Herodotus v4

- Experts

- Nadiya Mirosh

- Versão: 3.8

- Ativações: 5

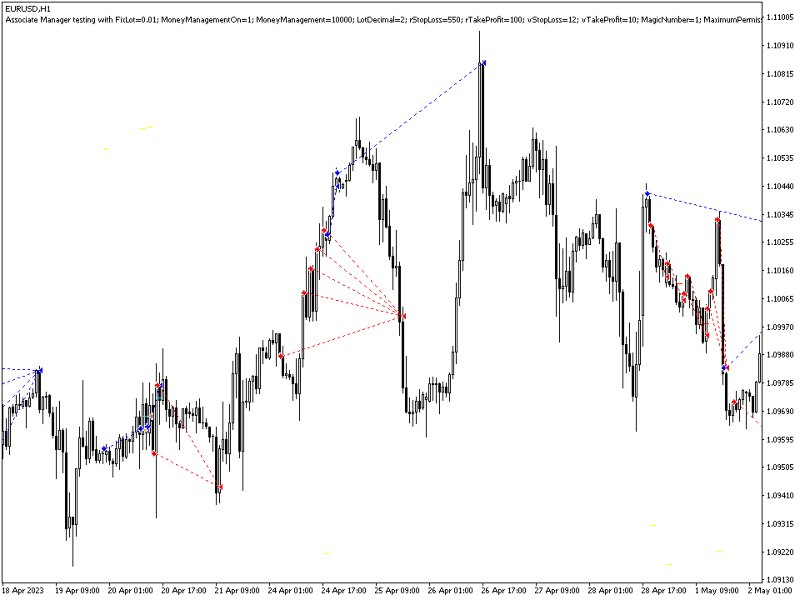

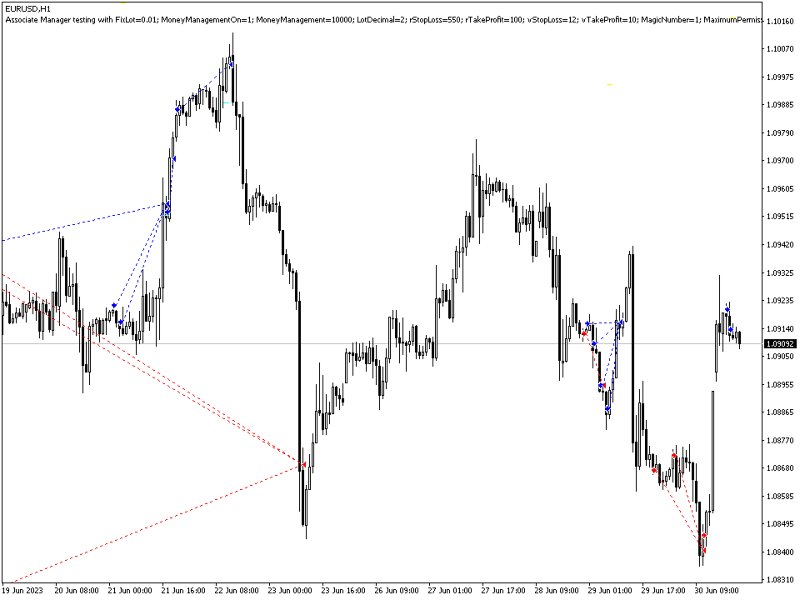

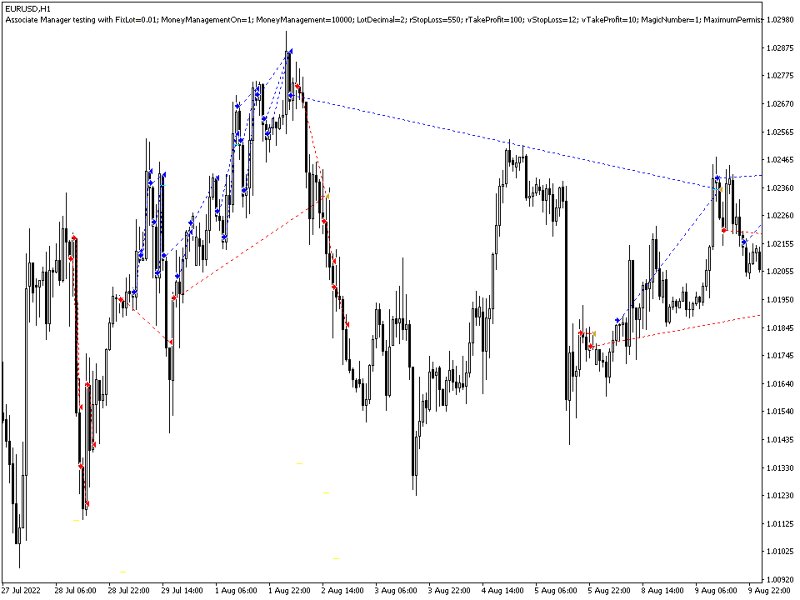

Forex market analysis expert, Herodotus, applies Elliott Wave theory to analyze the following currency pairs:

