MultiSymbol Triple Screen Trading System MT5

- Indicadores

- Aleh Sasonka

- Versão: 1.44

- Ativações: 5

Purpose

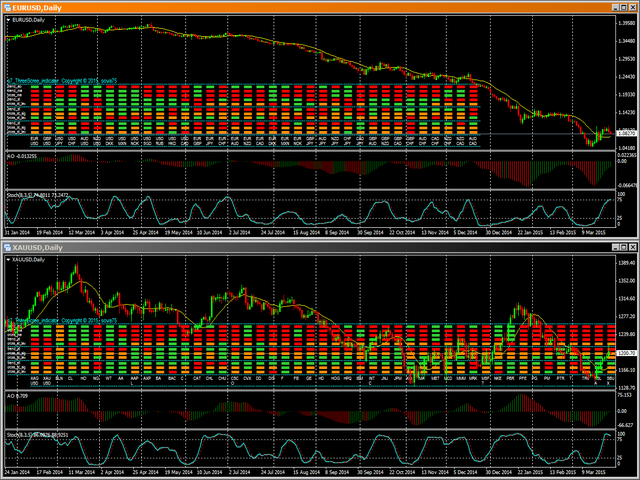

The indicator is intended for manual multi-currency trading based on the Triple Screen Strategy.

It works with any symbols located in the Market Watch window of the MT5: currencies, metals, indexes, etc.

The number of instruments can be limited by capacity of the МТ5's parameters. But if desired, you can create several windows with various set of instruments and parameters.

Operation Principle

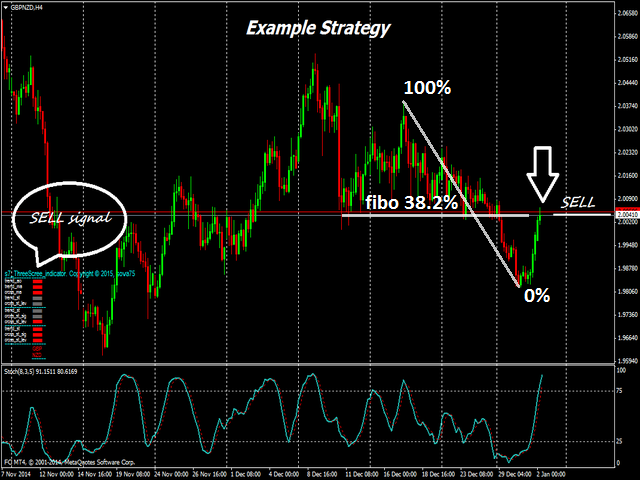

The indicator uses the modified Triple Screen Strategy for determining trend direction in the third window via Awesome Oscillator, Moving Average or Stochastic Oscillator at the trader's discretion. The oversold/overbought level is determined in the second window via Stochastic indicator. We also use Stochastic indicator in the first window, but this time we are determining the best market entry point. As a result, we obviate the necessity to move pending orders according to the market (what the classical system requires) and can enter the market at once.

Target Audience

The indicator will be useful for those who prefer multi-currency trading.

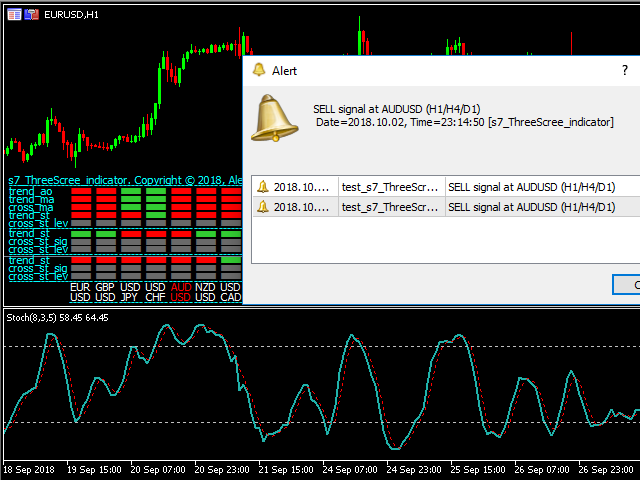

If you use the Triple Screen Strategy, you have to analyze three time periods for each instrument. You need a lot of time to work with a large number of symbols. We created this indicator to facilitate this work. It independently analyzes all chosen instruments by three time periods. When it finds the required combination of parameters' values, it notifies a trader about a possibility to perform a trade.

The trader only needs to specify parameters which will be used by the indicator to check the possibility to perform the trade with given instruments.

Features

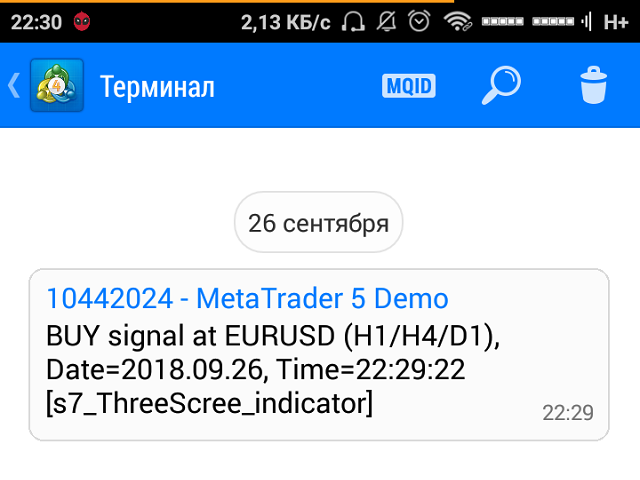

The indicator informs the trader about the possibility to perform the trade by means of a message popping up on the screen, sending message to an e-mail or a mobile terminal, or just by a sound notification.

