Great Ox EA

- Experts

- Hatem Koshok

- Versão: 1.10

- Atualizado: 1 agosto 2018

- Ativações: 5

Great Ox EA is a fully automated EA that works on both Classical and ECN accounts. It is programmed to use various trading systems, such as trending, hedging, neural network, etc. SL and TP are always present. The expert strategy is to collect the previous trend data of the pair then to try to match the previous trend with different strategies like hedging, neural network to get the optimum place for the orders. Meanwhile a neural network function is present to determine if the current trend is matching with the overall pair trend or its odd performance so it can modify itself to match this new trend. Also a convergence and hedge functions are used to determine trend start and end.

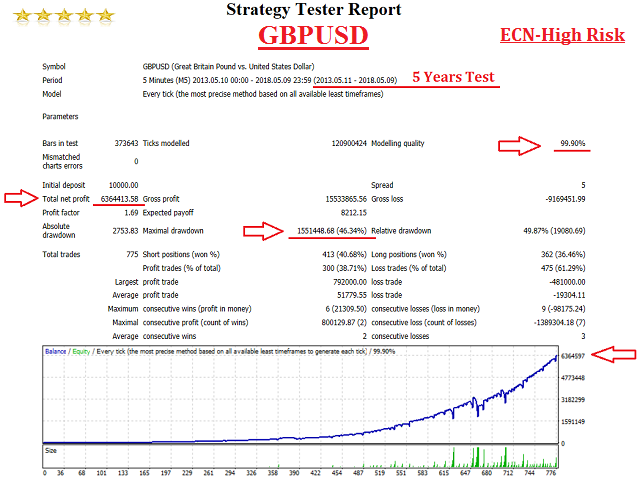

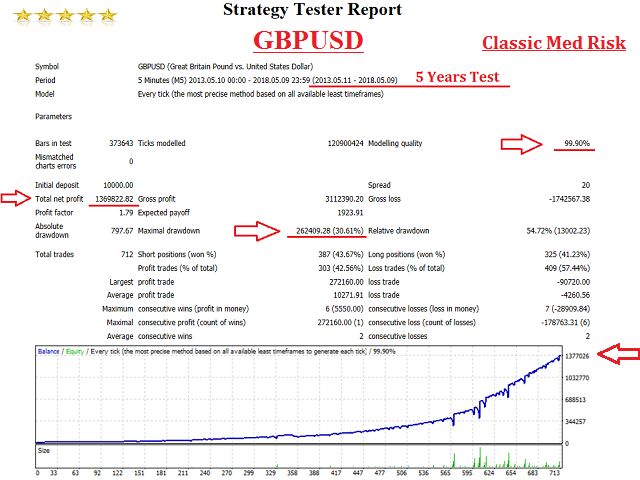

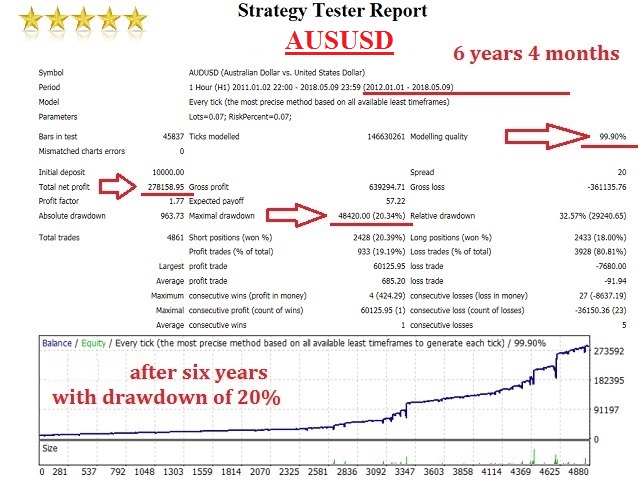

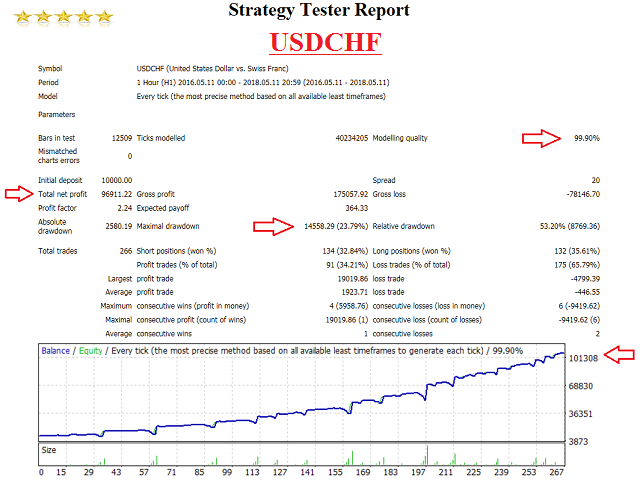

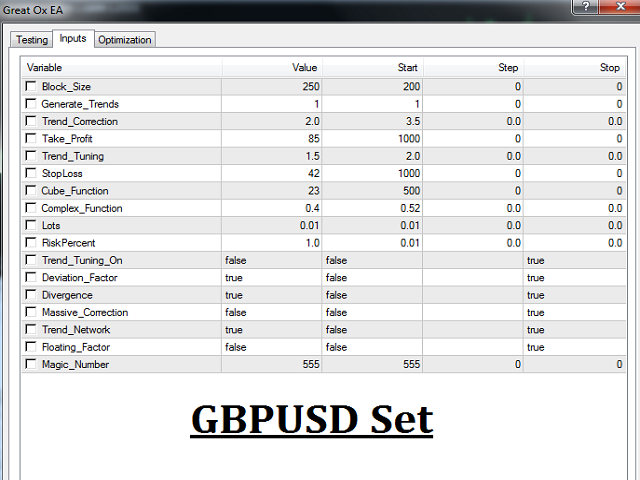

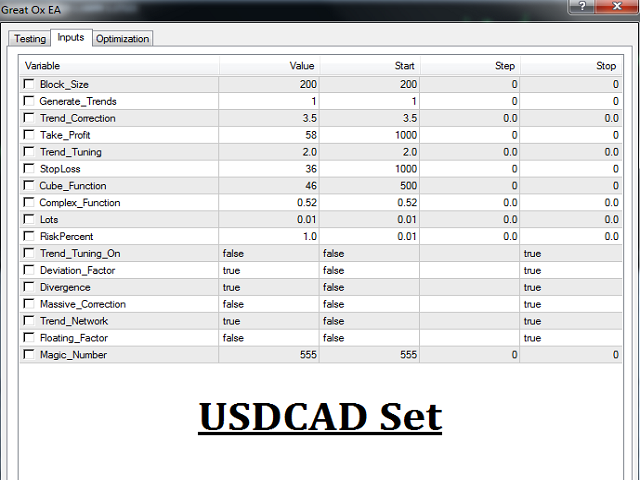

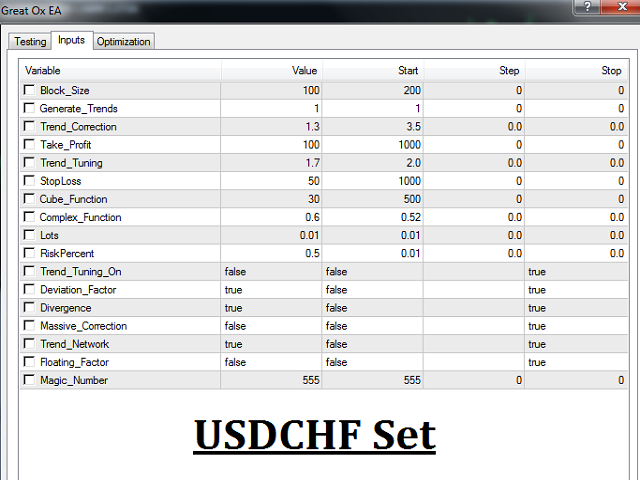

The performance is optimized for different pairs EURUSD, GBPUSD, USDCHF, USDCAD & AUSUSD and the optimized set for each pair is provided in screenshots section.

