Soprano

- Experts

- Vincent Visoiu

- Versão: 1.5

- Atualizado: 15 outubro 2024

- Ativações: 5

Soprano EA – Precision Trading Without the Hype

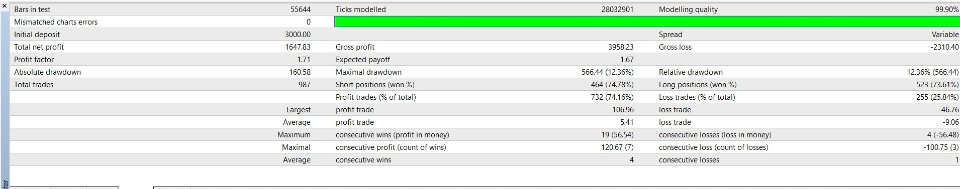

Soprano EA is a sophisticated Expert Advisor meticulously crafted over 10 years of development. It leverages unique, technical algorithmic rules to deliver consistent performance across both backtests and live trading. Unlike many EAs relying on AI-based optimizations—which often yields impressive backtests but fails in real-world conditions—Soprano EA is built to excel in live markets and based on quantifiable no non-sense technical indicators.

Key Features

1. Advanced Money Management

- Fixed Lots or Risk-Based Trading: Choose between fixed-lot trading or a customizable risk-based approach.

- Global and Magic Loss Control: Protect your capital with configurable loss thresholds (Global Loss: 25%, Magic Loss: 10%).

- Commission Adjustments: Fine-tune your trades by factoring in broker commission rates for optimal accuracy.

2. Smart Trade Management

- Scalable Positions: Open up to 10 trades per symbol for maximum market exposure.

- Dynamic Lot Multipliers: Grow your positions automatically with a 1.x multiplier for winning streaks. You can set the multiplier at 1.0 if you don't want to take additional risk.

- Trailing Stop & Step: Secure profits as trends unfold with a trailing stop, automatically adjusted by your preferred step size.

3. Intelligent Market Exit Logic

- Time-Based Position Closure: Minimize risk by closing positions after a predefined X-minutes window.

- Disaster Stop Loss: In case of unexpected volatility, the EA ensures disaster mitigation with a configurable stop loss.

- Profitless Position Exit: Automatically exit trades with no profits if trends shift unexpectedly, ensuring optimal capital allocation.

- Every trade has a SL: Once the EA opens a trade, it always places an optimal SL to protect the trade

4. Customizable Filters and Indicators

- CCI Trend Filters: Detect overbought or oversold conditions with advanced CCI filters to avoid false signals.

- ATR and Goose Neck Ratio Filters: Use volatility-based filters for dynamic market adaptation.

5. Precision Time Management

- Multi-Session Trading: Configure up to three trading sessions with precise start and end times to align with market hours.

- End-of-Week Trade Closure: Avoid overnight risk by automatically closing positions before the weekend.

Recommendations for Best Results

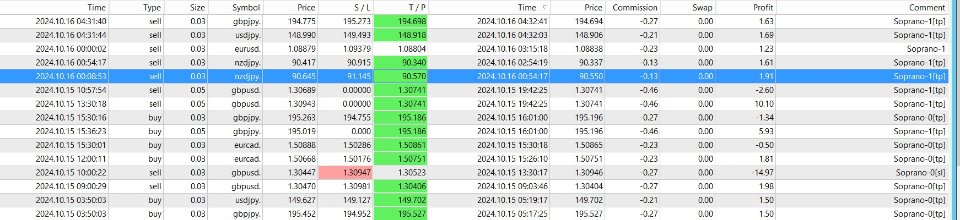

- Currency Pair: Optimal performance on high-liquidity pairs like EURUSD, GBPUSD, AUDUSD, USDCAD etc. (major pairs) and of course XAUUSD. Best pair is USDJPY so far.

- Timeframe: M5

- Minimum Deposit: $500 for one pair or $1,000 recommended to leverage Soprano EA's full capabilities for several pairs.

- Account Type: ECN or Raw spreads for enhanced trade execution.

- Leverage: Use 1:500 or higher leverage for optimal profitability.

- VPS Recommended: Run the EA on a VPS to ensure uninterrupted 24/7 operation.

Why Choose Soprano EA?

Soprano EA stands out with its blend of risk management precision, dynamic lot scaling, and intelligent exit strategies. Its flexible settings allow traders to tailor the EA to their individual trading goals, helping to manage risk more effectively. Whether you prefer aggressive or conservative strategies, Soprano EA adjusts to your preferences with ease.

Still promo price at $179.00. Next price increase will be to $229.00. The intent is to increase the price eventually to $1999 or sell only 50 copies whichever comes first.

Presets for Soprano EA (where have you seen that many useful presets for any EA on MQL5?)

Money Management Options:

- Use Fixed Lots: Enables fixed lot size for trades.

- Lots Risk Percent: Sets the percentage of capital risked per trade.

- Max Global Loss Percent: Caps total loss across all trades at a percentage of account equity.

- Max Magic Loss Percent: Limits loss on trades grouped by specific magic numbers.

- Use Commission Correction: Adjusts for broker commission to ensure accurate trade calculations.

- Default Commission: Sets the expected commission rate per trade.

Trade Management Options:

- Max Symbol Open Trades: Limits the number of trades that can be open simultaneously for a symbol.

- Take Profit (TP): Defines the profit target in pips.

- Stop Loss (SL): Sets the maximum allowable loss per trade in pips.

- Trailing Stop: Adjusts the stop loss to lock in profits as the trade moves in a favorable direction.

- Trailing Step: Specifies how frequently the trailing stop is updated.

- Lots Level Multiplier: Increases the lot size for consecutive winning trades.

