ADXS

- Indicadores

- Stanislav Korotky

- Versão: 1.1

- Atualizado: 18 novembro 2021

- Ativações: 5

Ever wondered why standard ADX is made unsigned and what if it would be kept signed? This indicator gives the answer, which allows you to trade more efficient.

This indicator calculates ADX values using standard formulae, but excludes operation of taking the module of ADX values, which is forcedly added into ADX for some reason. In other words, the indicator preserves natural signs of ADX values, which makes it more consistent, easy to use, and gives signals earlier than standard ADX. Strictly speaking, any conversion to an absolute value destroys a part of information, and it makes sense to skip the operation. In addition, the indicator provides additional buffers for your convenience.

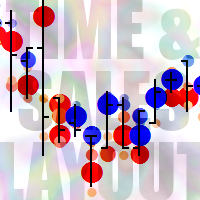

The indicator displays 4 lines:

- ADXS itself - thick light-blue line;

- +(-DI) negative directional index - dash-dotted light brown line (always positive);

- -(+DI) inverted positive directional index - dash-dotted light-green line (always negative);

- (+DI)-(-DI) difference between 2 indices - thick gray line.

Whereas traditional ADX is always positive, ADXS may be both positive and negative. The signals ADXS gives are similar to ADX, but more clear:

- When ADXS goes up (no matter - above or below 0), trend up is active. When ADXS goes down (no matter - above or below 0), trend down is active.

- The moment when you should open a position in the trend direction is when the directional indices difference has a sign corresponding to the trend. Normally, ADX rules imply you go buy when +DI crosses -DI up, and go short when +DI crosses -DI down, but ADXS provides a single convenient buffer for this - the 4-th buffer: if it's > 0, it's OK to buy, when it's < 0, it's OK to sell.

- You may also notice that +(-DI) and -(+DI) form now a channel, which gives you additional signals and can be treated as a confirmation - for example, when the difference goes outside the channel, the signal becomes more strong than when the difference crosses 0, suitable for position enlarging.

Screenshots below demonstrate how ADXS behaves in comparison with conventional ADX. It can be noted that ADXS gives signals earlier than ADX. On bars marked by vertical lines ADXS produces signals for new trends, but ADX is still falling down and misses optimal entry points.

Parameters are ADX period (default - 14) and price type (default - close).

Лучшая доработка стандартного ADX на всём маркете!