Daily Candle Scalper

- Experts

- Salvatore Caligiuri

- Versão: 3.4

- Atualizado: 23 agosto 2024

- Ativações: 10

| PROMO - Only for next 3 buyers, PORTFOLIO EVOLUTION expert advisor as gift! |

BACKTEST INFO:

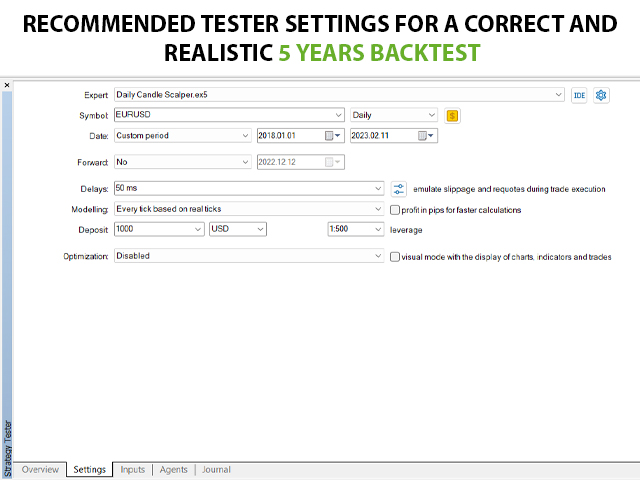

Due to the large number of trades and to the complexity of the algorithm, backtest can be slow to start, let the tester download data brom broker server and it will start

To backtest correctly, use default settings and recommended tester settings (check screenshot)

This expers works analyzing every tick of the markets, Use only "Every ticks based on real ticks" mode to get it work correctly and for realistic results

Differences between backtest and live trading are due to news filter that doesnt works during backtest

Before buy: backtest and past results can never guarantee same results in the future. Trading is a risky activity, be sure you know the risks involved before invest your money. Trading with this expert advisor involves a high degree of risk and can result in a large sums of money, including the entire paid-up capital. You should always invest an amount you can afford to lose.

***** IMPORTANT: BACKTEST ONLY TO LEARN HOW TO USE THE EXPERT, TO FIND YOUR BEST SET AND STUDY THE BAHAVIOR. RESULTS CANNOT BE CONSIDERED RELIABLE DUE TO NEWS FILTER NOT WORKING IN BACKTEST AND BECAUSE REAL TRADING CONDITIONS WILL NEVER BE REPLIED BY ANY TESTER. TRUST AND BUY ONLY EXPERTS THAT GIVES YOU REAL ACCOUNTS MONITORING *****

***** IMPORTANT: THIS IS NOT THE USUAL HISTORY READER THAT GIVES FABULOUS AND UNREALISTIC BACKTEST RESULTS. MOST OF PEOPLE BUY THAT KIND OF EXPERT ADVISOR DUE TO THE PERFORMANCE IN STRATEGY TESTER BUT THEN RELEASE 1 STAR REVIEW BECAUSE RESULTS ON REAL MARKETS ARE COMPLETELY DIFFERENT. THIS IS NOT THE CASE, OUR EXPERT IS 100% GENUINE AND TRASPARENT WITH REAL ACCOUNT MONITORING YOU CAN SEE BELOW *****

Daily Candle Scalper EA with full customizable money management is an advanced trading tool specifically designed to be used in various and different ways. This powerful Expert Advisor leverages the elastic nature of financial markets and offers a customizable money management system to effectively manage multiple assets on a dedicated account or within a portfolio. User will be able to allocate for this expert a % of the balance and a % risk exposure for that amount improving with a customable risk the personal performance of forex trading.Different examples (intelligent and realistic ways) to use this expert, ask me for set files adapted to your trading style:

