Murrey Math Levels MT4

- Indicadores

- KEENBASE SOFTWARE SOLUTIONS

- Versão: 1.3

- Atualizado: 10 maio 2024

- Ativações: 5

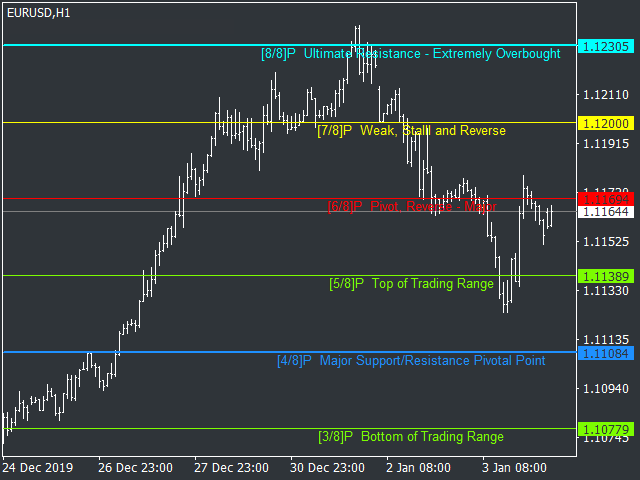

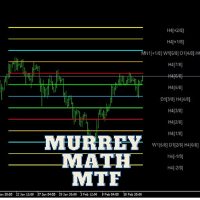

It shows the Murrey Math levels on chart and also provides an alert when price touch a particular level. T. Henning Murrey, in 1995, presented a trading system called Murrey Math Trading System, which is based on the observations made by W.D Gann.

Applications

- For Murrey Math lovers, this is a must-have indicator in their arsenal.

- There is no need to be present on the screen all the time. Whenever the price touches a level, it will send an alert.

- Spot upcoming reversals in advance by speculating the price reaction around extremely overshoot levels.

Understanding the Murrey Math Levels

Murrey Math trading system is based on the assumption that price behaves the same in all markets; that's why different markets have similar characteristics.

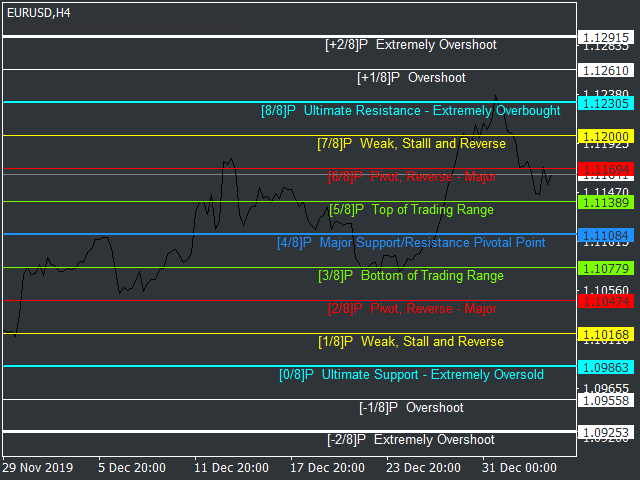

Murrey Math divides the prices into 1/8 intervals. The basic concept of the Murrey Math Trading System is that the price movement of a market usually retraces in multiples of 1/8 to 8/8.

Thirteen Murrey Math levels

- [-2/8]P Extremely Overshoot

- [-1/8]P Overshoot

- [0/8]P Ultimate Support - Extremely Oversold

- [1/8]P Weak, Stall and Reverse

- [2/8]P Pivot, Reverse - Major

- [3/8]P Bottom of Trading Range

- [4/8]P Major Support/Resistance Pivotal Point

- [5/8]P Top of Trading Range

- [6/8]P Pivot, Reverse - Major

- [7/8]P Weak, Stalll and Reverse

- [8/8]P Ultimate Resistance - Extremely Overbought

- [+1/8]P Overshoot

- [+2/8]P Extremely Overshoot

While every level has its significance, Murrey Math traders believe that market reverse 95% of the time when price cross above or below the [2/8]P Extremely Overshoot level.

Inputs

- Octave Period: Number of bars to calculate the price range for Murrey math levels.

- Time-Frame: Select the time frame.

- Shift Back: Shift back in bars to avoid the repaint of levels when price make a new high/low.

- Levels Color

- Levels Width

- Alert Settings