Stochastic Standard and Hidden Divergences

- Indicadores

- Christopher Kryza

- Versão: 1.2

- Atualizado: 27 novembro 2018

- Ativações: 5

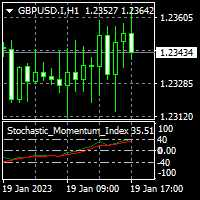

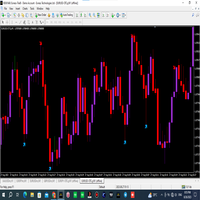

The Stochastic Standard/Hidden Divergence indicator will plot the stochastic (%K and %D), and will also identify and plot standard (regular) divergences between the indicator and the price action, OR it can be set to identify and plot hidden (reverse) divergences between the indicator and the price action. The divergences themselves are implemented as lines (default green for bullish divergence and red for bearish divergence) drawn in the indicator pane. If activated via the Inputs dialog, alerts will be generated whenever a new divergence is identified or when an existing divergence is extended.

An option is also provided to highlight the divergences in the price pane. When this option is selected, shapes will be drawn above the bar highs that identify the starting/ending point of an upper (bearish) divergence, and vice-versa for lower (bullish) divergences. You can select to highlight all divergences, or just the most recent divergence.

A divergence is often a precursor to a price reversal. In a bullish (regular) divergence, price will be making lower-lows while the indicator being tracked will make higher lows which typically indicates a reduction (or reversal) in momentum. The reverse is true for a bearish (regular) divergence.

When a security is in a strong trend, regular divergence will tend to generate a number of false signals. In this situation hidden divergences can be used to identify entry/re-entry points. A bullish (hidden) divergence occurs when price makes a higher-low while the indicator makes a lower-low. The reverse is true for a bearish (hidden) divergence.

While divergences can be used to generate entry signals, most traders use them to confirm some other trading signal. And as mentioned above, if the security is trending you would look for hidden divergences while at all other times you would focus on regular divergences.

Almost any oscillator can be used for purposes of divergence-detection, but there are certain indicators that are more effective at this task and these include the CCI, RSI, Momentum, Stochastics, and MACD. We offer divergence-checking versions of all of these.

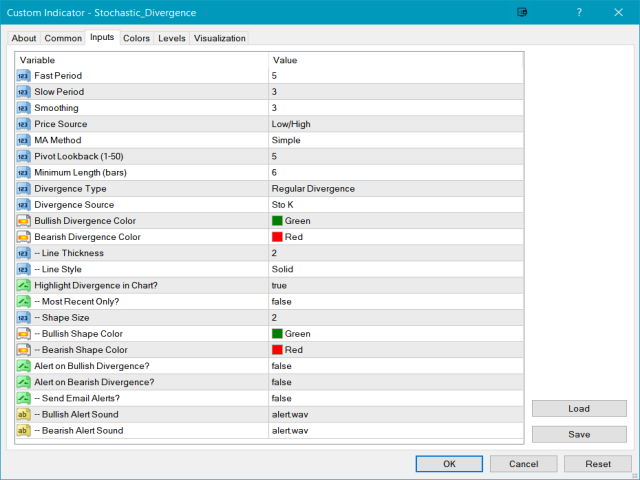

The Inputs menu provides full control over the underlying indicator parameters as well all divergence-specific properties and cosmetics.

| Menu Option | Description |

|---|---|

| Fast Period | Set the fast period. Default is 5. |

| Slow Period | Set the slow period. Default is 3. |

| Smoothing | Set the smoothing period for the stochastic calculation. Default is 3. |

| Source | Select the price input source. Default is Low/High. |

| MA Method | Select the averaging method. Default is Simple. |

| Pivot Lookback | Set the number of pivots over which divergences should be scanned. Default is 5, range is 1-50. |

| Minimum Length | Set the minimum length, in bars, for a valid divergence. Default is 6. |

| Divergence Type | Select from Regular Divergence and Hidden Divergence. |

| Divergence Source | Select the plot to use for divergence-checking. Default is Sto K. |

| Bullish Divergence Color | Set the color for bullish divergence lines. |

| Bearish Divergence Color | Set the color for bearish divergence lines. |

| --Line Thickness | Set the line thickness for divergence lines. Range is from 1 to 6. Default is 2. |

| --Line Style | Set the line style for divergence lines. Default is Solid. |

| Highlight Divergence in Chart? | True or False. If True then the starting/ending points of divergences will be highlighted in the price pane. |

| --Most Recent Only? | True or False. If True then only the most recent divergence will be highlighted in the price pane. |

| --Shape Size | Set the size of the shape to be used when highlighting divergences. |

| --Bullish Shape Color | Set the color to be used for highlighting bullish divergences. |

| --Bearish Shape Color | Set the color to be used for highlighting bearish divergences. |

| Alert on Bullish Divergence? | True or False. If True then alerts will be generated for bullish divergences. |

| Alert on Bearish Divergence? | True or False. If True then alerts will be generated for bearish divergences. |

| --Send Email Alerts? | True or False. If True then email alerts will be generated along with the standard audio alert. |

| --Bullish Alert Sound | Set the WAV file to be used for bullish alerts. |

| --Bearish Alert Sound | Set the WAV file to be used for bearish alerts. |