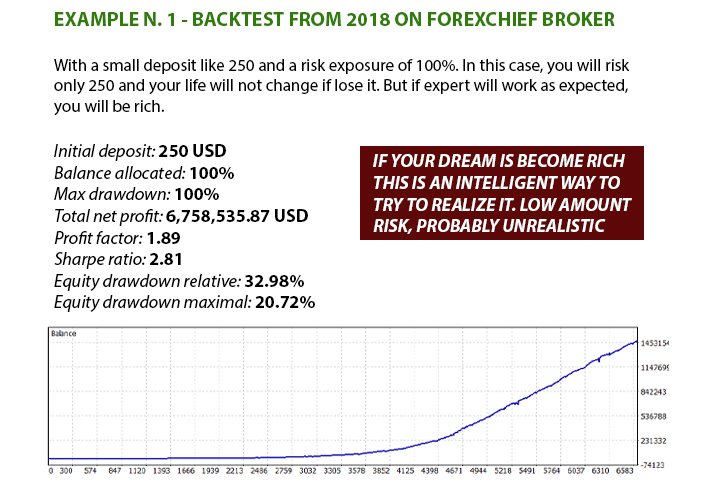

- With a small deposit like 250 and a risk exposure of 100%. In this case, you will risk only 250 and your life will not change if lose it. But if expert will work as expected, you will be rich. (check screenshot n. 1)

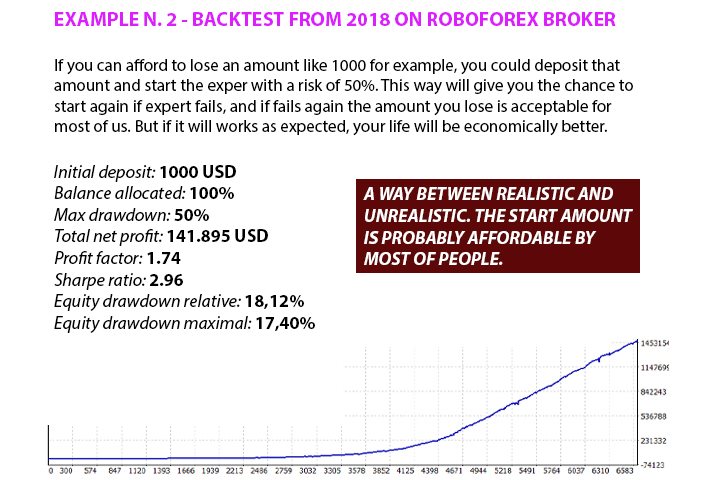

- If you can afford to lose an amount like 1000 for example, you could deposit that amount and start the exper with a risk of 50%. This way will give you the chance to start again if expert fails, and if fails again the amount you lose is acceptable for most of us. But if it will works as expected, your life will be economically better. (check screenshot n. 2)

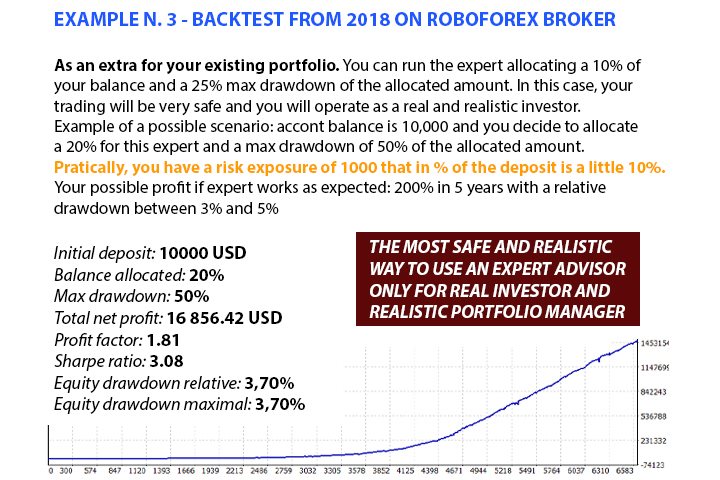

- As an extra for your existing portfolio. You can run the expert allocating a 10% of your balance and a 25% max drawdown of the allocated amount. In this case, your trading will be very safe and you will operate as a real and realistic investor. Example of a possible scenario: accont balance is 10,000 and you decide to allocate a 20% for this expert and a max drawdown of 50% of the allocated amount. Pratically, you have a risk exposure of 1000 that in % of the deposit is a little 10%. Your possible profit if expert works as expected: 200% in 5 years with a relative drawdown between 3% and 5% (check screenshot n. 3)

-

Elasticity Strategy: The EA's core strategy focuses on identifying elastic market conditions across various assets within a portfolio. By analyzing historical price data, volatility, and key technical indicators, it detects potential price expansions and contractions, taking advantage of market reversions to optimize portfolio performance.

-

Customizable Money Management: The EA provides extensive customization options for portfolio management. Traders can tailor risk exposure and position sizing for each asset based on their specific risk appetite and portfolio objectives. Parameters such as account balance allocator, lot size, equity stop loss, maximum drawdown, and profit targets can be individually configured, allowing for a well-balanced and diversified portfolio.

