KT Ichimoku Trader

- Experts

- KEENBASE SOFTWARE SOLUTIONS

- Versão: 2.0

- Atualizado: 3 julho 2020

- Ativações: 5

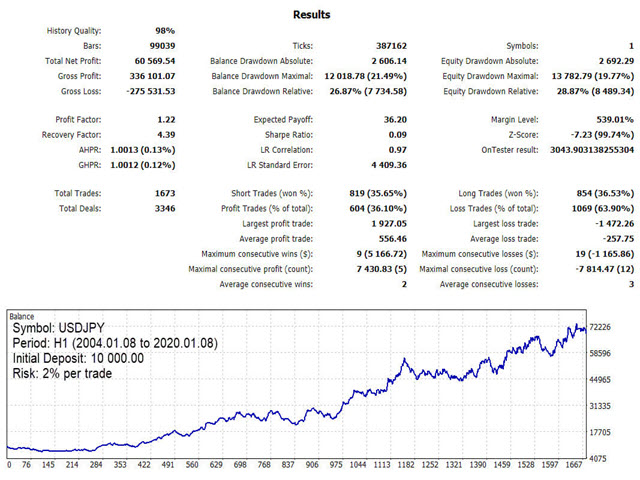

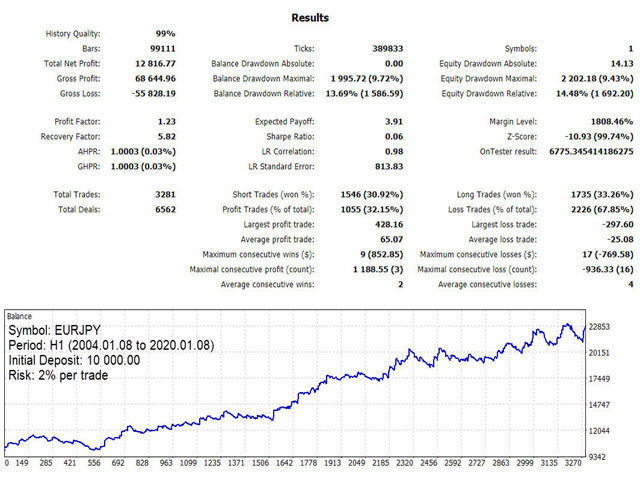

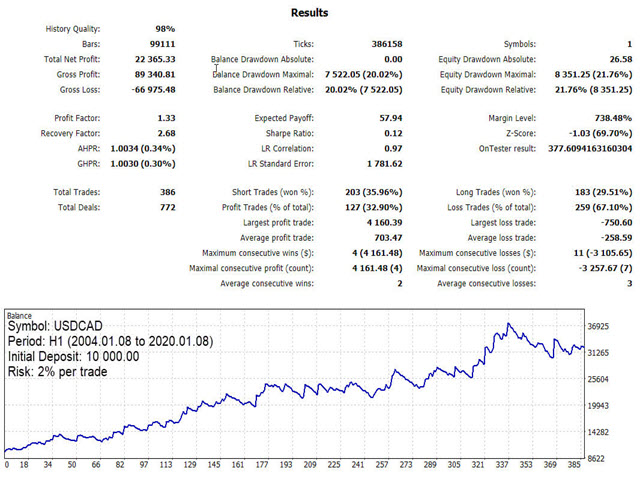

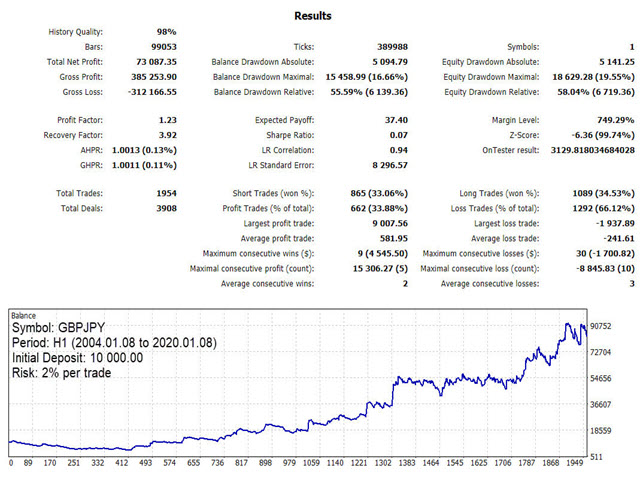

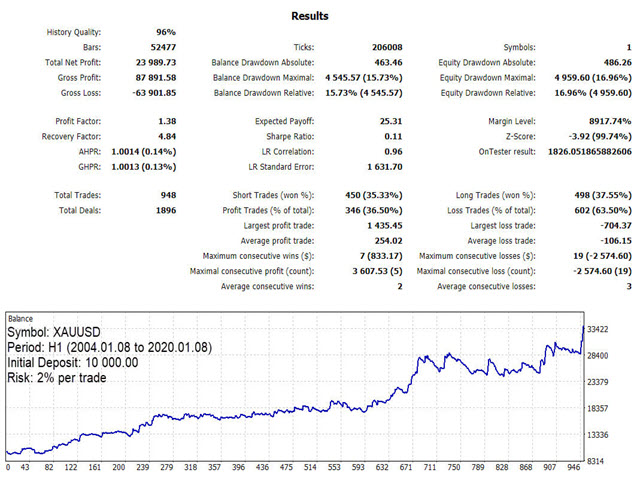

KT Ichimoku Trader is a fully automated expert advisor that offers five popular trading strategies based on the Ichimoku indicator. Each strategy has it's own entry and exit method without any interference to other strategies. The Ichimoku system can be applied to all major currency pairs and metals. However, we found that it performs reasonably well mainly on two pairs.

MT5 Version is available here https://www.mql5.com/en/market/product/35043

Features

- Trade up to 5 famous trading strategies based on the Ichimoku.

- Comes with 4 advance trading filters that can be fully customized.

- Inbuilt algorithm to fire trades only in the direction of trend.

- Possible to place the SL, TP and Trailing either in pips or the volatility coefficient.

- Comes with proper money management and loss avoidance module.

Trading Strategies

