EuroRun

- Experts

- Aristeidis Gitas

- Versão: 1.0

- Ativações: 5

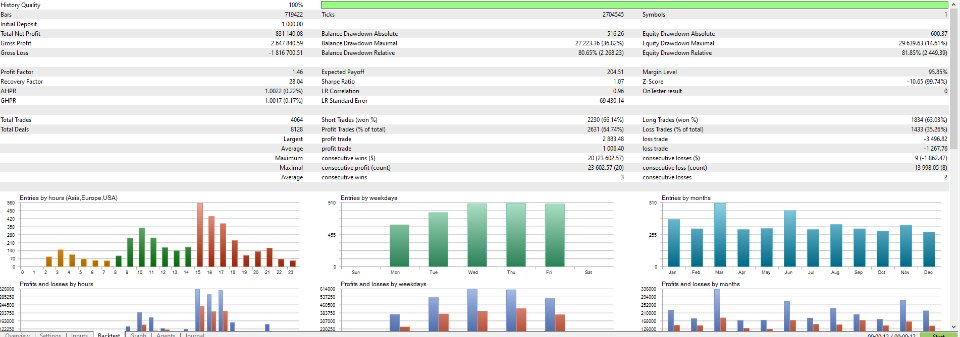

Overview: "Euro Run" is a highly sophisticated Expert Advisor (EA) meticulously designed for trading the EUR/USD pair on the 5-minute (M5) timeframe. This EA has been built with an emphasis on safety, consistency, and long-term reliability, making it an ideal tool for both novice and experienced traders. Unlike many other EAs, "Euro Run" explicitly avoids the use of grid trading, a strategy known for its potential risks. Instead, it employs a series of well-tested and optimized trading strategies that have consistently delivered positive results over the past 10 years. The recommended minimum deposit to start using "Euro Run" is $100, ensuring that even traders with smaller accounts can benefit from its features.

Key Features and Indicators:

-

Moving Averages (MA):

- The EA utilizes multiple moving averages, including MA50, MA100, MA200, MA400, and MA500, to assess overall market trends. These moving averages serve as key indicators for determining market momentum, trend direction, and potential reversal points.

-

Relative Strength Index (RSI):

- The RSI indicator is integral to the "Euro Run" strategy. By using RSI with various parameters, the EA can effectively identify overbought and oversold conditions in the market. This helps in pinpointing optimal entry and exit points, reducing the likelihood of entering trades at the wrong time.

-

Support and Resistance Levels:

- The EA dynamically calculates support and resistance levels based on historical price data. These levels are crucial in determining market behavior and are used to set strategic entry and exit points, ensuring that trades are executed with a high probability of success.

Pre-Configured Settings: One of the standout features of "Euro Run" is that all settings and parameters are pre-configured and optimized for maximum performance. This means that traders do not need to spend time adjusting complex settings. The EA has been fine-tuned through extensive backtesting and forward testing to ensure that it operates effectively under a wide range of market conditions.

Trading Strategies: "Euro Run" incorporates more than seven different trading strategies, each designed to adapt to different market scenarios. These strategies are based on a combination of technical indicators, including moving averages and RSI, as well as critical support and resistance levels. Each strategy has been carefully crafted to meet a minimum win rate of 60%, ensuring that the EA consistently generates profitable trades. Some of the strategies focus on breakout opportunities, while others are designed to capitalize on market reversals or trend continuations.

Risk Management: Risk management is a core component of the "Euro Run" EA, ensuring that trading risks are minimized while maximizing potential returns. The EA uses a well-defined risk management system that includes the following elements:

-

Position Sizing:

- The EA automatically adjusts the position size based on the account balance, ensuring that no single trade risks too much of the account equity. This dynamic position sizing is calculated using a formula that scales the lot size according to the trader's account size, with a default starting lot size of 0.01.

-

Stop Loss and Take Profit:

- "Euro Run" employs precise stop loss and take profit levels for every trade, which are calculated based on market conditions and the specific strategy being used. The stop loss levels are set to minimize potential losses, while the take profit levels are strategically placed to capture optimal gains. These levels are designed to be far from psychological points to avoid premature exits caused by market noise.

-

Time Filters:

- The EA includes built-in time filters that control when trades can be executed. For example, it avoids placing trades during high volatility periods like major news releases, which can lead to unpredictable market movements. This time-based risk management helps in avoiding periods where market conditions are less predictable and more prone to sharp reversals.

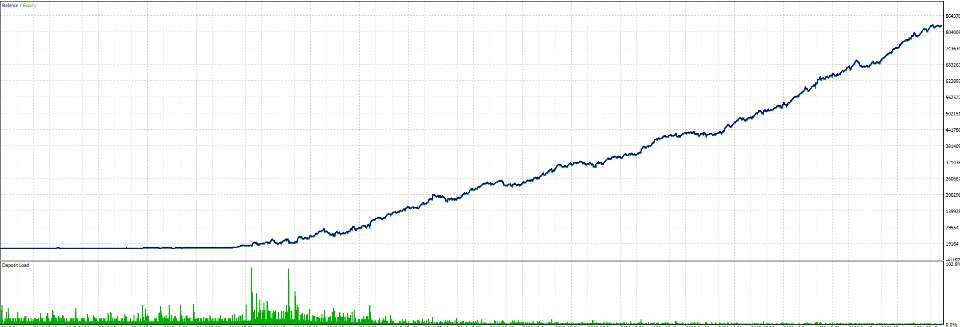

Safety and Long-Term Performance: "Euro Run" has undergone rigorous testing over the last decade, including both backtesting on historical data and forward testing in live market conditions. This extensive testing period has proven the EA's ability to adapt to various market environments, from trending to ranging markets, while consistently delivering positive results. The emphasis on safety and risk management makes "Euro Run" not just a profitable tool, but also a reliable one that traders can trust over the long term.

Conclusion: In summary, "Euro Run" is a well-rounded, highly secure Expert Advisor that offers traders a reliable way to participate in the EUR/USD market. With all settings pre-configured and optimized, it allows traders to start trading immediately without worrying about complex configurations. The EA's focus on risk management, combined with its robust trading strategies, ensures that it not only generates consistent profits but also protects the trader's capital, making it an ideal choice for those looking for a stable and secure trading solution.