The indicator works with current prices (uses the zero bar).

To reduce the CPU load, it is possible to customize the period for redrawing the indicator values.

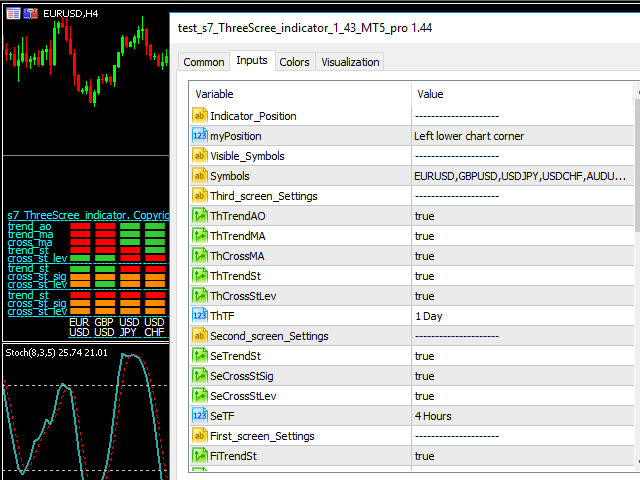

Input parameters

- Indicator_Position

- myPosition - indicator location in the main window of the chart

- Visible_Symbols

- Symbols - enter the instruments for tracking (separated by commas, without spaces)

- Third_screen_Settings

- ThTrendAO - trend direction based on the Awesome Oscillator indicator on the third screen (ON/OFF)

- ThTrendMA - trend direction based on the Moving Average indicator on the third screen (ON/OFF)

- ThCrossMA - price above/below the Moving Average indicator line on the third screen (ON/OFF)

- ThTrendSt - trend direction based on the Stochastic Oscillator indicator on the third screen (ON/OFF)

- ThCrossStLev - the main value of Stochastic Oscillator above/below the oversold/overbought level on the third screen (ON/OFF)

- ThTF - timeframe of the third screen

- Second_screen_Settings

- SeTrendSt - trend direction based on the Stochastic Oscillator indicator on the second screen (ON/OFF)

- SeCrossStSig - intersection of the signal line by the main line of the Stochastic Oscillator on the second screen (ON/OFF)

- SeCrossStLev - the main value of Stochastic Oscillator above/below the oversold/overbought level on the second screen (ON/OFF)

- SeTF - timeframe of the second screen

- First_screen_Settings

- FiTrendSt - trend direction based on the Stochastic Oscillator indicator on the first screen (ON/OFF)

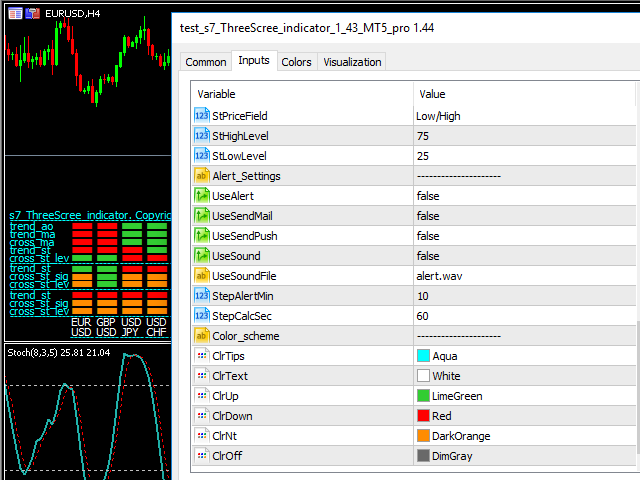

- FiCrossStSig - intersection of the signal line by the main line of the Stochastic Oscillator on the first screen (ON/OFF)

- FiCrossStLev - the main value of Stochastic Oscillator above/below the oversold/overbought level on the first screen (ON/OFF)

- FiTF - timeframe of the first screen

- Color_scheme

- ClrTips - color for labels and the indicator grid

- ClrText - color to indicate the instruments and periods

- ClrUp - color for the bullish trend signals

- ClrDown - color for the bearish trend signals

- ClrNt - color for the neutral signals

- ClrOff - color for the disabled signals

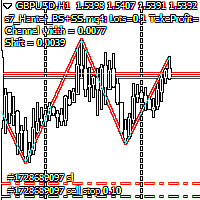

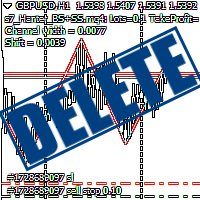

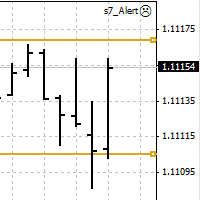

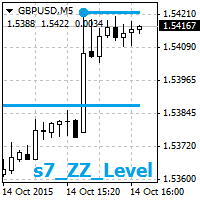

Display

- green - buy signal;

- red - sell signal;

- orange - neutral signal;

- gray - parameter is disabled.

How to use

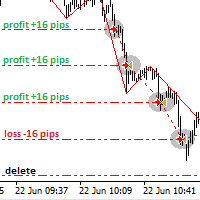

Screenshots below indicate an example of trading using this indicator.

The indicator was developed for the contest of traders using manual trading based on the Triple Screen Strategy.

I've owned this for some time and don't understand why it hasn't had a positive review.

It does what is says and I find it useful for analysis.

As a trading system it doesn't offer up many opportunities, but I think its up to the individual to decide how to use the data.

I've deducted one star (4/5) as its pricey and seems prone to lock up my system (suggesting it demands a lot of resources).

I use it for analysis, then screen shot the result and close it down.