Berserk

- Experts

- Andrey Kolmogorov

- Versão: 1.4

- Atualizado: 5 fevereiro 2023

- Ativações: 5

There is always movement and price return in the market. Usually, the price return occurs after an abnormally large candlestick size.

The main goal of the Berserker is to make money on this.

In his work, Berserker uses 3 modes of opening orders:

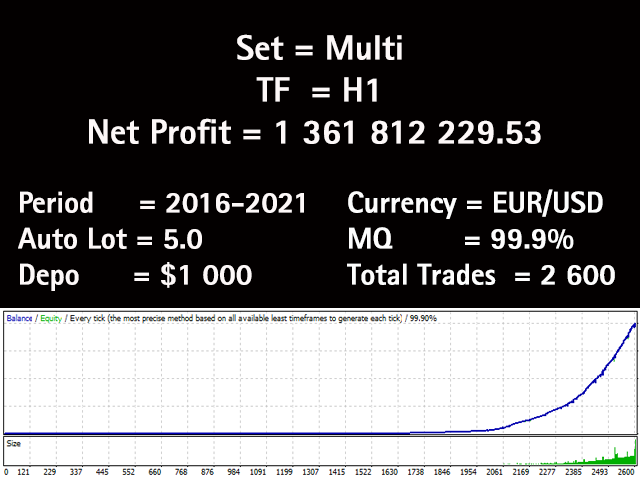

1. Multi - a mode in which 2 opposite orders are opened simultaneously;

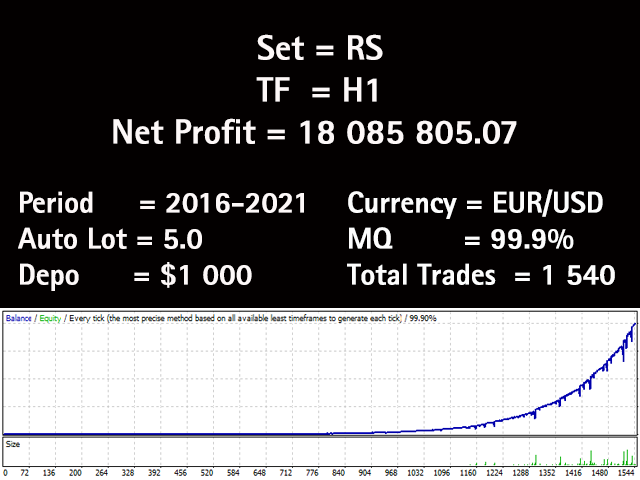

2. Reverse - a mode in which, immediately after closing an order by Stop Loss, a new order is opened in the opposite direction;

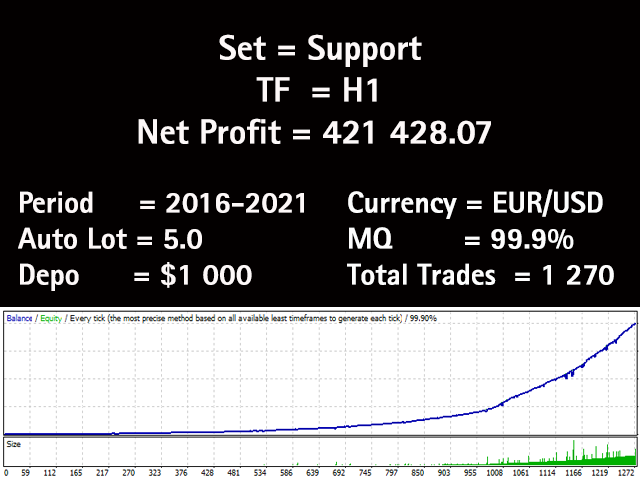

3. Support - Mode of operation of support orders.

All orders are opened with a strictly fixed Stop Loss.

Sets are in the "Comments" section comments #23-25.

Key Advantages

- A constructor of unique strategies;

- No need to close the robot during news releases;

- It works with 4 and 5-digit quotes.

Working parameters

- Currency pairs: EUR/USD, GBP/USD, JPY/USD, AUD/USD, AUD/CAD, AUD/NZD, EUR/CHF, USD/CHF;

- Leverage: >200;

- Timeframe: any (default parameters are optimized for H1);

- Broker: any;

- Account: any.

General Trading Settings

- Start trading - enable/disable the Expert Advisor.

- TakeProfit - take profit value for the orders opened by the EA, depends on the specific currency pair and trading style (if set to zero, ATR values are used);

- StopLoss - stop loss value, depending on the trading style (if set to zero, ATR values are used).

- Maximum spread - maximum allowable spread;

- Slip - maximum allowed slippage.

- MagicNumber - unique number of positions opened by the EA;

- Set name - Set name;

- Comment for order - a unique comment on open positions by an adviser.

SETTINGS for CANDLE

- Minimum candle height - the minimum height of the previous candle to open an order;

- level for auto TakeProfit in % (Candle) - Take Profit level in % of the previous candle height;

- level for auto StopLoss in % (Candle) - Stop Loss level in % of the previous candle height;

- Candle coefficient - the candle coefficient, the higher it is, the less often orders will be opened.

SETTINGS for MODE SYSTEM

- Start Multi System, Start Reverse System or Start trading for support orders: 1. activation of a multi system in which, simultaneously, 2 opposite orders are opened; 2. activation of the reverse system in which, immediately after the order is closed by Stop Loss, a new order is opened in the opposite direction; 3. activation of support orders.

SETTINGS for REVERSE SYSTEM

- Use Time Break - enable / disable the filter of the time pause between orders;

- Last order before Time Break - order number after which a time pause is activated;

- Maximum Time Break (hour) - the number of hours of the temporary pause;

- LotExponent in Reverse System - lot exponent for orders of the reverse system.

- Maximum support orders - the maximum number of open support orders;

- LotExponent in support orders - lot exponent for support orders;

- Use filter for minimum distance - use a filter to open support orders;

- Minimum distance between support orders - the minimum distance between support orders.

RISK MANAGEMENT

- Lots - initial lot size. It is activated, if the values of Risk and DepoStep are zero;

- Risk - percentage of the deposit balance to increase the initial lot. It is activated, if the value of Lots size is zero;

- DepoStep - deposit size step for doubling the initial lot. It is activated, if the values of Lots and Risk are zero.

- Stop by equity - enable/disable limitation of losses by equity.

- Value of equity - allowable loss by equity, at which all orders previously opened by the EA are closed.

TRAILING STOP LOSS

- Use Trailing Stop - enable/disable the Trailing Stop parameter.

- Fixed trailing size - size of the Trailing Stop in points from the order opening price;

- The size of the correction Trailing Stop - price range in points from Fixed trailing size to trigger Trailing Stop;

- The size of the correction Trailing Stop Level II - the range of the price movement in points from Fixed trailing size to the triggering of Trailing Stop Level 2.

Work of art as usual. Thank You! More set-files for different non-correlated pairs would be nice.