Dual Strategy MT4

- Experts

- Andriy Sydoruk

- Versão: 1.1

- Atualizado: 28 novembro 2020

- Ativações: 5

The Dual Strategy bot uses a strategy based on classic and reliable Moving Average as well as the Relative Strength Index oscillator.

You have always wanted a reliable strategy that works according to well-known rules according to the classic and understandable approach to the formation of signals for entry and exit. To make everything clear and transparent? Do you find many implementations of such strategies, but they all have problems in trading and significant drawbacks and shortcomings when entering the real market? This strategy is just for you!

The Progressive Moving bot implements a classic strategy with the right approach to market analysis and market signal processing. This strategy will take advantage of the MA c trend indicator and the RSI indicator. The bot enters only by trend and only when the oscillator displays the origin of the movement! It is precisely the inception and not its end phase. The description of the indicators used is further in the text. You will also see the benefits and options in this description.

Briefly about Moving Average (MA):

A significant advantage of MA is trading in the direction of the current trend. This can be seen on the terminal screen after breaking the Moving Average line. Moving average trading is understandable even for a beginner. One of the most common methods is crossing two or more moving averages. In one indicator, a shorter period is configured, in the other, a longer one. Moving Average is a time-tested tool based on the analysis of calculated average asset prices.

Briefly about the Relative Strength Index (RSI):

The principle of its operation is that when the average value of positive changes in the closing price is greater than the average value of negative changes in the closing price, then the RSI rises because the RS value is greater than one. Accordingly, when the average of the positive changes in the closing price is less than the average of the negative changes in the closing price, the RSI falls because the RS is less than one.

Probably the most famous way of working with the Relative Strength Index indicator is to work on a pullback when the RSI exits overbought or oversold zones.

The bot copes well with errors and all sorts of abnormal situations that the market can generate. To understand the advantages of this bot over others implementing a similar strategy. In addition to the general idea, you need to realize it needs professional implementation in a specific bot. We present to your attention just such a development. How can you be sure of this? Very simple, beyond the given list of facts, just analyze.

Facts that will convince you to buy this particular bot:

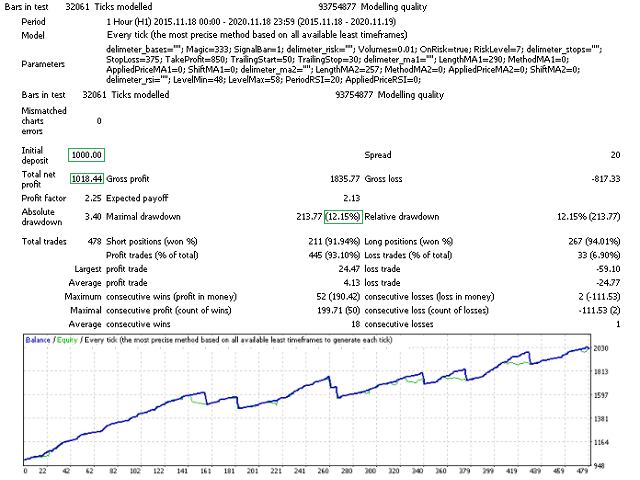

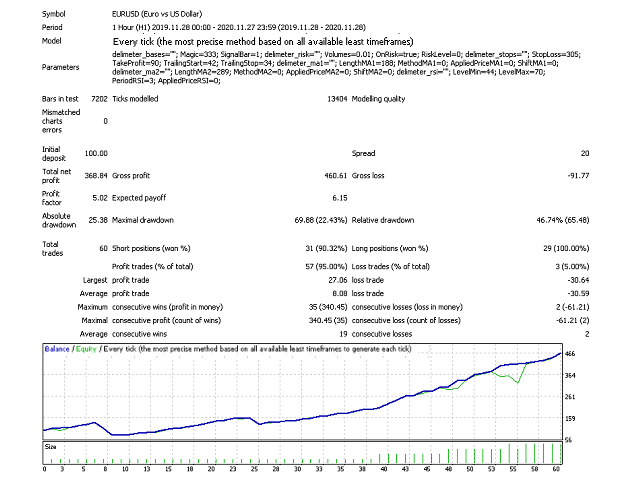

- When optimizing with a forward period (year by year) on opening prices (that is, very fast), you get a good graph for a year into the future.

- You optimize on opening prices (that is, very quickly), and carry out control tests in any mode! Including on real ticks.

- This Expert Advisor implements a truly professional money management system, you can check it by setting different initial deposits.

- The bot's work is based on reliable indicators (Moving Average and Relative Strength Index), and they are the most reliable trend indicators from which there will be no unexpected signals.

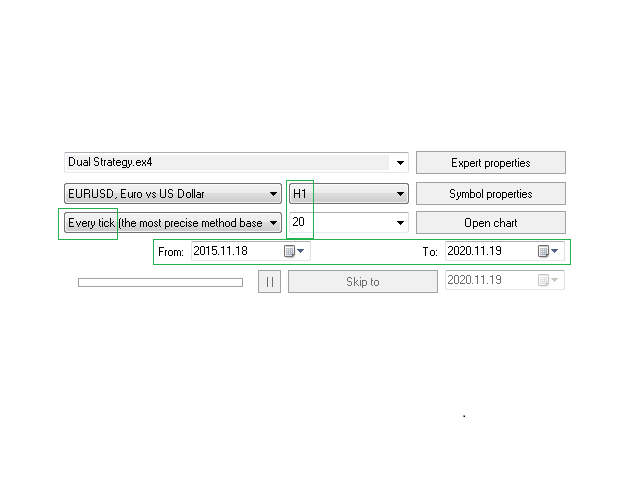

The bot needs optimization, but it is very fast and can be done at any time. You can experiment on any time frames and periods.

The bot also exists for MT5 (Progressive Moving MT5).

Bot parameters:

- Magic - The magic number of the order.

- SignalBar - Signal bar of the indicator (if it is zero, then the signal is probably not stable there yet).

- Volumes - Volume (works when the OnRisk switch is off).

- OnRisk - Allows you to work with a lot dependent on the deposit, and not specified in the Volumes field.

- RiskLevel - The bot's riskiness level (only for work with the OnRisk switch on).

- StopLoss - Stop Loss.

- TakeProfit - Take Profit.

- TrailingStart - Trailing Start.

- TrailingStop - Trailing Stop.

- LengthMA1, MethodMA1, AppliedPriceMA1, ShiftMA1 - Standard settings of the first Moving Average trend indicator.

- LengthMA2, MethodMA2, AppliedPriceMA2, ShiftMA2 - Standard settings of the second Moving Average trend indicator.

- LevelMin, LevelMax, PeriodRSI, AppliedPriceRSI - Standard settings for the Relative Strength Index oscillator.