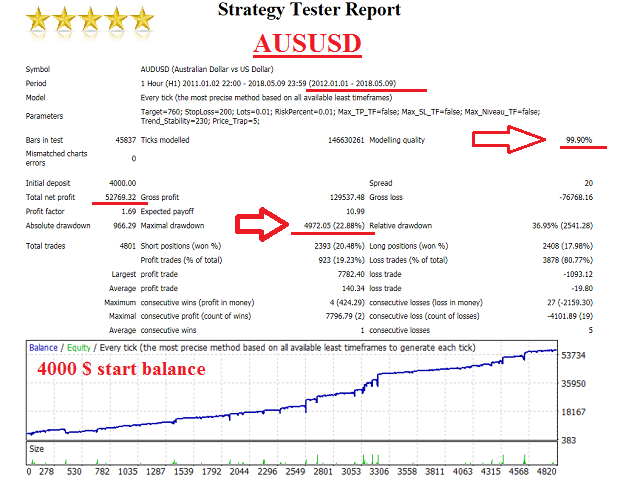

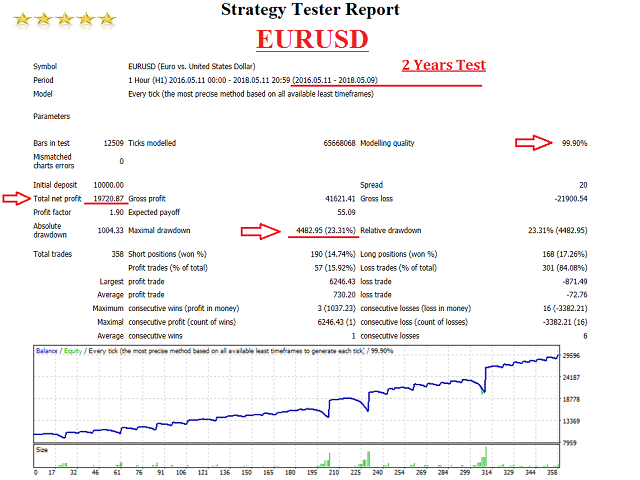

It has passed 6 years back test on real tick data with 99.9% accuracy.

Minimum balance required is $4000 for standard accounts or $40 for micro accounts.

The screenshots section shows the back-test results.

Working Strategy

- I recommend to open 5 charts (H1) for the mentioned pairs (EURUSD, GBPUSD, USDCHF, USDCAD & AUSUSD).

- Add the expert to each of the charts.

- Apply the set in the screenshots sections for each pair.

- I recommend to use the risk percent in the sets but you can change it to lower values if you wish.

- In case of micro accounts the risk percent should be multiplied by 100 (so if the image says risk value is 0.5 then for micro account it should be 50).

Features

- Works with any broker.

- No need for fast VPS.

- Uses only the best features from various systems, such as trending, hedging, neural network, etc. SL and TP are always present.

- Good test results on various time intervals;

- Excellent results when tested in different ways;

- No need to disable the robot during news;

- Does not require exceptional execution.

- Full Time Support.

Expert Parameters

- Block_Size - the number of points to create a block to avoid price fluctuation.

- Generate_Trends - generate a number of trends to match current price trend.

- Trend_Correction - correction for the current trend to avoid taking orders in fluctuation area.

- Take_Profit - the profit needed to close the deals.

- Trend_Tuning - slight tuning for the trend if a clear trend could be identified.

- StopLoss - the stop loss of the deals.

- Cube_Function - calculate the expected end of the trend based on the block size value.

- Complex_Function - identify how complex the current trend is and if the trend change is expected to avoid placing orders.

- Lots = 0.01 - lot of the orders.

- Riskpercent = 1 - generally check the screenshots section to get the optimum value for the risk that is suitable for each pair.

- Trend_Tuning_On - False - enable/disable the trend tuning option.

- Deviation_Factor - False - enable/disable the trend correction option.

- Divergence - False - include divergence in considering trend end.

- Massive_Correction - False - in case there was high fluctuation in the pair and usually for the mentioned pairs there is no severe fluctuation.

- Trend_Network - False - consider trend correction as a new trend or not.

- Floating_Factor - False - measure the new trend angle in case trend network option is set true.

- Magic Number.

Symbols: EURUSD, GBPUSD, USDCHF, USDCAD & AUSUSD.

Time Frame - H1 but other time frames can be used.

O usuário não deixou nenhum comentário para sua avaliação