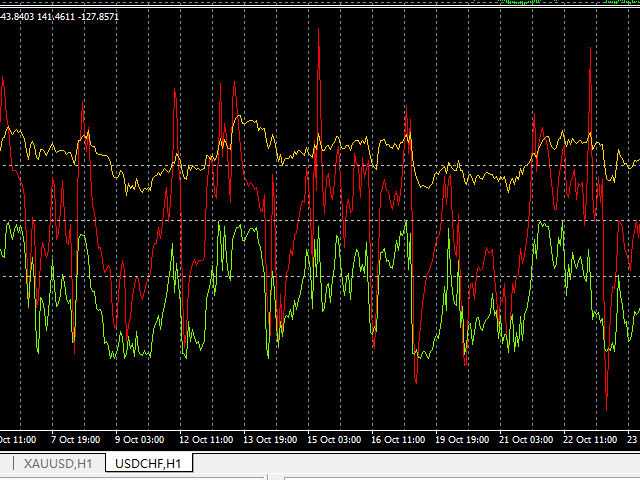

CRW CCI and RSI and WPR

- Indicadores

- Kaijun Wang

- Versão: 1.0

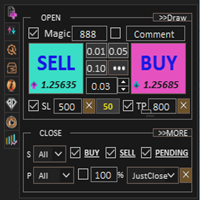

Necessary for traders: tools and indicators

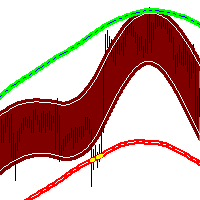

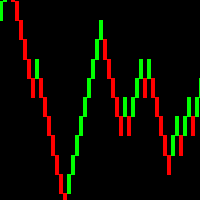

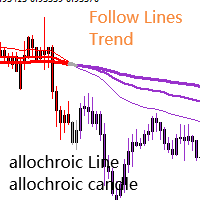

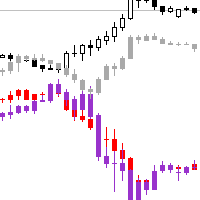

| Waves automatically calculate indicators, channel trend trading | Perfect trend-wave automatic calculation channel calculation , MT4 | Perfect trend-wave automatic calculation channel calculation , MT5 |

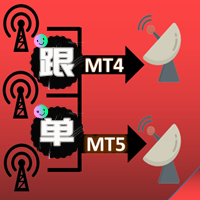

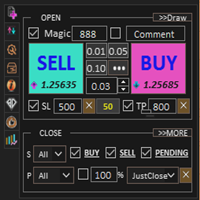

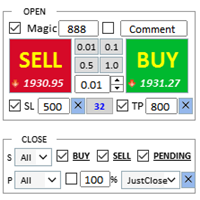

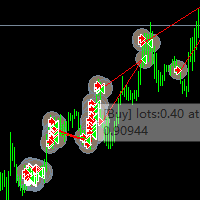

| Local Trading copying | Easy And Fast Copy , MT4 | Easy And Fast Copy , MT5 |

| Local Trading copying For DEMO | Easy And Fast Copy , MT4 DEMO | Easy And Fast Copy , MT5 DEMO |

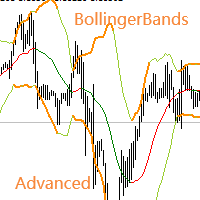

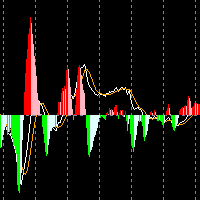

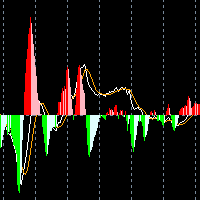

The homeopathic indicator is also called the CCI indicator. The CCI indicator was proposed by Donald Lambert, a US stock market technical analyst in the 1980s, to specifically measure whether stock prices, foreign exchange or precious metal transactions have exceeded the normal distribution range. It belongs to a special kind of overbought and oversold indicators. Fluctuates between positive infinity and negative infinity. However, there is no need to use 0 as the central axis, which is also different from indicators that fluctuate between positive infinity and negative infinity.

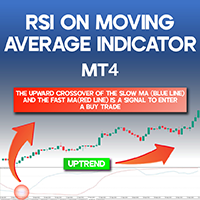

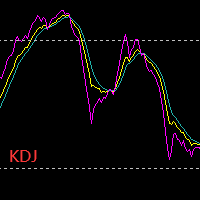

The relative strength indicator RSI is a technical curve made based on the ratio of the sum of the number of points rising and the number of falling points in a certain period of time. It can reflect the prosperity of the market in a certain period of time. It was first applied to futures trading by Welles Wilder. Later, it was discovered that in many technical analysis of charts, the theory and practice of strength indicators are extremely suitable for short-term investment in the stock market, so it was used in stocks. The rise and fall are being measured and analyzed. The design of the analysis indicator is to reflect the strength of the price trend with three lines. This kind of graph can provide investors with operating basis and is very suitable for short-term spread operations.

The William Index (Williams %R) or W%R for short is the "How I made one million dollars last year trading commodities" published by Larry Williams in 1973. First published in the book, this indicator is an oscillatory indicator that measures whether a stock/index is overbought or oversold according to the swing point of the stock price. It measures the ratio of the distance between the peak (highest price) created by the long and short sides from the daily closing price to the range of stock price fluctuations within a certain period of time (such as 7 days) to provide a signal of the stock market trend reversal.

Good indicator