Vini MT5

- Experts

- Vinicius Pereira De Oliveira

- Versão: 1.129

- Atualizado: 6 fevereiro 2025

- Ativações: 5

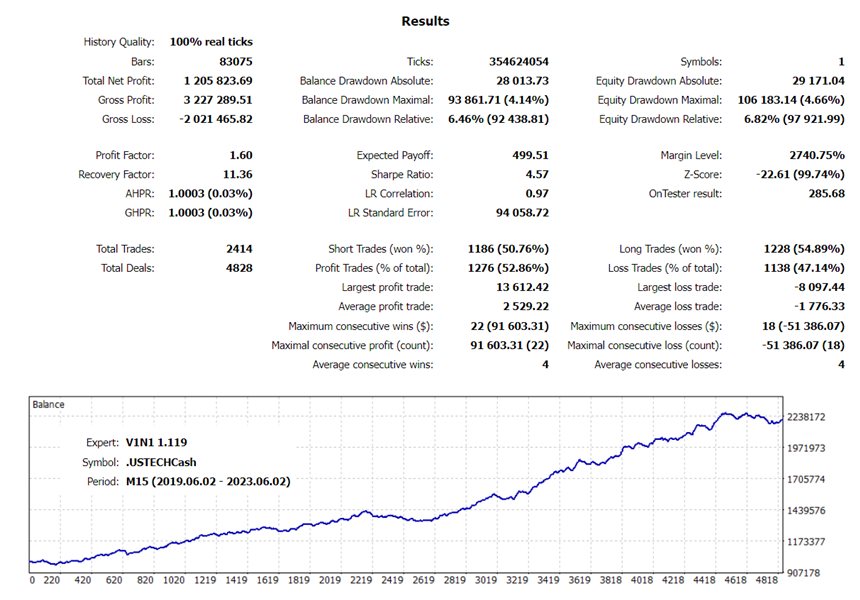

The Expert Advisor is fully automated, trades in all sessions (full-time), using a strategy based on candlestick patterns:

- Bullish Patterns: Reversal Composite Candles (similar to the Hammer pattern, but it uses the composite candle instead the single candle), Three White Soldiers, Piercing Line, Morning Doji, Engulfing, Harami, Morning Star, Hammer and Meeting Lines;

- Bearish Patterns: Reversal Composite Candles (similar to the Hanging Man pattern, but it uses the composite candle instead the single candle), Three Black Crows, Dark Cloud Cover, Evening Doji, Engulfing, Harami, Evening Star, Hanging Man and Meeting Lines.

Real account monitoring

Follow the EA operating in real conditions, using Automatic Settings: Vini MT5 Signal.

Recommendations and features

- To trade on all symbols of this strategy, an account balance from 5K is recommended;

- The EA must be attached to the symbol's M5 chart, so it can operate normally on up to 4 timeframes (M5, M15, M30 and H1);

- The conditions for opening and closing positions and the movement of the trailing stop are checked with each new bar;

- The EA can manage simultaneously, without conflicts, open positions from 2 settings files for the same symbol: one defined automatically and the other defined by the user;

- Before attaching the EA, make sure the symbol has at least 6 months of historical data;

- Account type must be Hedge.

Risk management

- Each trade is protected by Stop Loss and Take Profit;

- Each position is only opened when the trade signal occurs;

- The Risk/Reward (R/R) ratio is 1:1, and losing positions are not kept open indefinitely, hoping for the market to reverse;

- The set R/R is 0.20% per trade. When it is not possible to use this R/R (due to the small amount deposited), the minimum lot is used;

- If there are open positions and a reversal signal is identified on the same timeframe, the positions will be closed;

- Option to set daily profit and loss limits for the account (check performed at each new bar);

- Option to set a profit limit for closing all open positions of the symbol (check performed at each new bar).

