RenkoTradingBot

- Experts

- Stanislav Korotky

- Versão: 1.2

- Atualizado: 21 maio 2018

- Ativações: 5

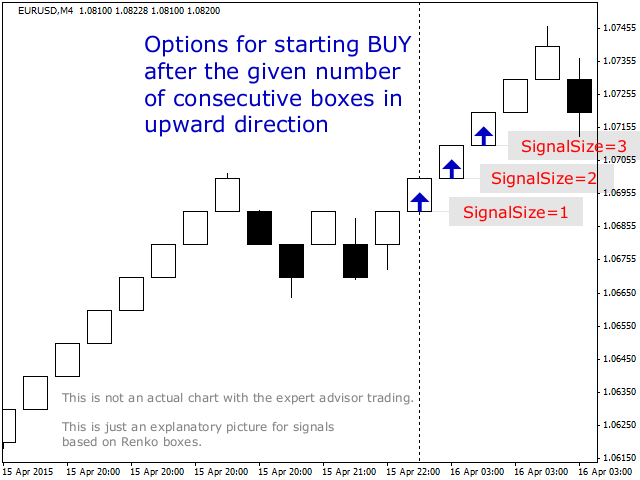

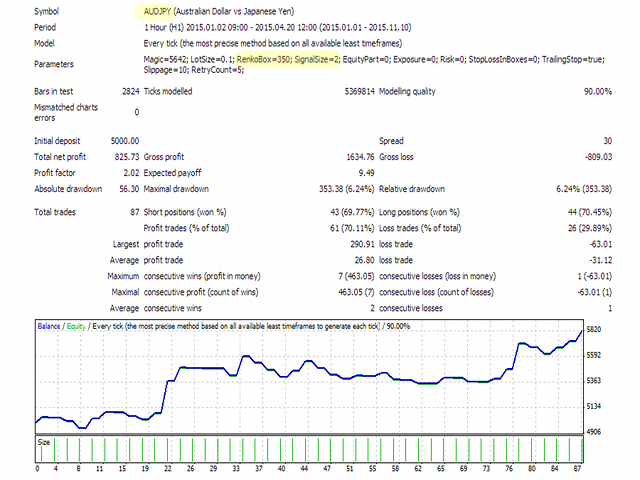

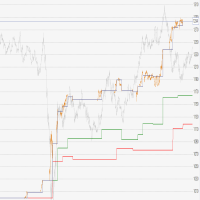

The Expert Advisor forms a virtual representation of Renko chart (no indicators used) and then trades on predefined formations of Renko boxes. An order is opened when a predefined number (SignalSize) of unidirectional Renko bars are formed after reversal.

The EA advantages:

- No more than one order on a symbol is opened in the market;

- No martingale, no drawdown, no averaging;

- Optional stop loss with trailing;

- Optional management of lot size according to deposit exposure or risk of losses with specified stop loss;

- Lot management using a dedicated fraction of deposit;

Please note that the expert does not produce Renko charts itself.

For visualization of levels, corresponding to given Renko size, on your work chart, one may use standalone indicators capable of showing grids or horizontal lines on granulated price values.

To analyze of the expert and visualization of Renko charts, one may use standalone indicators or offline experts. One of them is available in the Comment tab of the product.

Parameters

- Magic - magic number of the expert, default value is 0;

- LotSize - a lot size for new orders, default value is 0.1; this parameter is ignored, if Exposure or Risk is used;

- RenkoBox - Renko bar size in points, default value is 100;

- SignalSize - number of successive unidirectional Renko bars formed after a reversal that opens a trade; default value is 3;

- MultipleOrders - if true, every subsequent Renko bar formed after SignalSize in previous direction activates an additional order; default is false, i.e. only one open order in the current direction;

- EquityPart - a value between 0 and 1; a part of free margin, that will be used for lot size calculation by Exposure or Risk; default value is 0, no limitation;

