Next Turbo

- Experts

- Maryna Shulzhenko

- Versão: 2.1

- Ativações: 5

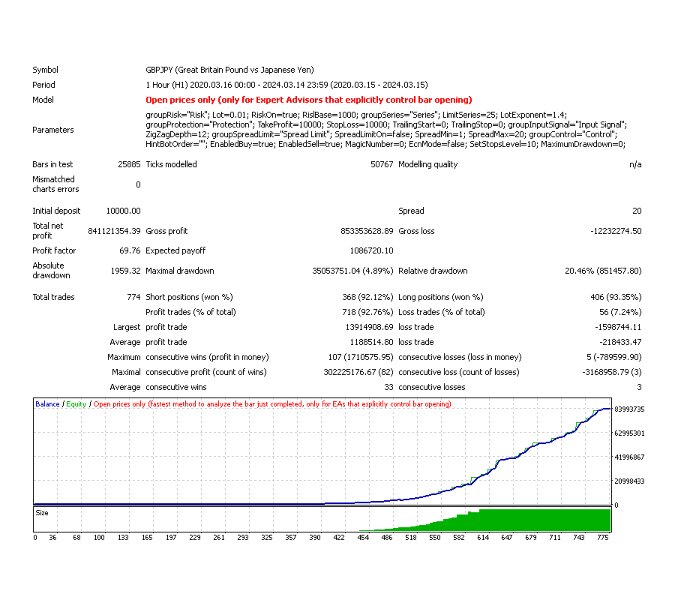

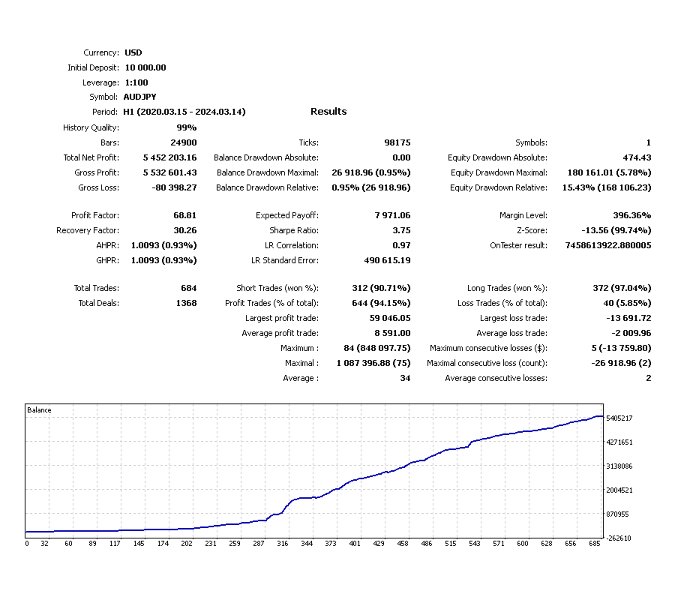

Turbo Next is a high-performance trading bot for the Forex market, designed to automate trading strategies and adapt to the ever-changing market conditions. This tool utilizes advanced algorithms to process market data, allowing it to automatically identify optimal entry and exit points, minimizing human error and improving trading results.

Key Features of Turbo Next:

