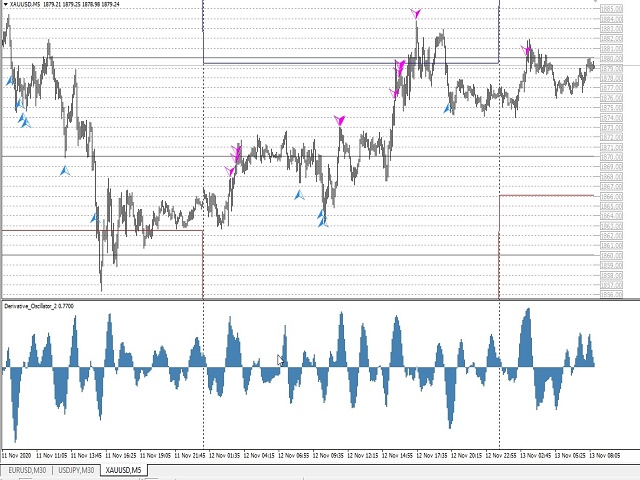

Derivative Oscillator

- Indicadores

- Sergey Bocharov

- Versão: 1.0

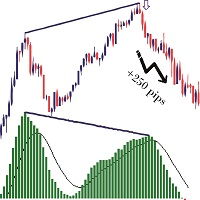

The technical indicator is a more advanced version of the relative strength index (RSI) that applies moving average convergence-divergence (MACD) principles to a double-smoothed RSI (DS RSI) indicator. The indicator is derived by computing the difference between a double-smoothed RSI and a simple moving average (SMA) of the DS RSI. The indicator's intent is to provide more accurate buy and sell signals than the standard RSI calculation.

The MACD is derived by subtracting the 12-period exponential moving average (EMA) from the 26-period EMA. It is in this way that the derivative oscillator uses MACD principles, since the derivative oscillator is also derived from subtracting the SMA from the double smoothed RSI.

The indicator can be used on any time frame.