Wilders Moving Average

- Indicadores

- Marco Antonio Cruz Dawkins

- Versão: 1.0

- Ativações: 5

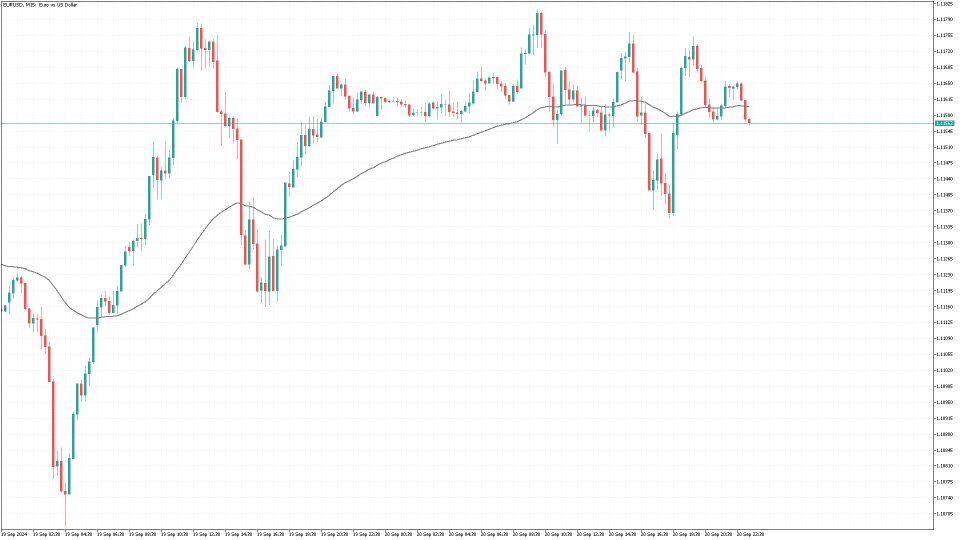

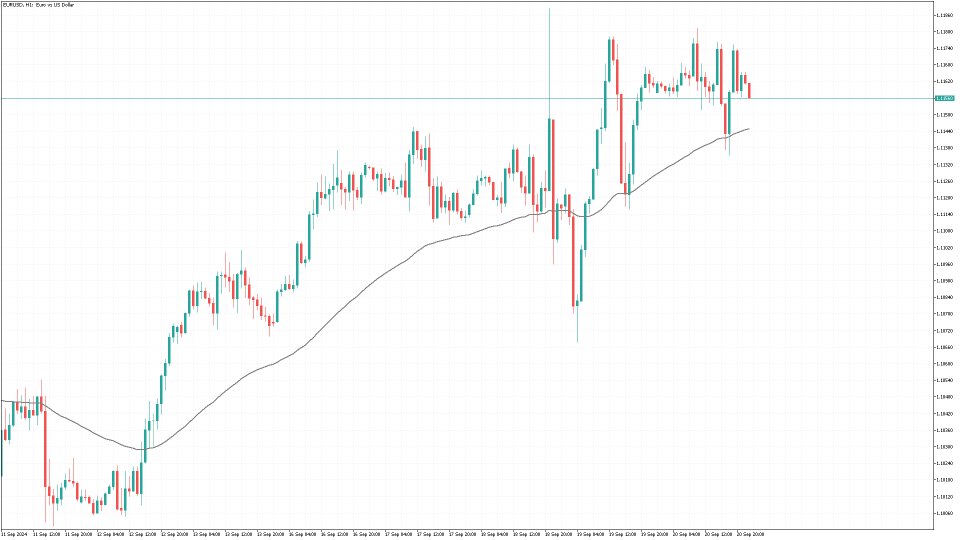

Wilder's Moving Average (Wilder's MA) is a smoothing technique developed by J. Welles Wilder, designed to reduce the impact of short-term price fluctuations and highlight longer-term trends. Unlike the standard Exponential Moving Average (EMA), Wilder's MA uses a unique smoothing factor, which gives it a slower and more stable response to changes in price.

The calculation method emphasizes a more gradual adaptation to market changes, making it particularly useful in volatile markets. It helps traders to better identify the underlying trend by filtering out the noise caused by sudden price movements.

Key Features:

- Smoothing Effect: Wilder’s MA provides a slower, more gradual response to price changes, making it ideal for identifying long-term trends.

- Trend Identification: It helps traders to distinguish between short-term volatility and the real direction of the market over time.

- Widely Used: It is often employed in various technical indicators, such as the Relative Strength Index (RSI) and Average True Range (ATR), also created by Wilder.

Traders who prefer a smoother trend-following approach often favor Wilder's MA for its ability to reduce short-term market noise and focus on broader market movements.