Signal Channel

- Indicadores

- Aleksey Ivanov

- Versão: 1.10

- Atualizado: 21 agosto 2020

- Ativações: 5

The principle of constructing indicator lines and their meaning.

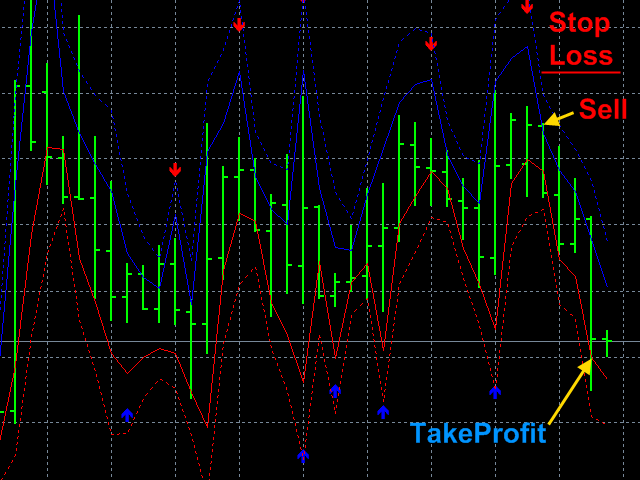

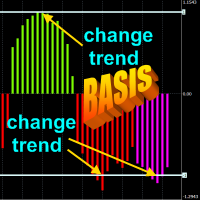

The Signal Channel indicator uses a robust filtering method based on two moving medians applicable to the High and Low prices, i.e. the lines <High> and <Low>, where <..> is the sign of linear averaging, which are shifted by certain values in an uptrend and by opposite values in a downtrend, which allows you to get a narrow channel, approximately outlining each bar. Sharp kinks of the lines of such a channel allow the most accurate and minimal possible delay to establish the beginning of a new trend movement. The possible change in the direction of the trend is also indicated by sharp narrowing of the channel lines, which, in fact, is expressed by the fall in volatility. The indicator also has an additional filtering function, upon activation of which the signal is identified only after a decrease in volatility, which makes the indicator more reliable. In addition to the main channel, inside which the most probable price fluctuations occur, an auxiliary channel is built (in dashed lines), beyond the borders of which the price does not go anymore, which serves to set stoplosses on it.

The advantages of the indicator and trading with it.

The indicator readings are extremely simple and do not require special explanations. Blue arrows pointing up are a buy signal, red arrows pointing down are a sell signal. Trading can be carried out in the direction prescribed by the signal arrow on one current bar; then the upper solid blue line of the channel serves as a take-profit for buy positions, and the bottom red dashed line then shows the positions of the stoplosses; for sales positions, on the contrary, the bottom solid red line serves as a take-profit, and stoplosses are located on the upper blue dashed line. You can trade according to the trends signaled by arrows; then only a stop loss is placed, and the profit position closes when an oppositely directed arrow appears. You can also, at the close of each regular bar, shift the stop loss of a profitable position, which in this case will close with a profit at the point of the last stop loss. For these strategies, the indicator has a lot calculation function based on the size of the deposit and the accepted risk level.

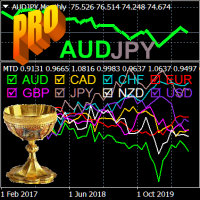

The Signal Channel indicator can be used both for trading according to scalper strategies, and when using long-term trading strategies. The indicator has all types of alerts. The indicator does not redraw.

Indicator settings.

- The averaging period - averaging period. Values: any positive integer (3 default).

- Signal only after a fall in volatility. Filter allowing signal only after volatility drops. Values: true, false(default).

- Line & arrow thickness - Values: any positive integer (1 default).

- Calculate the lot size from the risk and deposit? Values: true, false(default).

- Deposit in $. Deposit in USD.

- Allowable losses in %. Accepted loss rate in%.

- The Signal method - Type of trading alert. Values: No (default), Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.