Roberto Jacobs / Perfil

- Informações

|

8+ anos

experiência

|

3

produtos

|

75

versão demo

|

|

28

trabalhos

|

0

sinais

|

0

assinantes

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

WTI Off Highs, Returns to $40.00 The barrel of the West Texas Intermediate (WTI) keeps its daily gains today, albeit it has retraced the earlier spike to levels above the $40.00 mark. WTI looks to regain the $40.00 handle Crude oil prices have bounced off last week’s lows in the $35...

Roberto Jacobs

GBP/USD Clings to Daily Gains The pound has been recovering ground against a softer greenback on Monday, with GBP/USD reaching 6-day highs at the 1.4250 area. The British currency is among the best performers of the day, posting decent gains versus the yen and the euro as well...

Roberto Jacobs

EUR Shorts Reduced, USD Longs Consolidating - Rabobank Jane Foley, Senior FX Strategist at Rabobank, lists down the IMM Net Speculators’ Positioning as at 05 April 2016. Key Quotes • “Despite the dovish position of the ECB, speculators have reduced their net EUR shorts for three consecutive weeks...

Roberto Jacobs

BoC: Not Expected to Change Policy - BBH Research Team at BBH, suggests that the Bank of Canada (BoC) meets this week, and is not expected to change policy...

Roberto Jacobs

EUR/USD Neutral/Bearish Short-Term – Scotiabank Shaun Osborne, Chief FX Strategist at Scotiabank, has reiterated the neutral/bearish outlook for the pair in the near-term. Key Quotes “EURUSD has spent the last seven days trading narrowing around the 1.14 area”...

Compartilhar nas redes sociais · 1

126

Roberto Jacobs

China: Important Inflation Numbers Out – Deutsche Bank Research Team at Deutsche Bank, suggests that there were important inflation numbers out of China this morning. Key Quotes “CPI for the month of March has printed at +2.3% yoy which was a smidgen below expectations (of +2...

Roberto Jacobs

US Dollar Surrenders Gains, Near 94.10 ahead of Fed The greenback, tracked by the US Dollar Index, has faded the earlier bullish attempt towards the 94.30/35, returning the 94.10 area. US Dollar now looks to Fed The index keeps the trade in the area of yearly lows in the vicinity of the 94...

Compartilhar nas redes sociais · 1

104

Roberto Jacobs

ECB May Have Exhausted the Room to Cut Interest Rates - BBH

11 abril 2016, 14:05

ECB May Have Exhausted the Room to Cut Interest Rates - BBH Research Team at BBH, suggests that the euro turned higher in the middle of the Draghi's post-ECB press conference last month when he indicated (yet again) that the central bank may have exhausted the room to cut interest rates (with a m...

Roberto Jacobs

EUR/USD Attempting Break Above 1.14 EUR/USD bounced back from hourly 200-MA and is now attempting a break above 1.14 handle amid positive action in the European equities and US index futures...

Roberto Jacobs

FXWIREPRO: Expect EUR/GBP Interim Justifiable Corrections After Jump Above 61.8% Fibos It is quite puzzling if you want to understand the technical intricacies of this pair, (to be precise in simple terms, this pair may dip a little in short term but long term uptrend still remains intact...

Roberto Jacobs

Sergey Golubev

Comentário ao tópico Forecast for Q2'16 - levels for EUR/USD

EUR/USD Intra-Day Technical Analysis - waiting for direction of the trend to break the levels M5 price is located near SMA with period 100 (100 SMA) and SMA with the period 200 (200 SMA) waiting for

Roberto Jacobs

Yen Rally Getting a Bit Extended Yen is enjoying its longest and strongest rally since the financial crisis, however that rally is looking a bit stretch now in the very near term and there could be short covering in USD/JPY, if equities rally or Dollar strengthens...

Roberto Jacobs

Sergey Golubev

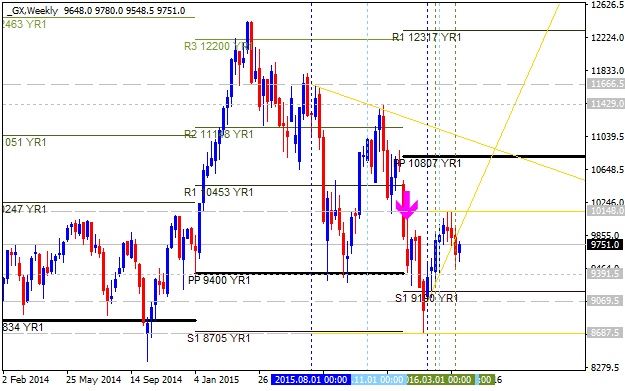

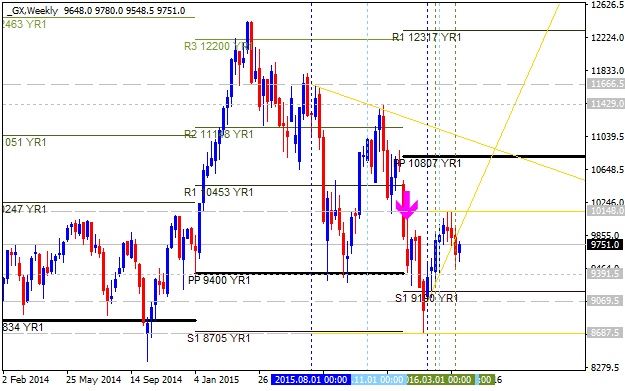

Comentário ao tópico Forecast for Q2'16 - levels for DAX Index

DAX Index Pivot Points Analysis - bearish ranging within Central Yearly Pivot and the First Support Pivot level W1 price is located to be below yearly Central Pivot at 10,807 and above S1 Pivot at

Roberto Jacobs

AUD/USD Still Aims for 0.7475/80 – UOB Analysts at UOB Group still believe the Aussie dollar could grind lower towards the 0.7470 area. Key Quotes “Despite the strong short-term rebound end of last week, we still think the current pull-back from the late March high of 0...

Roberto Jacobs

FXWIREPRO: GBP/JPY Faces Strong Resistance at 154.80, Good to Buy at Dips Major resistance – 154.80 (3 W EMA) Minor support -153.25 The pair has jumped till 154.22 on Friday and declined from that level. It is currently trading around 153.34...

Roberto Jacobs

EUR/JPY Off Lows, Regains 123.00 and Above After a brief dip towards the 122.80 area, EUR/JPY has pulled itself together and has now retaken the 123.00 handle and above...

Roberto Jacobs

China: Housing Supports CPI Inflation; Subsiding PPI Deflation - ING Tim Condon, Chief Economist at ING, suggests that the evidence of demand-side CPI pressure and narrowing PPI deflation lessen the case for PBOC rate cuts...

Roberto Jacobs

Weakness of the US Economy has Undermined the Greenback - BBH Research Team at BBH, suggests that the weakness of the US economy and the caution by the Federal Reserve to raise rates again after the December lift-off has undermined the greenback...

Roberto Jacobs

Oil Prices Wobble as Output Freeze is Viewed with Skepticism Oil prices recovered losses seen in early Europe, but gains are hard to come as markets believe next Sunday’s output freeze meeting in Doha is unlikely to help address supply glut issue...

Roberto Jacobs

Fair Value in USD/JPY – Deutsche Bank George Saravelos, Strategist at Deutsche Bank, suggests that the Japan’s biggest problem with the current yen rally is that it is justified by fundamentals. Key Quotes “Across most of our metrics USDJPY is still expensive or only just approaching fair value...

: