Catching Bot mt4

- Experts

- Andriy Sydoruk

- Versão: 1.0

- Ativações: 5

Catching Bot is an automated advisor used for trading in all financial markets. This bot combines rich functionality for working on the Forex market and on any instruments. The bot implements methods that can overcome the security of the forex market and help you work with it with an acceptable reasonable risk.

Briefly about the essence of the problem. As you know, working in the forex market is not easy, it is difficult to predict the price movement, and if you work with one order, it is difficult to achieve an advantage in the number of winning positions, because the market is too unpredictable and, for example, taking 100 different orders with, for example, the same stop losses and take profits to to achieve an advantage of at least 1%, that is, 51% of winning operations and 49% of losing operations, you need to have an algorithm that practically predicts the future. When using a trailing stop, the situation does not change much. And as you know, historical data does not contain such detailed information to predict the future so accurately. The information contained in history in the sense of using it to predict the future will be enough to predict a short impulse at most. But as you know, the market is protected from the prediction of short impulses with the help of spreads and commissions, i.e. even if you can miraculously predict a few pips, you will pay more commission for it than these few predicted pips.

This problem is usually solved using a series of orders, the so-called grid, or its variation with an increase in the volume of each subsequent order in the grid, the so-called Martingale. This approach allows you to increase the chance of profitability in each individual series, but there is a hidden threat here. Namely, when using such a system, there is a risk of losing a significant share of the capital, not as in the case of a loss when using one order, with this technique, you can lose all the capital, but at the same time, having worked for several months or more in a win. These problems are solved in this bot.

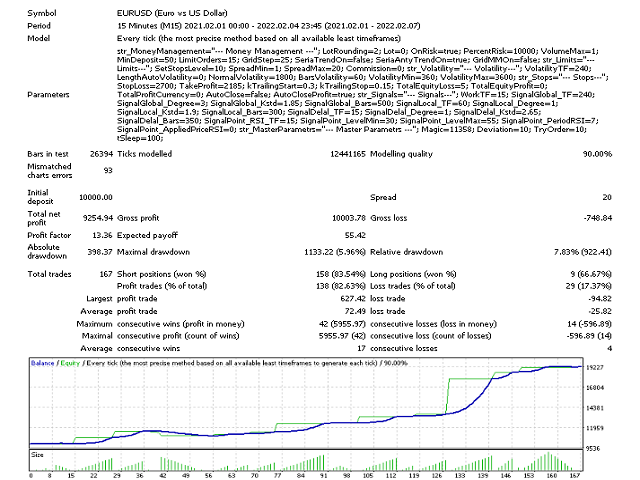

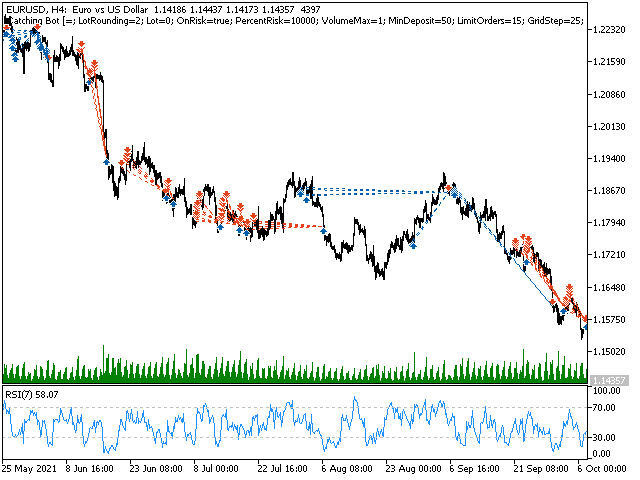

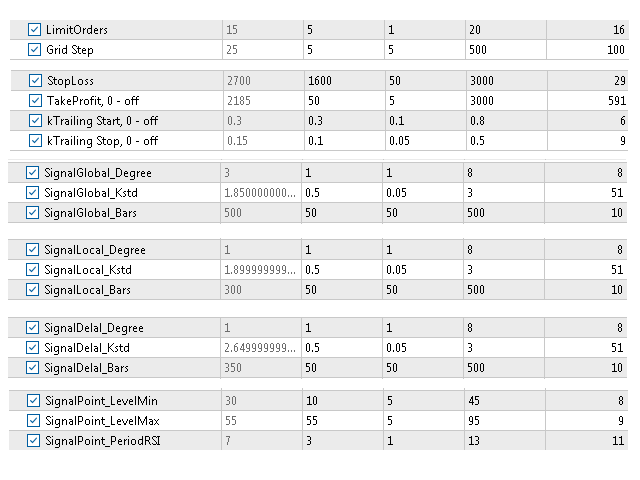

Solution. To solve the problem, methods of combining a series of orders with a stop loss are used. That is, in this case, all possible tools are correctly used. Entry by complex signals from different timeframes. Stop Loss, Take Profit, Trailing Start, Trailing Stop. In addition, a limit of orders in a series is used, which will allow you to drain the deposit. An important point is the automatic correction of all values associated with pips from market volatility. These features are used in combination and all are optimized in such a way that we achieve the prediction result, but at the same time are insured by a stop loss. The bot also uses many other functions.