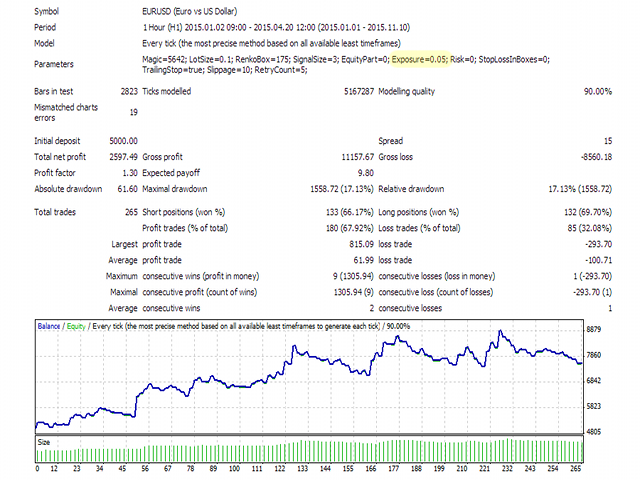

- Exposure - a value between 0 and 1; an exposure on deposit, used for lot size calculation with respect to the free margin or a part of the free margin specified in EquityPart; default value is 0, the mode is disabled, a fixed lot specified in LotSize is used;

- Risk - a value between 0 and 1; a measure of risk - an allowable loss amount as a percent of the free margin in the event of the predefined stop loss (StopLossInBoxes); default value is 0, the mode is disabled, a fixed lot specified inLotSize is used;

- StopLossInBoxes - stop loss size as a ratio of Renko bar size (RenkoBox); for example, if RenkoBox is 300 points, and StopLossInBoxes is 2, then a distance to stop loss is 600; default value is 0, stop loss is not placed;

- TrailingStop - enable/disable stop loss trailing (StopLossInBoxes should be > 0); default value is true;

- TakeProfitInBoxes - take profit as a number (fractions allowed) of Renko bars; if 0, no take profit is set;

- Slippage - slippage in points when orders are executed; default value is 10;

- RetryCount - a number of attempts to perform a trading operation in case of errors; default value is 5; if the operation failed even after RetryCount attempts, and signal remains, the expert will try to process it on the next tick;

- AllowCloseBy - allow the use of the OrderCloseBy function; default is true; ignored if the OrderCloseBy function is disabled by the broker;

- VersionCompatibility (default is 0) - if changed to 1.1, the robot starts working according to the old algorithm from version 1.1 (can be useful to those who have successful settings for the previous algorithm, although it was not canonical);

Recommended timeframes: M15, M30, H1.

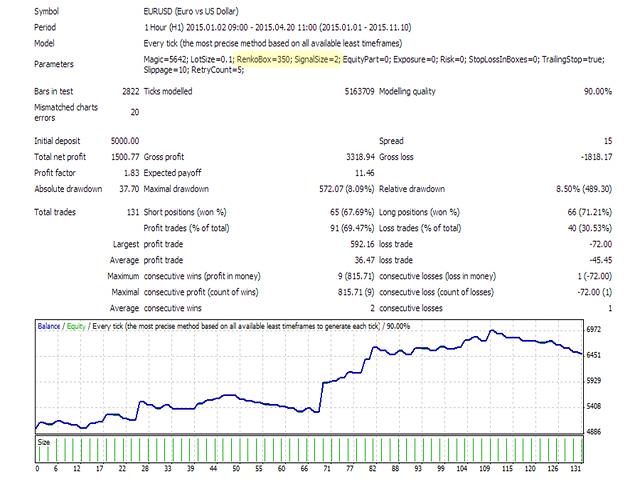

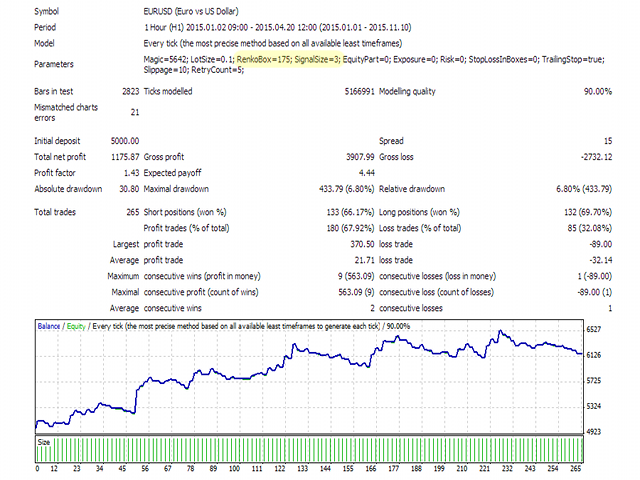

"Every tick" mode is required for testing and optimization

Screenshots below demonstrate formation of trading signals and testing results.