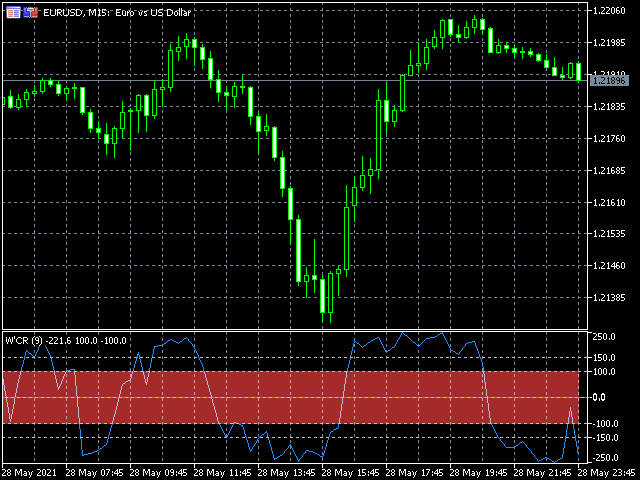

Williams Conditional Range

- Indicadores

- Andrey Sorokin

- Versão: 1.3

- Atualizado: 15 dezembro 2021

The Williams Conditional Range (WCR) is a technical analysis indicator used to determine the oversold / overbought condition of the market by examining the position of the closing price in a given range formed by the extremes in the past and looking for divergences that indicate the likelihood of a reversal. It allows you to assess whether buyers or sellers have had a stronger influence on the price over a certain period of time, and to suggest further developments. The indicator is easy to interpret.

Setting:

W-line Period = 9, default.

Signals:

• overbought - above "100" / oversold - below "-100"

• position relative to the zero level line;

• divergence / convergence.

Excellent. Thank you very much