Five popular trading strategies based on the various Ichimoku elements. Each of the strategies has it unique entry and exit point without any interference to other strategies.

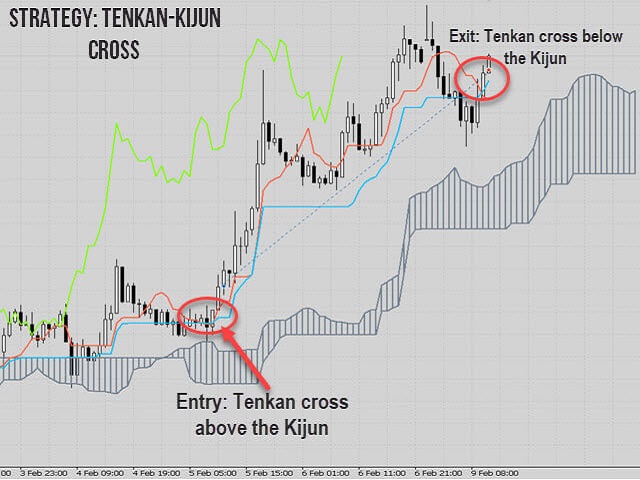

Strategy 1: Tenkan-Kijun Cross

Normal Mode:

- Buy Trade: When Tenkan-sen cross above the Kijun-sen.

- Sell Trade: When Tenkan-sen cross below the Kijun-sen

- Buy Exit: When Tenkan-sen cross below the Kijun-sen.

- Sell Exit: When Tenkan-sen cross above the Kijun-sen.

Advanced Mode:

- Buy Trade: When Tenkan-sen cross above the Kijun-sen + Tenkan-sen is above the Kumo Cloud + Kumo Cloud is bullish.

- Sell Trade: When Tenkan-sen cross below the Kijun-sen + Tenkan-sen is below the Kumo Cloud + Kumo Cloud is bearish.

- Buy Exit: When Tenkan-sen cross below the Kijun-sen.

- Sell Exit: When Tenkan-sen cross above the Kijun-sen.

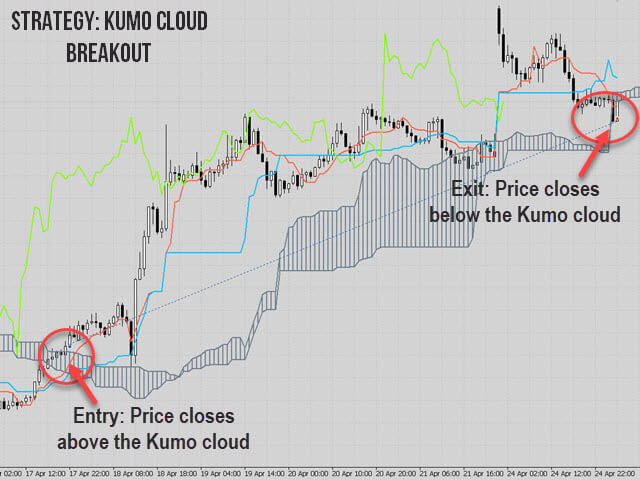

Strategy 2: Kumo Cloud Breakout

Normal Mode:

- Buy Trade: When price close above the Kumo cloud.

- Sell Trade: When price close below the Kumo cloud.

- Buy Exit: When price close below the Kumo cloud.

- Sell Exit: When price close above the Kumo cloud.

Advanced Mode:

- Buy Trade: When price close above the Kumo cloud + Tenkan-sen is above Kijun-sen + Future Kumo is bullish.

