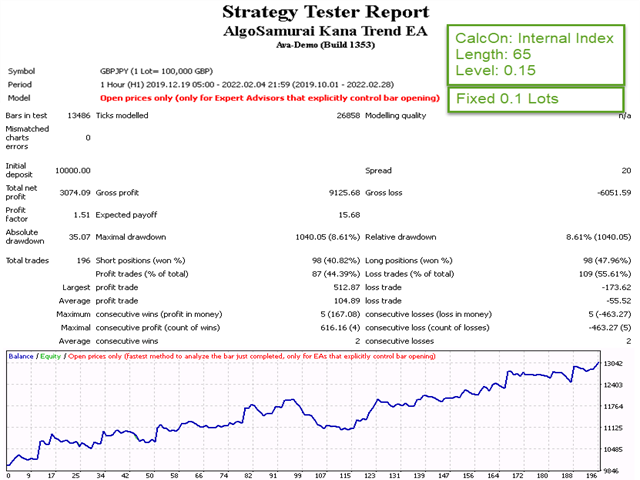

AlgoSamurai Kana Trend EA

- Experts

- BLAKE STEVEN RODGER

- Versão: 1.3

- Atualizado: 6 abril 2022

- Ativações: 5

Promo price: $199 for the first 5 buyers.

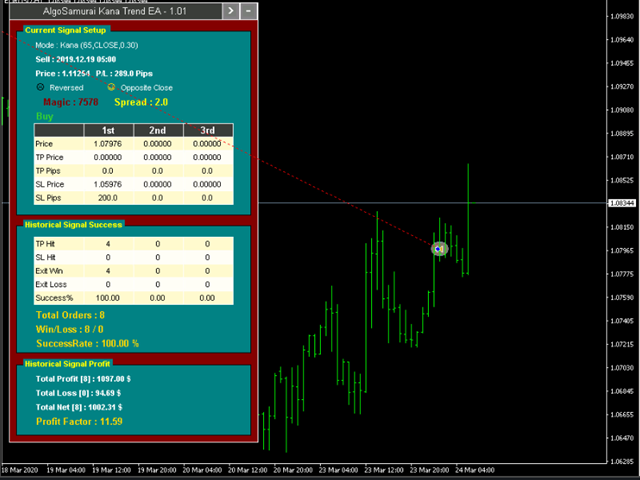

Kana Trend EA is a short term, always-in-market trend trading system that shows great results on multiple symbols.

You can place this EA on any instrument without worry about missing out on a trend, for if there is one, it is bound to get it. It is always-in-market, trending and reversing into new trends, on small timeframes like H1, a difficult to accomplish feat in a noisy environment.

You can place this EA on your account without worry about catastrophic loss, because it can provide its healthy returns without much leverage and without relying on hedging mechanisms like grids or martingales.

