Purple Ice

- Experts

- Andrea Ferrino

- Versão: 1.0

- Ativações: 5

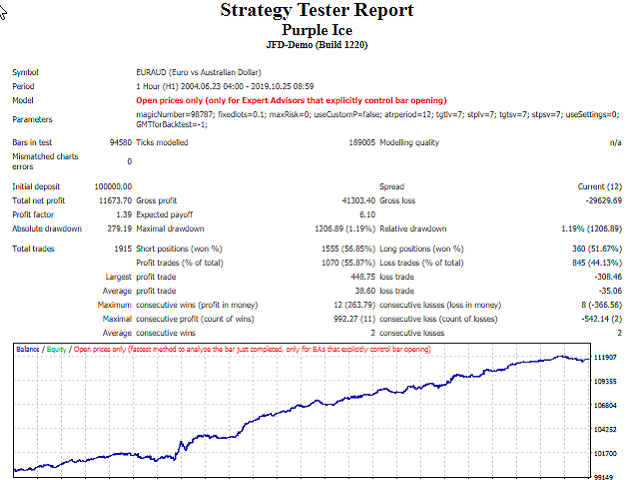

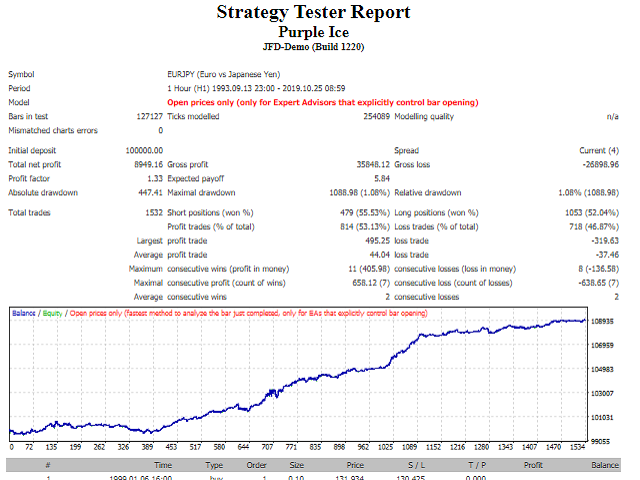

Purple Ice

Purple Ice is a bias trading robot that sells and buys at predefined hours on specific days. It has been developed on three crosses, EURJPY, EURAUD and EURNZD on H1 timeframe.

Key Features

- Absence of dangerous algorithms.

- It works just when the bar is closed.

- Each order has a protective dynamic SL and TP level based on the current volatility.

- Easy to use, optimization not required, very few parameters.

Description of the Main Expert Advisor Settings

- Magic Number: self-explicative

- Lots: if this parameter is not equal to zero, the EA will open trades using this lot size. This parameter takes precedence on maxRisk.

- Max Risk: if this parameter is not equal to zero, the EA will open trades using a variable lot size, risking a fix percentage of the account. For instance, if maxRisk is equal to 1.0, an order will be opened for X lots, but the stop loss will be around 1.0% of the account. Due to roundings and different calculations, the maximum risk cannot be exactly 1.0%, but it will be a number really close to it (most of the times a bit bigger).

- Use custom settings: if true the EA will use the next five parameters to calculate stop loss and target based on a multiplier of the average true range of last X periods (see paragraph below).

- ATR period: period of the average true range.

- Target multiplier long: multiplier of the average true range for long position targets.

- Stop multiplier long: multiplier of the average true range for long position stops.

- Target multiplier short: multiplier of the average true range for short position targets.

- Stop multiplier long: multiplier of the average true range for short position stops.

- Setting copied from: this EA can be used on any cross, but since it is a bias robot, you need to specific from which cross you should copy the settings.

- GMTforBacktest: this variable is used just during the backtest. Please read below for instructions.

Stops and targets

Stops and target are calculated as a multiplier of the averarage true range. For instance:

- Stop long = entry price - multiplier1 * iATR(X), with X as the number of periods.

- Target long = entryprice + multiplier2 * iATR(X).

- ...

Backtest

If you want to backtest it you can directly use open prices only since the EA is working with closed bars. Besides that you need to set the variable GMTforBacktest with the time difference between UTC+1 and your broker timezone.

To do that you can do as following:

- Change your pc timezone to UTC+1 (Amsterdam, Rome, Berlin, etc.).

- Open your MT4 platform and look at the Market Watch time.

- Subtract Market Watch time from the UTC+1 time and use the value for the parameter GMTforBacktest.

Some examples:

- If Market Watch time is 10:54 and UTC+1 is 11:54 then GMTforBacktest is equal to -1 because 10:54 - 11:54 = -1

- If Market Watch time is 12:55 and UTC+1 is 11:55 then GMTforBacktest is equal to 1 because 12:55 - 11:55 = -1

- Etc.

FAQ

- Do you trade this system? Yes I do, even though I sometimes stop it because it does not fit in my portfolio. EA experiences drawdowns and they will always do, they cannot be treated as a single and invincible system. The way to be profitable in trading is to have a balanced and diversified portfolio and of course to risk little. All others way are pure gambling.

- Do you think this system will work in the future? I do not have any clue. What I do know, is that it has been built following very known and solid best practices in May 2019, so you can consider the period from June 2019 onwards as real out of sample. Long story short, it can either work for years or stop working tomorrow, nobody knows the future.

- Do you have some suggestions overall? Yes, as I said before, the only knows thing in trading is risk, profit is not a given. Whenever you open a position you are risking money, that's it. So be wise with your exposure and try to risk as little as possible, do not get greedy, do not think you can be rich in two months. And by the way, be wise in choosing your broker, tight spreads and low commissions are always beneficial, these are hidden costs that you can control.