- EURUSD

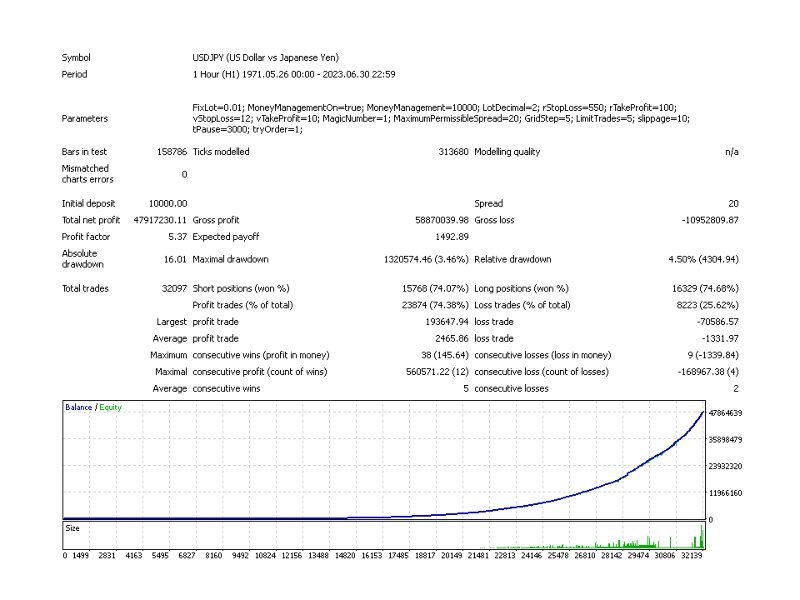

- GBPUSD

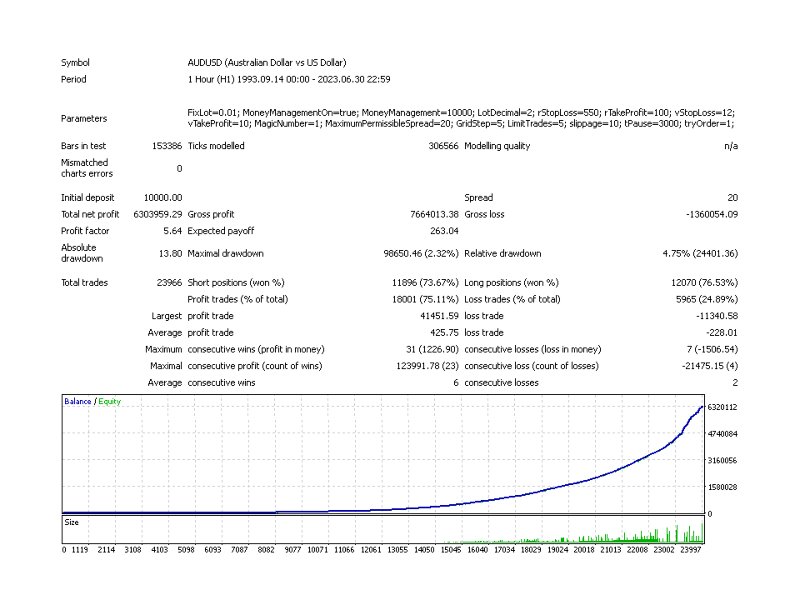

- USDJPY

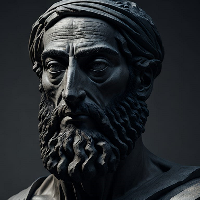

- AUDUSD

- USDCHF

- EURGBP

- EURJPY

- NZDUSD

- USDCAD

- EURCHF

- AUDJPY

- CADJPY

Elliott Wave Theory is a method of analyzing price movements, based on representing market processes as waves.

Ralph Elliott, the author of this theory, identified eight types of waves, five of which move in the direction of the trend, and three against it. Price on the market typically develops in the form of five waves, of which:

- Three (1, 3, and 5) are impulsive waves that move with the trend.

- Two (2 and 4) are corrective waves that move against the trend.

Basic principles of Elliott Wave theory:

- Wave 2 does not cross the starting point of wave 1.

- Wave 3 cannot be the shortest wave.

- Wave 4 does not move beyond the price range of wave 1.

The impulsive waves always have five parts, and the corrective waves have three.