-

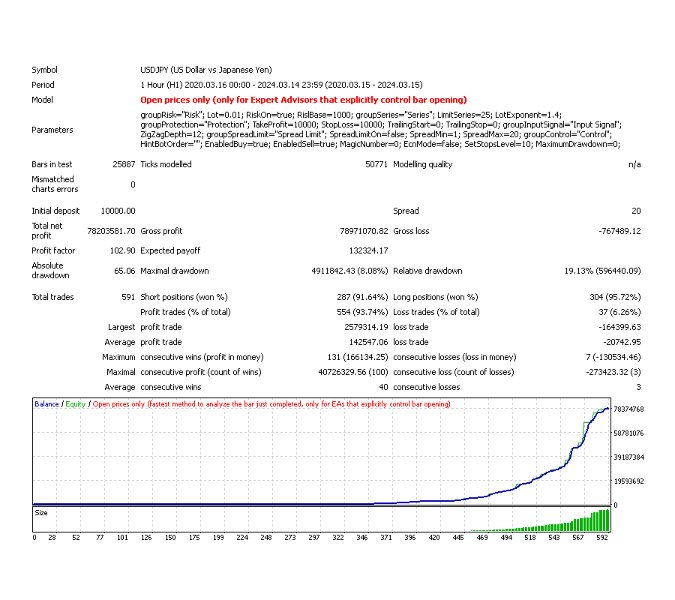

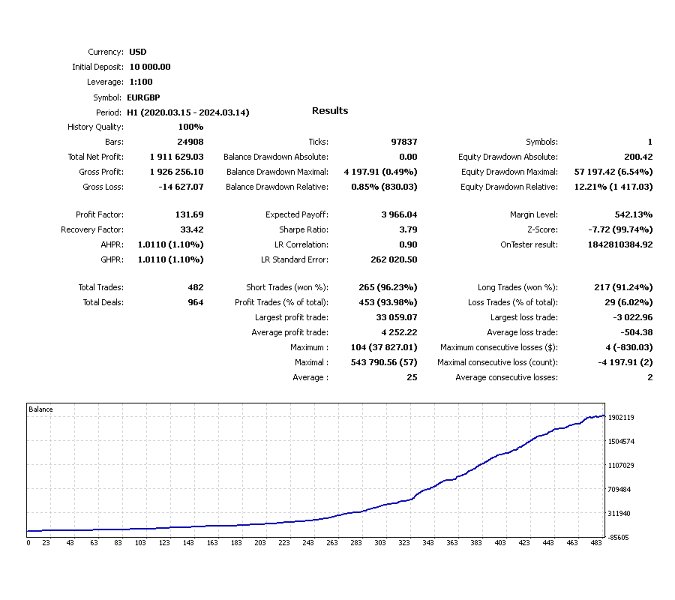

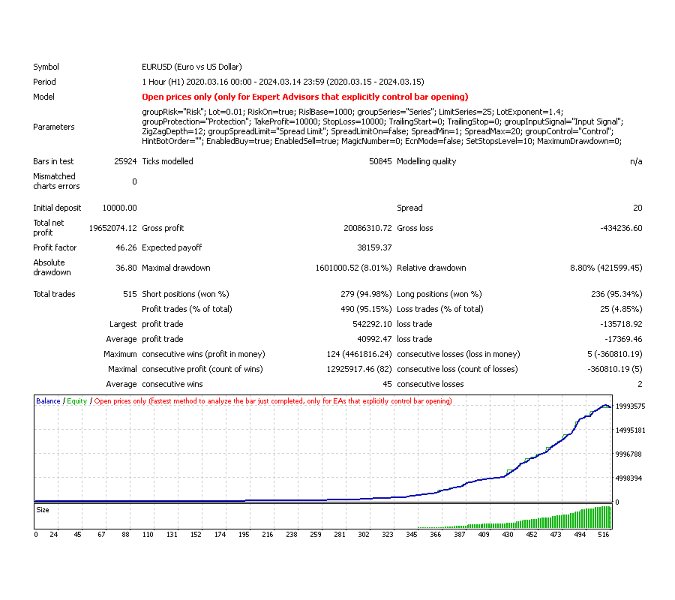

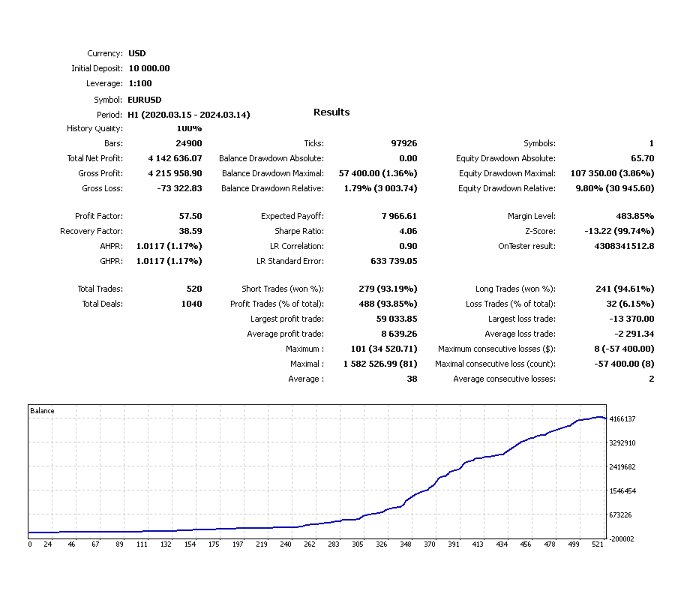

Support for Multiple Currency Pairs: Turbo Next works with a wide range of currency pairs such as EURUSD, GBPUSD, USDJPY, AUDUSD, USDCHF, and many more. This enables traders to diversify their portfolios and minimize risks associated with trading a single currency pair. By doing so, you can optimize your strategy and expand trading opportunities.

