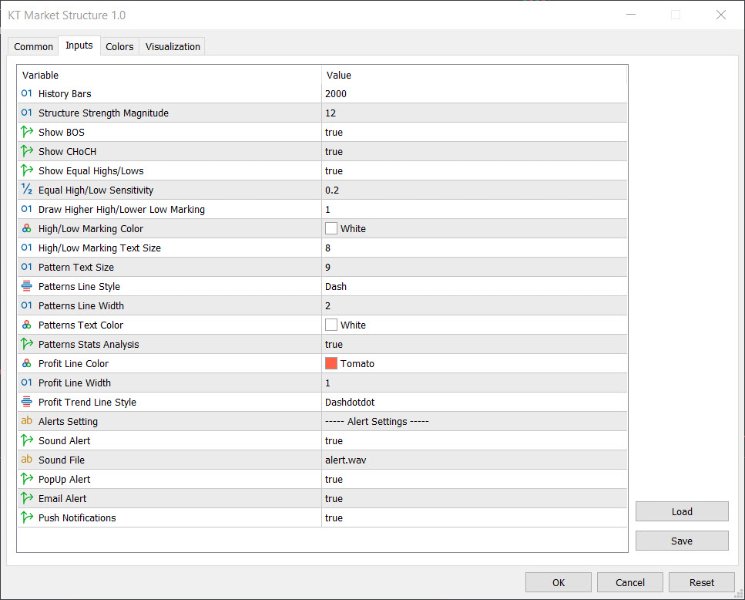

KT Market Structure MT4

- Indicadores

- KEENBASE SOFTWARE SOLUTIONS

- Versão: 1.1

- Atualizado: 25 novembro 2024

- Ativações: 10

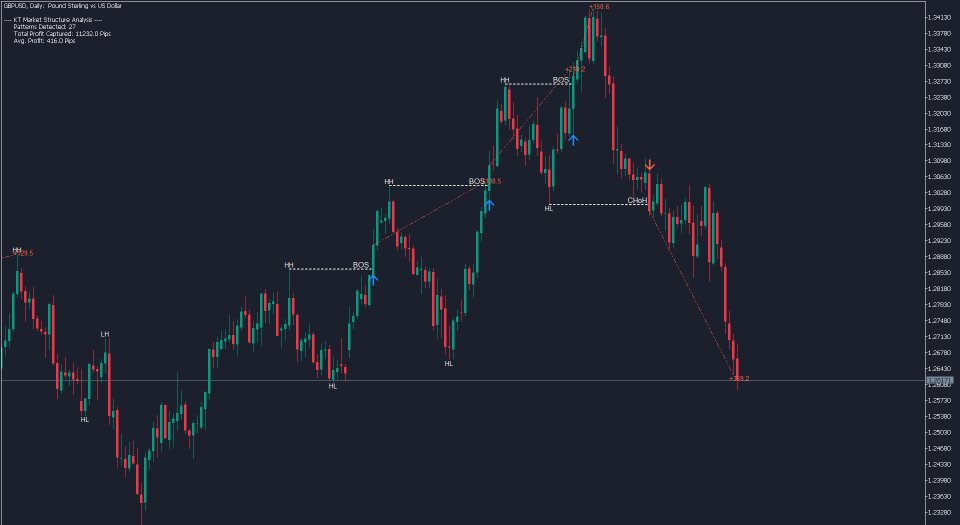

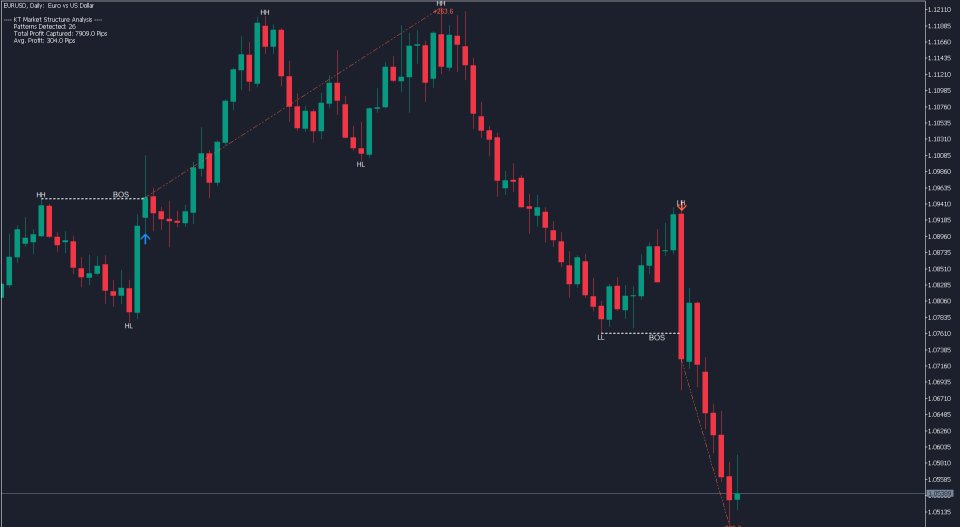

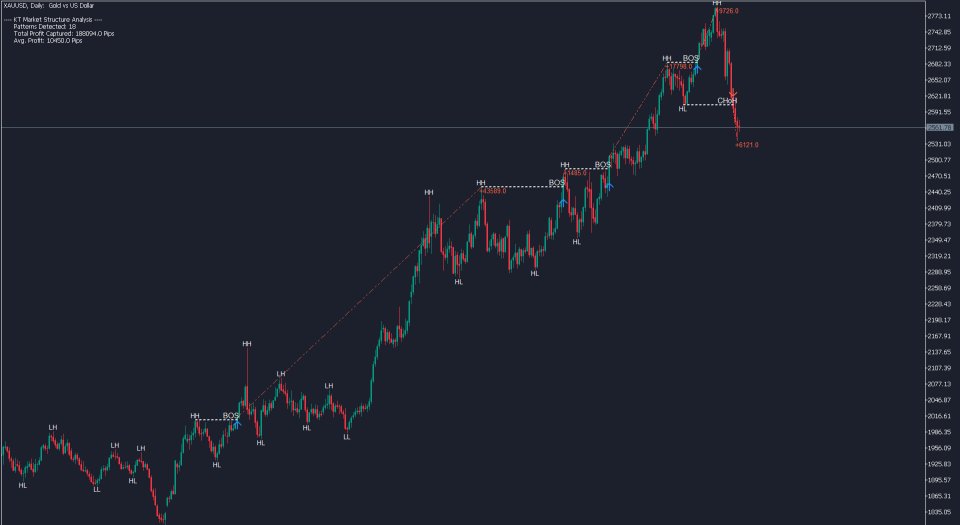

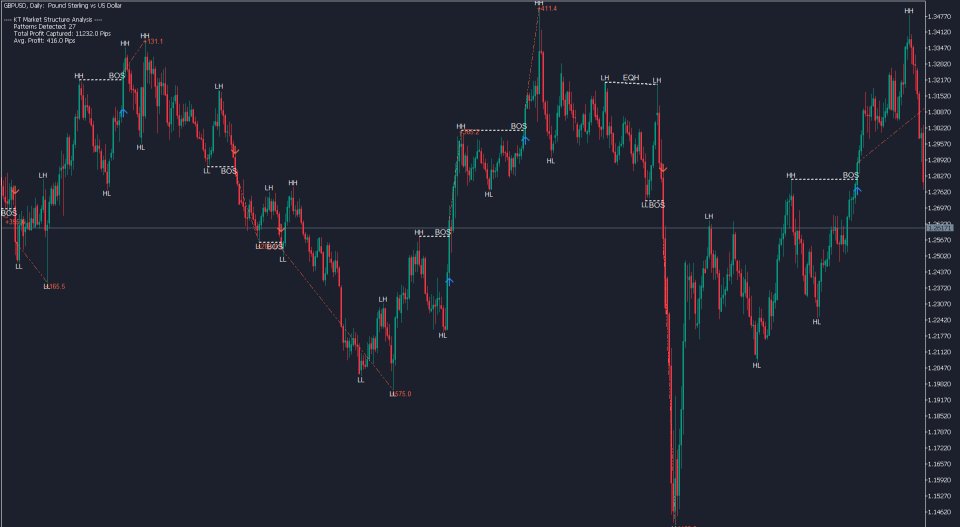

The KT Market Structure intelligently detects and displays Break of Structure (BOS), Change of Character (CHoCH), Equal Highs/Lows (EQL), and various significant swing high/low points using our proprietary algorithm for accurate pattern detection.

It also offers advanced pattern analysis by effectively demonstrating the captured profit for each pattern.

A fully automated EA based on this indicator is available here: KT Market Structure EA MT4

Features

- Accurate Pattern Detection: Our advanced algorithm analyzes multiple data points to ensure precise identification of market structure patterns.

- Customizable Structure Magnitude: Adjust the structure magnitude to suit both day trading and swing trading strategies.

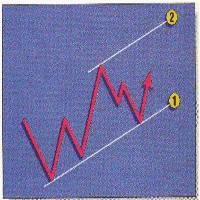

- Comprehensive Market Markings: Alongside BOS and CHoCH, the indicator also displays EQL (Equal Highs/Lows) and marks significant swing points such as LH (Lower High), HH (Higher High), HL (Higher Low), and LL (Lower Low).

- Clutter-Free Design Enhancing SMC Strategies: The indicator boasts a minimalist design that enhances Smart Money Concepts (SMC) strategies by reducing chart clutter, allowing traders to focus on essential market structures.

- Fully Customizable and Compatible: The indicator is fully customizable and compatible with third-party indicators, allowing seamless integration into your existing trading strategies.

- Comprehensive MetaTrader Alerts: Stay informed with full support for all MetaTrader alerts, ensuring you never miss a critical market movement.