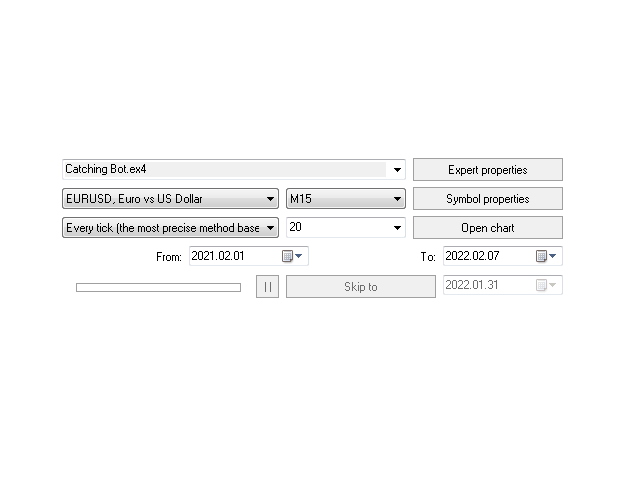

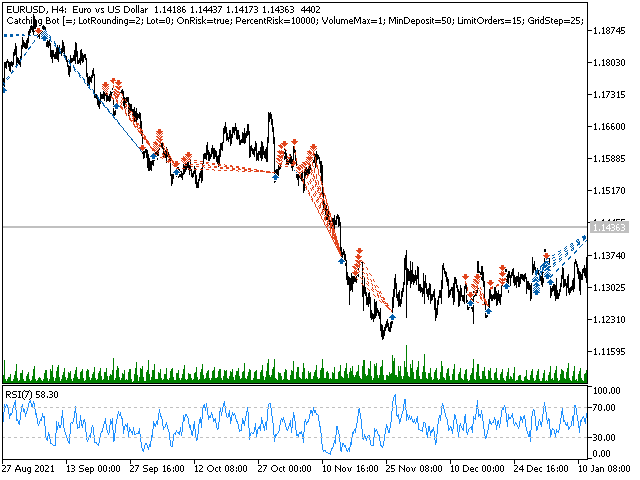

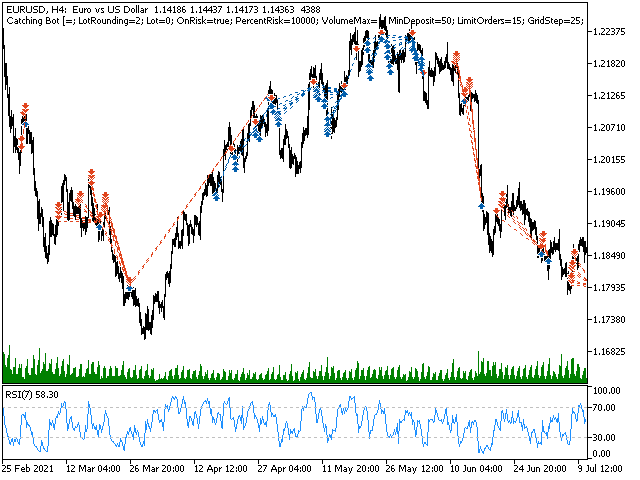

The bot uses three regression indicators to provide market entry. In order to filter and not enter at the peaks, RSI is used. This is done so that when the market moves, you do not quickly enter the market at the peak just before the reversal and do not pull the big anchor of the series that began in awkward moment. A competent approach to the implementation of devices and all the functionality of the bot. You can optimize the bot by opening prices, you need to choose a smaller timeframe used in the bot settings. After that, you can test for all ticks or for real ticks and the work will be the same, usually the same work will be in real mode. To do this, the functionality of the bot is made in such a way that any action is rounded up to the opening price of the specified timeframe, or the price of the shadow of the previous bar, for example, when trailing or any other calculations, the bot uses exactly this approach. This approach provides the maximum determinism of the algorithm.

Catching Bot is in demand among beginners and experienced traders due to such advantages as the exact execution of the trading rules of the chosen strategy, the reduction in the number of subjective errors, and the release of user time. The great value of this algorithm is the possibility of optimizing by opening prices and correctness after such optimization of work on real ticks. This significantly speeds up optimization and makes working with this strategy as real and deterministic as possible in different modes.