MultiCurrencyLite MT5

- Utilitários

- Hao-Wei Lee

- Versão: 6.0

- Atualizado: 2 março 2025

Everything You Need Before Starting a Trade

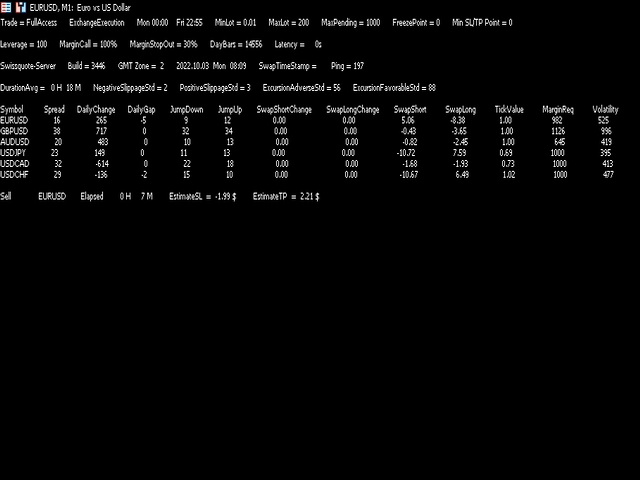

Network Connection / Broker / Symbols / Historical Order Benchmarks / Current Order Status

1. Symbol’s Trading Privileges – Ensure the symbol is tradable.

2. Order Execution Mode – Check the broker’s execution type.

3. Trade Session Hours – Verify the trading hours.

4. Min/Max Lot Sizes – Check the allowed lot range.

5. Max Pending Orders – Confirm the maximum number of pending orders allowed.

6. Freeze Point & Pending Order Distance – Minimum distance required for pending orders (0 = optimal).

7. Min SL/TP Points Required by Broker – Minimum stop-loss/take-profit points (0 = optimal).

8. Account Leverage – Verify the leverage level.

9. Margin Call – Required margin level must be > 100% to open an order.

10. Margin Stop-Out – Forced order closure if margin falls < 30%.

11. Day Bars – Number of D1 bars available.

12. Latency Check – Difference between the symbol’s server time and quote time.

13. Trade Server Name – Identify the connected trading server.

14. Terminal Version – Ensure the trading platform is up-to-date.

15. Server Time Zone – Note that on weekends, the value may be inaccurate due to market closure.

16. Current Server Time – Verify the real-time server clock.

17. Symbol’s Swap Timestamp – Swap normally occurs during the New York session.

18. Network Connection Ping – Measure the latency of the trading connection.

19. Historical Orders Holding Average Time – Analyze past order duration.

20. Historical Orders Negative Slippage Standard Deviation – Example: A sell order with SL at 1.10020 but closing at 1.10040 results in more loss.

21. Historical Orders Positive Slippage Standard Deviation – Example: A buy order with TP at 1.10100 but closing at 1.10120 results in more profit.

22. Historical Orders Excursion Points – Maximum Adverse Excursion (MAE) / Maximum Favorable Excursion (MFE).

23. Symbol Information & Spread – Check the current spread value.

24. Daily Change & Price Gap – Difference between yesterday’s D1 close and today’s open.

25. Tick Jump Down/Up Points – Consider ping value when analyzing jumps (reset daily).

26. Daily Swap Short/Long Changes – Track variations in swap values.

27. Current Swap Short/Long – Review the latest swap rates.

28. Tick Value – Example: 1 tick = 1 lot = $1 per point.

29. Margin Requirement – Example: 1000 means holding 1 lot requires $1,000.

30. Volatility (20 Days) – Compare symbol volatility, normalized with tick value (Tip: If volatility is 500, setting SL/TP points accordingly is effective).