- Sell Trade: When price close below the Kumo cloud + Tenlan-sen is below Kijun-sen + Future Kumo is bearish.

- Buy Exit: When price close below the Kumo cloud.

- Sell Exit: When price close above the Kumo cloud.

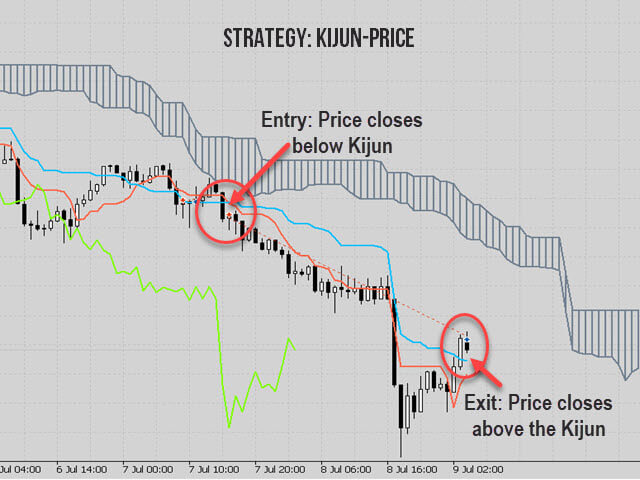

Strategy 3: Kijun-Price Cross

- Buy Trade: When price close above the Kijun-sen and Kijun-sen is above the Kumo.

- Sell Trade: When price close below the Kijun-sen and Kijun-sen is below the Kumo.

- Buy Exit: When price close below the Kijun-sen.

- Sell Exit: When price close above the Kijun-sen.

Strategy 4: Chikou Breakout

- Buy Trade: When Chikou breakout above the range of last 26 period price.

- Sell Trade: When Chikou breakout below the range of last 26 period price.

- Buy Exit: When price close below the Kijun-sen.

- Sell Exit: When price close above the Kijun-sen.

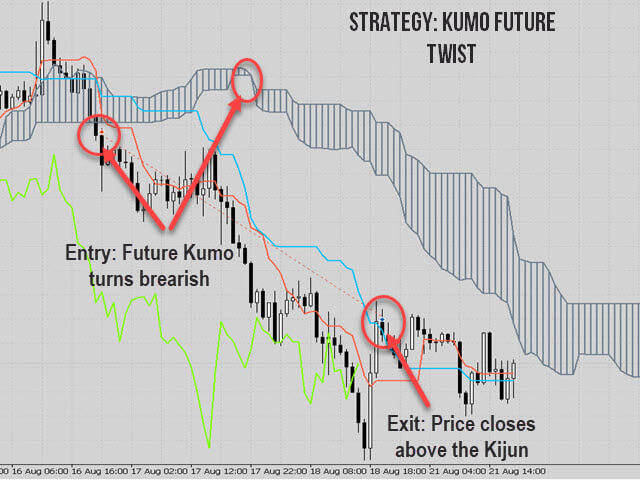

Strategy 5: Kumo Future Twist

Normal Mode:

- Buy Trade: When future Kumo turns bullish i.e. SpanA cross above the SpanB in future.

- Sell Trade: When future Kumo turns bearish i.e. SpanA cross below the SPanB in future.

- Buy Exit: When future Kumo change the direction or Price close below the Kijun-sen.

- Sell Exit: When future Kumo change the direction or Price close above the Kijun-sen.

Advanced Mode:

- Future Kumo turn bullish/bearish + price is above/below the current cloud.

Input Parameters

- ----- Trading Filters -----

- Trading Session: Choose the appropriate trading session from the list.

- Trend Filter: If true, the EA avoids new positions that may be against the market trend.

- Volatility Filter: If true, the EA avoids new positions during the period of high or low volatility (depends on the chosen volatility coefficient).

- Vortex Filter: This filter distinguishes the price movement into two positive and negative oscillating lines. A long position is preferable when the positive line is above the negative line and vice versa.

- MMI Filter: Market Meanness Index

- ----- Miscellaneous settings -----

- Max. Loss Protection: If true, the EA will stop trading when the total loss becomes more than the maximum Loss Limit set by the user.

- Max. Loss Limit in Percentage: Insert the loss limit in percentage.

- EA Capital: Insert the capital amount dedicated to the EA.

- Logging: EA logs it's operation details in the journal tab.

EA is temperamental, according to author the EA trades according to certain strategies but it doesn't always carry out the trades. The basis of selection whether to open a trade is unknown, also I had a few trades following Cloud Breakout that closed suddenly without crossing the cloud and without a SL/TP set. I have found another EA that is cheaper and does the job better. What a waste of 80 USD. EDIT (9/7/20): Author has updated EA to list the activation criteria, hopefully this will be useful for future buyers.