US30 Evening Breakout MT4

- Experts

- Koen Arnold Terpstra

- Versão: 1.0

- Ativações: 15

https://www.mql5.com/en/market/product/130989?source=Site+Profile MT5 Version

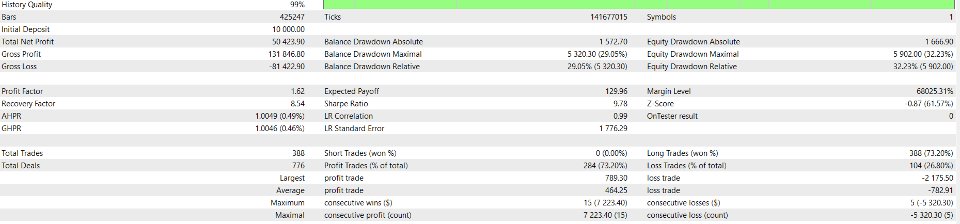

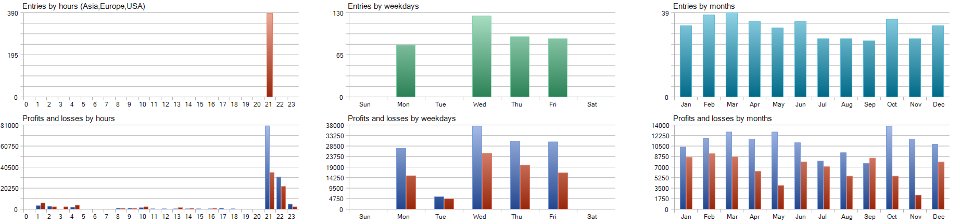

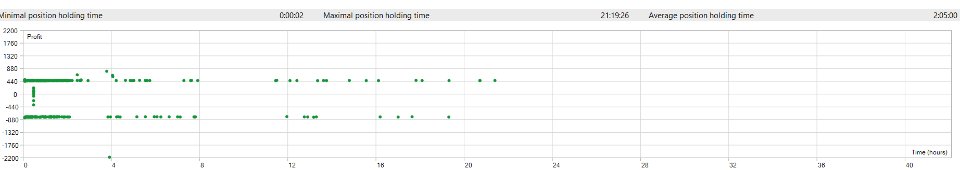

Trading US30, one of the most traded Indexes in the market, demands patience, a strategy and good risk management. US30 Evening Breakout seamlessly integrates these elements into a sophisticated system . The robot is thoroughly tested from 2019 until now. With 0.01 lotsize it has never exceeded 6% ($600) Drawdown on a $10.000 dollar account. (This is different from other brokers, there are also brokers where 0.01 lot would only have $60 drawdown) This test was done on ICMarkets. The EA is only made to Buy, as this is the overall trend on US30, and is completely specialized to trade US30 only. The robot itself trades on the 5M chart and waits for a breakout to open a long position. If there is no breakout, it will delete its pending order within 24 minutes to avoid trading weak breakouts. In times of a down trending market the robot will not have a big drawdown, just look at the backtest in 2020 (Covid crash). Unlike EA's that have insane profit factors in backtests but don't actually work, US30 Evening breakout trades exactly like the backtests show. I use the robot myself in my personal portfolio. It can have slippage when the market moves extremely fast, but this is usually not the case because the robot trades late in the day, when there are usually no news releases and no big price spikes.

| Symbol | US30 |

| Timeframe | M5 |

| Capital | min. $700 for 0.01 lot / $7000 for 0.1 lot (Some brokers use different sizes per lot, backtest on your own broker to see your max drawdown. This test was done on ICMarkets) |

| Broker | any broker |

| Account type | any, lower spread preferred |

| Leverage | from 1:30 |

| VPS | preferred, but not mandatory, also MQL VPS |

Intelligent Risk Management

To safeguard your capital, the EA integrates a robust risk management framework. It uses fixed Stop-Loss (SL) and Take-Profit (TP) orders. By avoiding risky techniques like Martingale, the EA prioritizes stability and security over high-risk strategies, ensuring a controlled approach to trading. The EA will never place a trade on Tuesday, as that has been the only day that it breaks even. So there is no point in trading when we have not gained anything in the last 5 years.

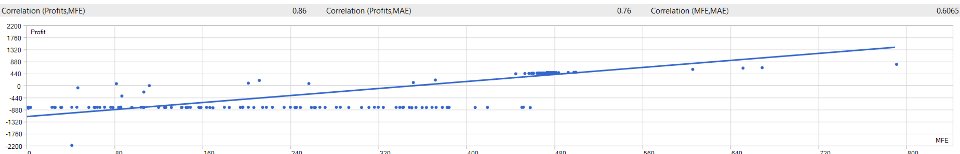

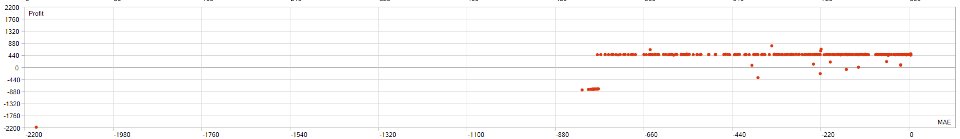

Proven Performance Through Extensive Testing

With over 5 years of backtesting using realistic market simulations, the EA has demonstrated its robustness and profitability even in challenging market conditions. The EA has shown consistent growth curves with controlled drawdowns, proving its stability across various broker data feeds and volatile phases, such as economic crises. (2020) The robot only places long trades and is completely optimized to capitalize on US30's movements.

How to Get Started:

- Chart Setup: Add the EA to a US30 chart, put the timeframe on 5M and enable automatic trading.

- Check settings: The robot is completely optimized for the default settings, lotsize is editable.

- Insert lotsize: For every 0.01 lot I recommend atleast $700 as the max drawdown per 0.01 lot has been $600. (Some brokers use different sizes per lot, backtest on your own broker to see your max drawdown. This test was done on ICMarkets)