London SE BreakOut EA

- Experts

- Alexander Titov

- Versão: 4.16

- Ativações: 5

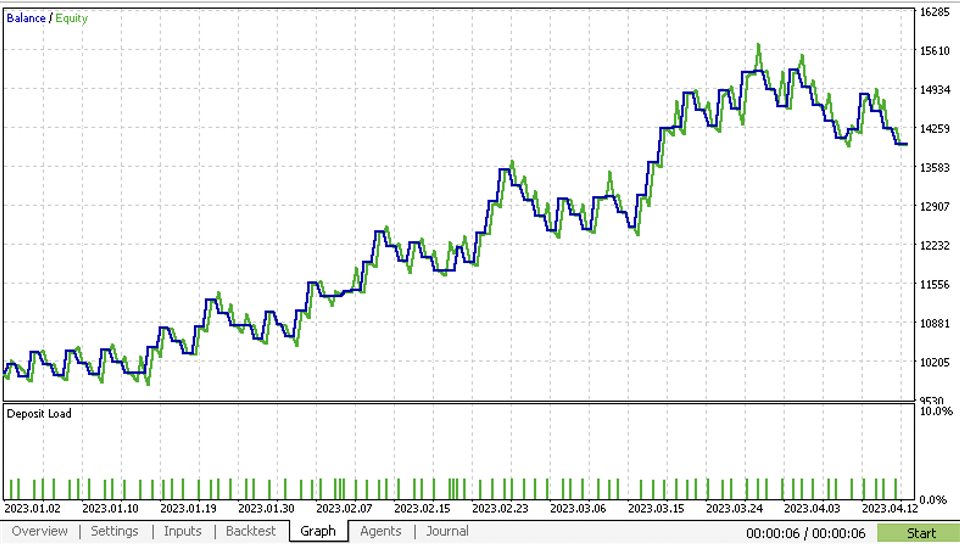

This EA is based on statistical observations how a price moves after American, European or Asian stock exchanges are open.

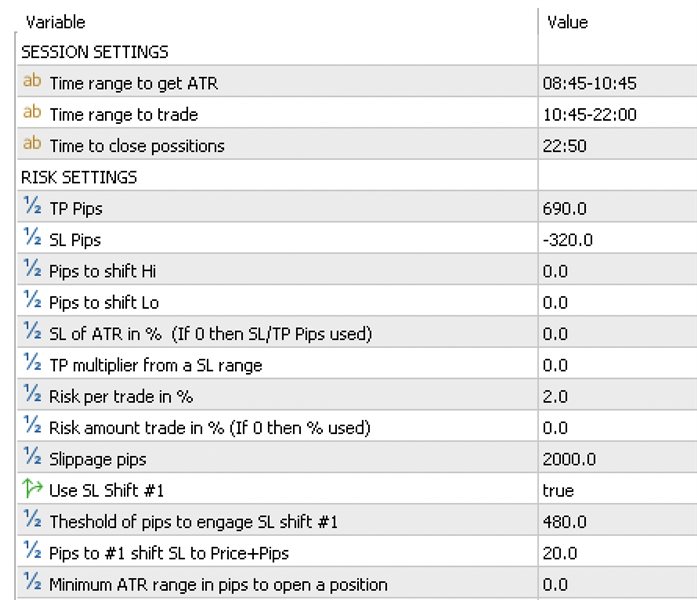

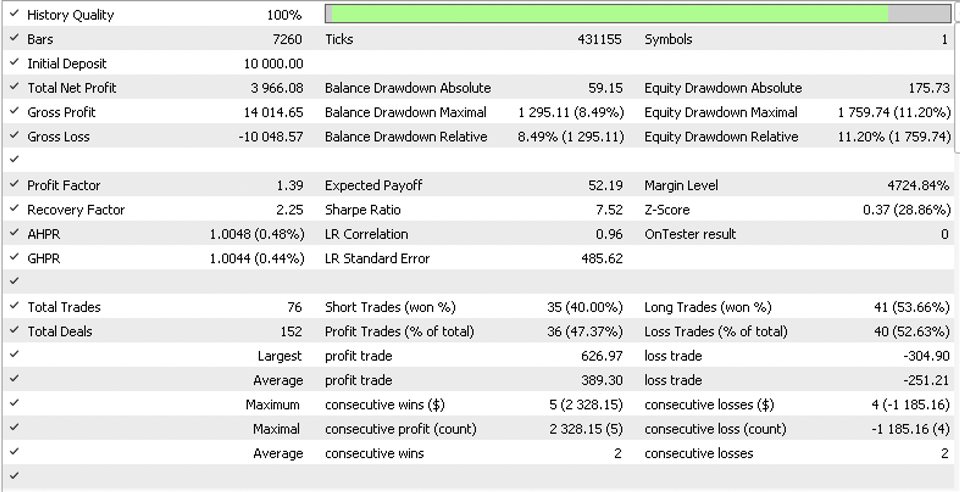

You can fine-tune this EA according to your favorite FX pair, its daily price range, your risk tolerance and signal sensitivity.

How it works:

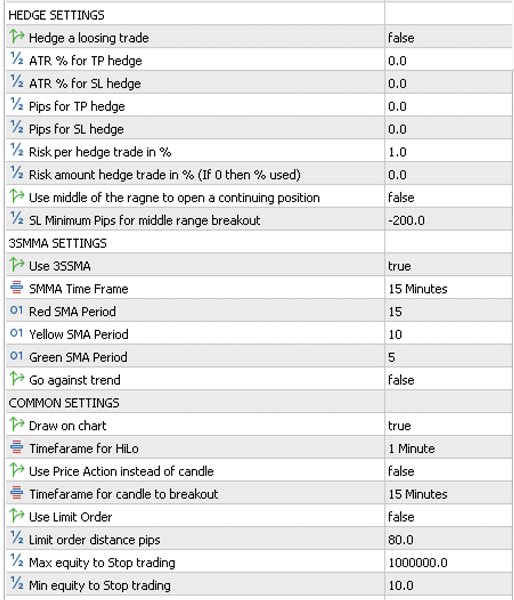

The EA is taking Hi-Lo price levels (ATR) from time range set buy a trader and watches for breakout of one of the level during the trading hours. If level is broken and other conditions are met, it places an order to open a long or short position according to the trend. Lot size is calculated based on risk tolerance and stop loss distance set by a trader. False breakouts can be filtered out with 3 moving averages (Red-Slow, Yellow-Middle, Green-Fast on the chart) to confirm the trend. If the price has not hit PL or SL then the positions will be closed by EA at a time set by a trader.

Suggestions:

- Do not use this EA with other EAs on the same account!

- Bigger risk requires bigger leverage

Additional options:

- Hedge the position after loosing trade. Try to recover on trend reversal.

- Set Middle Price to breakout instead of one of the levels

- Stop trading if target balance is reached (Lowest and highest).

- Choose to place Market or Limit Orders

- Choose to use Price Action or Candle closing event.

- Narrow slippage range to bypass high volatility in market.

- Use automatic SL shift to set your trending position to be break-even or to fix a small profit.

Pay attention:

- Use format HH:MM-HH:MM for time range variables (extra characters or spaces may lead to incorrect time recognition)

- Use HH:MM for closing time

Default Settings are recommended to use with GBPJPY pair and based on London Stock Exchange session time and GBPJPY daily price range. The parameters have been used on live trading accounts since January 2023.