What is BOS?

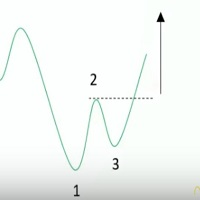

Break of Structure (BOS) is a fundamental concept in technical analysis that signifies a significant shift in market trends or momentum. It occurs when the price action breaks through a previous higher high or lower low, indicating a potential reversal or continuation of the current trend.

Identifying BOS patterns helps traders anticipate market movements and adjust their strategies to capitalize on emerging opportunities.

What is CHoCH?

Change of Character (CHoCH) is a technical analysis term used to identify potential reversals in market trends. It occurs when the price action shifts from making higher highs and higher lows to making lower highs and lower lows, or vice versa.

This change signifies a transition in market sentiment, indicating that buyers or sellers are gaining control. Detecting CHoCH helps traders anticipate trend reversals early, allowing them to adjust their trading strategies to capitalize on new market directions.

What is EQL?

Equal Highs and Lows (EQL) refer to instances in the market where the price reaches the same high or low multiple times. This repetition indicates strong support or resistance zones in technical analysis.

Identifying EQL is crucial for traders as it highlights potential reversal points or consolidation areas, allowing them to anticipate market movements and adjust their trading strategies accordingly.

Key Takeaways

- Understanding market structure is essential for effective Forex trading and strategy development.

- Market structure provides clear visualizations of market dynamics, helping traders identify key levels, reduce losses, and improve trading accuracy.

- Combining market structure with other indicators and aligning them to your unique trading style is key to achieving greater trading success.