- Minimum Lots: Defines the smallest lot size allowed. Initially use 0.01 and increase gradually per your comfort level.

- Maximum Lots: Sets the largest lot size allowed. EA will never exceed this Lot Size for safety.

Expert Management Options:

- Step Level (Pips): Determines the pip distance between consecutive trades.

- Step Level Multiplier: Scales the step level after each trade.

- Use ATR Step Pips: Adjusts step levels dynamically based on market volatility.

- Min Level Step: Sets the minimum step level in pips.

- Price Step Channel: Defines the range in which trades will be executed.

- Step Channel Multiplier: Adjusts the size of the price channel.

- Use ATR Channel Pips: Dynamically sets the price channel based on ATR.

- Min Channel Step: Defines the minimum allowed step within the price channel.

- Channel Update Time: Sets how often the channel is updated, in minutes.

- Channel ATR TimeFrame (Channel_ATR_TF): Specifies the timeframe for ATR-based calculations.

- MA Envelopes TimeFrame (MA_Envelopes_TF): Sets the timeframe for moving average envelopes.

Exit Logic Options:

- UseAdaptiveExit: Exit trade it when the price moves suddenly and favorably in the direction of the trade by 10 or more pips

- Position Life Minutes: Defines how long a position can remain open.

- Time Exit on No Profit: Closes positions after a set time if no profit is realized.

- Disaster Stoploss: Sets a stop loss for extreme market conditions.

Filter Options:

- Use CCI Trend Filter: Filters trades based on CCI trend signals.

- CCI Trend Filter Period: Number of periods for calculating the CCI.

- CCI Overbought Level: Threshold for overbought market conditions.

- CCI Trend Filter TimeFrame (CCITrendFilter_TF): Timeframe for applying the CCI filter.

- Use Goose Neck Filter: Uses the Goose Neck pattern for trade confirmation.

- ATR Reference Lookback: Sets the lookback period for ATR-based calculations.

- Goose Neck Ratio: Adjusts sensitivity of the Goose Neck filter.

Time Management Options:

- Use Trading Times 1: Enables the first custom trading session.

- Start Time Hour 1: Start hour for the first trading session.

- End Time Hour 1: End hour for the first trading session.

- Use Trading Times 2: Enables the second custom trading session.

- Start Time Hour 2: Start hour for the second trading session.

- End Time Hour 2: End hour for the second trading session.

- Use Trading Times 3: Enables the third custom trading session.

- Start Time Hour 3: Start hour for the third trading session.

- End Time Hour 3: End hour for the third trading session.

- Start of Week (SOW) Start Hour: Defines the hour trading starts for the week.

- Start of Week (SOW) Start Minute: Sets the minute trading starts for the week.

- Close Trades End of Week: Closes all trades at the end of the week.

- Friday Close Hour: Sets the hour for closing trades on Fridays.

- Friday Close Minute: Sets the minute for closing trades on Fridays.

- Friday Stop Before Close: Stops trading a specified time before Friday close.

- No Trades on Friday: Disables trading on Fridays.

- No Trades After Day: Stops trading after a specific day of the week.

- No Trades After Day Num: Defines which day to stop trading.

- No Trades After Day Hour: Sets the hour to stop trading on the specified day.

- Skip Rollover Time: Avoids trading during rollover periods.

- Rollover Hour: Sets the hour when rollover occurs.

- Minutes Before Rollover: Stops trading this many minutes before rollover.

- Minutes After Rollover: Resumes trading this many minutes after rollover.

Miscellaneous Settings:

- Max Slippage: Sets the maximum slippage allowed for trades.

- Max Stop Level: Limits the maximum allowable stop level.

- Show Activity Status: Displays the EA's current status.

- Show Spread: Shows the spread on the platform.

- Enable Alert: Enables alerts for specific events.

- Enable Print: Activates logging of the EA’s actions.

- Do Not Trade: Disables trading when enabled.

- Close All Symbol Positions: Closes all open trades for the specified symbol.

- Magic Number Base: Sets the Magic base number for tracking trades with magic numbers.

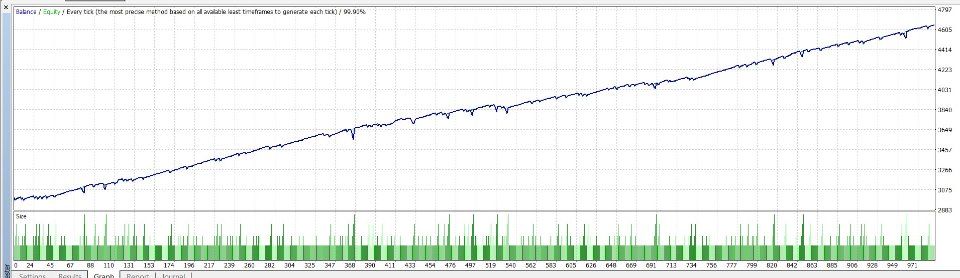

Live account monitor will be added soon. In the meantime, you can backtest the EA with 99% tickdata modelling on M15 TF or rent it before you decide to buy to realize its true potential.

After purchase please PM me with proof of purchase and I will provide you with a private preset for the EA.

Disclaimer

While the Soprano EA has shown good performance in backtesting, it is important to understand that past results do not guarantee future profits. Live market conditions can vary significantly, and financial markets are inherently unpredictable. The EA is designed to optimize trading strategies and improve decision-making, but it cannot eliminate the risks associated with trading. Use of the Soprano EA should be accompanied by sound risk management practices, and traders should be prepared for potential losses. Trade responsibly and understand that no trading system can guarantee consistent profits in live accounts.

O usuário não deixou nenhum comentário para sua avaliação