RSI Stocks Rebound

- Experts

- Alexandru Chirila

- Versão: 1.4

- Atualizado: 18 fevereiro 2025

- Ativações: 10

RSI Stocks Rebound

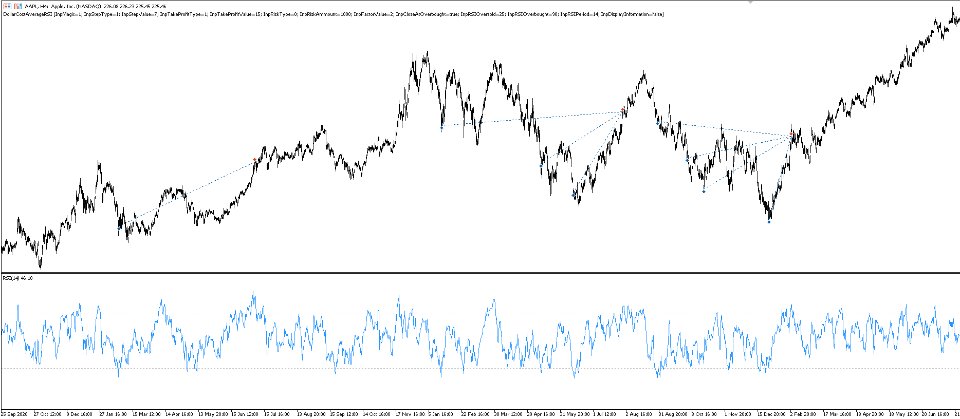

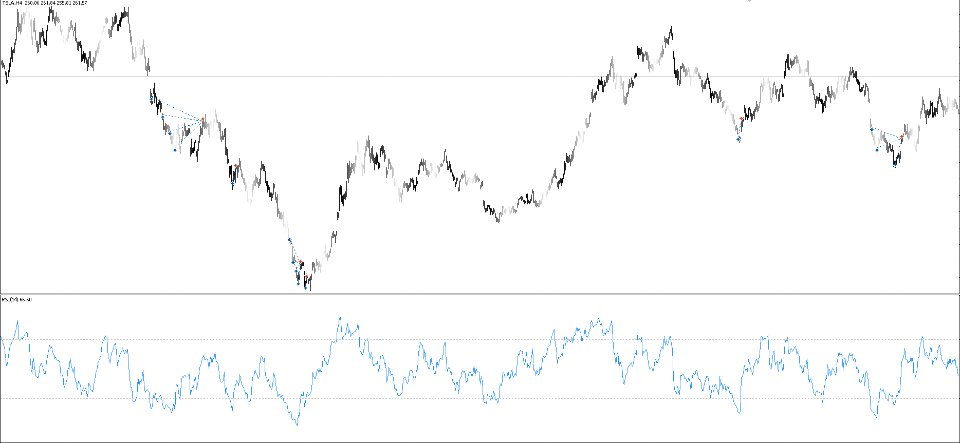

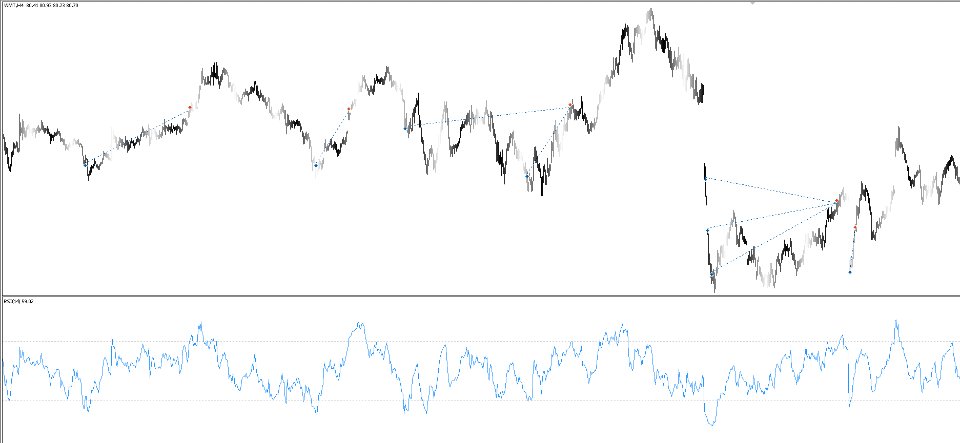

The Dollar Cost Average with RSI Expert Advisor (EA) combines the power of the Dollar Cost Average (DCA) strategy with the Relative Strength Index (RSI) indicator to optimize entry and exit points for trades. This EA is specifically designed for traders who want to take advantage of market conditions, using the RSI to trigger buy signals during market dips and executing a DCA strategy to accumulate positions when the market continues to move against them.

