be used both for trading according to scalper strategies, and when using long-term trading strategies.

✔️ It has built-in management

✔️ The indicator has all types of alerts.

✔️ The indicator does not redraw.

✔️ One of the best indicators with optimal market noise filtering.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Signal Channel https://www.mql5.com/en/market/product/50988

The Signal Channel indicator uses a robust filtering method based on two moving medians applicable to the High and Low prices, i.e. the lines and , where <..> is the sign of linear averaging, which are shifted by certain values in an uptrend and by opposite values in a downtrend, which allows you to get a narrow channel, approximately outlining each bar. Sharp kinks of the lines of such a channel allow the most accurate and minimal possible delay to establish the beginning of a new trend movement. The possible change in the direction of the trend is also indicated by sharp narrowing of the channel lines, which, in fact, is expressed by the fall in volatility. The indicator also has an additional filtering function, upon activation of which the signal is identified only after a decrease in volatility, which makes the indicator more reliable. In addition to the main channel, inside which the most probable price fluctuations occur, an auxiliary channel is built (in dashed lines), beyond the borders of which the price does not go anymore, which serves to set stoplosses on it.

✔️ The Signal Channel indicator can be used both for trading according to scalper strategies, and when using long-term trading strategies.

✔️ It has built-in management

✔️ The indicator has all types of alerts.

✔️ The indicator does not redraw.

✔️ One of the best indicators with optimal market noise filtering.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Absolute Bands FREE https://www.mql5.com/en/market/product/33826

The Absolute Bands indicator is reminiscent of the Bollinger Bands indicator with its appearance and functions, but only more effective for trading due to the significantly smaller number of false signals issued to them. This effectiveness of the Absolute Bands indicator is due to its robust nature.

✔️ One of the best indicators with optimal market noise filtering.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Absolute Bands FREE https://www.mql5.com/en/market/product/33826

The Absolute Bands indicator is reminiscent of the Bollinger Bands indicator with its appearance and functions, but only more effective for trading due to the significantly smaller number of false signals issued to them. This effectiveness of the Absolute Bands indicator is due to its robust nature.

✔️ One of the best indicators with optimal market noise filtering.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

StatPredict https://www.mql5.com/en/market/product/38721

✔️The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend. Using mathematical methods for predicting random processes, StatPredict indicator predicts the most probable values of the future price and calculates the confidence interval for them.

✔️StatPredict also provides the option to calculate the lot, based on the positions of the last points of the calculated channel of confidence probability, as well as the size of the deposit and the allowable risk, which are specified in the indicator settings.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

StatPredict https://www.mql5.com/en/market/product/38721

✔️The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend. Using mathematical methods for predicting random processes, StatPredict indicator predicts the most probable values of the future price and calculates the confidence interval for them.

✔️StatPredict also provides the option to calculate the lot, based on the positions of the last points of the calculated channel of confidence probability, as well as the size of the deposit and the allowable risk, which are specified in the indicator settings.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Velocity of price change https://www.mql5.com/en/market/product/62315

The Velocity of price change indicator shows the average rate of price change at those characteristic time intervals where this rate was approximately constant. The robust algorithm used in Velocity of price change to smooth out the price from its random jumps, ensures the reliability of the indicator reading, which does not react to simple price volatility and its insignificant movements.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Velocity of price change https://www.mql5.com/en/market/product/62315

The Velocity of price change indicator shows the average rate of price change at those characteristic time intervals where this rate was approximately constant. The robust algorithm used in Velocity of price change to smooth out the price from its random jumps, ensures the reliability of the indicator reading, which does not react to simple price volatility and its insignificant movements.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Absolute price https://www.mql5.com/en/market/product/54630

✔️ This indicator is intended for professionals assessing fundamental market trends. This indicator calculates the index of any instrument and analyzes it.

✔️ The indicator has modes for analyzing the indices themselves, namely: Moving Average; Relative Strength Index; Momentum; Commodity Channel Index; Bollinger Bands; Envelopes.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️ This indicator is intended for professionals assessing fundamental market trends. This indicator calculates the index of any instrument and analyzes it.

✔️ The indicator has modes for analyzing the indices themselves, namely: Moving Average; Relative Strength Index; Momentum; Commodity Channel Index; Bollinger Bands; Envelopes.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

TrueChannel FREE https://www.mql5.com/en/market/product/61769

The TrueChannel indicator shows us the true price movement channels. This indicator resembles Donchian Channel in its appearance, but is built on the basis of completely different principles and gives (in comparison with Donchian Channel, which is better just to use to assess volatility) more adequate trading signals.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

TrueChannel FREE https://www.mql5.com/en/market/product/61769

The TrueChannel indicator shows us the true price movement channels. This indicator resembles Donchian Channel in its appearance, but is built on the basis of completely different principles and gives (in comparison with Donchian Channel, which is better just to use to assess volatility) more adequate trading signals.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

StatZigZag https://www.mql5.com/en/market/product/61091

Its indicator that allows you to get real sustainable profits in long-term trading.

✔️The algorithms of this indicator are unique and developed by their author

✔️ The StatZigZag indicator also builds a channel of maximum price fluctuations around the broken regression line, on the lower (red) line of which you can set StopLoss for buy orders, and on the upper (blue) line - StopLoss for sell orders.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

StatZigZag https://www.mql5.com/en/market/product/61091

Its indicator that allows you to get real sustainable profits in long-term trading.

✔️The algorithms of this indicator are unique and developed by their author

✔️ The StatZigZag indicator also builds a channel of maximum price fluctuations around the broken regression line, on the lower (red) line of which you can set StopLoss for buy orders, and on the upper (blue) line - StopLoss for sell orders.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Friends, I am a theoretical physicist and a trader, mathematically rigorously studying market processes, aspects of which I have already begun to present in my articles. https://www.mql5.com/en/articles/10955

https://www.mql5.com/en/articles/11158

https://www.mql5.com/en/articles/12891

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(1) market entry points are determined,

(2) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(3) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

https://www.mql5.com/en/articles/11158

https://www.mql5.com/en/articles/12891

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(1) market entry points are determined,

(2) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(3) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

: