Hedge Ninja

- Utilitários

- Robert Mathias Bernt Larsson

- Versão: 1.2

- Atualizado: 29 fevereiro 2024

- Ativações: 20

Make sure to join our Discord community over at www.Robertsfx.com, you can also buy the EA at robertsfx.com

WIN NO MATTER IN WHICH DIRECTION THE PRICE MOVES

This robot wins no matter in which direction the price moves by following changing direction depending on in which direction price moves. This is the most free way of trading to this date.

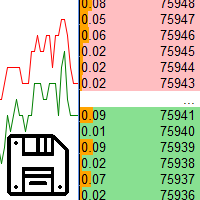

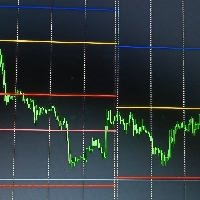

So you win no matter which direction it moves (when price moves to either of the red lines as seen on the screenshot, it wins with the profit target you have set up).

The only risk you have is if price is consolidating (stays in one place).

Hedge Ninja is a semi-automatic trading tool that you setup with the hedge settings below. When you tell it to trade, either buy or sell it then handles everything for you.

Every time the robot changes direction, it will cover up for your previous losses, so when you reach either of the red lines, your profit will be what you decided it to be.

A good rule of thumb is to use a pretty high risk to reward, but you wind the trading secrets I know how to trade this robot on this link. What you want is for the price to move, and once it starts to move, you're moving straight towards your profit money :)

Settings

ADR / Avg Spread

The ADR is the average daily range showing how many pts this instrument normally moves in a day, on average. This is good to know because you do not want this robot to run over market rollovers where the spread gets a lot higher.

So if ADR is 500 pts, you should try to keep your target points lower than this, more like half your ADR. It's great to combine Hedge Ninja with ADR Scalping indicator.

First Lot / Next Lot

Show your first/next trades lot size. This one calculates real-time so between entry and until you reach the hedge price this will change.

Trade cycle settings

A trade cycle is all your combined hedge trades together. So each cycle aims to open one or more positions, counted together as one unit, and when all trades in that cycle are in total profit or drawdown that you decided, it will close all trades.

Hedge Size (Pts)

This is your hedge distance is before the EA changes the direction of your trade. This could be seen as your stop loss for each position.

Target Size (Pts)

This is how many points away from your entry and hedge your target (take profit) should be. It's not exact but the EA calculates lot sizes the best it can to have your target reach desired price levels.

If you trade intraday, a tip is to have these within the ADR high and low.

Profit Target (%)

This is how much you want to profit in percent of your account equity when the price reaches any of your target lines, both upper and lower.

Max Drawdown (%)

How many % are you allowed to use for your hedge trades before it closes everything in loss?

Exit B/E from Pos+

Set a number from where the EA will close the trade at breakeven if possible. If you enter 3, it will close the trade as soon as it reaches breakeven. This is good if you want to reduce your risk after a certain amount of positions and start over with another trade.

Great tool! If used the right way it can be a massive addition to your trading if you are into hedging. Great author too, very supportive and helpful. 5/5