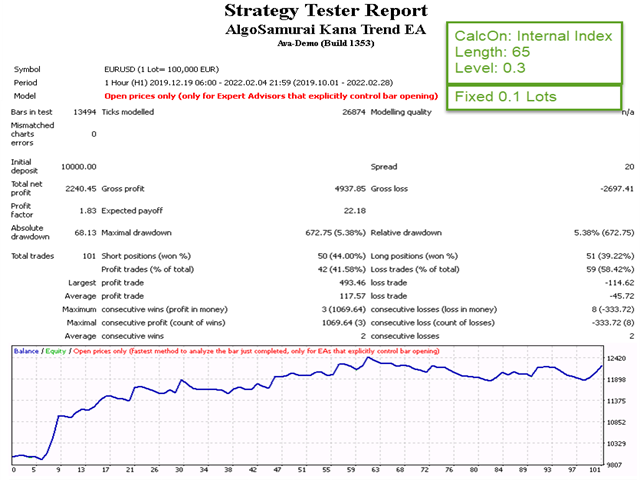

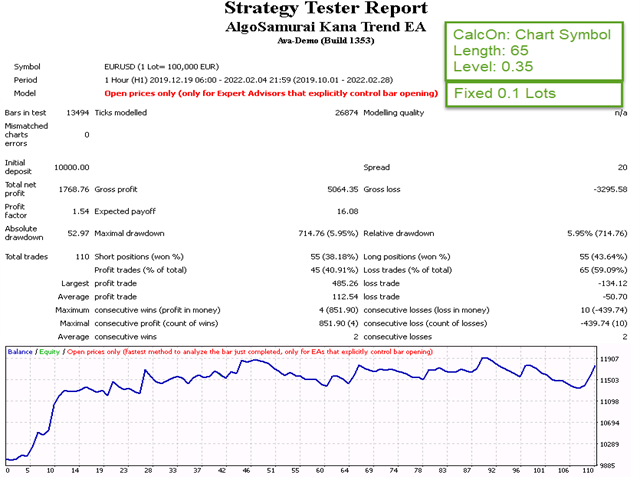

When using the Internal Index mode, you will discover that it is profitable on most USD pairs and Yen crosses without need for tailored calibration of inputs, thus passing a difficult to achieve standard of robustness.

The EA is very simple at its core, entering one trade at a time and exiting on the opposite close, with a default SL that is rarely hit, but it is loaded with an arsenal of optional features.

Features of the EA:

- Trend trading based on the Kana Indicator with only two optimizable parameters (Length and Level). Hint: Length works best between 50 and 80, in steps of 5, and level works best between 0.1 to 0.35 in steps of 0.05. While the indicator is a great tool to have as well, there is no need to buy it, as it is built into the EA.

- Finds trends in 3 separate modes: Chart Symbol, Other Symbol and Internal Index.

- Chart symbol calculates trends from the symbol it is placed upon.

- Other Symbol culculates trends from different, user selected correlated instrument (or offline chart, such as Renko chart).

- Internal index calculates trends from a (proprietary) internal index for the dollar pairs or yen crosses. Hint: This mode is the most powerful of the three, but it does need you to download the data of 6 majors.

- Primarily trades 1 trade a time. However, there is the option to add up two additional entries (total of 3) at:

- the same price, for the potential to trade different take profit levels;

- different levels of loss (ATR or pips) from the initial trade;

- different levels of profit (ATR or pips) from the initial trade.

- Allows mapping trades to multiple symbols (multi-symbol trading).

- Three lot sizing methods: Fixed, Risk, Money Ratio (ex: 0.01 per $300)

- Exit on opposite close (the primary exit method).

- Stop Loss based in ATR or Pips. Rarely hit because most trades exit on opposite close.

- Take Profit based on ATR or Pips, for each of the 3 possible trade entries. Not defaulted because trend trading is usually about letting profits run.

- Advanced Trailing stop mechanisms based on the best selling Ultimate Trailing Stop EA (again, not defaulted bacause of the principle of letting profits run):

- Automatically trail your open positions using one of 16 trailing algorithms: fixed, percent, ATR Exit, Chandelier Exit, Moving Average, Candle High Low Exit, Bollinger Bands, Parabolic, Envelope, Fractal, Ichimoku Kijun-Sen, Alligator, Exit After X Minutes or Bars, RSI and Stochastic

- Choose between a real or virtual trailing stop, and get out fully or partial percent, on bar touch or bar close

- You can deploy Stoploss, TakeProfit, Breakevens, in pips and ATR mode

- You can deploy 3 levels of partial take profit, as a percent of TP or in pips

- Basket Close in Total $ Profit | Total $ Loss | % Drawdown | % Updraw

In terms of backtesting, if you are not using the advanced trailing stops on bar touch, the EA opens and closes on the open of a new bar, so Model: Open prices only is the fastest (and just as accurate) backtesting model in the Strategy Tester (no need for the slower, Model: Every tick method). That is also why some of the backtest reports I publish are done in open prices only.