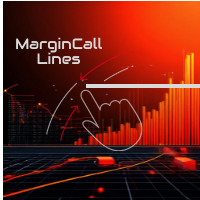

CME Exchange margin zones

- Utilitários

- Roman Vasilchenko

- Versão: 1.8

- Atualizado: 14 fevereiro 2019

- Ativações: 5

The utility is designed to display on the chart the margin zones built on the basis of margin requirements for futures of the Chicago Mercantile exchange (CME). These margin zones are good levels of resistance and support, as seen in the screenshots.

How to use

To trade on margin zones, use the following rules:

- buy after the day has closed above one of the zones to the next zone;

- sell after the day has closed below one of the zones to the next zone;

- after opening a sell trade, place limit sell orders from the local minimum from the start time of the zone;

- after opening a buy trade, place limit buy orders from the local maximum of the zone from the time the zone starts;

- you can use zone 3/4 as a target from zone 1/2 (especially if limit orders are triggered);

- for better understanding of the process, see the attached video and screenshots.

Control buttons

- 1 - draw the 1/4 zone from the cursor position

- 2 - draw the 1/2 zone from cursor position

- 3 - draw the zone 1 from cursor position;

- TAB - extend the zone under the cursor;

- Shift - delete the zone under the cursor.

To build a zone from the border of another zone (for example, zones 3/4, 5/4, etc.), move the cursor closer to the desired edge of the zone and press the number 1, 2 or 3.

When plotting from Highs, the cursor should be above the chart, when plotting from Lows, it should be below. The maximum/minimum value in the vicinity of the cursor is determined and a zone is drawn from it.