PowerPlay BullBear

- Experts

- Thomas William Kelly

- Versão: 1.0

- Ativações: 5

Attention Trader: Maximise This 5 Star Trading System

+R3 System Is Now In Play

Why Is The +R3 PowerPlay BullBear System Different?

+R3 trading systems are different because of how they work. In short +R3 systems follow three rules which give consistent performance.

By following the +R3 system when trading manually you can have some success by just using one of the laws, but when you combine them you have a trading system which blows everything else out of the water.

What Are the 3 Laws To Follow?

As you might have guessed the 3 laws all begin with the letter R:

- Routine - This is when you trade and how often

- Rules - This is the rule you follow

- Risk:Reward - This is the percentage amount of your account which is at risk

Routine

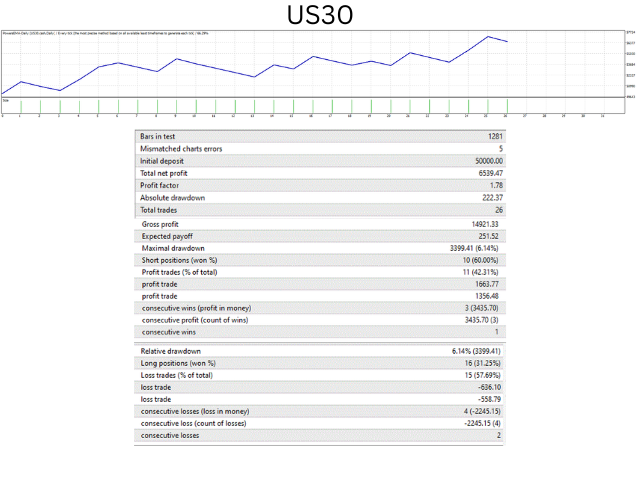

With a set routine of when the system is going to trade you can become a very strict trader. Within the +R3 Trend Trading System, the routine of trading depends entirely on the market you are trading. Throughout the in depth testing it has been found that XAUUSD & US30 work best after 12pm GMT, whilst USDCHF, EURCHF, AUDCAD, CADJPY & CHFJPY work best around the open of UK / EU markets. Additional testing is always taking place.

Rules

With set rules written down you know that a trade will only be made if certain rules are made. Most EAs on sale have to have this, but they can become inconsistent in certain market conditions. The rules you set should have multiple layers to ensure that your money is protected.

Risk:Reward

Managing risk no matter where you are up to in your trading career has to be the most important aspect. A general rule is that no more than 1% of your trading account should be at risk at any one trade, therefore the reward (target profit) should be a multiple of your risk. Using this simple process a 1:2 ratio means that you risk 1% for a 2% gain.

Setup

Installing

- Recommended Timeframe: Daily

- Recommended Currencies: USDCHF, EURCHF, AUDCAD, CADJPY, CHFJPY

- Additional Info: US30 is potentially an option during testing using a larger SL provided successful instead of 50Pips 5,000 or 50,000Pips is an option