-

Technical Indicator Integration: The EA seamlessly integrates with a wide range of technical indicators to enhance its trading decisions. By incorporating multiple indicators such as moving averages, oscillators, or trend-following tools, traders can further optimize the EA's performance based on their preferred portfolio management strategies.

-

Trade Execution and Management: The EA automatically executes trades across multiple assets within the portfolio based on its analysis and predefined parameters. It includes essential risk management features such as stop loss and take profit levels to protect each asset's downside and secure profits. Additionally, trailing stop functionality can be implemented to maximize gains during favorable market conditions.

-

Backtesting and Optimization: The EA facilitates rigorous backtesting and optimization to evaluate its performance across the portfolio. By utilizing historical data, traders can assess the EA's effectiveness and fine-tune its parameters for optimal performance and risk-adjusted returns across various market conditions.

-

User-Friendly Settings: The EA provides a user-friendly settings description. Traders can easily understand every setting of the expert without complicated words or concept to understand.

The Elasticity EA with Customizable Money Management for Portfolio Management offers a comprehensive solution to optimize portfolio performance by capitalizing on market elasticity. It is essential for traders seeking a systematic approach to portfolio management, enabling them to effectively manage risk, diversify their investments, and maximize returns across multiple assets. It is recommended to thoroughly test the EA on demo accounts and consult with experienced traders or financial advisors to fine-tune its parameters and align it with individual portfolio objectives and risk tolerance.

RECOMMENDATIONS:

- Choose the right broker: any with low spread and low commissions. My best: ForexChief, IC Markets, AdmiralMarkets and Roboforex. Alternatives: VantageFX, XM, ThinkMarkets

- For best performance, run on a dedicated account on a PC/VPS with low latency to broker server

- Min deposit 250 USD (or equivalent in other currencies) - Min leverage 1:30, it depends by the initial deposit

- The EA must be attached to only EURUSD D1 chart in One chart mode (multicurrencies)

- Allow web requests in MT5 settings to the following URL to activate news filter: htt*ps://sslecal2.forex*prostools.c*om/ (delete * characters)

SETTINGS DESCRIPTION:

General settings

Magic number - orders identifier, must be univoque for this expert and not equal to other robot running on the same account.

Set trades comment - User can set a customable comment for trades placed by the expert

Max spread in points - If running spread is higher, trade will be not placed

Symbols mode - One chart mode or Multi chart mode. One chart mode will trade all symbols (multicurrencies) specified in the Symols field, Multi chart mode only the symbol of the current chart

Symbols to trade in one chart mode - Symbols you want to trade in multicurrencies way. Default value are the supported symbols

Balance to allocate for this EA (in %) - Amount in percent of the balance to allocate for this expert. All calculations of risk and lot size will be based on this amount

Risk settings mode - Custom or auto risk preset. If custom you can set risk and money management setting in fields below, if Auto risk preset calculations will be automatic base on risk level you will set

Risk preset - Only if Risk settings mode = Use auto risk preset - in percentage. If expert will reach specified drawdown limit will close all positions

News filter settings

Activate news filter- true to activate the news filter, false to deactivate it

GMT time zone (broker) - Your broker server GMT offset time. Set the right value to use the filter correctly

Stop trading before news - trading will be disabled this number minutes before the news

Resatrt trading after news - trading will be enabled again after this number of minutes after news

Money management settings only if CUSTOM RISK SETTINGS

Lot size method - AutoLot or fixed

Balance for 0.01 size for AutoLot size method - if AutoLot size is selected, set the amount balance needed for 0.01.

Initial size for FixedLot size method - only if FixedLot size mode is selected. Is the size of the first trade expert will place

Equity stop loss - in percentage. If reached, expert will close all positions

RSI settings

RSI timeframe - the TF to use for RSI indicator

RSI period - Set RSI period

RSI Os/Ob level - oversold and overbought RSI levels. Oversold = this value, Overbought = 100 - this value

Trend settings

Trend timeframe - set timeframe to estabilish main trend

Moving average period - set period of moving average main trend

Distance between trades - set minimum distance in pips before next trade

Targets settings

Profit target for single trade - profit in pips for a single trade

Profit target for multiple trades - profit in pips if multiple trades

很好,非常好的EA。