Gold Momentum Accelerator

- Experts

- Tadeas Rusnak

- Versão: 1.0

- Ativações: 15

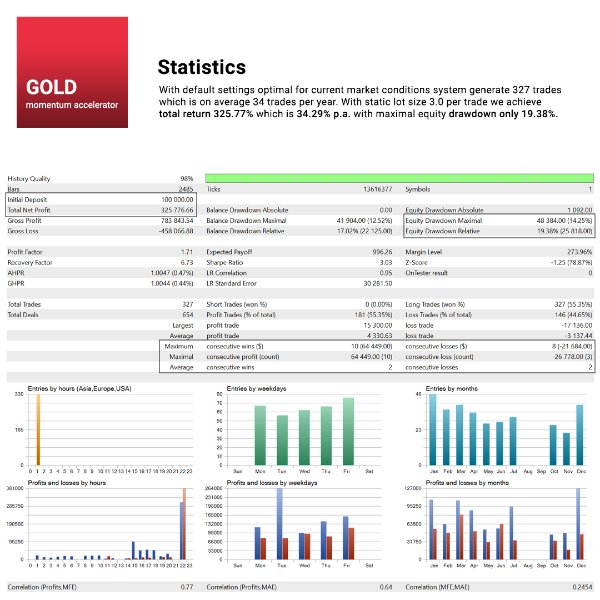

Gold Momentum Accelerator System Description

Long-term growth with low risk.

The system primarily uses daily timeframe statistics to generate levels suitable for entry when all conditions are met. A new level is created each day, determining the threshold above which there is a high probability of an uptrend continuing.

System is not sensitive to high slippage and latency.

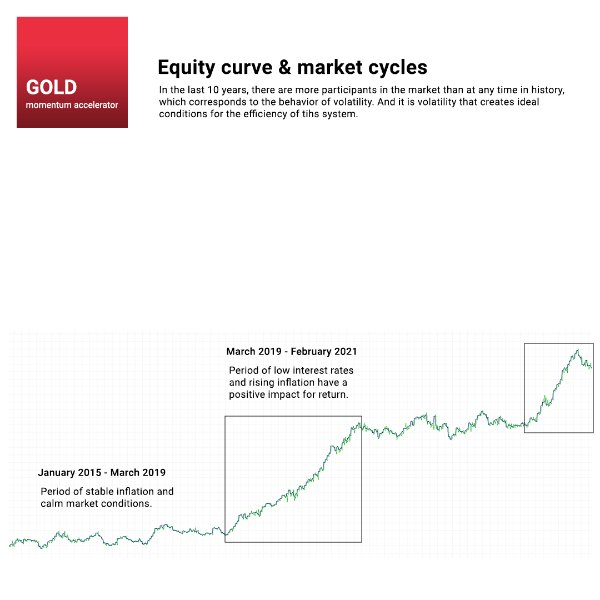

Market cycle and seasonality.

As it has been proven that in certain periods the system is less effective due to the cycle and correlations of the gold asset with the USD and the stock market. The best return of a system is when we are in inflationary cycle and low interest rates enviroment.

System has options for allow or avoid market cycles.

_________________________

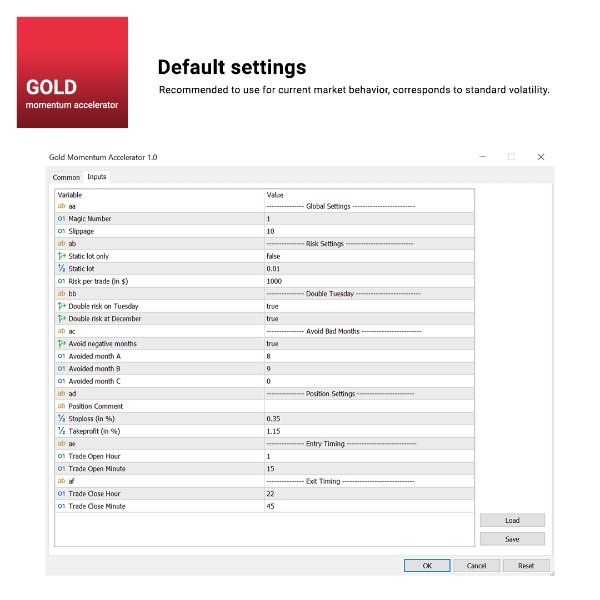

Settings and recommendations

Timing settings

- Entry Hour & Minute

- Exit Hour & Minute

The timing is set by default to capture the entire daily movement because price has high chance of accelerating to the upside.

Therefore, it is always set 15 minutes before closing and after opening, to prevent those first minutes against large spreads.

Stop & Profit settings

- Stoploss (in %)

- Takeprofit (in %)

The percentage interval is used because of logical reasons for better evidence of statistical measurements.

Each value is calculated differently, stoploss is a value in % from the previous day low, and takeprofit is a % value from today's open price.

Seasonality settings

- Double Tueseday ( if is set to true, the position size will be doubled automaticaly.)

Statistics of intraday movements in periods of continued momentum shows high success on Tuesday if the previous day (Monday) had a positive return. - Double December (if is set to true, the position size will be doubled each day of december(except for Tuesday, to avoid over-sizing).

Annual statistics for the last 20 years showed more positive return in the month of December.

- Avoiding Months (if is set to true, system is not allowed to trade months with low success rate.

Annual statistics for the last 20 years showed more negative return in months August, September, November, these months are historically associated

with higher volatility in dollar and stock market. To minimize risk is recommended to skip trading at least in September.