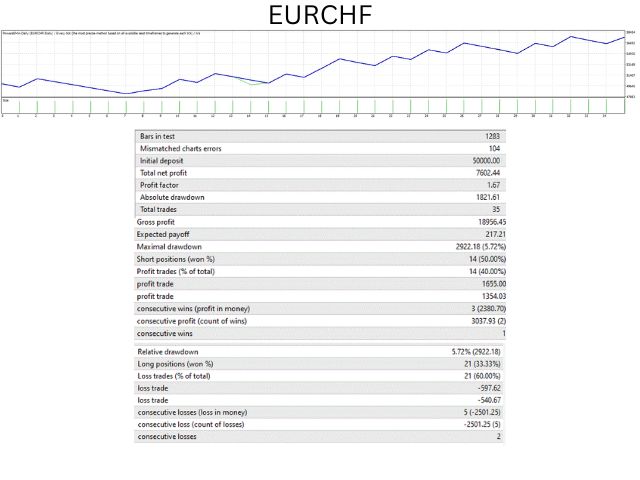

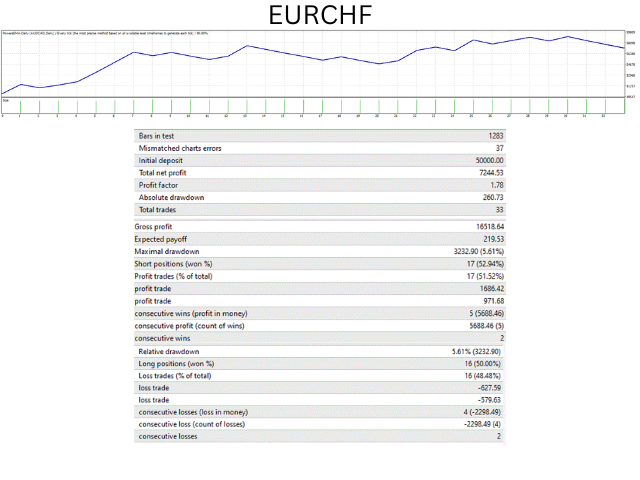

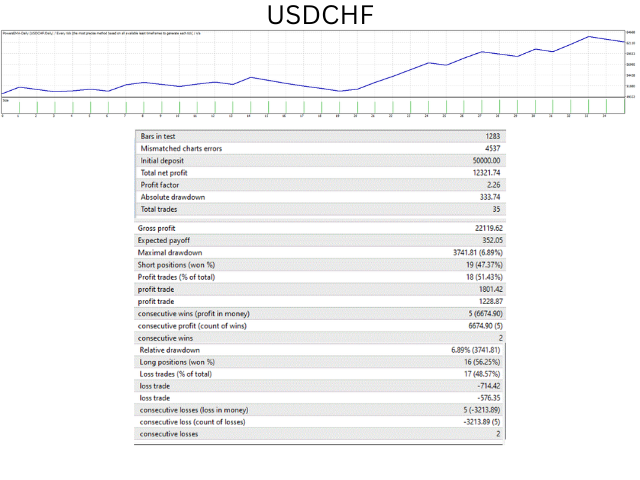

Back Testing

My recommendation to ANYONE looking to do significant back-testing on an EA / Strategy would be to use Tick Data Suite from (https://eareview.net/downloads) for MT4. (Please note I have no affiliation to this product!)

The reason I recommend Tick Data is because of the spread accuracy which they provide. This is after like so many here I got burnt with EAs which looked good in back-testing but in reality aren't all that good!

Back testing was carried out on FTMO demo accounts with a 1:100 account. Additional back testing would be recommended for your broker.

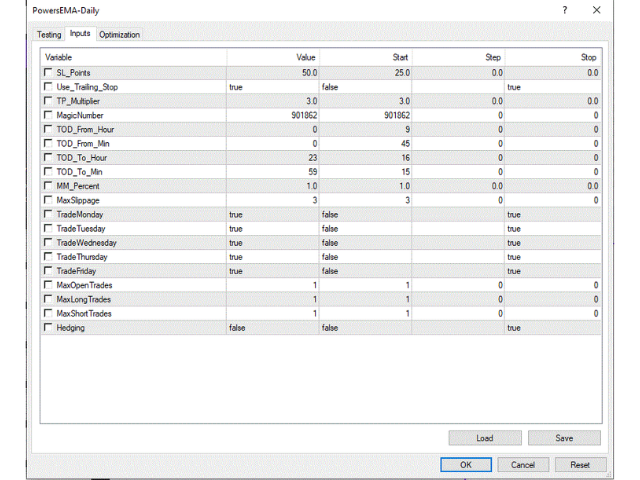

Inputs

- SL Pips: The number of pips before a trade is closed once in drawdown.

- Use Trailing Stop: True / False as to use trailing stop. Trailing levels are determined by the SL Pips, to ensure risk is managed correctly.

- TP Multiplier: This is the multiple the SL Pips will be multiplied by to set the TP level.

- MagicNumber: Needs to be unique if running on the same currency on multiple timeframes

- From Hour: Hour system is allowed to start 0 = midnight

- From Min: Minute within hour system is allowed start to trading

- To Hour: Hour system will stop 0 = midnight

- To Min: Minute within hour system is allowed start to trading

- MM_Percent: Risk percentage per trade 1 = 1%

- MaxSlippage: Max pips price can slip

- TradeMonday: True = Trade on Monday

- TradeTuesday: True = Trade on Monday

- TradeWednesday: True = Trade on Monday

- TradeThursday: True = Trade on Monday

- TradeFriday: True = Trade on Monday

- MaxOpenTrades: Number of open trades allowed at once. If Hedging is true then this needs to be more than 1.

- MaxLongTrades: Number of Long open trades allowed at once. If Hedging is true then this needs to be more than 1.

- MaxShortTrades: Number of Short open trades allowed at once. If Hedging is true then this needs to be more than 1.

- Hedging: True will allow Long and Short positions to be open at the same time.

O usuário não deixou nenhum comentário para sua avaliação