MMM CCI and MA Plus

- Experts

- Andre Tavares

- Versão: 1.1

- Atualizado: 29 maio 2020

- Ativações: 12

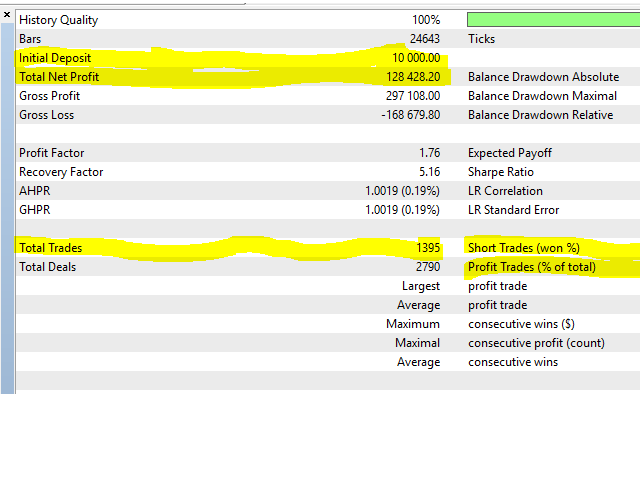

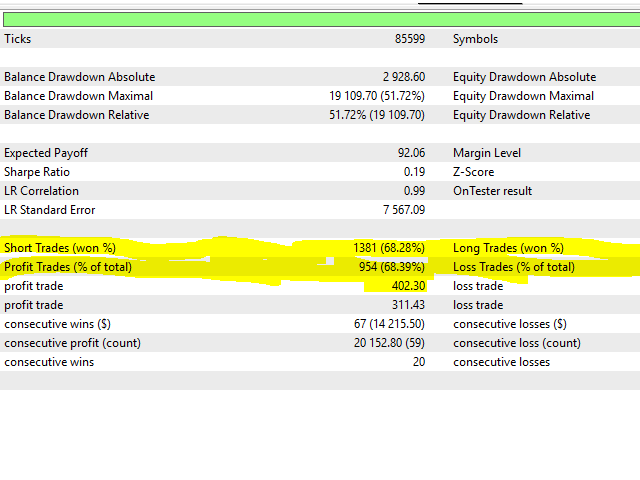

The strateggy:

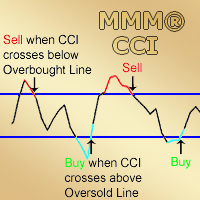

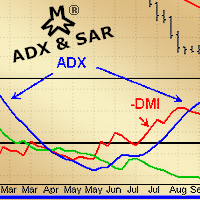

- This EA has built-in CCI and MA indicators to determine the assets prices trend directions. The Commodity Channel Index (CCI) determines the trend directions by measuring the prices oscilations as the two Moving Averages (MAs) conffirm the trends as they cross each other;

- The EA has different inputs for long and short positions because tests show it is more efficient;

- It works with Trailing Stop Loss technique to protect the profiting positions.

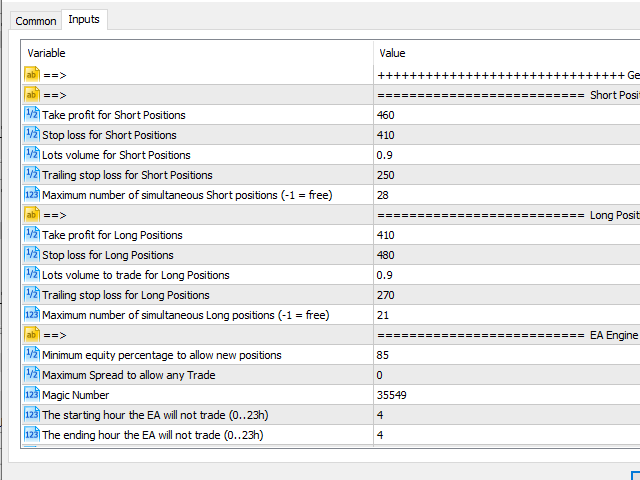

The Short Positions Inputs:

- Take profit for Short Positions;

- Stop loss for Short Positions;

- Lots volume for Short Positions;

- Trailing stop loss for Short Positions;

- Maximum number of simultaneous Short positions (-1 = free);

The Long Positions Inputs:

- Take profit for Long Positions;

- Stop loss for Long Positions;

- Lots volume to trade for Long Positions;

- Trailing stop loss for Long Positions;

- Maximum number of simultaneous Long positions (-1 = free);

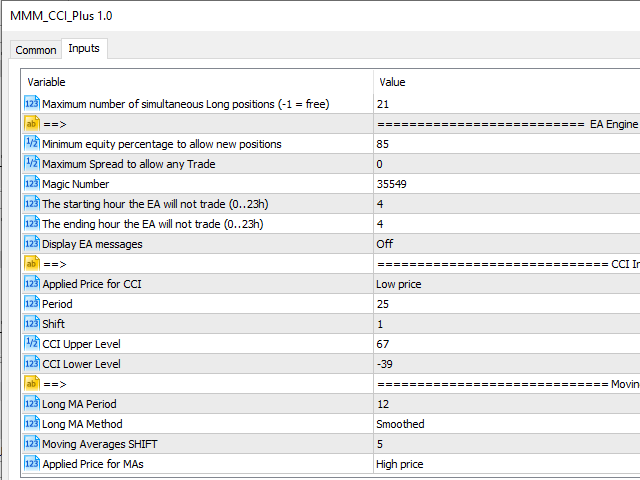

The EA's General Inputs:

- Minimum equity percentage to allow new positions;

- Maximum Spread to allow any Trade;

- Magic Number;

- The starting hour the EA will not trade (0..23h);

- The ending hour the EA will not trade (0..23h);

- Display EA messages.

The CCI Indicator's inputs Inputs:

- Applied Price for CCI;

- Period;

- Shift;

- CCI Upper Level;

- CCI Lower Level.

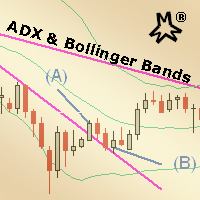

The Moving Averages' inputs:

- Long MA Period;

- Long MA Method;

- Moving Averages SHIFT;

- Applied Price for MAs.

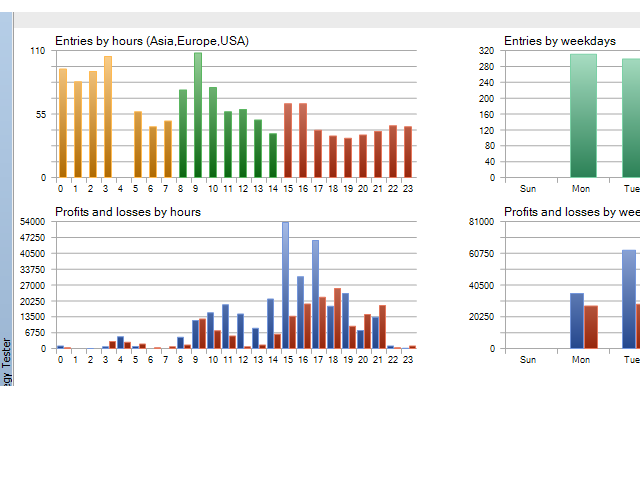

This EA is optimized for the asset EURUSD at timeframe M15 for the period btween 01/01/2019 and 12/31/2019. If you want to trade another asset or work at a different timeframe, I strongly recommend you to perform inputs optimization by using the platform's Strategy Tester utility. This way it will surely find the best input values for you automatically. Learn something about the Strategy Tester usage.