Power of Three

- Indicadores

- Suvashish Halder

- Versão: 1.0

The "Power of Three" (PO3) is a concept developed by the Inner Circle Trader (ICT) to illustrate a three-stage approach used by smart money in the markets: Accumulation, Manipulation, and Distribution.

ICT traders view this as a foundational pattern that can explain the formation of any candle on a price chart. In simple terms, this concept is effective for any time frame, as long as there's a defined start, highest point, lowest point, and end.

MT5 - https://www.mql5.com/en/market/product/124993/

Join To Learn Market Depth - https://www.mql5.com/en/channels/suvashishfx

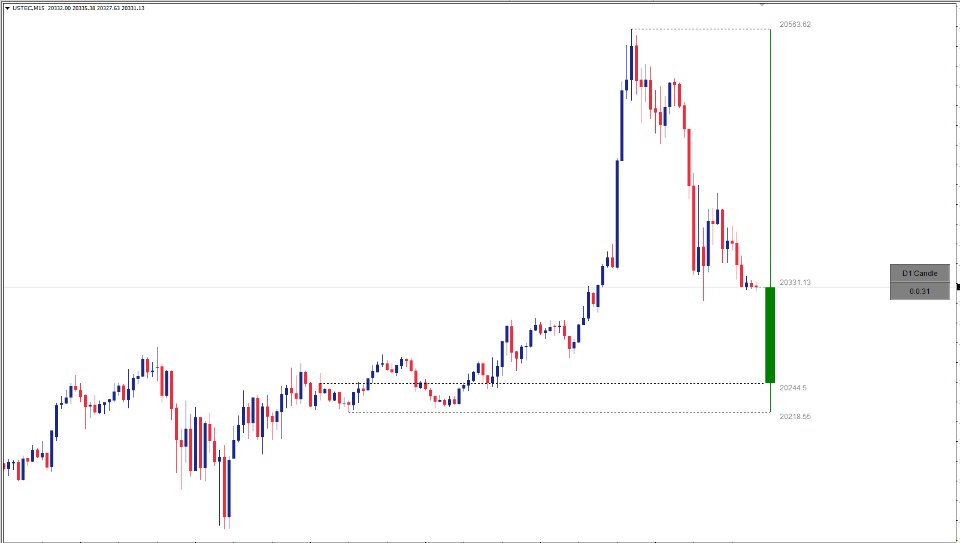

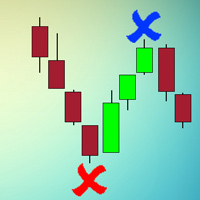

Understanding the Bullish Candle Development in PO3 Terms:

- Candle Open: The initial price before any significant market movement.

- Accumulation: Buyers gather positions near the opening price.

- Manipulation: Price moves to create short liquidity (for sellers) while weakening long liquidity (for buyers).

- Range Expansion: A surge in price movement as the imbalance unfolds.

- Distribution: Buyers start closing positions, and new buy orders come in.

- Candle Close: The price level at the end of the period, following the movement.

The same PO3 stages apply to a Bearish candle but in reverse, where sellers dominate.

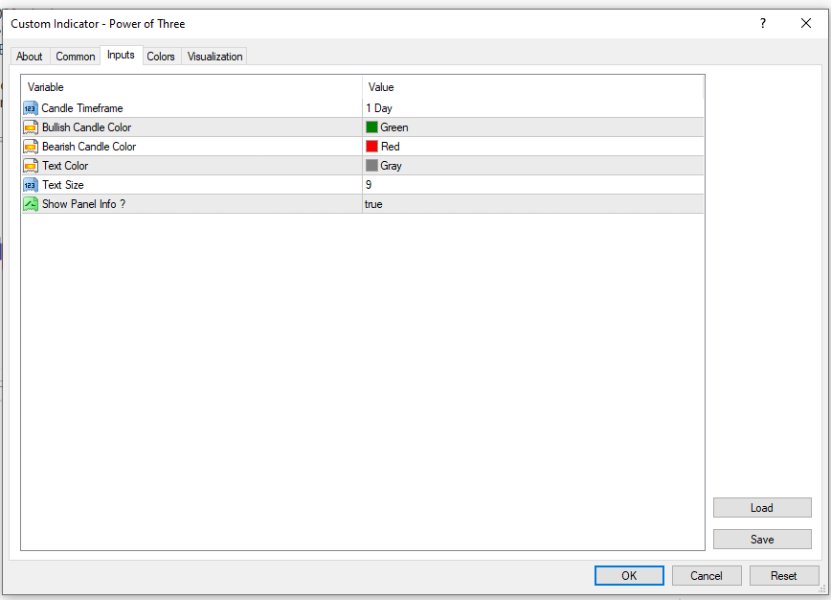

Using the Higher Timeframe (HTF) PO3 Indicator

The HTF PO3 Indicator provides a real-time look at how the current higher timeframe candle is developing. With this tool, you can:

- Track the candle’s Open, High, and Low on a lower timeframe with high accuracy.

- Know when it’s expected to Close (on timeframes shorter than a day).

- See its Low to High range to get a clearer picture of market behavior on lower timeframes.

- Trade PO3 with more confidence, without needing multiple chart layouts.

This tool is particularly helpful for building a structured trading approach and identifying key institutional levels in the market.

Wishing you all the best and happy trading! Please note that support is not available for free products.

nice indicator.. i love it....