Multi Pair Hedging System EA

- Experts

- Stanislav Sarbey

- Versão: 2.3

- Ativações: 10

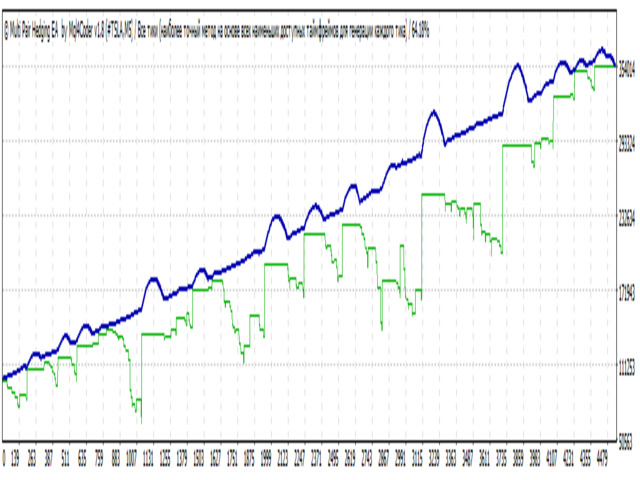

THIS ADVISOR REALLY WORKS !!! I present to you my own adviser, designed to work on the instrument TSLA (shares of companie Tesla). The work of the adviser is based on hedging positions. Purely mathematical model of averaging positions. Advisor can be configured to work on buy or sell, as well as buy and sell at the same time. This is a multi-currency Expert Advisor, so it can be used simultaneously on a different stocks at the same time, and the work on each stocks can be set separately. It is possible to work on one stocks in both directions, the lot size can be set as a percentage of the deposit. Advisor recommend to use on stocks, which is limited downward movement. It is recommended to use stocks that cost less than $ 400. In this case, the adviser will never merge your deposit and trading will bring 5-10% profit per month with a very small drawdown, which will not exceed 10% of your deposit. It is recommended to calculate the lot in such a way that if the stock price falls to zero (which is not possible in principle), there will be enough funds in the account to withstand the drawdown. For example, consider the shares of Tesla. The cost of shares for example $ 300. If you open a buy order in increments of every $ 5, it is not difficult to calculate that a lot with a size of 0.01 will never merge a $ 10,000 deposit, even if the share price falls to zero. The average range of work of this action + -150 $. That is, while the price is in this range, it is possible to work on buy and sell at the same time. Currency pairs in this regard are more dangerous, volunteering is higher, so there is a risk of a deposit being drained. Advisor gives a lot of options to configure and each user can choose a trading style for themselves, creating an individual trading system. I recommend taking up to 10 tools to work at the same time, with one tool with high volatility, and the rest with low volunteering. I recommend this set of tools: TSLA, MU, JPM, NKE, HPQ, INTC, T, XOM... The set can be absolutely any.

OPTIONS:

Step - step, number of points for opening the next order by instrument

StepKoef - increment ratio for the next lot, if you specify 2, it will increase the step of the next lot by 2 times

CntOrdersForKoef - indicates after what number of open orders, the step of the next lot will begin to increase by the StepKoef coefficient.

CloseToProfit - false - do not use, true - use the following setting

ProfitToCloseAll - indicates the percentage of the deposit. For example, set 10 - means that when profit on trades on a buy or sell separately reaches 10% of the deposit amount, for each instrument separately, all orders of this type will be closed, not reaching the take profit mark.

CloseToProfitEq - false - do not use, true - use the following setting

ProfitToCloseAllEq - percentage of total profit for all instruments. If you specify 10, then all orders will be closed for all currency pairs with a total profit of 10% of the deposit amount.

TakeProfit - Number of points for closing a position in profit. Take profit is virtual, is not set in the terminal, when trading on shares, frequent gaps are closed at maximum profit.

mm - false - do not use, true - use the following setting

risk - lot calculation as a percentage of the deposit

Lots - fixed set lot size

mult - lot duplication ratio

PanelSet - panel settings on the chart, which shows the levels of virtual take profits, according to which orders will be closed.

You can install on one of the graphs, trading will be carried out on all prescribed instruments. It is also possible to install for each tool separately, you only need to change the Magic. Any timeframe. Any broker, any spreads and commissions.