EagleFX

- Utilitários

- Youssef Wajih Saeed I Said It Here

- Versão: 4.9

- Atualizado: 27 abril 2025

- Ativações: 10

Summary

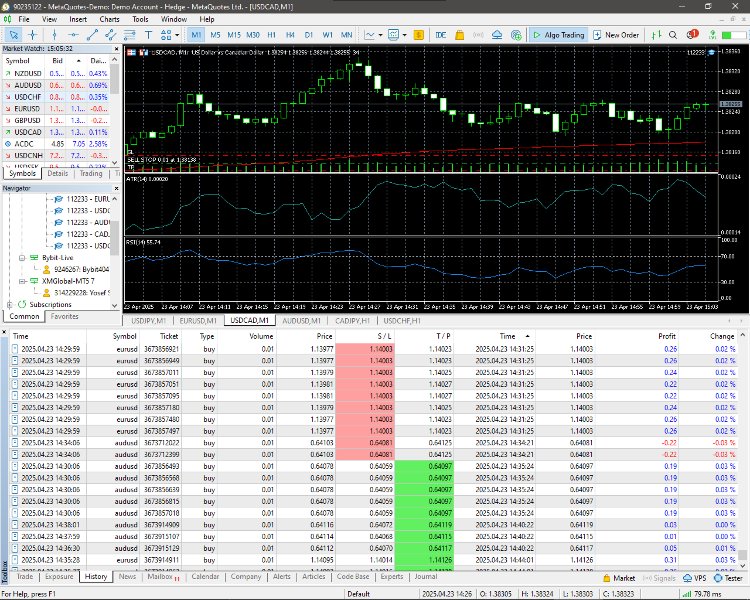

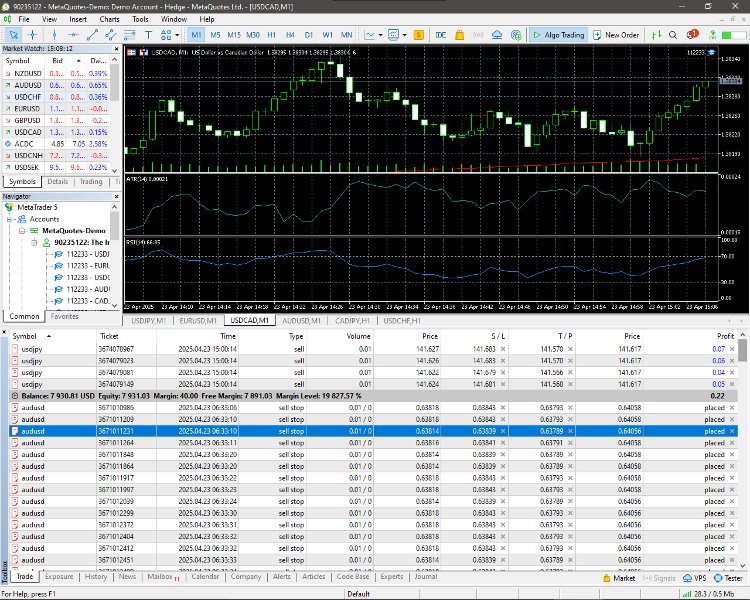

EagleFX is a fully automated Expert Advisor (EA) for MetaTrader 5 that executes high-precision, algorithmic trading strategies 24/7 across multiple instruments InvestopediaHandWiki. It removes emotion from decision-making, rigorously backtests every signal, dynamically adjusts risk parameters, and leverages advanced machine-learning-inspired memory modules to continuously refine its performance InvestopediaInvestopedia.

-

Continuous, Emotionless Execution

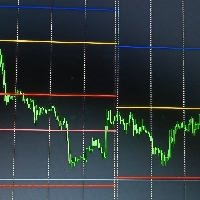

EagleFX operates around the clock without fatigue, continuously monitoring price action and executing trades the moment predefined conditions—such as ATR breakouts and EMA crossovers—are met InvestopediaWikipedia. Unlike human traders prone to fear and greed, it adheres strictly to its coded strategy, eliminating emotional biases Investopedia. -

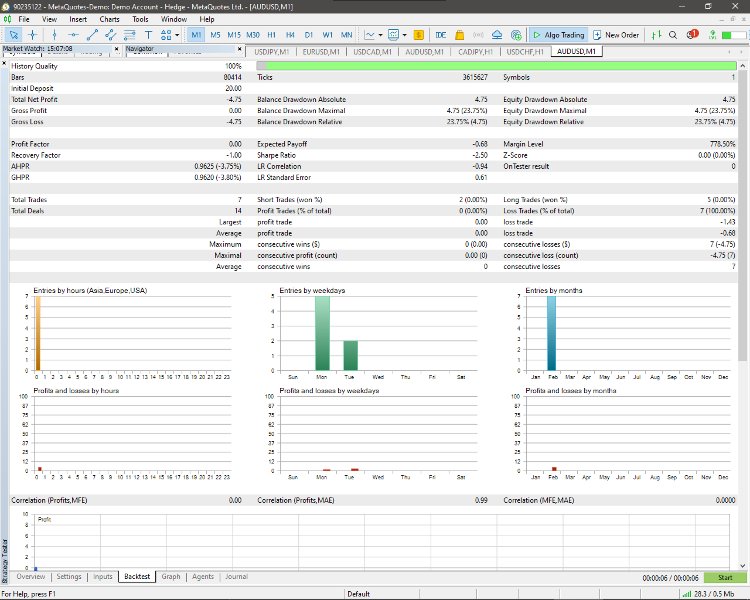

Proven, Backtested Strategies

All entry and exit rules within EagleFX are based on quantitative criteria—drawing from technical indicators such as ATR, EMA, and RSI—backtested on years of historical data to ensure statistical robustness and avoid overfitting Investopedia. Before live deployment, every parameter set undergoes rigorous walk-forward analysis, simulation under varying volatility regimes, and optimization for both trending and ranging markets. -

Advanced Architecture & Adaptivity

Built as a self-contained EA for MT5, EagleFX uses handle-based indicator calls for maximum efficiency and layer-aware memory structures inspired by LLM-based agents to prioritize recent, relevant market events while retaining longer-term context HandWikiInvestopedia. This multi-layer design allows the bot to adapt its signals in real time, akin to quantitative deep-reinforcement frameworks such as FinRL. -

Robust Risk & Money Management

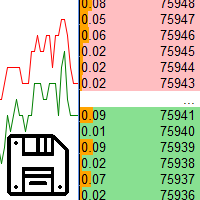

EagleFX employs dynamic position sizing via a Kelly-criterion approach, capped by user-defined risk fractions, and enforces daily/weekly drawdown limits to preserve capital Investopedia. It automatically normalizes lot sizes to broker constraints, validates stop-loss and take-profit distances against minimum stop levels, and adjusts pending orders to meet fill-or-kill requirements—ensuring every trade conforms to strict risk parameters. -

Broad Market Coverage & Reliability

Designed originally for Forex pairs, EagleFX’s modular codebase easily extends to CFDs, indices, and commodities, leveraging MT5’s multi-symbol capabilities HandWikiWikipedia. It integrates seamless logging and error-handling (e.g., OrderCheck , OrderSend diagnostics), guaranteeing that any invalid requests are caught and reported instantly, maintaining uninterrupted operation and trader confidence.