Keltner Channels Ind

- Indicadores

- HITESH ARORA

- Versão: 1.0

- Ativações: 5

Contact us for any custom order, CodeYourTrade.com.

Keltner Channels are volatility-based envelopes. Moving average dictates direction and the ATR sets the channel width. It’s a trend following indicator used to identify reversals. Channels can also be used to identify overbought and oversold levels when the trend is flat.

Trading Strategy

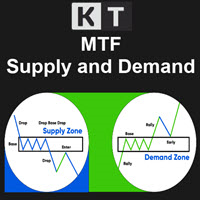

We have created 2 zones SELL ZONE and BUY ZONE using the Keltner channels. In SELL ZONE (upper) we take only sell orders and in BUY ZONE (lower) we take only buy orders. Entry timeframe is M15, M30 or H1.

SELL Entry: It satisfies the below 4 conditions:

- Inside the SELL ZONE and form one bearish candle.

- Stochastic Oscillator is overbought.

- Divergence is seen in the oscillator. It is optional to increase the accuracy.

- The major trend for H4 and D1 is bearish

BUY Entry: It satisfies the below 4 conditions:

- Inside the BUY ZONE and form one bullish candle.

- Stochastic Oscillator is oversold.

- Divergence is seen in the oscillator. It is optional to increase the accuracy.

- The major trend for H4 and D1 is bullish.

StopLoss: It can be taken as the distance between BUY and SELL zones.

TakeProfit: First TP is till the mid-band and second TP is the start of the other zone.

After you attached the indicator to a chart it will show the channel information on the chart. You can hide all the information displayed in the chart by setting false to Display.

Indicator Setting

Channel Setting

- Enable Channel: Shows the channel on chart

- MA Period: Number of periods

- MA Method: Moving average method

- Simple

- Exponential

- Smoothed

- Linear Weighted

- MA Applied Price: Applied Price

- Close Price

- Open Price

- High Price

- Low Price

- Median Price

- Typical Price

- Weighted Price

- MA Shift: Moving average shift

- ATR Period: Number of periods

- Shift: Multiplier