Stop and Reverse Martingale EA

- Utilitários

- Joaquin Nicolas Metayer

- Versão: 1.2

- Atualizado: 21 setembro 2021

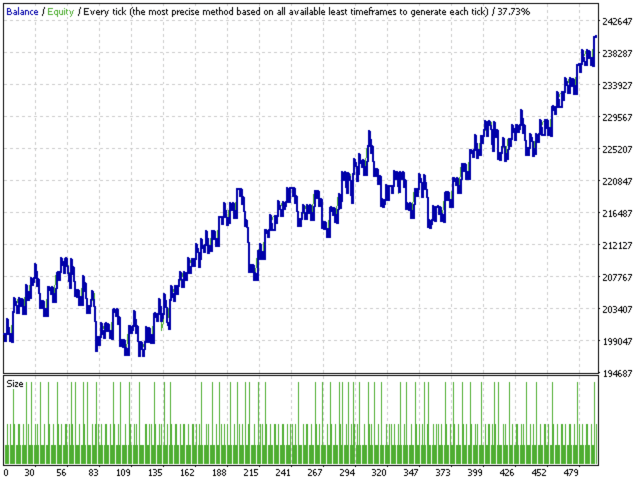

Stop and Reverse Martingale EA is an expert advisor that integrates the following inputs within it:

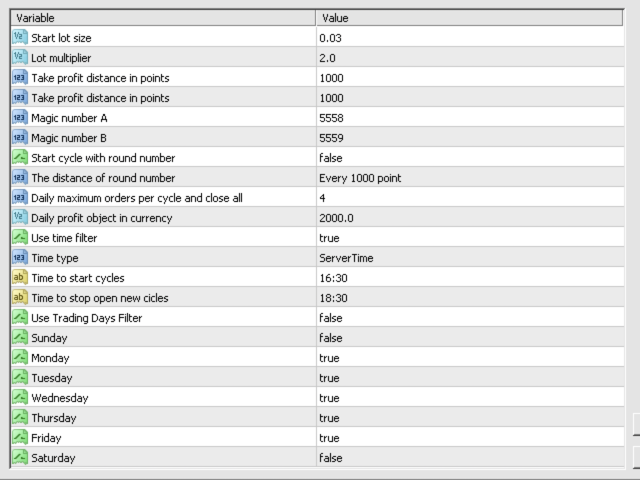

- Start lot size

- Lot multiplier

- Take profit distance in points

- Take profit distance in points *this input is a stop loss, is misspelled within the code of the EA

- Magic number A and B

- Start cycle with round number

- The distance of round number

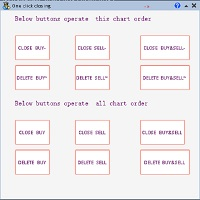

- Daily maximum orders per cycle and close all

- Daily loss (maximum orders per cycle when this last order hit the stop loss the EA close all orders in the same moment)

- Daily profit object in currency

- Use time filter

- Time type

- Time to start cycles

- Time to stop open new cicles

- Use Trading Days Filter

Its operation is based on the logic of opening orders in height of round numbers with simultaneous buy and sell, for each losing order a new opposite order will be opened with the multiplication of volume (lot), take profit distance, stop loss, hours and other corresponding entries already defined within it.

Let's look at the following example:

Market entry with a buy with 1 lot, it will be lost.

Open a new sell order with the multiplication of 2, which corresponds to an order of 2 lots. If the order wins, the multiplication “cycle” closes, but if the order loses again, the opposite order is opened with the corresponding multiplication until one of them wins or we reach the maximum loss limit or maximum order per cycle.

It is a hedging system under a few simple parameters, the work must be on the trader's side to find an asset that meets the following parameters:

- High volume concentration in a specific hour.

- Low spread.

- Do not tend to be consolidated.

- In market opening that generates wide movements so that the robot executes the orders and reaches the daily objective as soon as possible.

- Place the inputs that best fit the asset using the mathematical calculations taking into account the following:

- Increase in volume (lot) and margin of the account.

- Distance relationship of take profit, stop loss and spread orders.

- Maximum loss, daily objective according to the balance.

- Distance of round numbers.

- Maximum orders per cycle.

- Day and hour of work.

Good, if you already figure out how to use it