One full cycle consists of eight waves, divided into two phases:

- A five-wave impulsive phase.

- A three-wave corrective phase.

Example: if wave 2 corrects wave 1, the sequence A, B, C will correct the entire cycle of waves from 1 to 5.

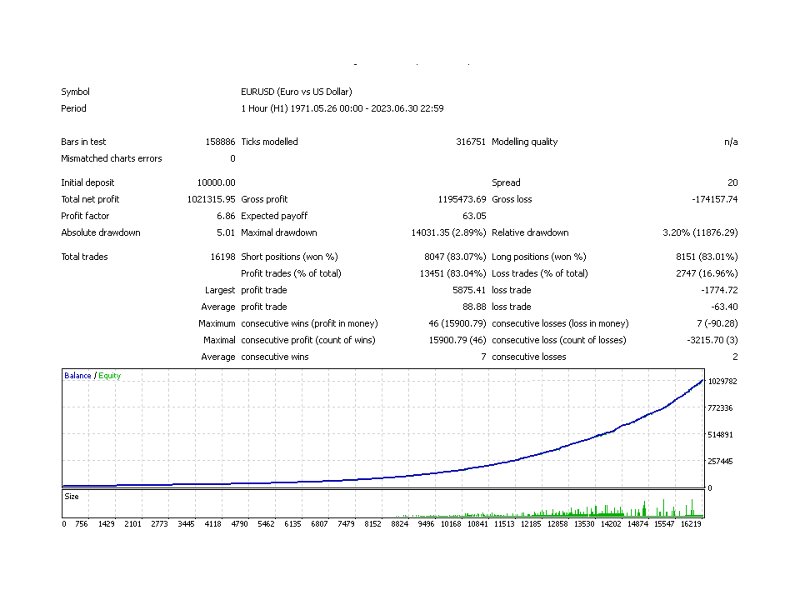

Key parameters for the Forex bot:

- Fix Lot – fixed lot size.

- Money-Management – automatic lot sizing based on account balance.

- Lot Decimal – rounding of the lot size.

- r Stop-Loss – real stop-loss.

- r Take-Profit – real take-profit.

- v Stop-Loss – virtual stop-loss.

- v Take-Profit – virtual take-profit.

- Magic Number – unique trade identifier.

- Maximum Permissible Spread – spread limit.

Bot’s operating conditions:

- Currency pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, USDCHF.

- Timeframe: H1.

- Maximum spread: up to 20 pips.

- Maximum drawdown: up to 30% (for a $1000 deposit).

- Required deposit: $10,000 or equivalent in another currency.