Key Features

-

RSI-Based Execution:

- Entry: The EA automatically opens buy trades when the RSI hits an oversold threshold with a candle closure (typically below 30), indicating that the market may be undervalued and ripe for a reversal.

- Exit: The EA closes trades when the RSI reaches an overbought threshold (typically above 70) and the position is in profit, ensuring trades are closed at optimal times.

-

DCA Mechanism:

- If the market continues to sell off, the EA will add to the position by executing additional buy trades at predetermined intervals (based on either a percentage price drop or a fixed pip value). This DCA approach lowers the overall average entry price, making it easier to reach a profitable exit point.

-

Batch Closure with Profit Target:

- The EA monitors the entire batch of trades opened under the DCA strategy. Once the cumulative profit from all trades reaches a predefined profit percentage, the EA closes all positions, securing the desired gain.

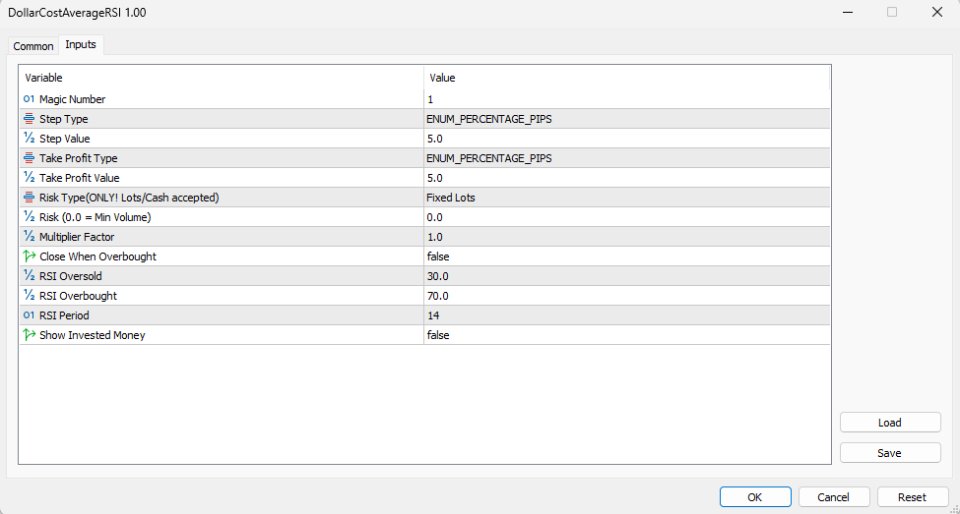

Configurable Parameters

- Magic Number: A unique identifier for each set of trades, enabling easy management and tracking of the EA’s positions.

- Max Trades: Sets the maximum number of simultaneous trades the EA will execute (modifiable during trading).

- RSI Oversold/Overbought Levels: Traders can customize the RSI levels for triggering buy entries (oversold) and closing trades (overbought) when in profit.

- RSI Preiod

- Close When Overbought: A toggle that lets the user choose if the position will close at Overbought or at the selected percentage

- DCA Step Type:

- Step Percentage: Opens additional positions when the market drops by a specified percentage from the previous entry price.

- Fixed Pips: Opens additional positions after a fixed number of pips from the previous trade.

- Step Value: Defines the threshold (either percentage or pips) for opening new DCA trades.

- Take Profit Type:

- Step Percentage Pips: Sets a take profit based on a percentage of the total investment in the instrument. For example, if $7500 has been invested and the Take Profit Value is 10%, the take profit for all trades combined will be set at $750.

- Step Fixed Pips: Sets a take profit at a fixed number of pips for the entire trade batch.

- Take Profit Value: The take profit threshold, depending on the selected take profit type.

- Start Lots: The initial trade volume, allowing traders to start with a minimum volume or a larger amount depending on their risk appetite.

- Multiplier: Adjusts the volume of subsequent DCA trades to increase exposure at better prices, which can maximize profitability when the market recovers.

Este destul de ok. Unele chestii despre el le afli in momentul utilizarii pe un cont live. De ca nu deschide tranz imediat ce atinge RSI min ci doar cand, in paralelel, se inchide lumanarea pe TF curent. As vrea sa stiu daca, odata instalat pe un MT5 al unui Broker, mai poate fi instalat si pe o alta platfirma MT5, de la un alt Broker, pe un cont de Prop Trading?