-

Market Pattern and Price Level Analysis: The bot uses complex algorithms to analyze market patterns, trends, and price levels, allowing it to accurately determine entry and exit points. This is especially useful for traders who rely on technical analysis. It can track various price levels, such as support and resistance, to generate more precise trading signals.

-

Market Volatility Analysis: Turbo Next is equipped with a market volatility analysis feature that automatically adjusts trading parameters depending on the current market conditions. This is crucial, as volatility can significantly impact the accuracy of predictions and the profitability of trades. In the case of high price fluctuations, the bot can reduce position sizes or modify the strategy to minimize risks.

-

Trade Scaling: A unique scaling feature allows the bot to adjust trade sizes based on the current market volatility. When volatility is high, the bot can automatically decrease position sizes to avoid excessive losses, while increasing position sizes during low volatility to maximize potential profit.

-

Trade Protection with Trailing Stop and Stop Loss: Turbo Next supports essential risk management features like trailing stop and stop loss, which help protect your trades from unexpected market movements. Trailing stop moves the stop loss as the price moves in your favor, allowing you to lock in profits while protecting from reversals. You can also set fixed stop loss and take profit levels to automatically close trades at pre-determined profit or loss points.

Settings and Parameters of Turbo Next:

-

Currency Pairs: Turbo Next allows traders to choose from a wide selection of currency pairs, offering great flexibility in strategy customization. In the bot’s settings, you can select pairs such as EURUSD, GBPUSD, USDJPY, AUDUSD, and many others, depending on your preferences.

-

Risk and Lot Size Settings:

-

Lot: This parameter adjusts the size of each trade. You can set the lot size according to your capital and chosen strategy.

-

RiskOn: This option enables or disables risk management features. When enabled, the bot automatically calculates lot sizes based on the set risk level.

-

RiskBase: This is the base parameter for calculating risk, and it can be adjusted according to your risk tolerance.

-

-

Trade Series and Strategies: Turbo Next allows traders to select from different trading strategies, such as grid trading, and set limits on the number of trading series. This feature helps prevent overly aggressive trading in periods of low liquidity, minimizing potential losses.

-

Trade Protection Settings:

-

TakeProfit: This is the take-profit level at which the bot automatically closes a trade to secure a profit.

-

StopLoss: This is the stop-loss level, which sets the maximum loss allowed on a trade before it is automatically closed.

-

TrailingStop: This feature moves the stop-loss order as the market price moves in your favor, ensuring that you lock in profits while reducing the risk of losing them.

-

-

Volatility Analysis and Data Filtering:

-

Length, Detailing, Smoothing: These parameters allow you to set the length of volatility analysis and the degree of smoothing, helping to make more accurate price predictions and avoid false signals.

-

BandsPeriod and BandsDeviation: Settings for configuring Bollinger Bands, which are used to identify overbought and oversold levels in the market.

-

How to Use Turbo Next:

-

Installation: First, download the bot file and move it to the "Experts" folder in your MetaTrader terminal. Ensure that your trading platform is configured to use expert advisors.

-

Configuring Parameters: After installation, open the bot’s settings window in MetaTrader and configure all necessary parameters such as currency pairs, risk, lot sizes, trading strategies, and trade protection settings. It’s important to ensure that these settings match your trading strategy and risk preferences.

-

Launching the Bot: After configuring the settings, activate the bot on the selected currency pairs. Ensure that key options like EnabledBuy and EnabledSell are enabled so that the bot can execute trades. Click "OK" to apply the settings and start the bot.

-

Monitoring and Adjusting: It’s important to regularly monitor the bot’s performance. Check that it’s operating according to your expectations and make adjustments as needed. If you notice any discrepancies or want to optimize the strategy, adjust the settings and test them on a demo account.

Important Recommendations:

-

Test on a Demo Account: Before using the bot on a live account, it’s crucial to test it on a demo account. This will help you understand how the bot reacts to different market conditions and allow you to fine-tune its settings without risking real money.

-

Risk Management: Pay close attention to your risk settings. Configure risk management parameters to minimize potential losses. It’s recommended to start with lower risk levels and gradually increase them as you gain confidence in the bot’s performance.

-

Regular Performance Review: Periodically review the bot’s performance and analyze its results. This will help you adapt the strategies based on market changes and improve trading performance.

Conclusion:

Turbo Next is a powerful and versatile tool for automated Forex trading. It offers a wide range of features for customizing and optimizing trading strategies, but it’s essential to remember that all trading involves risk. For the best results, it’s recommended to thoroughly test the bot on a demo account first and then use it cautiously on a live account.