ChopZonei

- Indicadores

- Kwuemeka Kingsle Anyanwu

- Versão: 1.0

- Ativações: 5

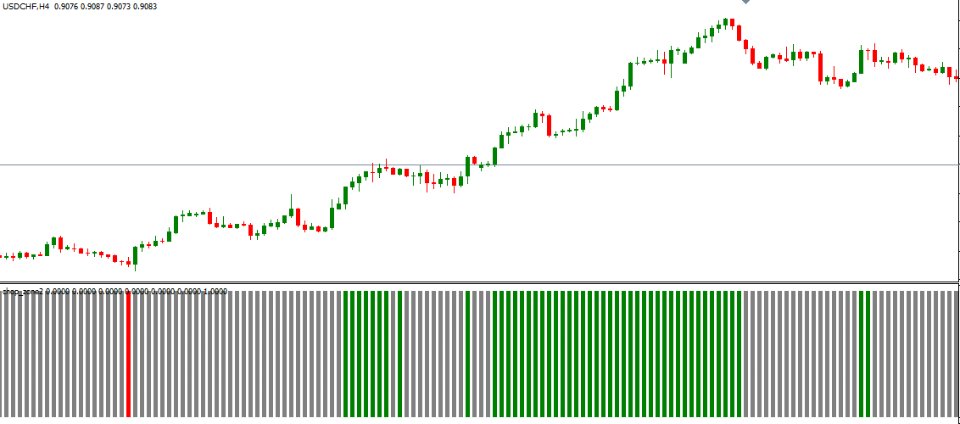

ChopZonei is a custom technical analysis indicator built to help traders identify trend strength and market conditions by calculating the angle of a chosen moving average (MA) over a specified period. The resulting angles are used to classify price action into various "chop zones," which are color-coded based on the direction and magnitude of the angle.

Key Features:

Multi-Timeframe Support: ChopZonei allows the user to calculate the indicator based on a higher timeframe (HTF) while avoiding potential repainting issues.

Moving Average Customization: Users can select from a variety of moving average types (EMA, SMA, WMA, etc.) and configure the length and source of the moving average.

Trend Angle Calculation: The indicator calculates the angle of the moving average, which represents the slope of the trend. Higher angles suggest a stronger trend, while smaller angles indicate market indecision or consolidation.

Customizable Step Size: Users can define the step size for angle calculations, allowing for greater control over the chop zone's sensitivity to market movements.

Zone Classification: The indicator classifies the market into various tiers or zones based on the MA angle, helping traders distinguish between bullish and bearish conditions, as well as periods of low volatility.

Alternate Slope Calculation: An option to use an alternate slope calculation method for advanced users who want more precision in the way the angles are derived.

Usage:

ChopZonei can be used to help identify trending and choppy market conditions, making it a versatile tool for both trend-following and range-bound strategies. By monitoring the calculated MA angle, traders can gauge whether the market is in a strong uptrend, downtrend, or consolidation phase. It is particularly useful for avoiding trades in "choppy" markets where price action is indecisive.

Inputs:

1. Timeframe: Select the desired timeframe for calculations.

2. Show Gaps: Option to show gaps when using higher timeframes.

3. MA Type: Choose the moving average type (EMA, SMA, WMA, etc.).

4. MA Length: Set the length of the moving average.

5. Lookback Period: Number of bars for highest high and lowest low calculation.

6. Step Size: Define the step size for chop zone classification.

7. Alternate Slope Calculation: Toggle the alternate slope calculation method.

Interpretation:

Positive Values (Green Bars): Indicate an uptrend or bullish market conditions.

Negative Values (Red Bars): Indicate a downtrend or bearish market conditions.

Neutral Values (Yellow Bars): Indicate a consolidating or ranging market with low volatility.

By using ChopZonei, traders can better time their entries and exits by aligning their strategies with the current market structure and trend strength.

ChopZonei is a custom technical analysis indicator inspired by the Chop Zone indicator from TradingView.