Tesla Quantum AI

- Experts

- Benrashi Sagev Jacobson

- Versão: 1.1

- Atualizado: 21 março 2025

Advanced Robustness Testing: Evaluating Adaptability and Potential Performance

My Expert Advisor (EA) was tested and passed various stress-testing techniques to explore how it might respond to different market conditions and parameter changes. Walk Forward Optimization (WFO) and Walk Forward Matrix (WFM) are used to analyze performance on unseen data and varying environments, potentially identifying if the EA can be successfully re-optimized and when, this EA is re-optimized on the specified date. Monte Carlo simulations introduce randomness to examine possible performance stability under diverse conditions. Sequential testing adjusts entry, exit, and indicator values to assess potential parameter stability, while system permutation testing explores performance consistency across multiple configurations. These unique methods aim to mitigate overfitting risks and assess the EA’s adaptability and sensitivity to market fluctuations.

Contact me if you’d like to learn more about the rationale behind these testing methods, how they are applied, and result proofs.

Strategy Overview

My Expert Advisor (EA) utilizes the Average True Range (ATR) to generate buy and sell signals while applying a false breakout screener to filter entries.

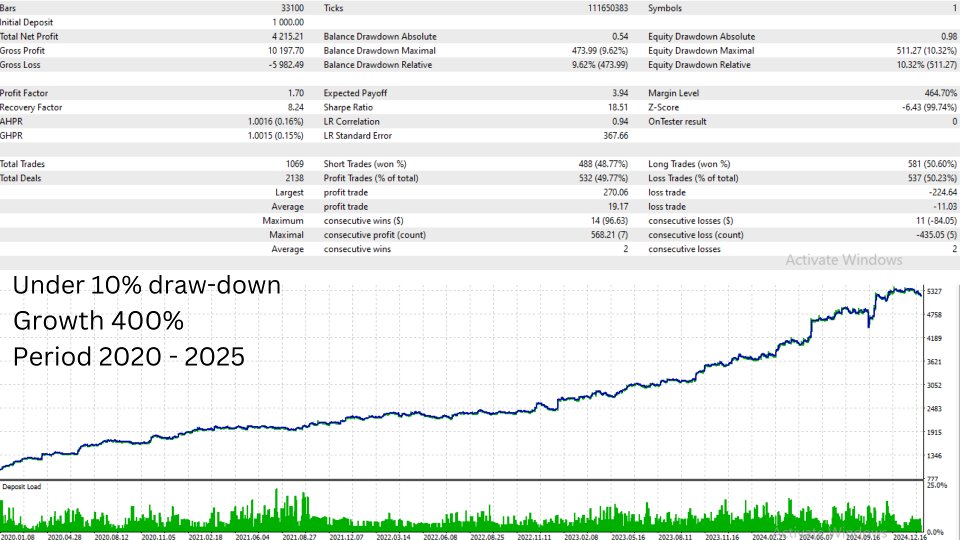

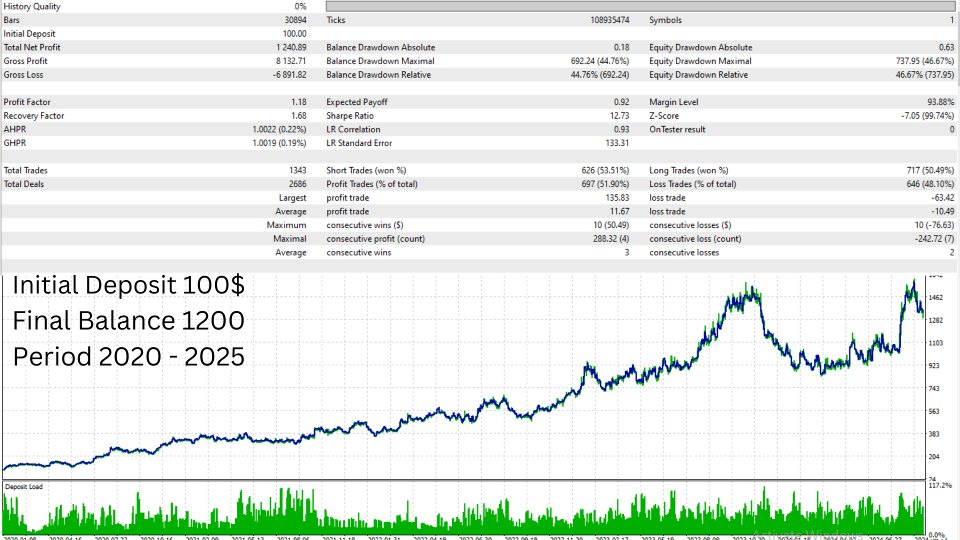

Back-test Information

All back-tests were conducted using real tick data from Darwinex for TSLA, and Dukascopy every tick data to verify similar back-test performance across different brokers (not displayed), and performs well using over 8 pip default spread. The first two back test images demonstrate results when trades are closed only on Fridays, whereas the last two show results from exiting trades at the end of each trading day. Closing trades on Friday generally yields better back-test results but exposes the strategy to potential large overnight gaps, which can lead to unexpected drawdowns. To mitigate this risk, it is recommended to disable the algorithm before earnings reports and other significant events.

Conversely, exiting trades at the end of each day reduces exposure to overnight gaps but results in lower back-test performance. This EA is specifically designed to hold trades until Friday, my Tesla Scalper EA provides an alternative for those seeking to avoid overnight gaps while maintaining similar back-test performance.

Algorithm Design and OOS data

The algorithm is intentionally kept simple, which may help reduce the risk of overfitting by avoiding excessive parameter complexity. This algorithm was designed using AI machine learning techniques and used 50% out of sample data. If the EA isn't overfit increased performance can reflect better adaptation to a wider range of past market behaviors and not noise.

Compatibility with Proprietary Trading Firms

Recommend FTMO, can be run on Darwinex zero however more than one person running this EA on Darwinex Zero causes correlation that could impact allocation, I'm currently developing a workaround. Flipping prop firm accounts may generate better results compared to running the EA on an account with drawdown risk settings below 10%.

Setup guide

Attached to M15 TSLA chart, using a different time-zone broker typically does not significantly impact performance. Trades should be exited on Friday 15 minutes before the U.S. market closes, set the trading time range to market open and 45 minutes before the close (will provide assistance if needed), and contact me to receive set files. If your brokers minimum TSLA tradable lot size is .1 change the mmDecimal value to 1, if .01 change the mmDecimal value to 2.

Disclaimer: Past performance does not guarantee future results, and my products do not guarantee, promise, or suggest profits through their name, logo, screenshots, or description.