BesteaOne

中文介绍

策略概念

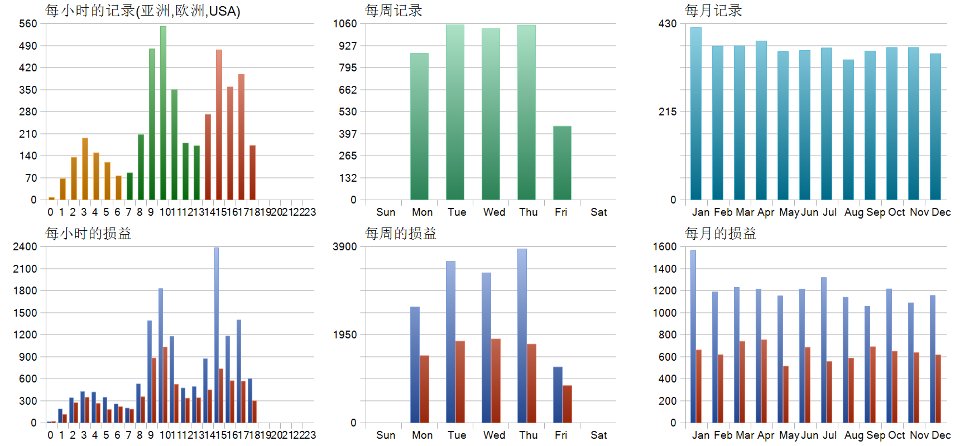

多指标多周期共振EA是一种自动化交易系统,通过整合多个技术指标(如MACD、RSI、均线)在不同时间周期(如1小时、4小时、日线)上的信号,捕捉高概率交易机会。其核心理念是:当短、中、长期周期及不同类别指标(趋势、动量、波动率)同时发出方向一致的信号时,称为“共振”,此时市场动能较强,交易成功率显著提升。

核心逻辑

- 多周期协同

- 同时分析至少3个时间周期(如15分钟、1小时、4小时),分别判断趋势方向。

- 短期周期(如15分钟)用于捕捉入场时机,长期周期(如4小时)用于确认主趋势方向。

- 多指标过滤

- 趋势指标(如移动平均线、MACD)确认方向。

- 震荡指标(如RSI、Stochastic)识别超买/超卖或动能强度。

- 量价指标(如成交量、OBV)辅助验证市场参与度。

- 共振条件

- 当所有周期及指标均指向同一方向时(如看涨或看跌),触发交易信号。

- 示例:

- H4周期:价格高于200日均线 + MACD柱线上涨。

- H1周期:RSI > 50 + 价格突破短期趋势线。

- 共振结果:开立多头仓位。

- 风险管理

- 动态调整仓位:根据账户净值或波动率(如ATR)计算风险。

- 止损规则:固定比例止损(如2%)或基于支撑/阻力位的移动止损。

- 止盈策略:追踪止盈或分批平仓。

优势

- 降低噪音:多指标多周期过滤可减少假信号和短期波动干扰。

- 趋势跟随:通过长周期确认,避免逆势操作。

- 灵活性:可适配外汇、股票、加密货币等市场。

适用场景

- 趋势行情:震荡行情中可能因指标冲突减少交易频率。

- 中长线交易:需等待多周期信号同步,不适合高频交易。

English Introduction

Strategy Concept

The Multi-Indicator & Multi-Timeframe Resonance EA is an automated trading system that combines signals from multiple technical indicators (e.g., MACD, RSI, Moving Averages) across different timeframes (e.g., 1H, 4H, Daily) to identify high-probability trading opportunities. Its core principle is: when short-, medium-, and long-term timeframes, along with diverse indicator types (trend, momentum, volatility), generate consistent directional signals simultaneously (called "resonance"), market momentum is strong, significantly improving trade success rates.

Key Logic

- Multi-Timeframe Synergy

- Analyze at least 3 timeframes (e.g., 15M, 1H, 4H) to determine trend direction.

- Short-term (e.g., 15M) for entry timing, long-term (e.g., 4H) for primary trend confirmation.

- Multi-Indicator Filtering

- Trend indicators (e.g., MA, MACD) confirm direction.

- Oscillators (e.g., RSI, Stochastic) identify overbought/oversold conditions.

- Volume-price indicators (e.g., Volume, OBV) validate market participation.

- Resonance Conditions

- Trigger trades only when all timeframes and indicators align (e.g., bullish or bearish).

- Example:

- H4: Price > 200MA + MACD histogram rising.

- H1: RSI > 50 + Price breaks short-term trendline.

- Result: Open long position.

- Risk Management

- Dynamic position sizing: Adjust based on account equity or volatility (e.g., ATR).

- Stop-loss: Fixed percentage (e.g., 2%) or support/resistance-based trailing stop.

- Take-profit: Trailing stop or partial closing.

Advantages

- Reduced Noise: Multi-layer filtering minimizes false signals.

- Trend Following: Long-term timeframe alignment avoids counter-trend trades.

- Adaptability: Compatible with forex, stocks, cryptocurrencies, etc.

Ideal Conditions

- Trending Markets: May reduce trade frequency in sideways markets.

- Medium/Long-term Trading: Requires patience for signal alignment; unsuitable for scalping.