TMA Trendfilter

- Indicadores

- Kevin Goehlich

- Versão: 1.0

- Ativações: 5

TMA & ATR Adjusted Indicator

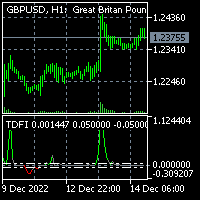

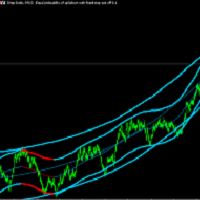

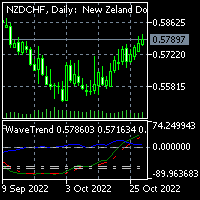

The TMA & ATR Adjusted indicator for MetaTrader 5 is a powerful tool that combines the Triangular Moving Average (TMA) with the Average True Range (ATR) to provide dynamic market insights. This advanced indicator adapts to market volatility and offers a clear visualization of trends with customizable upper and lower bands.

Key Features:

- Triangular Moving Average (TMA): A smooth moving average that gives more weight to central data points, providing a refined trend analysis. You can choose the price type (open, close, high, low) to calculate the TMA.

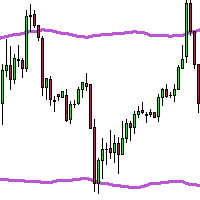

- ATR-Based Bands: The indicator dynamically adjusts upper and lower bands around the TMA based on the ATR, offering flexible support and resistance zones according to market volatility.

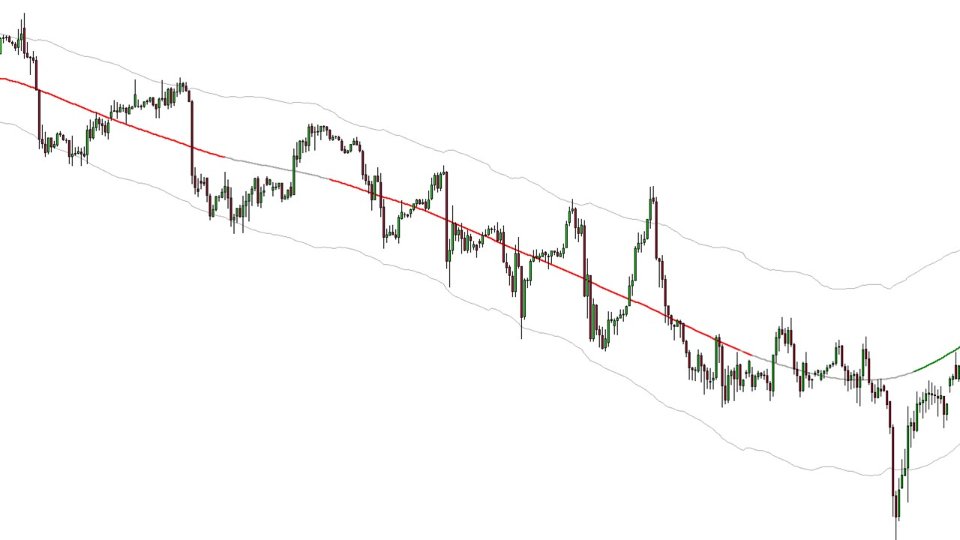

- Trend Detection with Color Coding: Visualize market trends with colored TMA lines. Green for strong upward trends, red for downward trends, and gray for neutral or sideways movement.

- Highly Customizable: Adjust the TMA period, ATR period, and ATR multiplier to suit different trading styles and market conditions.

- Real-Time Data Analysis: Works seamlessly with real-time price data, offering reliable insights for making informed trading decisions.

How It Works:

- The TMA line smooths the price movement for clearer trend direction, while the ATR-based bands help identify potential breakout or reversal points.

- The color-coded trend indication allows for quick identification of market momentum: green for uptrends, red for downtrends, and gray for flat or weak trends.

- The bands expand or contract based on market volatility, helping traders adjust their strategies during high or low volatility periods.

Ideal For:

- Trend-following traders looking for smoother trend lines.

- Volatility-based trading strategies.

- Traders who need dynamic support and resistance zones.

Enhance your trading with TMA & ATR Adjusted — the perfect balance of trend and volatility analysis for MetaTrader 5.