VWAP Level MT5

- Indicadores

- Francesco Lenza

- Versão: 1.0

The VWAP Level indicator is a technical analysis tool that calculates the weighted average price for the traded volumes of a specific asset. The VWAP provides traders and investors with the average price of an asset over a specific time frame.

It is commonly used by investors to compare data on "passive" trading operations, such as pension funds and mutual funds, but also by traders who want to check if an asset has been bought or sold at a good market price.

To calculate the VWAP level we use this equation:

VWAP = ∑ (number of assets purchased x the price of the asset) / number of shares purchased in a single trading day.

The VWAP is usually calculated to measure the total volume of intraday trades, but can be used to analyze longer time frames.

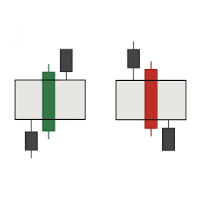

The VWAP average is represented on the graphs by a line.

This is an intraday indicator so it will only be displayed at low timeframes.

VWAP averages are used in algorithmic or automated trading to help traders and investors identify the cheapest buy or sell price of an asset, based on the market's trading volume. The higher the liquidity levels of an asset are, the lower the trading costs and the better the execution will be.

The VWAP Level indicator is used in the Zero DrawDown intraday strategy as a price to put at break even the trade or to take a partial profit.