Symbols

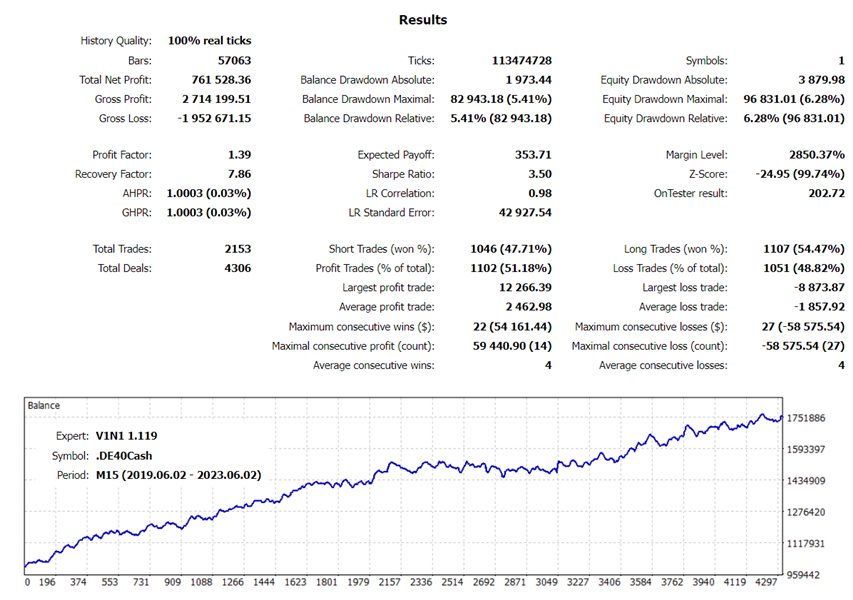

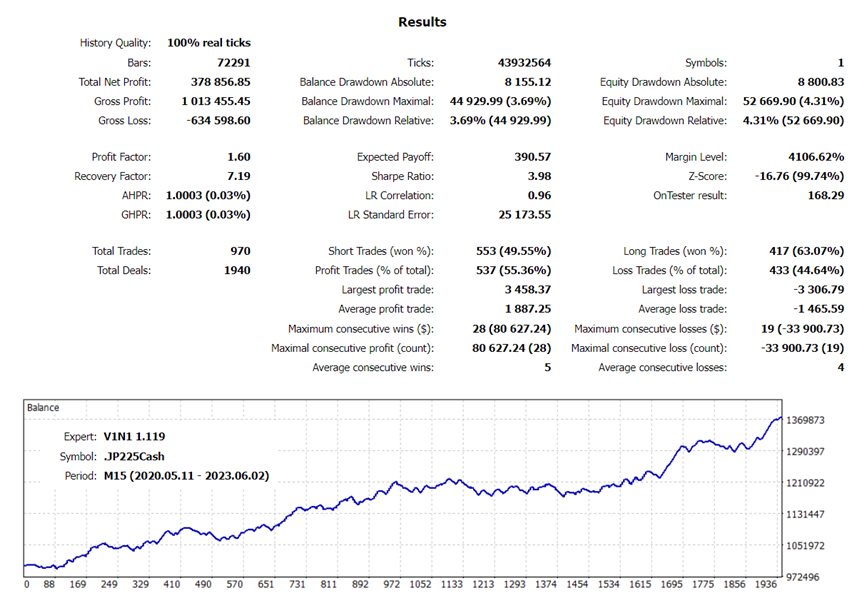

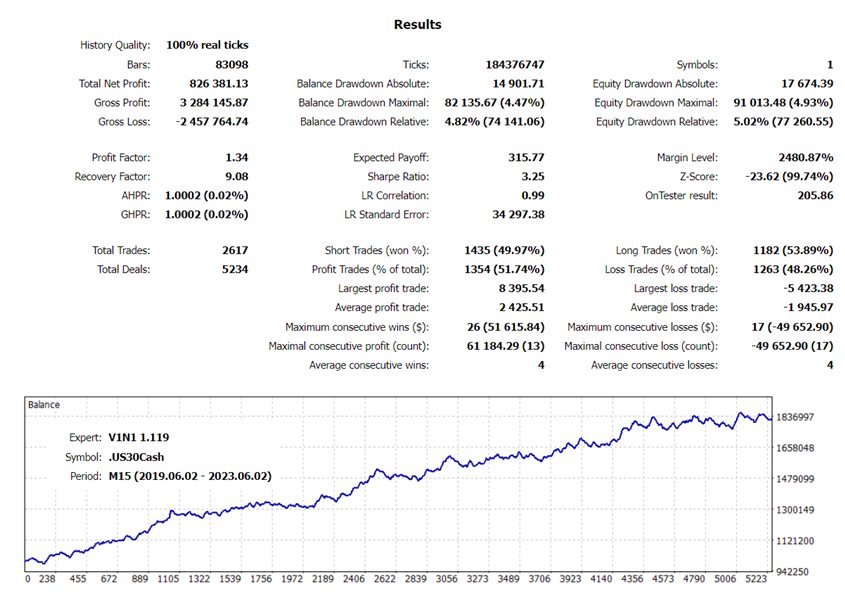

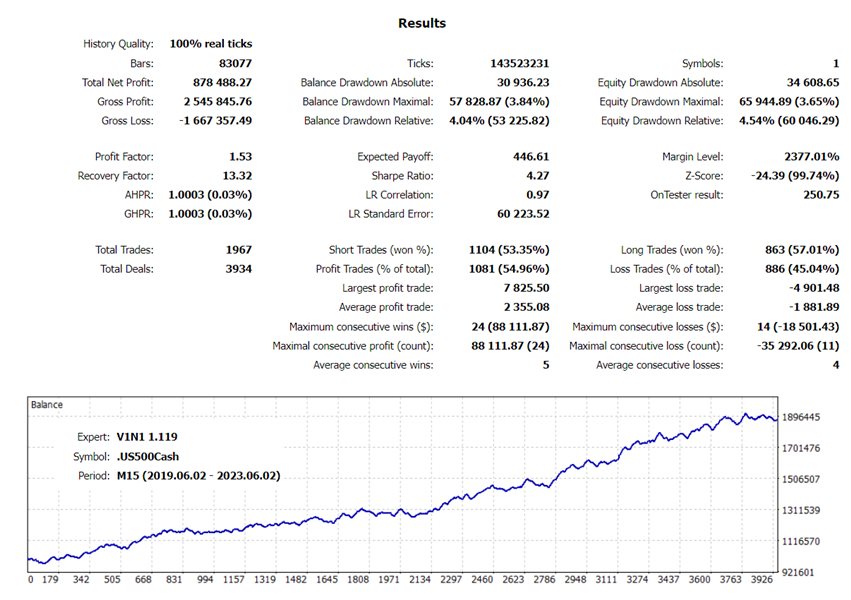

- Indices: DE40 (Dax 40), JP225 (Nikkei 225), US30 (Dow Jones), US500 (S&P 500) and USTECH (Nasdaq 100);

- Currency Pairs: AUDJPY, AUDUSD, CADJPY, EURJPY, EURUSD, GBPJPY, GBPUSD, NZDUSD, USDCAD and USDJPY;

- Metals: XAGUSD and XAUUSD;

- Energies: BRENT and WTI;

- Stocks: AAPL (Apple Inc.), AMZN (Amazon.com Inc.), DAL (Delta Air Lines), GM (General Motors Company), META (Meta Platforms Inc.), MSFT (Microsoft Corp.), NVDA (Nvidia Corp.), PYPL (PayPal Holdings Inc.) and TSLA (Tesla Inc.).

Input parameters

> Risk Management

- Settings Mode: if you want to use your own parameter settings and perform optimizations, select User Settings; if you want the EA to select parameter settings automatically, select Automatic Settings (this option ignores the parameter settings entered by the user); if your broker uses a different nomenclature and the EA cannot identify the symbol, select it from the list of this parameter to use the most appropriate settings (this option ignores the parameter settings entered by the user);

- Positions Risk Mode: select Percentage or Fixed Lot;

- Positions Risk Size: percentage of capital or lot size that EA will use in each trade, according to the option selected in the previous parameter.

> Limits Management

- Global Daily Profit Limit: set a maximum daily profit percentage for the account (considering open and closed positions), or enter zero if you do not want to enable this option (check performed at each new bar);

- Global Daily Loss Limit: set a maximum daily loss percentage for the account (considering open and closed positions), or enter zero if you do not want to enable this option (check performed at each new bar);

- Close Symbol Positions At Profit: set a maximum profit percentage for closing all open positions of the symbol, or enter zero if you do not want to enable this option (check performed at each new bar).

The percentages of the input parameters Global Daily Profit Limit and Global Daily Loss Limit must be the same for all symbols that will be traded.

> Levels Management

- Indicator Periods: select the period of the indicators;

- Indicator Factors: select one of the available options;

- Trading Level Mode: select a strategy for trading;

- Trading Levels: select one of the available options.

> Signals Management

- Trading Mode: select the trade type or disable trade for the timeframe;

- Candle Range: select an option to calculate the range;

- Candle Size: minimum size (height) of the range - percentage of ATR;

- Candle Body: parameter used to calculate the minimum size of the candle body;

- Shadow Big: percentage of Candle Size;

- Shadow Small: percentage of Shadow Big.

Optimization

The trading hours of the symbols can vary for each broker, which will require specific settings files (.set) for the broker and symbol. See an example of how the EA can be optimized in the Comments tab (comment 18) . . .

O usuário não deixou nenhum comentário para sua avaliação